Far East Hospitality Trust - Resilient balance sheet and ready to acquire

8 Jan 2024- Forward booking for 2H23 and 1H24 was healthy on the back of the recovery of flight capacity and a series of upcoming events. Hotel RevPAR is anticipated to reach 97% of pre-pandemic levels and serviced residence is already at 122% of the pre-COVID level.

- Downside risk is protected by the master lease structure and the fixed component alone is expected to generate c.4% of the dividend yield. Due to low gearing of 32%, FEHT also alluded to potential mid-size acquisition in Japan, we expect a positive carry of c.2%.

- S$18.0mn incentive fee generated from Central Square’s divestment was set to cushion the erosion of DPU due to the high interest rate, aiming for a FY23e target dividend yield of c.6%. We initiate coverage with a BUY recommendation on Far East Hospitality Trust, a DDM-based target price of S$0.79, and a dividend yield of 5.9%.

Company Background

Far East Hospitality Trust (FEHT) has its full presence in Singapore with an asset value of S$2.5bn as of Dec 22 and listed on Aug12. This portfolio encompasses 12 properties, including 9 hotels and 3 serviced residence, collectively 3,015 hotel rooms. It also has a total of 177 units of retail and office spaces in 8 of its properties. All properties operate under a Master Lease Agreement, with rental based on a fixed component and a variable component which linked to the property’s operational revenue. FEO Hospitality Asset Management Pte Ltd serves as the manager for FEHT. The Sponsor, Far East Organization is the largest private property developer in Singapore.

Key Investment Merits

- Riding on the leisure recovery. SIA aims to reach around 90% of pre-pandemic capacity by Mar24, up from 83% in Sep23. In 3Q23, the Average Daily Rate (ADR) surpassed pre-COVID levels by 5.5%, excluding the hotel under government contract (+26% YoY). Revenue per Available Room (RevPAR) for serviced residence (SR) is notably 22% higher than pre-COVID levels. As flight capacities normalize and Chinese travelers return, hotel RevPAR is expected to achieve 97% of pre-pandemic levels over the entire year (3Q23: 99%). Anticipating a packed MICE schedule, we project strengthened Net Property Income (NPI) for SR, driving DPU growth in FY24.

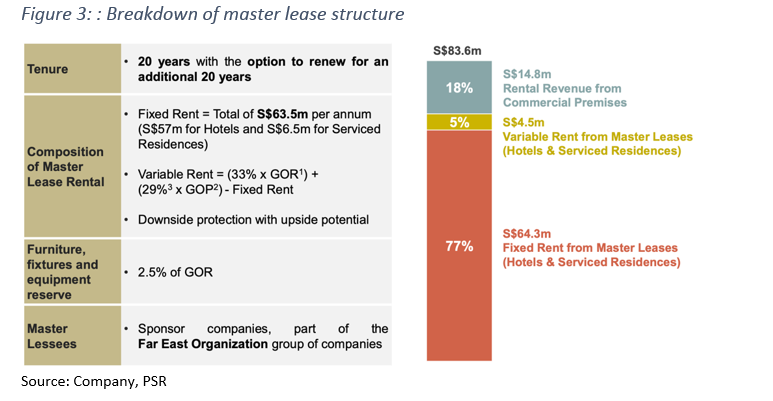

- Master Lease Structure to protect the downside. FEHT has master leases that combine fixed-rent protection with variable rents to capture the upside. The variable component is tied to underlying revenue and profits, which is more favorable in response to rising RevPAR. Fixed component alone generated 77% of total revenue and translated into a 4% dividend yield in FY22. This minimizes potential income risk caused by uncertainty and volatility of global economic conditions. FEHT also has a larger proportion of commercial rentals compared to other hospitality REITs (17.7% of total revenue), and it enjoys a relatively higher level of downside protection due to the longer lease terms.

- Possible overseas expansion. The divestment of Central Square, yielding 1.8% on exit, supported an upward trend in DPU for FEHT. To counter the impact of high-interest rates, FEHT plans to cushion distributions with the S$18.0mn incentive fee, targeting a FY23 dividend yield of c.6%. Post-divestment, FEHT stands as one of the least leveraged S-REITs, with a 32% leverage ratio and a 3.2% cost of debt. With a debt headroom of c.S$900mn (Gearing at 50%), FEHT is exploring potential acquisitions in Japan, currently deferring equity fund-raising. Their focus is on smaller assets, roughly S$70-80mn each, we expect to generate a positive carry of c.2%.

We initiate coverage with a BUY rating and a target price of S$0.79 based on DDM valuation, COE of 6.5%, and terminal growth of 1.5%. We expect a DPU of 3.79 cents for FY23e and 3.95 cents for FY24e, translating into yields of 5.6% and 5.8%, respectively.

Revenue

Gross revenue

Gross revenue consists of Master lease rental, Retail, and office revenue. In 3Q23, the Hotel segment contributed 56.3% to the total gross revenue, while Serviced Residence accounted for 14.4%, and commercial premises comprised 6.5%. Revenue for the hotel and serviced residence segment is calculated based on the operating period multiplied by the average daily rate and average occupancy rate. Commercial rental income is generated by leasing the Excluded Commercial Premises in the Properties directly to individual tenants.

Master Lease Structure

The initial term of the Master Lease Agreements for each of the Properties will be 20 years from the Listing Date (Aug2012) with another 20 years‘ optional extension.

The Master Lease Agreements consist of both a Fixed Rent component and a Variable Rent component. Variable rent is calculated by combining 33% of the Property’s Gross Operating Revenue and a specified percentage of Gross Operating Profit (which varies across properties), minus the Fixed Rent. In cases where the calculation of the Variable Rent results in a negative value, the Variable Rent will be considered as zero.

As visitor arrivals began picking up from the 2Q22, operational performance has gradually improved to levels above the minimum fixed rent from the master leases. By the end of 2022, half of the REIT’s properties comprising 3 hotels and all 3 serviced residence exceeded the minimum fixed rent.

Joint venture

FEHT holds 30% interest in Fontaine Investment Pte Ltd (“FIPL”), a joint venture company established to develop a hotel site in Sentosa. Therefore, FEHT directly has a 30.0% stake in a joint venture for the development of Village Hotel Sentosa, The Outpost, and The Barracks. Joint ventures are equity accounted for, and are therefore included in the Share of profit of joint ventures under the income statement.

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla Airbnb Inc - Solid results overshadowed by weak guidance

Airbnb Inc - Solid results overshadowed by weak guidance May 9th - Things to Know Before the Opening Bell

May 9th - Things to Know Before the Opening Bell Trade of the Day - Pfizer Inc. (NYSE: PFE)

Trade of the Day - Pfizer Inc. (NYSE: PFE)