DAILY MORNING NOTE | 8 September 2022

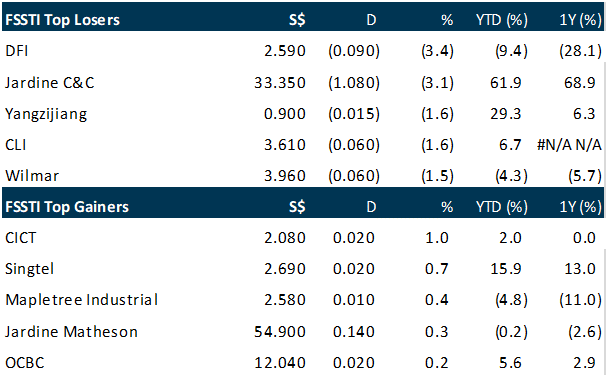

Worries over more aggressive monetary policy tightening by the United States Federal Reserve sent Asian markets – including Singapore’s – falling on Wednesday (Sep 7). The benchmark Straits Times Index (STI) fell 0.4 per cent, or 13.35 points, to 3,210.83. Losers outnumbered gainers 195 to 297, as some 1.5 billion shares worth S$1.2 billion changed hands. Elsewhere in the region, major indices also fell. South Korea’s Kospi fell 1.4 per cent, while Japan’s Nikkei closed 0.7 per cent lower.

Wall Street stocks finished solidly higher on Wednesday, shrugging off recent weakness despite more hawkish Federal Reserve commentary. Analysts pointed to a drop in oil prices as a key support to US equities on a day that saw investors engage in bargain hunting. “We got oversold in the short term, and a couple of things broke in the right direction,” said analyst Art Hogan of B. Riley Wealth Management, noting falling crude prices. The Dow Jones Industrial Average gained 1.4 per cent to close at 31,581.28. The broad-based S&P 500 rose 1.8 per cent to 3,979.87, while the tech-rich Nasdaq Composite Index advanced 2.1 per cent to end at 11,791.90.

Stocks to watch: Nio

SG

Higher expenses, including for research and development, weighed on the latest performance of Chinese electric carmaker Nio, with the company widening its net loss for Q2 ended June to 2.7 billion yuan (S$545 million), from 659.3 million yuan the year before. Revenue for the quarter rose 21.8 per cent to 10.3 billion yuan, with vehicle sales up 21 per cent to 9.6 billion yuan. This came as vehicle deliveries rose 14.4 per cent to 25,059, of which 9,914 were of the ES6 model. The increase in vehicle deliveries came despite pandemic-related challenges, said William Bin Li, Nio’s founder, chairman and CEO, in the company’s earnings statement on Wednesday (Sept 7).

SRS Auto Holdings’ voluntary cash conditional offer to privatise precision engineering company Allied Technologies has turned unconditional in all respects, according to a bourse filing late on Tuesday (Sep 6). The total shares owned, controlled or agreed to be acquired by the offeror and its concert parties, including valid acceptances, amounted to around 90.06 per cent of the total number of Allied Tech shares, as at 5.30 pm on the same day. SRS Auto’s offer will be open for acceptances until 5.30 pm on Sep 20. The private car rental and motor financing company will also exercise its right of compulsory acquisition.

Quetzal Offshore, a wholly-owned unit of Swiber Holdings, on Aug 31 signed a conditional agreement to sell a motor vessel, the Swiber Quetzal, for a proposed sum of US$8.5 million in cash. The buyer is Central de Desarrollos Marinos, a Mexico-incorporated company related to the Protexa group, which specialises in chartering and the operation of offshore vessels, Swiber disclosed in a Wednesday (Sept 7) bourse filing. Built in 2009, the Swiber Quetzal is a pipe-lay and accommodation work barge registered under the Mexico flag. It has been mortgaged as security for Quetzal Offshore’s obligations under banking facilities extended to it. Swiber is a guarantor to these obligations.

Participation of not just individuals or Singaporeans, but trade associations and chambers (TACs) and business associations is critical in the Forward Singapore exercise, said Low Yen Ling, Minister of State for Trade and Industry on Wednesday (Sep 7). The exercise is a movement that aims to review and refresh the country’s social compact. TACs shine the light on emerging opportunities and challenges in their respective sectors. They also play a critical role in supporting their members who are seeking to “future-proof” their operations, such as in achieving net-zero carbon emissions by 2050, noted Low during a fireside chat at a TAC networking event organised by the Singapore Business Federation (SBF).

US

A Delaware judge granted on Wednesday (Sep 7) Elon Musk’s request to add whistleblower claims to his Twitter countersuit but denied the billionaire’s request to delay the trial over Musk’s bid to walk away from his US$44 billion deal for the company, according to a court order. “I am convinced that even 4 weeks’ delay would risk further harm to Twitter,” wrote Chancellor Kathaleen McCormick of Delaware’s Court of Chancery. Musk’s legal team argued in court on Tuesday that justice demanded delaying the 5-day trial, currently scheduled to begin Oct 17, so he could investigate allegations that Twitter had misrepresented its data security.

The dollar was lord of all it surveyed on Wednesday (Sep 7), at a fresh 24-year peak on the rate-sensitive yen and retesting multi-year highs on the euro and sterling as economic problems in Europe contrasted with a strong US economy. The dollar soared as high as 144.99 yen, up 1.5 per cent, hitting the level for the first time since August 1998. It is now within a large leap of its 1998 high of 147.43. Meanwhile sterling was at US$1.4175, down 0.7 per cent. It was holding just above the US$1.1413 level, a fall below which would be its weakest level since 1985, according to Refinitiv data.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Singapore Banking Monthly – Volume and margins still rising

Recommendation: Overweight (Maintained)

Analyst: Glenn Thum

• August 3M-SIBOR was up by 25bps MoM to 2.72%, the highest in over a decade. Loans growth in Singapore rose 6% YoY in July.

• Singapore domestic loans grew 6.3% YoY in July, tracking our estimates, while Hong Kong’s domestic loans declined 0.08% YoY and 0.42% MoM in July.

• Maintain OVERWEIGHT. We remain positive on banks. Bank dividend yields are attractive at 5% with upside surprise due to excess capital ratios. Stable economic conditions and rising interest rates remain tailwinds for the banking sector. SGX is another beneficiary of higher interest rates. Pressure points for the banks will be higher staff costs and a nudge in general provisioning due to weaker economic assumptions.

FAANGM Monthly August 22 – Seeing some stabalisation

Analyst: Jonathan Woo, Maximilian Koeswoyo

Recommendation: OVERWEIGHT (Maintained)

• The FAANGM declined 5.0% in August, modestly better than the Nasdaq’s loss of 5.2%. The S&P 500 also declined 4.2% for the month.

• Elevated inflationary pressures, macroeconomic weakness and interest rate uncertainty continue to place downward pressure on FAANGM in Aug, after a brief relief rally in July. Now, we are starting to see FAANGM stabilise after its steep sell-off earlier this year, down only 0.7% over the last 3 months.

• We remain OVERWEIGHT on FAANGM as we continue to believe that they will be long-term winners. Secular tailwinds remain intact for streaming, cloud, cybersecurity, and digital advertising.

Upcoming Webinars

Guest Presentation by Credit Bureau Asia [NEW]

Date: 14 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Rj2MP4

Guest Presentation by AIMS APAC REIT [NEW]

Date: 15 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3KAETjD

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Research Videos

Weekly Market Outlook: Singtel, Salesforce Inc, Silverlake Axis, Phillip On The Ground, SG Weekly…

Date: 5 September 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials