Singapore Exchange Limited - Derivatives and treasury income boost growth

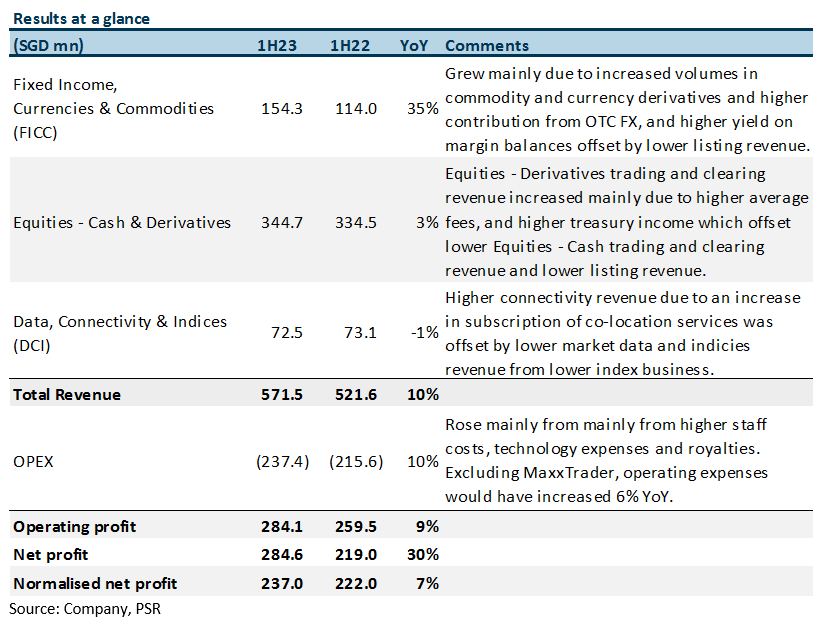

13 Feb 2023- 1HFY23 revenue of S$571mn met our estimates, at 48% of FY23e, and adjusted PATMI of S$237mn also met our estimates, at 49% of FY23e. 1HFY23 DPS was unchanged at 16 cents.

- Treasury income surged 124% YoY to S$47mn, mainly due to higher yield on margin balances from the higher interest rate environment.

- FICC grew 35% YoY, led by increased volumes in commodity and currency derivatives and higher contribution from OTC FX.

- We maintain BUY with an unchanged target price of S$11.71. Our estimates remain unchanged, and our target price remains pegged to +2SD of its 5-year mean or 26x P/E. Catalysts include continued growth from derivatives volumes and fees, and higher treasury income as the higher interest rates start to kick in. Expense growth for FY23e was also guided down by management and expected to be at the lower end of the range (7%).

The Positives

+ Treasury income surged in 1H23. Treasury and other income surged 85% YoY to S$73mn in 1H23 with higher interest rates earned from customer collateral balances. 1H23 treasury income on collateral balances held in trust was reported at S$47mn, which surged 124% YoY from 1H22’s treasury income of S$21mn and made up 96% of FY22’s treasury income of S$49mn.

+ Higher fees from FTSE China A50 and Nifty 50 contracts. Despite the flat growth of equity derivatives volumes of 1% YoY, Equities – Derivatives trading and clearing revenue grew 11% YoY to S$145.4mn in 1H23, mainly due to higher average fees from SGX Nifty 50 Index futures and SGX FTSE China A50 Index futures contracts. Average fee per contract for Equity, Currency and Commodity derivatives was higher at $1.58 (1H22: $1.50) mainly due an increase in proportion of higher fee-paying customers for SGX FTSE China A50 Index futures and higher fees realised from SGX Nifty 50 Index futures.

+ OTC FX business on track. SGX’s OTC FX business (BidFX, MaxxTrader and Electronic Communication Network (ECN)) average daily volume grew 34% YoY to US$68.4bn with a target of US$100bn in the medium term, and contributed S$36.2mn, or 6%, to 1H23 revenue. Consequently, FICC – Currencies and Commodities trading and clearing revenue grew 29% mainly due to increased volumes in commodity and currency derivatives and higher contribution from OTC FX. SGX said that it is on track to reach its ADV target of US$100bn as clients settle into the new platform.

The Negatives

– Lower listing revenue hurt Fixed Income and Cash businesses. FICC – Fixed Income revenue was down 35% YoY mainly due to lower listing revenue with 449 bond listings raising S$104.3bn in 1H23 (1H22: 492 bond listings raised S$209.4bn). On the Equities – Cash side, revenue was 10% lower YoY mainly due to listing revenue decreasing 13% YoY and trading and clearing revenue decreasing 11% YoY as daily average traded value, total traded value and overall average clearing fees declined. Overall, equities revenue accounted for 60% (1H22: 64%) of revenue and grew 3% YoY to S$344.7mn, as the growth in Equities – Derivatives revenue pulled up the decline in the Equities – Cash business.

– Data, Connectivity and Indices (DCI) business dipped in 1H23. DCI revenue accounted for 13% (1H22: 14%) of total revenue and decreased 1% YoY to S$0.6mn as market data and indices revenue dipped 8% YoY, mainly due to lower revenue from the index business. Nonetheless, this was offset by an increase of 9% in connectivity revenue mainly due to an increase in subscription of co-location services.

Outlook

Continued development of multi-assets to anchor long-term growth. SGX remains committed to expanding its suite of products through strategic partnerships and new product development for newly acquired businesses.

Investing for the medium term. SGX has maintained their guidance of FY23 expenses growth of 7-9% from FY22. This includes ~2% growth from the full-year impact of the acquisition of MaxxTrader. However, expectations are expenses growth will be at the lower end of guidance (7%). The higher expenses are mainly from the buildout of their OTC FX business and higher staff costs from salary increments. With that, SGX expects medium-term expense guidance to remain at mid-single digit growth.

Rising interest rates. Apart from the banks, SGX is another beneficiary of higher interest rates, and treasury income is expected to recover with rising interest rates. As at FY22, SGX reported a S$14bn float from collateral and S$49mn of interest income, which represents 10% of FY22 net income. 1H23 treasury income of S$47mn is currently at 97% of FY22’s. In comparison, in FY20, SGX reported interest income of S$135mn and earned a yield of 98bps on collateral balances when the Fed fund rate peaked at 2.50%. We believe there is a huge upside in their treasury income with the potential to more than triple with the current high interest rate environment.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

May 17th - Things to Know Before the Opening Bell

May 17th - Things to Know Before the Opening Bell Trade of the Day - Boeing Co. (NYSE: BA)

Trade of the Day - Boeing Co. (NYSE: BA) Singapore Banking Monthly - Fee income the driver

Singapore Banking Monthly - Fee income the driver May 16th - Things to Know Before the Opening Bell

May 16th - Things to Know Before the Opening Bell