DAILY MORNING NOTE | 9 December 2022

**Do note that the last day of Morning Note Issuance is on 15 December 2022. Morning Note will resume in January 2023**

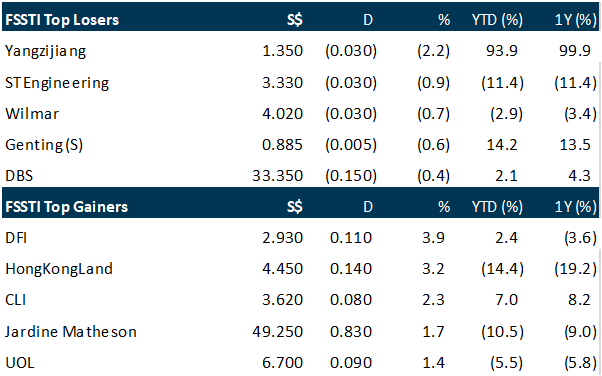

Singapore shares rose on Thursday (Dec 8) despite a broader decline across most Asian markets amid a cautious risk environment. The benchmark Straits Times Index (STI) climbed 0.3 per cent or 10.63 points to close at 3,236.08. Shares of DFI Retail Group led the index gainers on Thursday, with the counter rising 3.9 per cent to end at US$2.93. Meanwhile, Yangzijiang Shipbuilding ended at the bottom of the index performance table, falling 2.2 per cent to S$1.35. DBS was also among the six STI counters that closed in the red, slipping 0.4 per cent to S$33.35. The other local banks, OCBC and UOB, both rose 0.6 per cent. Across the broader Singapore market, gainers outnumbered losers 304 to 222, after 1.4 billion securities worth S$928.8 million changed hands. Elsewhere, most regional markets closed in the red as traders continued to grapple with the possibility of recessions in the US and Europe. Key indices in Japan, Shanghai, South Korea, Taiwan and Australia fell between 0.1 and 0.7 per cent. However, the Hang Seng Index in Hong Kong bucked the trend with a 3.4 per cent gain, on reports that the city may consider easing more Covid-19 rules.

Wall Street stocks shrugged off recent weakness and pushed higher on Thursday as tech shares rallied and the S&P 500 snapped a five-day losing streak. Shares of Apple and Amazon gained along with those of chip companies like Nvidia, advancing as equities sought to recover from a slump thus far in December, a typically strong month for stocks. The market this week has been buffeted by recession worries and fears that the Federal Reserve will maintain its aggressive posture to counter surging inflation. But the S&P 500 finished up 0.8 per cent at 3,963.51, its first positive session since Nov 30. The Dow Jones Industrial Average rose 0.6 per cent to 33,781.48, while the tech-rich Nasdaq Composite Index jumped 1.1 per cent to 11,082.00. The gains come ahead of Friday’s data on wholesale prices, a precursor to next week’s anticipated reading on consumer costs. Among individual companies, Microsoft rose 1.2 per cent as the US Federal Trade Commission sued to block its US$69 billion buyout of gaming giant Activision Blizzard, raising doubts on the future of the transaction. Officials from both companies expressed confidence the deal will still close. Shares of Activision fell 1.5 per cent. ExxonMobil rose 0.6 per cent after the oil giant said it would boost its share buyback programme to US$50 billion, rebuffing calls from President Joe Biden to steer extra cash towards increasing energy production. ExxonMobil, which has enjoyed record profits in 2022, said it plans to maintain its annual capital budget of US$20 billion to US$25 billion through 2027.

SG

The cut-off yield on Singapore’s latest six-month Treasury bill (T-bill) that closed on Thursday (Dec 8) shot up to 4.4 per cent, the second highest since the return last peaked at 4.73 per cent in 1988. The risk-free, fixed-income product by the Singapore government was about two times subscribed for the S$4.6 billion allotment in the latest auction, with the non-competitive bids totalling S$1.2 billion being fully allotted. Those who submitted bids at the cut-off yield of 4.4 per cent were allotted 82 per cent of what they applied for. Those who specified a lower yield were fully allotted, whereas those specified a higher yield were not allotted. The total value of applications amounted to S$9.3 billion, down from S$11.9 billion in the auction a fortnight ago. The last time yield on Singapore T-bills was above the 4 per cent level was in October at 4.19 per cent, while the highest yields before that were 4 per cent in 1989 and 4.73 per cent in 1988, according to data from the Monetary Authority of Singapore (MAS) website dating back to 1987. After October’s high yield, the number of bids surged to over 92,000 on Nov 10. Fierce competition among banks for cash has benefitted yield-hungry investors, with current fixed deposit rates after several rounds of raises now being around 4 per cent. T-bills have received explosive investor interest lately. In a non-competitive bid for T-bills, the investor specifies only the amount to invest and accepts the cut-off yield. Investors who would want to invest only if the yield is above a certain level submit competitive bids. Up to 40 per cent of the total issuance amount will be allotted to non-competitive bids first. If the amount of non-competitive bids exceeds 40 per cent, the bond will be allocated to non-competitive investors on a pro-rated basis, with the balance of the issuance amount going to competitive bids, from the lowest to highest yields. T-bills are issued at a discount, and investors get back the full face value at maturity. The bills can be purchased with cash, Supplementary Retirement Scheme funds or Central Provident Fund (CPF) monies, although investors who choose to use their CPF savings have to drop in personally at the branches of any of the trio of local banks. The CPF Board has earlier stated that the banking trio are targeting to allow online applications for Singapore Government Securities (SGS) products, including Treasury Bills, using CPF funds, in the first quarter of 2023. With yields from Treasury bills elevated, current account and savings account holders have deployed their funds to the risk-free bond, prompting banks to raise their interest rates; at least one of them has launched a fixed deposit for CPF funds.

Keppel Corporation’s shareholders voted overwhelmingly for the merger of its offshore and marine (O&M) unit with Sembcorp Marine (Sembmarine), with 99.96 per cent of votes cast for the proposal. This translates to 562.8 million votes, Keppel said in a bourse filing after an extraordinary general meeting on Thursday (Dec 8) held to put the proposal to a vote. Against votes amounted to 214,126, or 0.04 per cent of the votes cast. Temasek Holdings, which holds some 371.4 million Keppel shares, abstained from voting. 99.96 per cent of votes, translating to about 562.3 million shares, were also cast in favour of a second resolution, which is for Keppel to make the distribution in specie of Sembcorp Marine’s shares at a time and date to be determined by Keppel’s directors. The long-anticipated merger of the two O&M giants was first announced in April 2022 with plans to carry out separate schemes of arrangement that will result in Keppel O&M and Sembmarine becoming wholly-owned subsidiaries of the combined entity. Terms of this deal were revised in October such that Sembmarine would directly acquire Keppel O&M from Keppel Corp at the revised equity-value exchange ratio of 46:54, as compared with the earlier 44:56 (Sembmarine:Keppel O&M). A Keppel spokesperson said: “We would like to thank Keppel’s shareholders for their strong support of the Keppel Offshore & Marine combination and the asset co-transfer, as well as the distribution of sembcorp marine shares. With the successful conclusion of Keppel’s Extraordinary General Meeting, we have received all the required shareholder and regulatory approvals on Keppel’s part.” Keppel shares ended Thursday up 0.5 per cent or S$0.04 at S$7.47. Sembmarine shares ended the day flat at S$0.142.

Keppel DHCS, a wholly-owned subsidiary of Keppel Infrastructure Holdings, has upped its stake in a joint venture for a district cooling system in Bangkok to 42 per cent, after acquiring 16 per cent from Thai renewable energy company BCPG. BCPG and Thai engineering consultancy Team Consulting Engineering and Management are the other two partners in the joint venture, known as Prathumwan Smart District Cooling Company. The consideration for the sale shares was 8 million Thai baht (S$311,020), and was arrived at on a willing buyer willing seller basis, based on the par value of the shares. As at Oct 31, the aggregate book value and net tangible asset value of the sale shares was 7.7 million Thai baht. The consortium of three companies was awarded the contract, worth more than 7.5 billion baht (S$329 million), in July 2020. Keppel DHCS is a district cooling system service provider that provides cooling services at major business parks, including Singapore’s Changi Business Park, one-north (Biopolis, Fusionopolis, Mediapolis) and Woodlands Wafer Fab Park. It is a wholly-owned subsidiary of Keppel Infrastructure, which is in turn a wholly-owned subsidiary of Keppel Corporation.

Billionaire Oei Hong Leong is set to acquire a 20 per cent stake in printing and recycling specialist A-Smart Holdings for S$5.37 million, A-Smart said in a bourse filing on Thursday (Dec 8). This translates into an issuance of 29.8 million new ordinary shares to Oei at S$0.18 apiece, a 50 per cent premium to A-Smart’s closing price of S$0.12 on 6 Dec, 2022. The placement makes Oei a substantial shareholder, and also the second-largest shareholder after Chinese entrepreneur Ma Wai Dong, who acquired a 52 per cent stake in 2016. When completed, the proposed placement will result in a transfer of controlling interest to Oei and will require shareholders’ approval at an extraordinary general meeting to be convened. The new shares to be issued will be subjected to a two-year moratorium from its issuance date. Oei sees A-Smart as an “ideal candidate” to tap the economic expansion of Timor-Leste’s resource-rich economy. “The young and resource-rich economy of Timor-Leste has been on my radar for some time. With the country’s eventual admission into Asean, I believe it will trigger a sustained period of economic expansion. Hence, A-Smart is identified as an ideal candidate given its groundwork established in Timor-Leste’s property market from as early as 2017,” Oei said. A-Smart is set to start construction for a mixed-use development in Dili, the capital city of Timor-Leste, later this month. The project has an estimated gross development value of US$85 million and will be carried out through a 69-per cent-owned consortium. The group has another plot of land in the country set aside for a high-rise mixed development in the future. It has also signed a memorandum of understanding with a local real estate company, Dili Development, to jointly develop a seafront resort in the capital city. A-Smart’s chief executive officer and executive director Lim Huan Chiang said: “The proposed placement brings a twofold benefit to A-Smart, one being the fresh capital to fund our working capital needs of property development projects in Timor Leste.” “Other than that, the inclusion of a prominent businessman in Mr Oei Hong Leong as a strategic investor is much welcomed as he brings years of experience and an extensive business network to the equation.” A-Smart shares ended Thursday flat at S$0.121.

US

Apple supplier Foxconn’s Covid-hit Zhengzhou facility in China has lifted its “closed-loop” management curbs on Thursday (Dec 8), it said in a statement posted on its WeChat account. The Zhengzhou industrial park where Foxconn’s plant locates has been under a so-called closed-loop system that isolated the plant from the wider world for 56 days, the statement said. The world’s largest contract electronics maker, which has been trying to replenish depleted staff numbers at the site after thousands left over the past month, expects the Zhengzhou plant to resume full production around late December to early January. Its Zhengzhou plant was in October hit by a Covid-19 outbreak that prompted it to impose tough restrictions that involved isolating many staff. This in turn fuelled fear and discontent among workers and caused many to have to isolate or flee. Later in November, it was hit by a fresh bout of worker unrest that saw staff clash with security personnel over bonus payment issues. Foxconn could have seen more than 30 per cent of the Zhengzhou site’s November production affected, Reuters reported last month citing a source familiar with the matter. Foxconn hasn’t disclosed details of the impact of the disruption on its production plans or finances, which took place during a traditionally busy period for Apple ahead of Christmas and January’s Chinese New Year holidays. The company’s November revenue fell 11.4 per cent year on year reflecting production problems related to Covid controls at the major iPhone factory.

The Federal Trade Commission said on Thursday it has filed an antitrust case against Microsoft to challenge the software maker’s attempt to acquire video game publisher Activision Blizzard. This isn’t Microsoft’s first time dealing with competitive pressure. In 1998 the U.S. Justice Department filed a broad antitrust case against the company. Microsoft changed some practices related to its Windows operating system business as a result. Regulators in the United Kingdom are looking into whether the Activision Blizzard acquisition would lessen competition in the country. Microsoft announced plans to acquire Activision Blizzard for $68.7 billion in January, with the goal of closing it by June 2023. The deal has come under pressure from Microsoft’s competitors in gaming, such as Sony. Microsoft has repeatedly said it won’t be the world’s leader in gaming if the deal were to close, and it has vowed to provide popular “Call of Duty” games on gaming platforms other than those owned by Microsoft. “We continue to believe that this deal will expand competition and create more opportunities for gamers and game developers,” Brad Smith, Microsoft’s vice chair and president, said in a statement. “We have been committed since Day One to addressing competitive concerns, including by offering earlier this week proposed concessions to the FTC. While we believed in giving peace a chance, we have complete confidence in our case and welcome the opportunity to present our case in court.” “With control of Activision’s content, Microsoft would have the ability and increased incentive to withhold or degrade Activision’s content in ways that substantially lessen competition — including competition on product quality, price, and innovation,” the FTC said in its complaint. “This loss of competition would likely result in significant harm to consumers in multiple markets at a pivotal time for the industry.” In the statement, the FTC said Microsoft has a record, including with its 2021 ZeniMax deal, of buying games and using the moves to suppress competition from other companies that make consoles. Microsoft promised the European Commission antitrust officials that the company wouldn’t have an incentive to stop people from playin ZeniMax games on consoles other than the Xbox, but after the European Commission permitted the deal to proceed, Microsoft announced that it was making ZeniMax games such as Elder Scrolls VI, Redfall and Starfield into exclusives, the FTC said in its suit. The FTC said Activision Blizzard has brought its games to a variety of devices, irrespective of their manufacturers, but that might change if Microsoft were to complete the deal. Microsoft could adjust prices or worsen the experience on competing hardware such as Sony PlayStation consoles, or keep Activision Blizzard consoles from reaching consoles other than Microsoft Xbox systems, the agency said. Microsoft does offer titles that are exclusive to the Xbox, and in October Phil Spencer, CEO of gaming at Microsoft, pointed out that Sony has its own set of exclusive franchises, but over time Microsoft has brought games such as Minecraft to other devices. He argued that it’s important for more people, not less, to play games the company owns. Microsoft is seeking to add subscribers to its Game Pass service that provides access to hundreds of games. The Game Pass Ultimate subscription tier also allows people to play games that stream from Microsoft data centers on a variety of devices, including smartphones. The FTC said in its case that the proposed acquisition is reasonably likely to reduce competition or bring about monopolies in the markets for gaming subscription services, cloud gaming and high-performance consoles. The lawsuit represents a major milestone for FTC Chair Lina Khan, who has long signaled aggressive action on tech. While her tenure has included a lawsuit seeking to block Facebook owner Meta from acquiring a virtual reality fitness app developer, the lawsuit seeking to block the Microsoft-Activision deal is notable for its scale, as the largest technology transaction to date. Federal enforcers have seen a string of losses in merger challenges in recent months, with the exception of one significant win by the Department of Justice in its case against Penguin Random House’s proposed acquisition of Simon & Schuster. The FTC’s administrative law judge rejected the commission’s challenge of Illumina’s proposed acquisition of Grail in the biotech space, though the FTC said it will appeal that ruling. The Antitrust Division has also said it’s appealing or considering appealing the three merger cases it lost so far: UnitedHealth Group-Change Healthcare, US Sugar-Imperial Sugar and Booz Allen Hamilton-EverWatch. Smith previewed Microsoft’s arguments against blocking the deal in a Wall Street Journal opinion piece published earlier this week, saying it would be a “huge mistake.” “Microsoft faces huge challenges in the gaming industry,” Smith wrote, adding that its Xbox console gaming system is in third place behind Sony’s PlayStation and the Nintendo Switch. Microsoft also has “no meaningful presence in the mobile game industry,” he said. He pointed attention toward Apple and Google, saying that while mobile gaming is a fast growing and high revenue segment, those two app store operators take a “significant portion” of those earnings through their fees on developers. Activision Blizzard does have a place on mobile devices thanks to its 2016 acquisition of King, which publishes the Candy Crush Saga game. The Candy Crush franchise has over 200 million monthly active users, Activision Blizzard said in November. Smith noted that Microsoft’s purchase of Activision would let it compete effectively in the gaming industry, spurring innovation and helping customers. He downplayed concerns voiced by competitors such as Sony, saying the company is “as excited about this deal as Blockbuster was about the rise of Netflix.” Activision Blizzard shares reached a session low of $73 per share after the FTC announced its case. Microsoft had agreed to pay $95 per share. Bobby Kotick, Activision Blizzard’s CEO, told employees in a memo that the assertion that the deal is anti-competitive doesn’t match with the facts.

The Federal Trade Commission (FTC), which enforces antitrust law, is about to engage in a real-life courtroom fight over virtual reality. On Thursday (Dec 8), a high-profile trial kicks off in which the FTC will try to prevent Facebook parent Meta Platforms from buying virtual reality (VR) app developer Within. The FTC sued in July to stop the deal, saying Meta’s acquisition of Within would “tend to create a monopoly” in the market for VR fitness apps. It has asked the judge to order a preliminary injunction that would halt the proposed transaction. The trial that starts on Thursday will serve as a test of the FTC’s bid to head off what it sees as a repeat of the company buying its way to dominance, this time in the nascent virtual and augmented reality markets. The FTC is separately trying to force Meta to unwind two previous acquisitions, Instagram and WhatsApp, in a lawsuit filed in 2020. Both were in relatively new markets at the time the companies were purchased. A government victory could crimp Meta’s ability to manoeuvre in an area of emerging technology that chief executive Mark Zuckerberg has identified as the “next generation of computing.” If blocked from making acquisitions in the space, Meta would face greater pressure to produce its own hit apps and would give up the gains – in terms of revenue, talent, data and control – associated with bringing innovative developers in-house. Within developed popular subscription-based virtual reality workout app Supernatural, which it advertises as a “complete fitness service” with “expert coaches,” “beautiful destinations” and “workouts choreographed to the best music available.” It is available only on Meta’s Quest devices, which are headsets offering immersive digital visuals and audio that market research firm IDC estimates capture 90 per cent of global shipments in the virtual reality hardware market. The majority of the more than 400 apps available in the Quest app store are produced by external developers. Meta owns the most popular virtual reality app in the Quest app store, Beat Saber, which it acquired in 2019. Meta is expected to argue that the FTC did a poor job of defining the relevant market and that it competes with a whole range of fitness content, not just VR-dedicated fitness apps. It is also expected to argue that the FTC underestimated the competition in the market for VR-dedicated fitness apps. The social media company agreed to buy Within in October 2021, a day after changing its name from Facebook to Meta, signalling its ambition to build an immersive virtual environment known as the metaverse. Meta did not disclose the price tag for the deal but tech publication the Information reported that it was about US$400 million. Zuckerberg will be a witness in the trial. Other potential witnesses are Within CEO Chris Milk and Meta chief technology officer Andrew Bosworth, who runs the company’s metaverse-oriented Reality Labs unit. The trial is at the US District Court for the Northern District of California. In addition to defending the Within acquisition, Zuckerberg is expected to be questioned about the Facebook parent’s strategy for its VR business, as well as the company’s plans to support third-party developers, according to a court document.

Twitter plans to change the pricing of its Twitter Blue subscription product to US$11, from US$7.99, if paid for through its iPhone app and to US$7 if paid for on the website, the Information reported on Wednesday (Dec 7), citing a person briefed on the plans. The move was likely a pushback against Apple’s 30 per cent cut on any payments made by users via apps on the iOS operating system, the report said. The lower pricing on the website was also likely to drive more users to that platform as opposed to signing up on their iPhones, the report said. It did not mention whether pricing would change for the Android platform as well. Musk, who took ownership of Twitter in October, is planning to roll out the micro blogging site’s verified service with different coloured checks for individuals, companies and governments after a botched initial launch led to a surge in users impersonating celebrities and brands on the platform. Twitter, Apple and Google, which owns the Android operating system, did not immediately respond to a request for comment. Musk, in a series of tweets last week listed various grievances with Apple, including the 30 per cent fee the iPhone maker charges software developers for in-app purchases. He also posted a meme suggesting he was willing to “go to war” with Apple rather than paying the commission. Musk later met Apple chief executive Tim Cook at the company’s headquarters and later tweeted that the misunderstanding about Twitter being removed from Apple’s app store was resolved.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

StarHub Limited – More DARE, less PLUS until FY24

Recommendation: ACCUMULATE (Maintained); TP S$1.15, Last close: S$1.07;

Analyst: Paul Chew

– Under StarHub’s DARE+ transformation (2022-26) to reduce cost and create new revenue streams, S$310mn of investments are required from FY22-24e. Around S$75mn has been spent with the bulk (est. S$150mn) to be spent in FY23e.

– EBITDA is expected to return to the FY21 baseline of S$500mn by FY24 (FY22e: S$415mn).

– The 3-5 month delay in project implementation and higher cost in cloud infrastructure will elevate the operating cost and Capex in FY23e. We have not modelled the higher cost pending FY23e guidance, but there is upside risk. Our FY22e and FY23e forecasts are unchanged, but the target price is maintained at S$1.15, pegged at 7x FY22e EV/EBITDA, in line with other mobile peers. We maintain an ACCUMULATE recommendation.

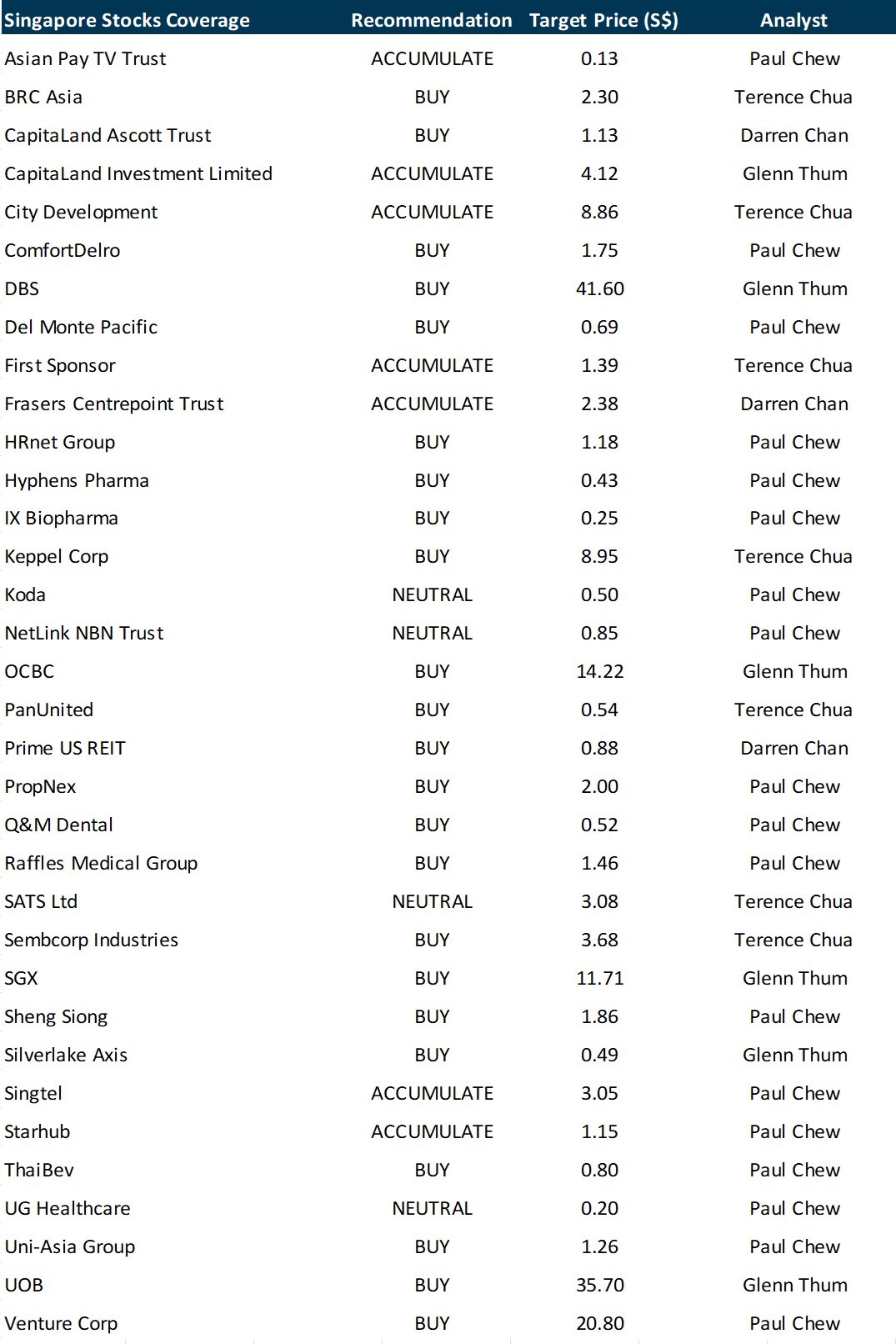

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by NoonTalk Media Limited [NEW]

Date: 13 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3gYzGI2

Guest Presentation by Keppel Infrastructure Trust ( KIT) [NEW]

Date: 15 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UBLxd4

Guest Presentation by iWoW Technology

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: Salesforce Inc, ThaiBev, BRC Asia, Tech Analysis, SGBanking, SGWeekly & More

Date: 5 December 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials