ComfortDelGro Corp Ltd - Weighed by upfront costs

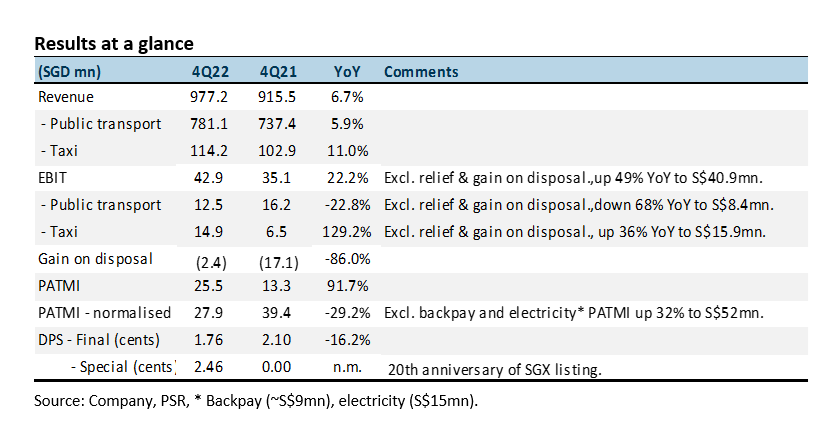

27 Feb 2023- FY22 revenue met expectations at 99% of our forecast. Adjusted PATMI was 13% below due to an additional S$15mn rail electricity expense from the new contract in Singapore. Cost recovery will come from the 13.5% fare adjustment effective late December 2022.

- Special dividend of 2.46 cents was declared to mark the 20th anniversary of the SGX listing. FY22 total special dividend was 3.87 cents while the ordinary dividend was 4.61 cents (3.8% yield).

- We lowered our FY23e PATMI by 20% to S$178.4mn as the timing of the indexation of the UK bus contract is unclear. Nevertheless, we expect earnings growth in FY23e from increased passenger volumes for both taxis and trains, re-pricing of rail fares in Singapore, indexation of UK bus contracts and reduction of taxi rebates in China. We maintain BUY with a reduced DCF target price of S$1.63 (prev. S$1.75).

The Positives

+ Taxi recovery on track. 4Q22 operating profit (excluding relief and gain on disposal) jumped 36% YoY to S$15.9mn. Earnings recovery on the back of lower rental discounts and introduction of booking commissions (May 22: 4%, Oct 22: 5%). Booking volumes in FY22 rose 31% to 34mn.

+ Piling up cash. Net cash in FY22 rose S$97mn to S$675mn. Free cashflow generated during the year was S$266mn. Gross CAPEX on vehicles was around S$300mn. FY23e CAPEX might be slightly higher for EV taxis, the PHV car rental fleet and EV charging stations. CAPEX is still below the S$400mn-500mn p.a. spent pre-pandemic.

The Negative

– China, UK and Ireland’s weak operating performance. We estimate UK and Ireland suffered a S$13mn operating loss in 4Q22 due to the one-off S$9mn UK bus driver pay deal backpay agreement. China operating earnings were down 60% to S$10.3mn in FY22 due to taxi rental rebates of S$11mn.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Phillip Macro Update - Key Points for May FOMC Meeting

Phillip Macro Update - Key Points for May FOMC Meeting Meta Platforms Inc. - Solid results, but tough comparisons ahead

Meta Platforms Inc. - Solid results, but tough comparisons ahead Singapore Telecommunications Ltd - Accounting spring cleaning, sprinkled with cash

Singapore Telecommunications Ltd - Accounting spring cleaning, sprinkled with cash Far East Hospitality Trust - Higher RevPAR by ramping up occupancy

Far East Hospitality Trust - Higher RevPAR by ramping up occupancy