Keppel Corporation Ltd - Building strategic infrastructure assets

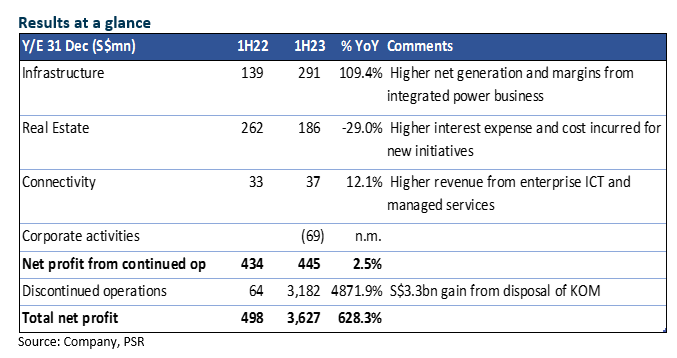

31 Jul 2023- 1H23 earnings were in line. Net profit from continuing operations rose marginally by 2.5% YoY, due to strong energy sales and spreads, which offset lower development and fair value gains from real estate, and higher interest expense.

- It booked S$3.1bn exceptional gain from the disposal of Keppel Offshore & Marine (KOM) and 2-month share of KOM’s loss. Distribution-in-specie of SembCorp Marine shares lowered equity by S$3.8bn (S$2.19/share).

- Proposed a distribution-in-specie of 1 Keppel REIT (KREIT) unit for every 5 Keppel Corp shares, equivalent to about S$0.18 per Keppel Corp share. Its stake in KREIT will reduce by 9.4% to 37%.

- Maintain ACCUMULATE and raised our TP to S$7.70, from S$7.01 previously. Keppel has garnered several leading-edge renewable energy projects that position it as a first-mover in the transition to new energy technology.

The Positives

+ Higher net generation and margins from integrated power business. 1H23 revenue and operating profit from sale of gas, utilities and electricity rose 65.7% YoY and 183% YoY, thanks to a surge in wholesale energy prices in 2Q. We estimate energy sale accounted for 60% and 68% of group revenue and net profit, respectively. More than 99% of their contracts are locked on fixed or indexed electricity price plans, hence the profit is sustainable.

+ Distribution-in-specie of KREIT units. Keppel proposed to distribute 1 KREIT unit for every 5 Keppel Corp shares, equivalent to S$0.18 per Keppel share, based on KREIT’s current share price. This will lower its stake in KREIT by 9.4% to 37%.

The Negatives

– Net profit from Real Estate fell 29%, due to lower development profit, and lower fair value gains on investment properties. Sentiment in the Chinese property market headed south in 2Q after a promising 1Q. Management sees an uncertain market ahead.

– Net gearing has risen to 0.86x (Dec 22: 0.78x). It recorded free cash outflow of S$732mn (1H22: outflow S$127mn), of which about S$470m net outflow was due to the divestment of KOM. As a group, interest expense rose 89.3% with average interest cost at 3.53%.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

May 8th - Things to Know Before the Opening Bell

May 8th - Things to Know Before the Opening Bell Trade of the Day - SATS Ltd (SGX: S58)

Trade of the Day - SATS Ltd (SGX: S58) Block Inc - Cost-cutting boost earnings

Block Inc - Cost-cutting boost earnings Trade of the Day - Oracle Corporation (NYSE: ORCL)

Trade of the Day - Oracle Corporation (NYSE: ORCL)