YOMA STRATEGIC HOLDINGS LTD. - Acquiring more Money

25 Jun 2020- Acquisition of Telenor’s 34.2% stake in Wave is at an attractive price of $76.5mn, a 20% discount to our projected valuation of Wave.

- Yoma will become the controlling shareholder of Wave through Wave Holdco at 63.7%. Yoma’s effective stake to increase up to 40.7% with a further US$25mn investment. We expect deeper collaboration and integration with Yoma’s other consumer businesses.

- Maintain BUY with an unchanged target price of $0.46.

Acquisition Details

The aggregate consideration for the acquisition is US$76.5mn in cash for Telenor’s stake (34.2%) in Wave Money (Wave). Yoma intends to restructure the holding of its interest in Wave through a newly incorporated investment holding company in Singapore, Yoma MFS Holdings (Wave Holdco). Wave Holdco will hold the Group’s existing interest (29.5%) in Wave.

As at 24 June 2020, Yoma plans to invest up to a further US$25.0mn into Wave Holdco for an additional stake of up to 11.2% in Wave. A consortium of investors, as new shareholders of Wave Holdco, would contribute the remaining amount for the acquisition. The consortium comprises of private equity and financial institutions, most of which Wave has existing relations with. Upon completion of the acquisition, Wave HoldCo will hold up to 63.7% interest in Wave Money. Yoma’s effective interest in Wave will be up to 40.7%.

Acquisition Impact:

+ Acquisition of stake at an attractive price of $76.5mn for a 34% stake, a 20% discount to our projected valuation of Wave. Wave’s over the counter (OTC) as well as e-wallet and digital payment business (WavePay) are currently valued at US$162mn and US$117mn respectively based on a EV/EBITDA metric of 9x and USD/MAU* metric of 90x (CY20**: OTC EBITDA – c.US$18mn, CY20: WavePay’s MAU – c.1.3mn). Over the past month, WavePay grew by more than 30% in MAU. Yoma is projecting for WavePay to hit its MAU target of 11.2mn by CY24.

+ Better strategic focus for Wave post-Telenor’s exit. Telenor has made a strategic decision that telecommunications will continue to be their core business. It has divested several smaller businesses prior to the current Wave transaction. Nonetheless, Wave will remain the preferred e-wallet business for Telenor and their business relationship is expected to continue. Post Telenor’s exit, Wave will be more focused in its strategy to grow, underpinned by Ant’s strength in financial services and technology coupled with Yoma’s local presence and expertise.

+ No change in management team or operations. In the early stages of Wave’s growth, Wave leveraged on Telenor’s network and technological infrastructure for its operations. However, within the past 2 years of operations, Wave successfully built its own standalone network and infrastructure. Although Wave’s key management team comprises members originated from Telenor (e.g. Wave’s CFO), the team has been with Wave since inception and has agreed contractually to stay for the next few years. Therefore, we are not expecting any change in the way Wave operates, nor in its management team.

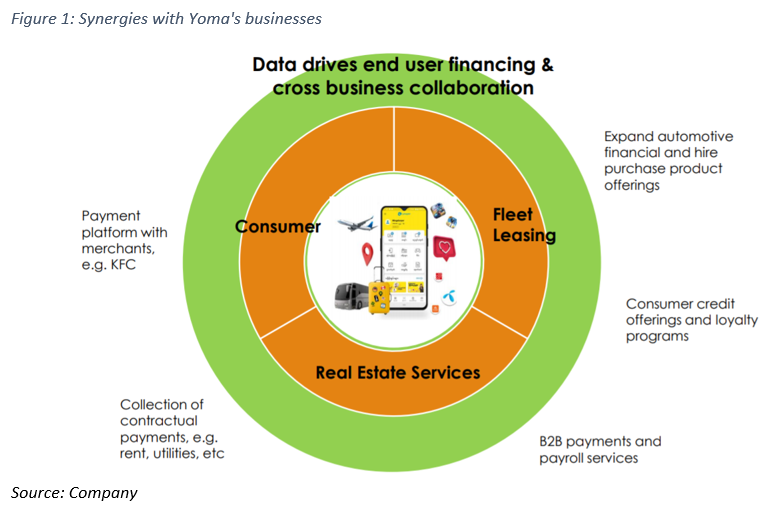

+ Controlling stake to increase collaboration between WavePay and the Yoma’s existing business lines. The collection of data from WavePay’s digital payment business will help Yoma better identify the drivers behind Myanmar’s consumerism. Additionally, this collaboration is expected to drive potential end-user financing and integration with Yoma’s existing businesses through certain payment functions (e.g. in consumer and real estate services) as well as a closer alignment of new products and features on WavePay (e.g. in Yoma Fleet). (Fig. 1)

*MAU = Monthly Active Users

** CY20 = Calendar Year 2020

Maintain BUY with an unchanged TP of S$0.460. Our target price translates to a total upside of 53.3%. We increased the valuation of Yoma’s stake in Wave Money, offset by a 15% devaluation in Pun Hlaing Estate’s land bank due to the expectation of a weaker outlook in the premium property space. Property and financial services will constitute 68% and 19% of the valuation respectively. A conglomerate discount of 20% has been applied (Fig.2).

The report is produced by Phillip Securities Research under the ‘Research Talent Development Grant Scheme’ (administered by SGX).

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla Airbnb Inc - Solid results overshadowed by weak guidance

Airbnb Inc - Solid results overshadowed by weak guidance May 9th - Things to Know Before the Opening Bell

May 9th - Things to Know Before the Opening Bell Trade of the Day - Pfizer Inc. (NYSE: PFE)

Trade of the Day - Pfizer Inc. (NYSE: PFE)