SATS LTD - Breakeven in sight and funding clarity to drive re-rating

21 Nov 2022- Funding clarity to reduce overhang on the Company. SATS has provided clarity on its funding structure for the Worldwide Flight Services (WFS) acquisition by committing to a cap of $800mn on the rights issue. We modeled a 3 for 10 rights issue scenario at an issue price of $2.29 (~15% discount to last close) to arrive at a TERP of $2.60.

- SATS profitability is at a key inflection point with breakeven in 2HFY23. We expect the Group to turn profitable by FY24e with the resumption of dividend in the same year.

- Initiate with ACCUMULATE and a target price of $3.02. Our valuation is pegged to 18.5x FY24e, which is -1sd below its historical average. Risks to our view include 1) Integration challenges for WFS and 2) revenue growth continuing to lag behind expenses growth.

Company Background

SATS is one of Asia’s leading providers of food solutions and gateway services, operating in countries across the Asia Pacific, UK, and the Middle East. Originally a subsidiary of Singapore Airlines, SATS divested from Singapore Airlines in September 2009, focusing on food solutions and gateway services. SATS has subsidiaries, associates and joint ventures across Asia and undertakes acquisitions and investments to grow its market share.

Investment Merits

- Funding clarity to reduce overhang. SATS has provided clarity on its funding structure for the WFS acquisition by committing to a cap of $800mn on the rights issue (Figure 5). The rest of the funds will be funded by term loans of $700mn and internal cash. We believe the latest clarity on its funding structure will alleviate some of the overhang on the stock from the uncertain funding structure.

- Profitability at key inflection point. We have modeled for SATS to reach breakeven point in 2HFY23, with the Group turning profitable in FY24e. We believe this will be driven by air travel recovering to ~80% of pre-Covid levels by the year end and the Group benefitting from operating leverage of its business. With the Group turning profitable, we expect the Group to resume the payout of dividends in FY24e.

- We like SATS for its strong cash flow generation and defensive balance sheet. SATS strong cash flow generation capability and defensive balance sheet places it well above peers. We expect SATS to generate free cash flow of ~$150m for FY24e, which will support its dividend payout.

Outlook

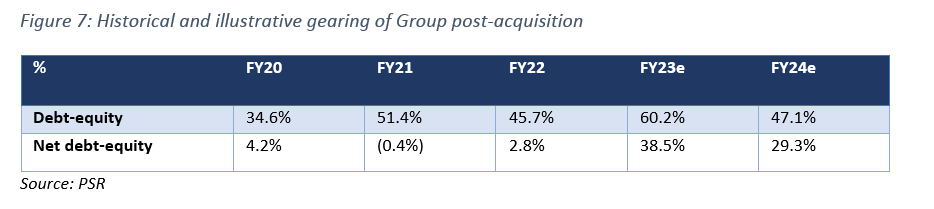

We are positive on the outlook for SATS. We see SATS as a prime beneficiary of the recovery in aviation travel. Post-consolidation of WFS, with gearing at ~58%, we believe SATS will embark on a deleveraging cycle of its balance sheet in order to be more aligned to its optimal capital structure of under 50%.

Initiating coverage with ACCUMULATE rating and target price of $3.02.

We initiate coverage on SATS with a BUY recommendation and a target price of $3.02. We peg SATS to a PE of 18.5x FY24e, which is -1sd below its historical average. We view SATS as best in class with a defensive business model and superior growth profile due to its overseas expansion plans and the expansion of new concepts. We believe SATS is at an inflection point and model the Group reaching breakeven point by 2H23e. We expect the Group to resume the payout of dividends by FY24e as the Group reverses back into profitability.

Background

SATS is one of Asia’s leading providers of food solutions and gateway services, operating in the Asia Pacific, UK, and the Middle East. Originally a subsidiary of Singapore Airlines, SATS divested from Singapore Airlines in September 2009, focusing on its food solutions and gateway services. SATS has subsidiaries, associates and joint ventures across Asia and undertakes acquisitions and investments to grow its market share.

SATS’ Food Solutions services (54.5% FY22 revenue) consists of inflight and institutional catering, food processing, distribution services and airline laundry services. Its Gateway services (45.3% FY22 revenue) comprises airport and cruise terminal services; and its airport services consists of airfreight handling services, passenger services, aviation security services, baggage handling and apron services to the groups handling customers. Its Cruise terminal services manages and operates Marina Bay Cruise Centre. The other operating segments are from the rental of premises and other segments (0.2% FY22 revenue).

Strategic plans

We believe the re-opening of borders globally will be a major re-rating catalyst for SATS. The relaxation of border restrictions for the last year have already seen its key metrics improve: number of passengers handled, flights handled, and gross meals produced by SATS has risen by 153%, 74% and 20% respectively YoY. Based on IATA’s travel recovery forecast, the aviation sector is expected to fully recover by 2024 and grow by 11% in 2025.

SATS is looking to deepen its expansion into the non-aviation sector to reduce its reliance on the aviation sector. It aims to do this through its experience providing safe and high-quality food – thanks to its reputable history of operating in the aviation section which requires the highest standard. SATS will leverage on this reputation when expanding into the non-aviation segment. It already has experience doing this. It currently serves about 20 Singapore Armed Forces camps; and served workers’ dormitories during the pandemic. It recently set up two retail restaurants – Twyst for its first foray into the B2C segment. Through its brand accelerator, FoodFlix, it has launched two signature hawker products under The Travelling Spoon label that will be available for a limited time only at 7-Eleven stores across Singapore.

SATS is also building on its capability in cargo management. Cargo revenue has already reached pre-crisis levels in FY22 and our base case assumes a 13-15% increase in the next two years. Its acquisition of WFS will expand the Group’s capability in cargo management, and give it a foothold in key trade routes in the United States and North America-Europe routes. It will also reinforce the Group’s earnings resilience and diversification that management set out as part of its five-year plan.

We believe SATS will continue to grow new revenue streams through various M&As and strengthen capabilities to ensure the growth and sustainability of the businesses across the value chain. SATS invested $150min Jurong Food Hub, acquired an 85% stake in Food City Company Limited (Thailand), a frozen food producer for a cash consideration of $20.4m, as well as acquiring an additional 16.4% to own a total of 65.4% stake in Asia Airfreight Terminal Co (Hong Kong), a cargo terminal operator for $58.5m. We expect SATS to further diversify its revenue streams going forward.

Investment Merits

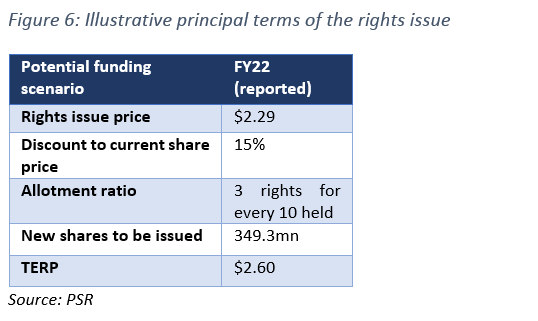

- Funding clarity to reduce overhang. SATS has provided clarity on its funding structure for the WFS acquisition by committing to a cap of $800mn on the rights issue (Figure 5). The rest of the funds will be funded by term loans of $700mn and internal cash. We believe the latest clarity on its funding structure will alleviate some of the overhang on the stock from the uncertain funding structure. The move to shift a greater portion of its funding requirements to debt we believe is motivated by the lower cost of funding (vs placement) and dilution given the sharp correction in its shares by over 33% since news of the acquisition broke. We modeled a 3 for 10 rights issue scenario at an issue price of $2.29 (~15% discount to last close) to arrive at a TERP of $2.60.

- Profitability at key inflection point. We have modeled for SATS to reach breakeven point in 2HFY23, with the Group turning profitable in FY24e. We believe this will be driven by air travel recovering to ~80% (~70% currently) of pre-Covid levels by year-end and the Group benefitting from operating leverage of its business. With the Group turning profitable, we expect the Group to resume the payout of dividends in FY24e.

- We like SATS for its strong cash flow generation and defensive balance sheet. SATS strong cash flow generation capability and defensive balance sheet places it well above peers. We expect SATS to generate free cash flow of ~$150mn for FY24e, which will support its dividend payout.

Initiating coverage with ACCUMULATE rating and target price of $3.02.

We initiate coverage on SATS with a BUY recommendation and a target price of $3.02. We peg SATS to a PE of 18.5x FY24e, which is -1sd below its historical average. We view SATS as best in class with a defensive business model and superior growth profile due to its overseas expansion plans and the expansion of new concepts. We believe SATS is at an inflection point and model the Group reaching breakeven by 2H23e. We expect the Group to resume the payout of dividends by FY24e as the Group reverses back into profitability.

Acquisition of Worldwide Flight Services to accelerate SATS transformation

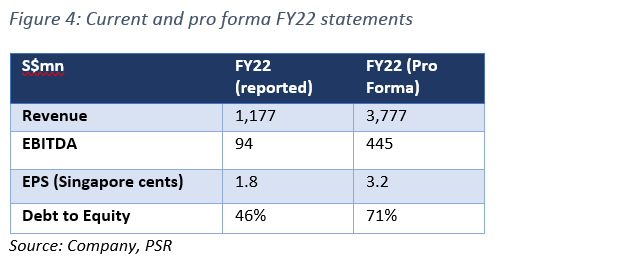

SATS has agreed to acquire 100% of WFS, the largest air cargo handler for €1,187mn (~S$1,639mn) or an enterprise value of S$3.11bn, indicating EV/EBITDA of 9.7x. We view the 9.7x EV/EBITDA valuation of WFS as largely in line with past peer transactions of between 10.1x-10.7x.

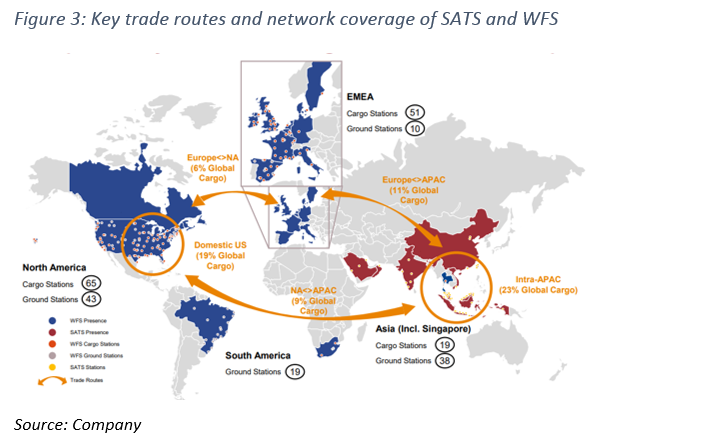

The decision to acquire WFS is driven by the opportunity to expand SATS’ market reach beyond APAC into US and Europe with leading positions in strategic hubs connecting key trade lanes across North America and Europe. SATS and WFS operate in different geographies without operational overlap in the cargo handling space (Figure 3).

Post-acquisition, SATS would have comprehensive global coverage across Americas-Europe-APAC covering trade routes responsible for more than 50% of global air cargo volumes. It will also have the ability to support needs of global customers with end-to-end solutions.

SATS has identified meaningful run-rate EBITDA synergies in excess of $100mn over 3-5 years for its acquisition of WFS. Importantly though, the management guided that the bulk of these synergies will come from revenue synergies from network expansion and not cost synergies. We believe this represents a greater challenge to management. Despite this, the management remains confident and guided that up to 40% of these synergies can be realised in the next two years. We have opted to be conservative in our modeling of WFS, and have omitted potential synergies that can be realised from the acquisition. The realisation of these synergies presents upside bias to our FY24e forecasts.

The acquisition is expected to be earnings accretive to SATS, with pro forma EPS of 5.4 Singapore cents (excluding the effect of intangibles amortisation) and 3.2 Singapore cents (including intangibles amortisation).

SATS funding clarity on WFS to reduce overhang

SATS has provided clarity on its funding structure for the WFS acquisition by committing to a cap of $800mn on the rights issue (Figure 5). The rest of the funds will be funded by term loans of $700mn and internal cash. We believe the latest clarity on its funding structure will alleviate some of the overhang on the stock from the uncertain funding structure. The move to shift a greater portion of its funding requirements to debt we believe is motivated by the lower cost of funding (vs placement) and dilution given the sharp correction in its shares by over 33% since news of the acquisition broke. We model a 5.5% cost of financing for its term loans, payable in three to five years.

We have provided an illustration of the possible rights issue funding structure in Figure 6 to illustrate the effects of the rights issue that SATS will announce likely in November or December.

Shareholders will be able to subscribe to the rights at an issue price of $2.29 or a 15% discount to the current share price. The rights issue could be made on a renounceable basis to entitled shareholders on the basis of three rights share for every 10 held by entitled shareholders.

Temasek, its largest shareholder (39.76% stake) has provided an irrevocable undertaking to vote in favour of the transaction and intends, subject to the terms of the rights issue to be finalised, to subscribe for its pro rata entitlement to the rights issue.

Even though the acquisition of WFS will drive up its net debt from ~3% to ~39% (Figure 7), we believe the Group will embark on a deleveraging cycle post-acquisition to reduce its overall funding costs. We believe this enables them to have capacity to continue to invest in growth to cope with increasing business activities, as well as M&A opportunities to expand its regional operations. We expect net debt to be lowered to ~29% by FY24e due to the strong cash flow generation capability of WFS.

In terms of timeline, SATS intend to make the funding announcement by November or December, with the EGM to be held in January 2023. The target completion date for the acquisition is in March 2023.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT) Apr 15th - Things to Know Before the Opening Bell

Apr 15th - Things to Know Before the Opening Bell Singapore REITs Monthly – Waiting for interest rate cuts

Singapore REITs Monthly – Waiting for interest rate cuts Apr 12th - Things to Know Before the Opening Bell

Apr 12th - Things to Know Before the Opening Bell