SRS Articles

Get Started Today

Open an Account EnquiryFor assistance, call 6212 1818 | Visit our Phillip Investor Centres

Frequently Asked Questions

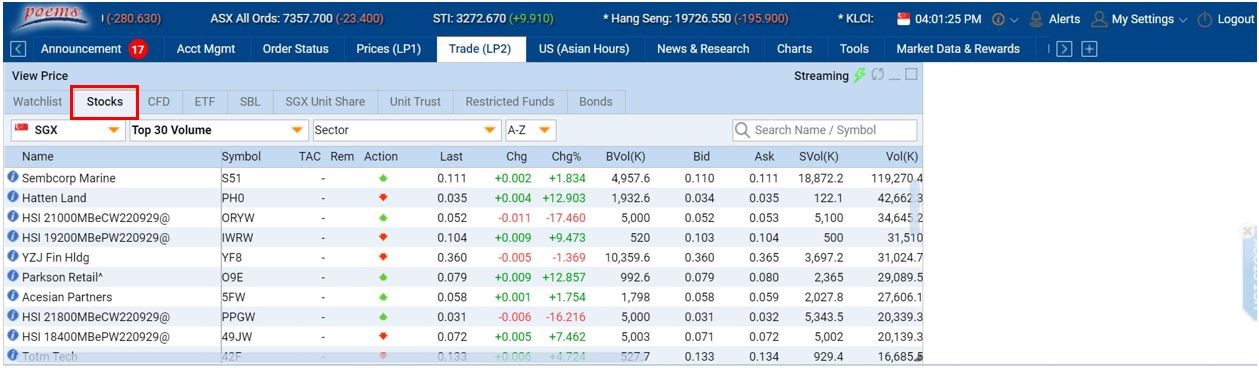

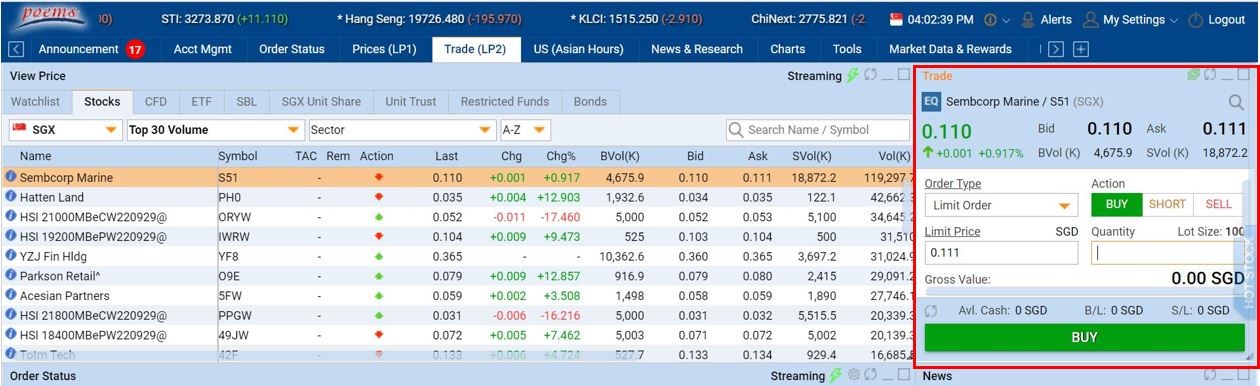

- Open a CPF Investment Account or SRS account with any of the three local banks (DBS, UOB, OCBC).

- Link your CPFIS/SRS Account to your trading account via POEMS 2.0 or POEMS 3:

- Log in to POEMS 2.0 > My Settings > My Account > Bank A/C information

- Log in to POEMS 3 > Me Tab > Bank A/C Information

- Before investing, check and ensure that you have computed the investable amount / have sufficient holdings before making the order submission.

- Please link your CPF or SRS account before 6pm for it to be updated within the same working day.

You may refer to Central Provident Fund Board (CPFB) or your agent bank’s website for guidance.

No, a CPF Investment Account (CPFIA) cannot be used for a joint trading account.

Contra is not supported by the banks. The bank may affirm your BUY position for a settlement if you have sufficient investable amount but the SELL position will be revoked to cash settlement and is subjected to buy-in by SGX unless you have sufficient holdings in your account to satisfy your delivery obligations.

Bank matrix for buy & sell on the same day with no holdings.

| Trade side | DBS | OCBC | UOB |

| Buy | Remains as CPF/SRS trade | Revoke to cash | Remains as CPF/SRS trade |

| Sell | Revoke to cash | Revoke to cash | Revoke to cash |

For CPF, you may refer to the SGX website for the list of CPF Approved Stocks.

For SRS, please refer to your SRS Operator for more details.

- CPF/SRS bank details is not linked to your trading account

- You have exceeded the investment limit

- You have insufficient funds/holdings in CPF/SRS Account

- Buying and selling within the same day

- Your CPF/SRS bank account is closed

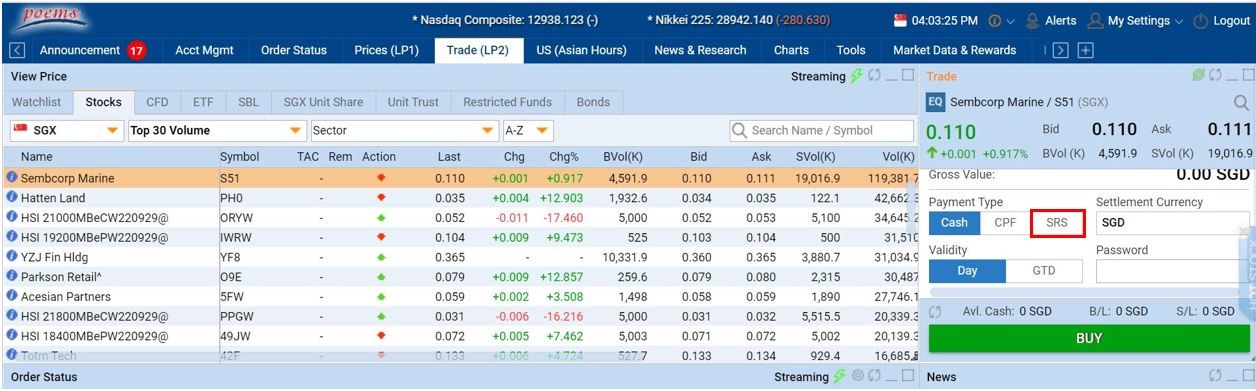

- Settlement currency in not in SGD

You can check your investible CPF savings by logging in to my cpf digital services with your Singpass and/or check with your CPF/SRS operating bank.

Contracts that are partially or fully revoked will be on cash settlement. If you do not have sufficient cash or shares to meet your payment or delivery obligations, the affected contract will be forced-liquidated or be subjected to buying-in accordingly.

Your CPF/SRS bank makes the decision to partially/fully revoke CPF/SRS trades based on investment limit/holding etc. For further enquiries, we advise you to check with your operating bank.

No, as this is subjected to the bank’s decision which is final and not debatable. For further enquiries, we will advise you to check with your operating bank.

For payments using 2 different settlement modes (e.g. Cash, CPF or SRS), there will be 2 contracts created and each contract is subjected to standard brokerage fees and charges.