DAILY MORNING NOTE | 9 January 2023

Week 2 Equity Strategy: We are near-term bullish. The release of declining US inflation data on Thursday could stroke an equity rally as markets price in soft landing or our so-called “Goldilocks lite” economic conditions in the US. Any rally we expect will be short. An economic slowdown is still underway as job gains in the US are at 2-year lows. The trade is for the Fed to only hike rates by 25 bps at the 31 Jan FOMC meeting with inflation data dropping faster than expected. Fed chief Jerome Powell’s speech this Tuesday may create some jitters as hawkish comments are expected.

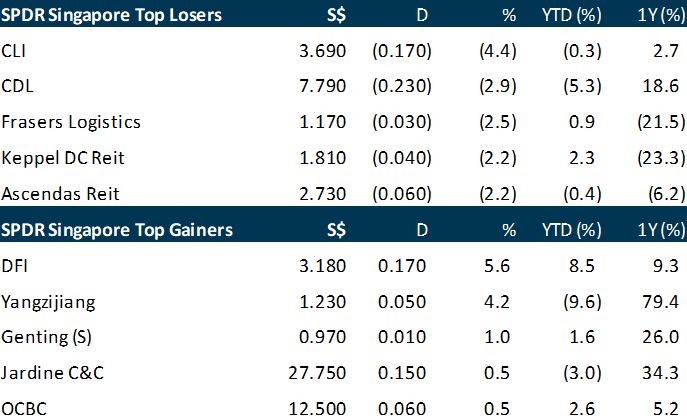

Singapore shares were in the red on Friday (Jan 6), mirroring a decline in US equities overnight, even as regional markets turned in a mixed performance. The Straits Times Index (STI) shed 0.5 per cent or 15.94 points to close at 3,276.72. Across the broader market, gainers beat losers 288 to 253, after 1.04 billion securities worth S$1.02 billion changed hands. In the US, all three major indices closed lower, with the tech-heavy Nasdaq leading the fall with a 1.5 per cent drop. Among regional markets, South Korea’s Kospi climbed 1.1 per cent, Japan’s Nikkei 225 rose 0.6 per cent, and the Jakarta Composite Index advanced 0.5 per cent. However, Hong Kong’s Hang Seng Index fell 0.3 per cent, while the Kuala Lumpur Composite Index edged down 0.03 per cent.

Wall Street stocks engineered their first rally of 2023 on Friday (Jan 6) after data suggested a slowing US economy, easing the pressure for more Federal Reserve interest rate hikes. The Dow Jones Industrial Average finished up 2.1 per cent at 33,630.61, a gain of about 700 points. The broad-based S&P 500 jumped 2.3 per cent to 3,895.08, while the tech-rich Nasdaq Composite Index surged 2.6 per cent to 10,569.29. All 11 indices of the S&P 500 finished in positive territory, with markets cheering a drop in the yield on the 10-year US Treasury note, a proxy for US interest rates.

Stocks to watch: Yangzijiang Shipbuilding Holdings Ltd

SG

Yangzijiang Shipbuilding (Holdings)’s subsidiary Yangzijiang Shipping has received a winding up application by Trinity Seatrading, seeking US$4.8 million. According to Yangzijiang in an SGX announcement on Jan 8, the claim was from the arbitration outcome of a dispute between the two parties and consists of US$3.25 million in damages plus accrued interest of US$1.59 million. Yangzijiang Shipping had earlier sold an oil tanker to the claimant, a Liberian company. According to Yangzijiang Shipbuilding (Holdings), the listed entity, the hearing date for the Winding Up Application has been fixed on January 20 2023.

Proceeds from South-east Asian environmental, social and governance (ESG) bonds rose 37.4 per cent year-on-year to US$2.9 billion in the last three months of 2022, bucking a global decline, according to data from Refinitiv. Worldwide ESG bond proceeds fell 52.9 per cent to US$133.3 billion in Q4 2022, compared to the US$203.8 billion in the same quarter in 2021. For the Asia ex-Japan region, ESG bond proceeds declined 16.8 per cent to US$29 billion from US$33.8 billion over the same period. For the whole of 2022, South-east Asia ESG bond proceeds grew 38 per cent to US$21.9 billion. Global ESG bond proceeds shrank 26 per cent to US$707.1 billion.

Singapore’s main crypto lobby group has pushed back on the central bank’s proposals to bar crypto firms from lending out retail customers’ digital tokens, saying such a measure is “overly restrictive.” The Blockchain Association of Singapore said such a blanket ban could instead push people to seek out unregulated offshore firms to lend their tokens to, according to an 11-page feedback that was sent late last month to the Monetary Authority of Singapore (MAS) and viewed by Bloomberg News. The document disagreed on areas like offering retail incentives though agreed to suggestions such as barring customers from borrowing to buy crypto tokens and segregation of customer assets from the company’s own.

US

Tech companies, including Microsoft and Meta Platforms, are expected to hit the bond market in size to buy back stock after last year’s rout. As much as US$20 billion in issuance from Microsoft and US$10 billion from Meta could be on the docket, according to analysis by Bloomberg Intelligence. The sector has more cash than others, giving it room to pursue bond sales to fund buybacks. Microsoft’s shares are down nearly 30 per cent in the last year, while Meta Platforms saw more than 60 per cent of its value erased. The massive sell off in many high-flying tech stocks may push the industry’s behemoths to borrow more to help return money to shareholders as cash levels drop.

A Tesla software engineer could earn anywhere from US$83,200 to US$417,600. Netflix has one job posting advertising a pay range of US$90,000 to US$900,000 and another at US$50,000 to US$600,000. Under a new California law that took effect this week, all companies with 15 or more employees advertising jobs based in the state are required to post an estimate for what the employer “reasonably expects to pay” with the posting. Much like when New York City’s law went into effect last year, some companies are taking a liberal interpretation of the new regulations with notably wide pay ranges. The Netflix and Tesla ranges were the widest among about 53,000 job posts from 700 tech companies analysed by Roger Lee, co-founder of Comprehensive.io, a pay data and analytics site. The average pay range in postings he looked at was US$130,000 to US$200,000.

Cloud-based software firm Salesforce is looking to cut costs by US$3 billion to US$5 billion, chief executive Marc Benioff told company insiders this week after announcing layoffs, Fortune reported, citing an audio recording of a meeting. Salesforce said on Wednesday (Jan 4) that it plans to cut jobs by 10 per cent and close some offices, after rapid pandemic hiring left it with a bloated workforce amid an economic slowdown. Real estate will be a major part of the cost restructuring process, Benioff told employees in a meeting on Thursday, the Fortune report said. He added that the company is still growing and is very successful.

3M has racked up more than US$450 million in defence costs as it struggles to fend off allegations defective earplugs it sold to the US military harmed soldiers’ hearing, court filings show. The company – which has lost a slew of test trials over the earplugs – put a unit into Chapter 11 in July in hopes of corralling the estimated US$7 billion litigation over the product. A bankruptcy court filing last month detailed how 3M’s lawyers are seeking more than US$19 million in fees and costs for work on the case just between July and October, bringing the running total to US$366 million.

Tesla shares kicked off the new year on an ominous note, buckling this week under renewed concerns about weakening demand for its electric cars, and sending its market value briefly below Facebook parent Meta Platforms’ for the first time in over a year. The Elon Musk-led EV maker’s shares fell as much as 7.7 per cent to US$101.81 in early trading on Friday (Jan 6). The stock later erased the losses to close up 2.5 per cent as the broader market rallied after economic data showed wage gains have slowed down, a development that can help the Federal Reserve fight inflation. Earlier in the session, Tesla’s market capitalisation dipped to around US$321 billion, dropping below Meta’s roughly US$334 billion.

FTX’s US-based bankruptcy team agreed to coordinate with liquidators who are winding down the crypto exchange’s operations in the Bahamas, resolving a dispute that threatened the recovery of what could be billions of dollars in lost funds. In a joint statement on Friday (Jan 6), the two sides said they will work to share information, secure property and coordinate litigation against third parties. FTX’s US bankruptcy team has been at odds with Bahamian officials since November, when competing bankruptcies were filed in the two countries.

The US dollar fell on Friday (Jan 6) after US jobs data showed a strong, but not blockbuster employment picture in December, while a separate report showed that US services industry activity contracted for the first time in more than 2-1/2 years that month. Employers added 223,000 jobs in December, more than economists’ forecasts of 200,000. Wages also grew 0.3 per cent last month, less than the 0.4 per cent in November and below forecasts of 0.4 per cent. That lowered the year-on-year increase in wages to 4.6 per cent from 4.8 per cent in November.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

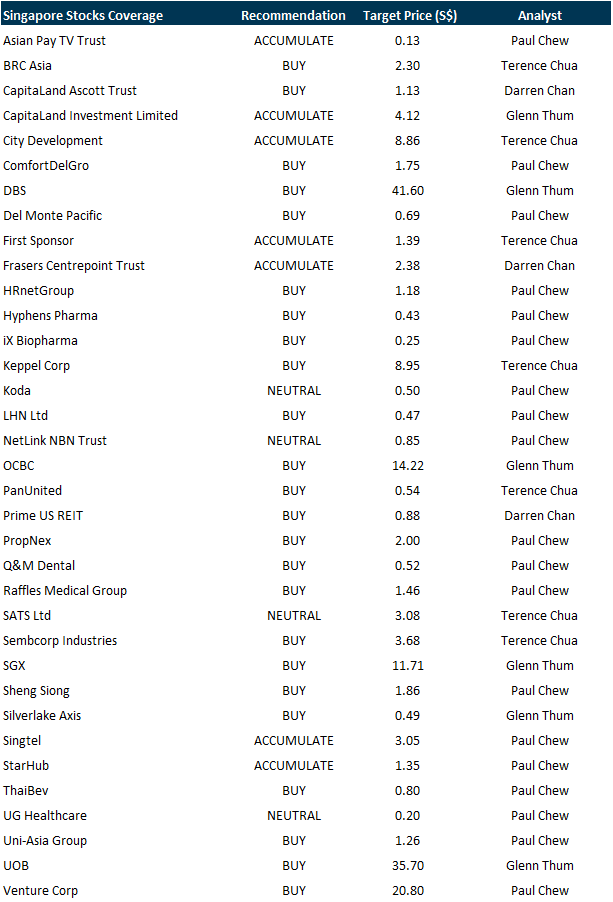

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Research Videos

Weekly Market Outlook: SGX, DelMonte, LHN, Zoom, City Developments, Zoom, Starhub, SG Weekly & More!

Date: 12 December 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials