DAILY MORNING NOTE | 6 January 2023

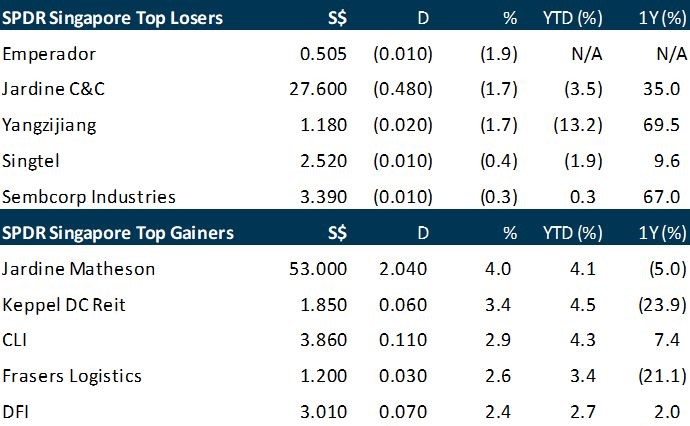

Singapore stocks recorded their first day of gains in this new year amid a rally across regional markets. The Straits Times Index (STI) climbed 1.6 per cent or 50.2 points to 3,292.66. Across the broader market, gainers beat losers 335 to 206, after 1.2 billion shares worth S$1.4 billion changed hands. This comes as Singapore retail sales rose 6.2 per cent year on year in November. On a month-on-month, seasonally adjusted basis, retail sales fell 3.7 per cent, reversing the 0.1 per cent growth posted in October. The top performer on the STI was Jardine Matheson Holdings. The company gained 4 per cent or US$2.04 to close at US$53. At the bottom of the table was Emperador, which fell 1.9 per cent or S$0.01 to close at S$0.505.

Solid US hiring data translated into another round of interest rate angst on Thursday, with US stocks ending sharply lower ahead of an upcoming government jobs report. Private employment bounced by 235,000 jobs in December, more than analysts expected. The data follows Federal Reserve meeting minutes released on Wednesday that continued to suggest a hard line on inflation after multiple interest rate hikes in 2022. The Dow Jones Industrial Average finished down 1.0 per cent at 32,930.08. The broad-based S&P 500 shed 1.2 per cent to 3,808.10, while the tech-rich Nasdaq Composite Index dropped 1.5 per cent to 10,305.24. Thursday’s drop comes ahead of Friday’s government jobs report for December. Among individual companies, Amazon shed 2.4 per cent as it announced it was cutting 18,000 jobs in the largest downsizing of the online giant’s history. Other large tech names also had a rough session, with Microsoft losing 3.0 per cent and Google parent Alphabet 2.2 per cent. Bed Bath & Beyond sank around 30 per cent as it warned that there is “substantial doubt about the Company’s ability to continue as a going concern,” a sign it could file for bankruptcy.

SG

Singapore’s retail sales rose 6.2 per cent on the year in November, continuing from the previous month’s 10.3 per cent growth, Department of Statistics (Singstat) data showed on Thursday (Jan 5). On a month-on-month seasonally adjusted basis, retail sales were down 3.7 per cent, reversing from the 0.1 per cent growth charted in October. November’s estimated total retail sales value was S$4 billion, with online sales accounting for 14.8 per cent. Excluding motor vehicles, retail sales expanded by 8.7 per cent from the year-ago period, and fell 4.3 per cent from the previous month, on a seasonally-adjusted basis. Year on year, most retail sales categories saw growth, while a majority of retail categories recorded sales declines on a month-on-month seasonally adjusted basis.

The cut-off yield for Singapore’s first six-month Treasury bill (T-bill) auction this year closed at 4.2 per cent on Thursday (Jan 5). The T-bills were around 2.6 times subscribed for the S$4.7 billion allotment in the latest auction. Non-competitive bids, which totalled S$1.4 billion in the latest auction, were fully allotted. Those who submitted bids at the cut-off yield were allotted around 27 per cent of their applications. Meanwhile, those who specified a lower yield were fully allotted, and those who specified a higher yield were not allotted. The total value of applications in this auction was S$12 billion, up from S$11.8 billion in the last auction in 2022.

Sheng Siong Group announced that its subsidiary, Sheng Siong (China) Supermarket on Dec 8, 2022, entered into a lease agreement with Yunnan Bi Yu Real Estate for a retail space of approximately 31,162 sq ft in Kunming City, Yunnan province, China. The new store is expected to be operational before the end of 2Q2023. This will bring the group’s store-count to 67 in Singapore and 5 in China. This new store is not expected to have a significant impact on the group’s financial performance for the financial year ended Dec 31, 2022.

Hong Lai Huat announced that its wholly-owned subsidiary, HLH Agriculture (Cambodia) (HLHA) has terminated its joint venture (JV) agreement with HSC Group (HSCG) for the proposed exploration and mining of mineral resources at the Cambodia-Singapore Agriculture Hub. The group says that the process to secure regulatory approval is still under review by the relevant authorities in Cambodia. However, the agreed period under the JV agreement has lapsed. The termination of this JV agreement shall not have any financial impact to the group’s financial results ending Dec 31, 2022.

Keppel Offshore & Marine (Keppel O&M) has secured a contract from an international renewable energy company for the construction of an offshore substation worth $130 million. The contract was secured by Keppel O&M’s wholly-owned subsidiary Keppel FELS Limited. The OSS will have a capacity of 600 MW and is scheduled to be completed in 2025. The OSS will be deployed in an offshore wind site in Asia Pacific.

US

U.S. jobless claims fell in the final week in 2022, signaling continued historic tightness in the labor market. Initial jobless claims, a proxy for layoffs, fell by 19,000 to a seasonally adjusted 204,000 last week, the Labor Department said Thursday. Seasonally adjusted jobless-claims figures tend to be volatile around holiday periods. The most recent data captured the week between the Christmas and New Year’s holidays. The four-week moving average of weekly claims fell to 213,750, a decrease of 6,750 from the prior week. Continuing claims, which reflect the number of people seeking ongoing unemployment benefits, ticked down to 1,694,000, a decrease of 24,000, in the week ended Dec. 24. While continuing claims remain at low levels, they moved somewhat higher during the fall months. Claims data point to a solid overall labor market, but some well-known companies are announcing layoffs. Workers generally can’t seek jobless benefits until after they separate from the company, which can be weeks after the layoff announcement. Also, high-skilled workers might quickly find new jobs in a still-tight labor market and forgo seeking benefits. The Labor Department will release its final jobs report for 2022 on Friday.

Amazon.com Inc.’s layoffs will affect more than 18,000 employees, the highest reduction tally revealed in the past year at a major technology company. The layoffs are concentrated in the company’s corporate ranks and represent roughly 5% of that element of its workforce, and 1.2% of its overall tally of 1.5 million employees as of September, which will be made over the coming weeks. Chief Executive Andy Jassy said that the majority of the cuts are on the retail and recruiting areas and that affected employees will be alerted this month.

Comment: The increased number of staff affected by the layoffs (~80% more than Amazon’s previous announcement of 10,000 in November) signals that the company is taking a more proactive action to rein in costs, while also preparing for continued slowing growth. Uncertain macroeconomic environment – with the Fed likely to continue raising rates throughout 2023 – constitutes a strong basis for taking the more conservative stance.

Maximilian Koeswoyo

Research Analyst

maximilian@phillip.com.sg

Tesla delivered 55,796 China-made electric vehicles in December, the lowest level in five months, according to data from the China Passenger Car Association (CPCA) on Thursday (Dec 5). That was a 44 per cent drop from November and 21 per cent fewer than a year earlier as the US automaker reduced output and cut prices to deal with rising inventories amid weakening demand. It also marks the fewest monthly deliveries since July when most production at Tesla’s Shanghai plant was suspended due to an upgrade to its production lines. For the whole of 2022, the US automaker delivered 50 per cent more vehicles produced in its Shanghai plant compared with 2021, the CPCA data showed.

Bed Bath & Beyond Inc. is preparing to file for bankruptcy within weeks after the home-goods retailer came up short on sales during the critical holiday season, according to people with knowledge of the matter. The retailer is in the early stages of planning for a chapter 11 bankruptcy filing and the discussions could extend into February, these people said. The company said that sales for its third quarter, which ended in November, are expected to fall by nearly a third and that losses are expected to widen nearly 40% to $385.8 million. A chapter 11 filing isn’t certain to occur. It is likely to secure the financing that would see it through the bankruptcy process from existing creditors, people familiar with the matter said. Chief Executive Sue Gove said that the results were hurt by inventory constraints as reduced credit limits prevented the company from adequately stocking its stores recently.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

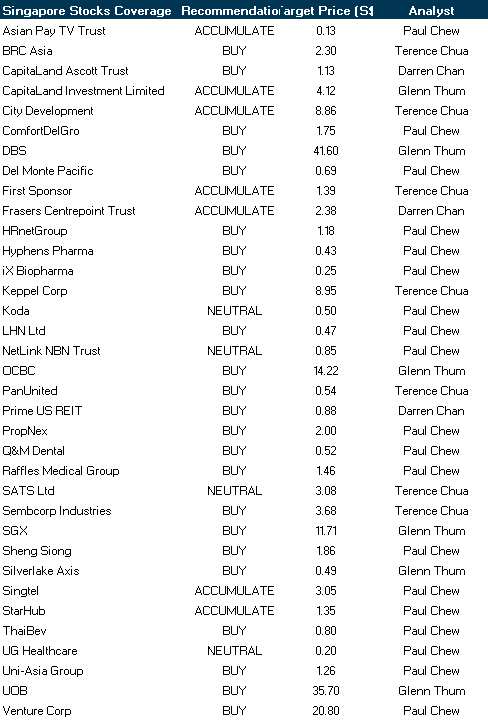

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Research Videos

Weekly Market Outlook: SGX, DelMonte, LHN, Zoom, City Developments, Zoom, Starhub, SG Weekly & More!

Date: 12 December 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials