DAILY MORNING NOTE | 8 August 2022

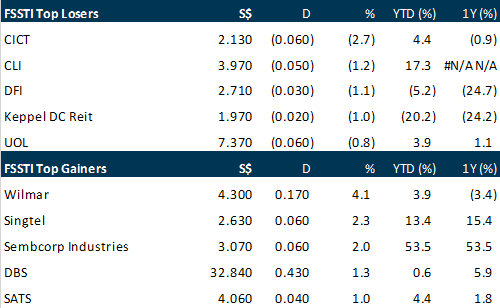

Asian markets were in rally mode as oil prices slid overnight, with Singapore’s Straits Times Index (STI) rising 13.02 points or 0.4% to 3,282.88 points on Friday (Aug 5). The STI rose 2.2% over the week, uplifted by bullishness in banking counters, amid heightened geopolitical tensions. The stock of top STI performer Wilmar International notched a gain of 4.1% to S$4.30. The counter that topped the most active trading in the broader market was mainboard-listed food-technology company Oceanus Group, which had a trading volume of 99.5 million when it closed 5.6% lower at S$0.017

The S&P 500 ended lower on Friday (Aug 5), weighed down by Tesla and other technology-related stocks after a solid jobs report torpedoed recent optimism that the Federal Reserve might let up its aggressive campaign to reign in decades-high inflation. Data showed US employers hired far more workers than expected in July, the 19th straight month of payrolls expansion, with the unemployment rate falling to a pre-pandemic low of 3.5%. The report added to recent data painting an upbeat picture of the world’s largest economy after it contracted in the first half of the year. That deflated investors’ expectations that the Fed might let up in its series of rate hikes aimed at cooling the economy. Tesla tumbled 6.6% and weighed heavily on the S&P 500 and Nasdaq. Facebook-owner Meta Platforms lost 2% and Amazon fell 1.2%, also pulling down the index. A largely upbeat second-quarter earnings season has helped the S&P 500 bounce back by about 13 per cent from its mid-June lows after a rough first-half performance. The S&P 500 declined 0.16 per cent to end the session at 4,145.19 points. The Nasdaq declined 0.50% to 12,657.56 points, while the Dow Jones Industrial Average rose 0.23% to 32,803.47 points. For the week, the S&P 500 rose 0.4%, the Dow fell 0.1% and the Nasdaq added 2.2%.

SG

Between Aug 1 and 2, Raffles Medical Group (RMG) executive chairman and non-independent director Loo Choon Yong acquired 353,800 shares of the private healthcare provider for a consideration of S$435,484. At an average price of S$1.23 per share, this increased his direct interest from 10.82 per cent to 10.84 per cent. Dr Loo’s total interest in RMG is 53.16%, which has gradually increased from 51.93% at the end of 2014. Attributed to the return of patients to its clinics, the H1 2022 healthcare division revenue of S$255.6 million was up 24.1% from H1 2021. At the same time, revenue from the hospital services division, decreased to S$151.8 million, down 11.4% from H1 2021, due to a decrease in the number of Covid-19 PCR diagnostic tests.

Baker Technology executive director Benety Chang acquired 132,000 shares of the company at an average price of 44.9 cents per share. With a consideration of S$59,275, this increased his total interest in the company from 52.96 per cent to 53.02%. Prior to this he had acquired 82,300 shares at 43.9 cents per share on May 4 and 279,000 shares at 44.8 cents per share on Mar 9. On Jul 29, Baker Technology reported H1 2022 group revenue of S$47.1 million, which represented a 55% increase from H1 2021, primarily due to higher fabrication revenue and charter revenue on improved operating conditions in the marine offshore industry. The group also noted that it benefited from its 54.98 per cent-owned subsidiary, CH Offshore, achieving marginal profits in H1 2022 compared to a net loss in H1 2021 primarily due to better vessel utilisation; and higher foreign exchange gains in the current period as the US dollar strengthened by about 3.0% against the Singapore dollar in H1 2022 compared to about 1.7% in H1 2021.

Non-executive director and vice-chair of the trustee-manager of Asian Pay Television Trust (APTT) Lu Fang-Ming, acquired 330,000 units of the business trust for a consideration of S$38,940. At an average price of 11.8 cents per unit, this increased Lu’s total interest in APTT from 1.04% to 1.06%. His preceding acquisitions were on Jul 14 with 300,000 units acquired at 12.2 cents per unit, and between Sep 23 and 27, 2021 with 1,888,400 units acquired at 13.0 cents per unit. APTT will announce its results for Q2 2022 and H1 2022, as well as the distribution for the quarter ended Jun 30, before the start of market trading on Aug 12.

US

Pfizer is in advanced talks to buy drugmaker Global Blood Therapeutics for about US$5 billion. Pfizer is aiming to seal a deal in the coming days, but other suitors are still in the mix, the report said. Shares of Global Blood, which makes a blood disorder drug called Oxbryta, soared 44% in afternoon trade to a 2-year high. The company had a market capitalisation of US$3.12 billion, as of Thursday’s closing price. New York-based Pfizer, flush with cash from its Covid-19 vaccine, is on the lookout for acquisitions that could bring in billions in annual sales by the end of the decade. Its US$11.6 billion deal for migraine drug maker Biohaven Pharmaceutical in May was the latest in a string of acquisitions including Trillium Therapeutics and Arena Pharmaceuticals over recent years. Biotech dealmaking activity has picked up again in recent months after a bleak start to the year, when a dearth of major acquisitions and clinical-stage drug failures dampened investor sentiment and squeezed funding.

Tesla’s months-long rally took a pause Friday (Aug 5) as the stock retreated following 7 sessions of gains after the electric-vehicle maker’s shareholders approved a 3-for-1 stock split on Thursday. The split – aimed at attracting an even larger number of retail investors, who have been piling into the stock – will bring Tesla’s shares down to the US$300 range. The Austin, Texas based-company in a regulatory filing on Friday said each stockholder of record on Aug 17 will get a dividend of 2 additional shares for each stock held, to be distributed after the market close on Aug 24. Trading on a split-adjusted basis will begin on Aug 25. Tesla first announced its plan on Mar 28 via a tweet. The 4-month lag between announcement and vote has proven to be beneficial, as a recovery in growth stocks has carried the Nasdaq 100 Index up 19% from a June low. Tesla is outperforming both the tech-heavy gauge and the broad S&P 500 Index with a gain of over 38% from a late-May low. Tesla’s recent rebound – it posted a 32 per cent gain in July for its best month since October – comes on the back of resilient second-quarter results and a bit of a lift from the climate change bill from the Biden administration, which aims to boost the use of clean energy through a series of tax incentives. Still, most of the risks that weighed on the company earlier this year continue to linger, with supply-chain disruptions far from sorted, tensions between the US and China rising, and Elon Musk involved in a potentially lengthy and costly legal dispute with Twitter. Moreover, recent high profile stock splits have failed to give a meaningful boost to other giants including Alphabet and Amazon.com this year. For Tesla, this will be the second share-split in less than 2 years. The company had a 5-for-1 stock split in 2020, prompting a 60 per cent surge in the share price from the day of the announcement to the execution date. The company already has a fairly strong retail investor following, often making it the stock with the most buy orders on Fidelity’s retail trading platform.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

StarHub Limited – More cost in 2H22

Recommendation: ACCUMULATE (Maintained); TP S$1.35, Last close: S$1.24; Analyst Paul Chew

• 1H22 revenue was in line with expectations at 47% of our FY22e estimates. EBITDA beat expectation at 36%. Nevertheless, we expect margins to contract more severely in 2H22 from further investments in IT outsourcing, EPL content, software licensing and 5G wholesale cost.

• Roaming revenue is improving but below pre-pandemic levels due to a lack of business travel and border restrictions in China.

• We maintain our FY22e revenue and EBITDA forecast. We cut depreciation by S$25mn due to accelerated depreciation of legacy system in prior quarters. FY22e will be a transition year for StarHub to undertake the necessary investments into new growth areas under the DARE+. Our target price is pegged at 8x FY22e EV/EBITDA, in line with other mobile peers. Our ACCUMULATE recommendation is maintained.

Venture Corporation Ltd – Riding on easing of lockdowns and improving supply chain

Recommendation: BUY (Maintained); TP S$20.80, Last close: S$17.73; Analyst Paul Chew

• 1H22 Revenue/PATMI was within expectations at 53%/48% of our FY22e earnings. 2Q22 PATMI jumped 21% YoY to S$90mn, back to pre-pandemic levels.

• Venture is coping with the supply chain constraint by piling up inventories. 2Q22 registered a 63% jump in inventories or S$483mn rise to S$1.25bn.

• The guidance for 2H22 is positive with customer demand remaining unabated. We lift our earnings by 5%, to account for a stronger 2H22. Our target price is modestly nudged up to S$20.80, based on 16x PE FY22e, its 5-year average. There is no change to our BUY recommendation. The dividend yield is healthy at 4.5% with earnings rebounding from lockdowns a year ago and improvement in the supply chain.

Amazon.com Inc. – Cost pressures surpassing healthy demand

Recommendation: NEUTRAL (Downgraded); TP: US$133.00, Last Close: US$142.57

Analyst: Jonathan Woo

• 2Q22 revenue beat expectations, but earnings missed modestly. 1H22 revenue at 45% of our FY22e forecasts, while normalised PATMI came in at 38%, excluding a pre-tax valuation loss of US$3.9bn from Rivian Automotive.

• Faced with US$4bn incremental cost from external factors: higher fuel prices, trucking, air and ocean freight rates. Higher energy costs to hurt margins, with 4% FX headwinds in 3Q22.

• We believe that earnings will remain suppressed due to increasing inflationary costs in the near term; our FY22e assumptions remain unchanged. We downgrade to NEUTRAL with an unchanged target price of US$133.00 based on DCF with a WACC of 6.4% and terminal growth of 5.0%.

Airbnb Inc. – Record profits and bookings

Recommendation: NEUTRAL (Downgrade); TP: US$119.00

Analyst: Ambrish Shah

• 1H22 Revenue/PATMI was at 44/27% of our FY22e forecasts. EPS of US$0.56 beat consensus estimates of US$0.43 by 30%. We expect profitability in 2H22 to rebound strongly driven by travel demand and higher operating leverage.

• Bookings volume grew 25% YoY to 103.7mn, but 3Q22 guidance was soft. Long-term stays (28+ days) grew 25% YoY and by almost 90% from 2Q19. Airbnb also announced a US$2bn share repurchase program.

• We downgrade to NEUTRAL from BUY after the recent run-up in its stock price. We maintain our DCF target price of US$119 (WACC 6.8%, g 4%) as our FY22e estimates remain unchanged. Macro uncertainties like rising inflation could weigh on discretionary demand for travel, but we believe Airbnb is a strong brand and could emerge as a preferred vacation option compared to hotels as its safe amid the spread of COVID-19, more affordable, and closer to home.

Upcoming Webinars

Guest Presentation by A-Sonic Group

Date: 11 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3PmoIrl

Guest Presentation by Marathon Digital Holdings

Date: 18 August 2022

Time: 10am – 11am

Register: https://bit.ly/3yNSfUu

Guest Presentation by First REIT

Date: 18 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3BqQe3q

Guest Presentation by Audience Analytics

Date: 23 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3P3eBYR

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Research Videos

Weekly Market Outlook: Microsoft, Meta Platforms, Alphabet Inc, UOB, Keppel Corp, Sheng Siong & More

Date: 1 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials