DAILY MORNING NOTE | 6 December 2022

**Do note that the last day of Morning Note Issuance is on 15 December 2022. Morning Note will resume in January 2023**

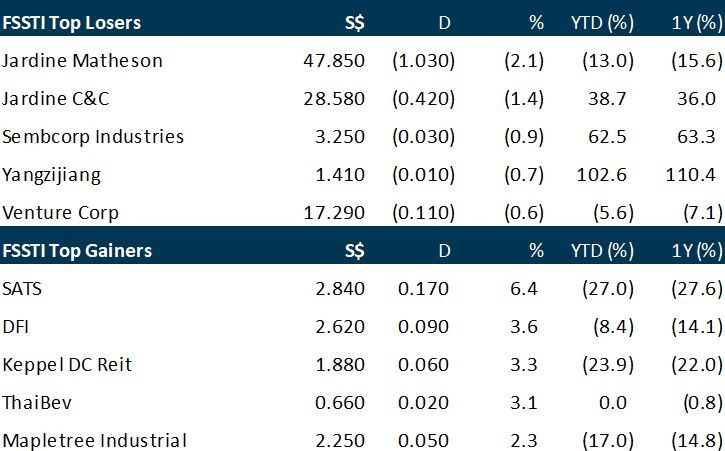

Singapore stocks climbed higher on Monday (Dec 5), tracking gains in major regional markets amid positive sentiment over reopening prospects in China. The benchmark Straits Times Index (STI) rose 0.3 per cent or 8.4 points to close at 3,267.54. Elsewhere in Asia, Hong Kong shares led regional gains, with the Hang Seng Index jumping 4.5 per cent higher as Chinese authorities eased some Covid-19 measures. The Shanghai Composite Index also rose 1.8 per cent, while key indices in Japan and Australia each closed between 0.2 and 0.3 per cent higher. On the local bourse, shares of Sats led the gainers on the STI on Monday, climbing 6.4 per cent to close at S$2.84. Meanwhile, shares of Jardine Matheson Holdings ended at the bottom of the index performance table, after falling 2.1 per cent to close at US$47.85. Across the broader market, gainers outnumbered losers 400 to 196 after 1.5 billion securities worth S$1.1 billion were traded. Shares of DBS were the most actively traded by value on Monday, climbing 0.1 per cent to S$34.50 after 3.1 million shares worth S$108.2 million changed hands.

Wall Street stocks dropped Monday after better-than-expected US services data added to worries that the Federal Reserve will prolong its aggressive policies to counter inflation. The Institute for Supply Management’s services index rose to 56.5 per cent last month, well above the 50-per cent threshold indicating growth and pointing to strong business activity despite efforts to cool the economy. The report comes on the heels of Friday’s employment data, which also topped estimates. The Dow Jones Industrial Average finished down 1.4 per cent at 33,947.10. The broad-based S&P 500 shed 1.8 per cent to 3,998.84, while the tech-rich Nasdaq Composite Index dropped 1.9 per cent to 11,239.94. Monday’s losses came after a strong day on Asian equity markets following signs that officials in Beijing and throughout China began easing some pandemic restrictions. Among individual companies, Tesla sank 6.4 per cent following a Bloomberg report that the company is cutting production at its Shanghai plant. VF Corporation slumped 11.2 per cent after announcing that Steve Rendle had retired as chief executive and that it has commenced a search for a new leader. The company, the owner of Timberland and other activewear brands, also lowered its forecast in light of a heavily promotional shopping environment.

SG

The three-month compounded Singapore Overnight Rate Average (Sora) rate, which is pegged to most floating home loan packages in Singapore, has passed the 3 per cent mark for the first time since 2007. The 3M Sora now stands at 3.0095 per cent, according to rates published on Monday (Dec 5). This means a homeowner paying 3.4 per cent per annum in interest for a UOB floating home loan package two weeks ago would now have to pay 3.7 per cent. Sora, which is the volume-weighted average borrowing rate in Singapore’s unsecured overnight interbank cash market, has been administered by the Monetary Authority of Singapore (MAS) since 2005. It is on track to replace the Singapore dollar Swap Offer Rate (SOR) as the main interest rate benchmark in Singapore’s financial markets. Meanwhile, the one-month compounded Sora crossed the 3 per cent mark as at the Oct 19 publication date. Several banks like RHB and HSBC offer floating home loan packages pegged to one-month compounded Sora rates.

Singapore’s Olam Agri has secured a US$2 billion bridge financing facility to support the reorganisation plan of its parent, Olam Group, the grains and animal feed trader said on Monday (Dec 5). Agri-business giant Olam Group announced its reorganisation plan in January 2020 to categorise its products under two operating businesses, with an intention to potentially spin out each unit and list them separately. It has since secured multiple loans including a US$2.9 billion facility in August for refinancing its existing loans. The 18-month bridge loan facility may also be used for general corporate purposes, Olam Agri said. “This transaction gives Olam Agri significant financial flexibility while Olam Group continues on its reorganisation pathway,” said Olam Group CFO N Muthukumar. In August, Olam Group posted a marginal rise in net profit for the first half of fiscal 2022, as a weak performance in its food ingredients unit partially countered strength in the Olam Agri business.

The liquidators for beleagured water-treatment company Hyflux will be declaring an interim dividend of 1.568 per cent to unsecured creditors of the company on or around Thursday (Dec 8). The dividend rate based on the total nominal value of the notes is expected to be S$0.01734 per note, and will be paid on or around Dec 21, the company’s appointed judicial managers from Kroll said in a bourse filing on Monday. The trustee’ fees and expenses will be paid in full, and the remaining dividend will be distributed, pari passu (on equal footing, without preference) to all noteholders, the liquidators said. The liquidators had said last month that unsecured creditors, including medium-term noteholders, are likely to receive a “small dividend” following the sale of assets. The liquidators said they have received total proof of debt amounting to around S$1.5 billion, but the realisations from the asset sales are unlikely to exceed S$100 million. The dividend will be credited directly into designated bank accounts for holders who held their notes with the Central Depository. For those who held their notes with depository agents, the dividend will be paid to beneficial owners by the respective depository agent or Central Provident Fund agent bank.

The offer to take MS Holdings private closed on Dec 2 with valid acceptances representing 96.72 per cent of the company’s total issued shares. The Catalist-listed company has called for a suspension of the trading of its shares on Monday (Dec 5) at 9 am. The offeror, Kingswin Investment, will exercise its right to compulsorily acquire all the remaining offer shares. In October, the offeror, fully owned by executive chairman Ng Chui Hwa, made a voluntary unconditional cash offer to privatise the company at S$0.07 per share. On Nov 5, MS Holdings announced that it lost its free float. The offer price represents a 16.7 per cent premium over the counter’s Aug 26 closing price of S$0.06, the last time MS Holdings’ shares changed hands before the offer announcement. MS Holdings, better known as Moh Seng Cranes in the industry, is in the business of leasing mobile and lorry cranes, as well as trading cranes and related equipment. Its counter last traded at S$0.069 on Nov 9.

US

US services industry activity unexpectedly picked up in November, with employment rebounding, offering more evidence of underlying momentum in the economy as it braces for an anticipated recession next year. The Institute for Supply Management (ISM) said on Monday (Dec 5) its non-manufacturing PMI increased to 56.5 last month from 54.4 in October, which was the lowest reading since May 2020. Economists had forecast the non-manufacturing PMI slipping to 53.1. A reading above 50 indicates expansion in the services sector, which accounts for more than two-thirds of US economic activity. The survey followed on the heels of data last Friday showing stronger-than-expected job and wage growth in November. Consumer spending also accelerated in October. The upbeat reports have raised optimism that the widely feared economic downturn in 2023 would be short and mild. Some economists are even betting that a recession could be avoided, with growth just slowing sharply. The Federal Reserve’s fastest rate-hiking cycle since the 1980s as it wages war against inflation is behind the hand wringing about a recession. Fed chair Jerome Powell said last week the US central bank could scale back the pace of its rate increases “as soon as December.” The acceleration in services industry activity confirms that spending is shifting away from goods and that the inflation baton has been handed over to services, indicating that overall price pressures in the economy could take a while to subside. Manufacturing activity contracted in November for the first time in 2-1/2 years, the ISM reported last week. In November, the ISM’s measure of services industry employment increased to 51.5 from 49.1 in October. But with orders stagnating, further gains are likely to be limited. The survey’s gauge of new orders received by services businesses dipped to 56.0 from 56.5 in October. Exports tumbled likely because of slowing global growth and a strong US dollar. A measure of prices paid by services industries for inputs slipped to 70.0 from 70.7 in October as supply continued to improve. The survey’s measure of services industry supplier deliveries fell to 53.8 from 56.2 in October. A reading above 50 indicates slower deliveries. Businesses continued to whittle down the backlog of unfinished work.

Apple supplier Foxconn expects its Covid-hit Zhengzhou plant in China to resume full production around late December to early January, a Foxconn source said on Monday, after worker unrest disrupted the world’s biggest iPhone factory. The Zhengzhou plant has been grappling with strict Covid-19 restrictions that have fuelled discontent among workers over conditions at the factory. Production of the Apple device was disrupted ahead of Christmas and January’s Lunar New Year holidays, with many workers either having to isolate to combat the spread of the virus or fleeing the plant. “The capacity is now being gradually resumed” with new staff hiring under way, said the person with direct knowledge of the matter. The person declined to the named as the information was private. “If the recruitment goes smoothly, it could take around three to four weeks to resume full production,” the person said, pointing to a period around late December to early January. Foxconn and the local government are working hard on the recruitment drive but many uncertainties remain, according to the source. The person cited “fears” some workers might have about working for the company after the plant was hit by protests last month that sometimes turned violent. “We are firing on all cylinders on the recruitment,” the person said. Foxconn declined to comment. Shares of Foxconn were up 0.5 per cent on Monday morning, in line with the 0.6 per cent rise in the broader market.

Tesla will lower production at its Shanghai factory, said sources familiar with the matter, in the latest sign that demand in China is not living up to the company’s expectations. The output cuts will take effect as soon as this week, and could reduce production by about 20 per cent, said the sources, who asked not to identified because the information was not public. One source said Tesla made the call after it evaluated its near-term performance in the Chinese market. The Shanghai plant’s production capacity was recently doubled to about 1 million cars a year. However, recent price cuts and added incentives – such as insurance subsidies and shorter delivery times – suggest that demand in China has failed to keep up with supply. The source added that there was enough flexibility for the automaker to increase output if demand were to increase. A Tesla representative in China declined to comment. The trims mark the first time Elon Musk’s electric vehicle (EV) pioneer voluntarily reduced production at its Shanghai plant. Previous reductions were caused by the city’s two-month Covid lockdown and supply chain snarls. Tesla is facing intensifying competition in China from local automakers such as BYD and Guangzhou Automobile Group. The two have raised prices in the world’s largest EV market. BYD posted a ninth consecutive month of record sales in November, with deliveries topping 230,000 units. This included almost 114,000 pure-electric models. Tesla’s reliability is also back in the spotlight after two recalls in China in the past month. One necessitated over-the-air software fixes, while another required some vehicles to be returned for maintenance. A recent fatal crash involving a Model Y that killed two people also sparked discussion over Tesla’s safety record.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

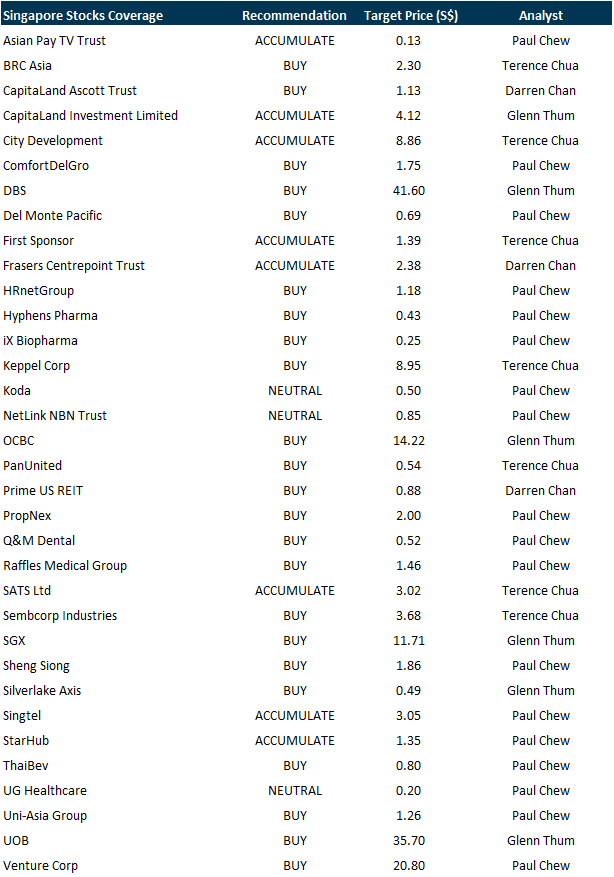

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Marco Polo Marine

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Guest Presentation by Sabana Industrial REIT

Date: 8 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UIuyXl

Guest Presentation by NoonTalk Media Limited [NEW]

Date: 13 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3gYzGI2

Guest Presentation by iWoW Technology

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: Salesforce Inc, ThaiBev, BRC Asia, Tech Analysis, SGBanking, SGWeekly & More

Date: 5 December 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials