SATS LTD - Acquisition costs and cargo weakness overshadow recovery

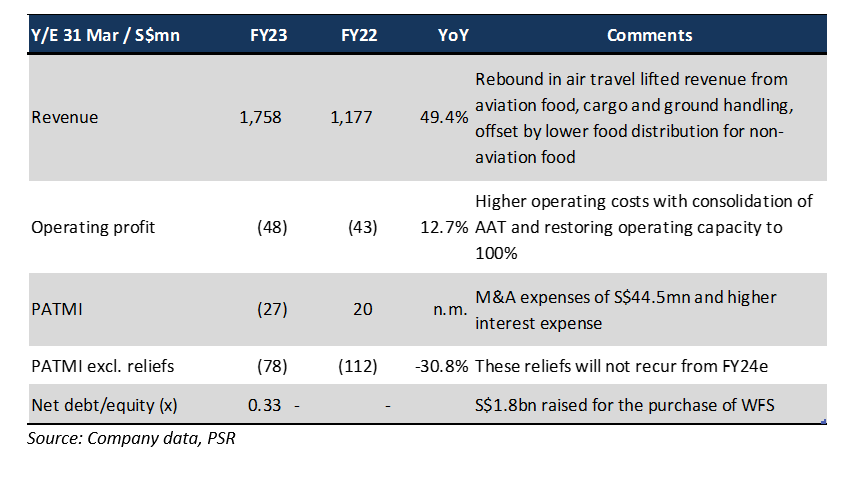

5 Jun 2023- FY23 revenue grew 49.4% YoY, which included a full-year contribution from 65.4%-owned HK cargo handler AAT. However, operating loss rose 12.7% YoY, dragged down by cost escalation (+48.1% YoY), S$44mn in M&A expenses, and weak performances from AAT, Malaysia ground handling and Saudi Arabia cargo handling. Net loss would be S$77.6mn if government relief were excluded.

- Staff costs surged by 62.0% YoY, a combination of inflationary pressure and restoration to full capacity ahead of the recovery in flight volume. As at March 2023, the number of flights at Changi Airport was 25% below pre-pandemic level.

- Balance sheet has turned into net debt, with net gearing at 0.33x. Consolidation of Worldwide Flight Services (WFS) could raise FY24e net gearing to 0.84x, we estimate.

- Maintain NEUTRAL with a lower target price of $2.51 (prev. $2.92). We see multiple headwinds ahead: 1) Slowdown in air cargo volume; 2) higher interest expense from the acquisition cost and debt at WFS; 3) air travel demand might plateau from 2H24e with rising recessionary risks.

The Negatives

– Cost escalation weighed on earnings. SATS reported higher operating loss of S$48mn (2H23: loss S$5.7mn) despite a 49.4% YoY gain in revenue, partly due to the consolidation of 65.4%-owned HK cargo handler Asia Airfreight Terminal which incurred losses. Total expenditure surged 48.1% as SATS restored to full capacity in anticipation of the ramp-up in flights by the air carriers. The number of commercial flights operating at Changi Airport was still 25% below pre-pandemic level in Mar 2023. Net loss excluding government relief was S$77.6mn. Staff costs rose 62% YoY and now account for 50% of total costs (FY22: 45%). Total employee count has returned to pre-pandemic level of 17,100. Higher inflationary pressure also lifted the cost of raw materials (+25.8%) and fuel and maintenance (+45.8%). SATS also incurred S$44.5mn for expenses relating to the acquisition of WFS.

– Mixed performance in the overseas markets. An uneven recovery in aviation in Asia and weaker cargo volume affected operations in Hong Kong, Malaysia and Saudi Arabia. Still, SATS is expanding central kitchen capacities in China and India to produce ready-to-eat meals for an uplift in international air travel and domestic consumption in these countries.

– Balance sheet turned into net debt of S$772.1mn, or net gearing of 0.33x. It has set aside S$1.8bn for the acquisition of WFS, which will be consolidated from FY24e.

The Positive

+ Nil

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

Trade of the Day - Nanofilm Technologies International Ltd (SGX: MZH)

Trade of the Day - Nanofilm Technologies International Ltd (SGX: MZH) May 6th - Things to Know Before the Opening Bell

May 6th - Things to Know Before the Opening Bell Apple Inc. - Waiting for the AI reveal

Apple Inc. - Waiting for the AI reveal Trade of the Day - Advanced Micro Devices, Inc. (NASDAQ: AMD)

Trade of the Day - Advanced Micro Devices, Inc. (NASDAQ: AMD)