Advanced Micro Devices - Stock Analyst Research

| Target Price* | 190.00 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 6 May 2024 |

*At the time of publication

Advanced Micro Devices Inc. - More demand for AI

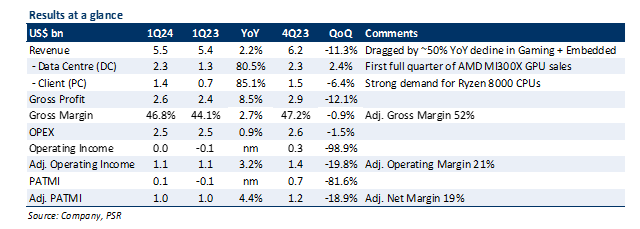

- 1Q24 results were slightly below expectations due to weaker Gaming and Embedded segments. 1Q24 revenue/PATMI was at 20%/4 % of our FY24e estimates. We expect both revenue and PATMI to be backloaded into 2H24e as the MI300x ramp-up continues and Embedded recovers.

- MI300x demand is still strong, with AMD increasing FY24e sales to >US$4bn on better supply visibility. Customers are seeing better inferencing performance in MI300x vs. Nvidia’s H100. AMD is also seeing very strong demand for its Ryzen 8000 Series CPUs as OEMs like Acer, HP, etc. began ramping their new notebook designs.

- We lower our FY24e revenue/PATMI by 4%/6% due to prolonged weakness in Gaming and Embedded, offset slightly by higher DC + PC demand. We lower our target price to US$190 (prev. US$195) while keeping our WACC/growth rate assumptions of 7.4%/5% unchanged. Due to recent price movements, we upgrade to a BUY from ACCUMULATE. We believe AMD will benefit from increasing AI-related investments while also gaining traditional server market share from enterprise transition to the Cloud. We also see significant market share gains in PC due to its strong CPU product line.

The Positives

+ DC growth supported by strong MI300x ramp-up and server CPU gains. 1Q24 was the first full quarter of MI300x sales (~US$600mn) as customer demand for AMD’s AI GPUs remained strong. MI300x deployments expanded at Microsoft, Meta, and Oracle, with customer feedback of better inferencing performance vs. Nvidia’s H100. AMD raised its FY24e GPU revenue to >US$4bn (prev. >US$3.5bn) on improving demand-supply dynamics, which we estimate equates to roughly US$300mn additional ramp per quarter. Server CPU (EPYC) growth is also doing well (est. ~25% YoY), with enterprise customers beginning their server refresh cycle and expanding cloud and on-premise deployments. EPYC adoption is accelerating due to higher efficiency and cost savings (~45%) vs. competitors, with AMD gaining market share. AMD guided strong YoY growth for GPU and CPU sales in 2Q24e.

+ Early signs of PC upgrading cycle with strong demand for Ryzen 8000 CPUs. AMD’s PC segment grew to 85% YoY (4Q23: 62% YoY), significantly quicker than main competitor Intel (31% YoY). Demand from OEMs picked up, with desktop CPU sales growing strong double-digits YoY and laptop CPU sales almost doubling. AMD is anticipating growth in the PC market for 2024 due to 1) early signs of a refresh cycle from enterprises, and 2) increasing AI PC adoption. AMD guided its PC segment to increase QoQ, and significantly YoY due to higher volume and ASPs.

The Negative

– Gaming is still a huge drag, with Embedded recovery delayed. Gaming and Embedded were both down ~50% YoY, with Gaming still weak due to its 5th year in the console cycle and customer inventory still elevated. AMD expects weakness in Gaming to continue significantly into 2H24e. Embedded’s -46% YoY decline was more than expected due to weaker demand from the communications, industrial, and automotive sectors. The overall segment looks to have bottomed, although AMD expects the recovery to be more moderate. Recovery in the Embedded segment will be a tailwind to overall margins (1Q24 Adj. Operating Margin: 40%).

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

May 17th - Things to Know Before the Opening Bell

May 17th - Things to Know Before the Opening Bell Trade of the Day - Boeing Co. (NYSE: BA)

Trade of the Day - Boeing Co. (NYSE: BA) Singapore Banking Monthly - Fee income the driver

Singapore Banking Monthly - Fee income the driver May 16th - Things to Know Before the Opening Bell

May 16th - Things to Know Before the Opening Bell