SATS LTD - Acquisition costs weighed on 1Q24 earnings

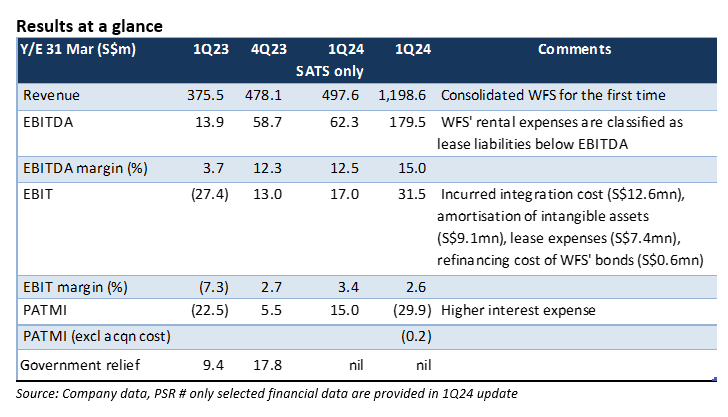

17 Aug 2023- SATS slipped into net loss in 1Q24, after booking S$29.7mn integration costs and amortization expenses relating to the acquisition of WFS. Excluding these, net loss was S$0.2mn, which was in line with our expectations. Operating gains were cancelled out by higher interest expense.

- SATS’ core operations turned in a profit, even with the expiry of government relief, though EBIT margin of 3.4% is still a far cry from pre-COVID level of 16%-17%. WFS’ volume declined in line with softer cargo demand, but yields are holding up.

- Maintain NEUTRAL recommendation and TP of $2.51. We lowered FY24e earnings forecast by 49% to take into account the integration costs.

The Negatives

– Acquisition-related costs weighed on earnings. WFS was consolidated for the first time. It incurred a one-off integration cost (S$12.6mn), amortization of intangible assets (S$9.1mn), lease expenses (S$7.4mn) and cost for refinancing of WFS’ bonds (S$0.6mn). The final amount of intangible assets will be determined in 2H24e. The annual amortization could change.

– Net debt rose to S$2.2bn (Mar 23: S$0.77bn). Higher interest expense cancelled out all the operating gains. Free cash flow was negative S$10.7mn in 1Q24.

– Volume handled by WFS has declined in tandem with the decline in global air cargo demand. However, the industry decline is moderating (Jun 23: -3.4% YoY, YTD: -8.1%).

The Positive

+ SATS-only operations were profitable, though it no longer enjoy government relief.

Outlook

The outlook is mixed. Aviation-related profits could improve with 1) inflight meals restoring to pre-COVID levels; 2) reduction in double-catering; and 3) increase in number of flights. On the other hand, air cargo volume might remain sluggish from lower manufacturing output and trade activities. The higher interest expense is a drag on earnings.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

Trade of the Day - Nanofilm Technologies International Ltd (SGX: MZH)

Trade of the Day - Nanofilm Technologies International Ltd (SGX: MZH) May 6th - Things to Know Before the Opening Bell

May 6th - Things to Know Before the Opening Bell Apple Inc. - Waiting for the AI reveal

Apple Inc. - Waiting for the AI reveal Trade of the Day - Advanced Micro Devices, Inc. (NASDAQ: AMD)

Trade of the Day - Advanced Micro Devices, Inc. (NASDAQ: AMD)