Yoma Strategic Holdings Ltd - Adapting well to the new environment

5 Jan 2024- Following the pandemic and coup in 2021, Yoma has undergone a major de-leveraging and rightsizing exercise. Net debt has shrunk from US$326mn in September 2021 to US$134mn in September 2023. The company disposed of investment properties, restructured Yoma Central debt, resized F & B operations, lowered manpower costs and generated operating cash flow.

- Real estate development has been the key performer for Yoma. Revenue has more than tripled in 1H24 to US$48mn. As of September 2023, there is a further US$65mn of unrecognized revenue. Buyers are seeking hard assets in an environment of rising inflation, negative real interest rates and a depreciating kyat currency.

- The macro environment in Myanmar has been extremely challenging. Myanmar’s GDP (in USD nominal terms) contracted 17.5% YoY in 2021 and 8.9% in 2022. Inflation is running at 20% p.a. and the kyat currency is officially down 60% since 2021. Yoma is responding to these challenges by de-gearing its balance sheet, disposing of non-core assets, localising costs and rebalancing its headcount. The share price is currently trading at a 71% discount to its book value of US$0.189.

Company Background

Listed on the SGX since 2006, Yoma is a leading conglomerate in Myanmar, with businesses

spanning real estate, mobile financial services, leasing, F&B, automotive & heavy equipment and investments. In November 2019, Ayala Corporation acquired a 14.9% stake in Yoma at S$0.45 per share, valuing the company at S$1,055mn. In December 2022, Yoma together with a consortium of investors completed the acquisition of Telenor’s 51% interest in Wave Money, raising Yoma’s effective stake in Wave Money to 65%. In terms of EBITDA in 1H24, the key divisions are real estate (67%), wave money (18%) and food and beverage (13%).

1H24 FINANCIAL RESULTS

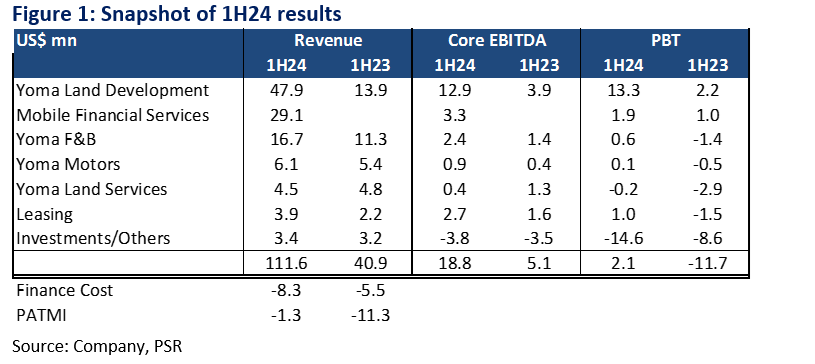

- Revenue: 1H24 revenue spiked 173% to US$111.6mn. The key driver to growth was the 245% YoY rise in real estate development revenue to US$47.9mn and contribution from Wave Money after raising its stake from 44% associate to 65% subsidiary in Dec23.

- EBITDA: There is an almost 4-fold spike in EBITDA to US$18.8mn. Around 2/3 of the jump came from the jump in property earnings. The next three major contributors were Wave Money, leasing and F&B.

- Profit After Tax: In 1H24 Yoma’s net loss narrowed from US$11.3mn to US$1.3mn and PBT turned positive to US$2.4mn. Finance costs have been the largest drag on earnings, rising 51% to US$8.3mn. Interest expense related to Yoma Central had previously been capitalized as part of the development cost. 1H24 interest expense from Yoma Central was US$4mn.

YOMA LAND

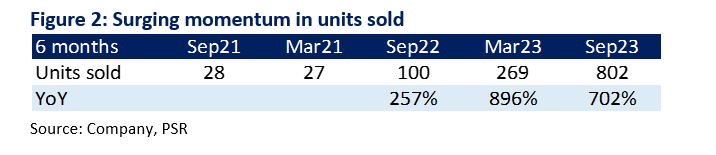

- Projects: Yoma has several property projects in Yangon, Myanmar: (i) City Loft @ StarCity: Apartments launched in November 2018.; (ii) Star Villas: Landed housing launched in 2020 May 2020; (iii) City Villas: Affordable landed homes launched in August 2022; (iv) City Loft West* (May23); (v) The Estella* (Oct23).

- Track record: Since 2018, Yoma has shifted its strategy toward more affordable housing. It has built up a brand name in project quality and completion. The payment terms for purchases are typically 20-30% upfront and the remaining balance in progressive payments. Yoma Land also works with banks to secure mortgages for its customers.

- Outlook: As of September 2023, there is US$65.2mn of unrecognised revenue from the property division, not included in this number are the 515 of the 527 Estella units which have been sold and booked since the launch in October 2023. Future launches include Phase 4 of the Estella (163 units) and City Loft West 3rd tower (247 units). There is another 6.2mn sft landbank (Star City 1.4mn, Pun Hlaing Estate 4.8mn) which Yoma can develop on its own or with partners.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla Airbnb Inc - Solid results overshadowed by weak guidance

Airbnb Inc - Solid results overshadowed by weak guidance May 9th - Things to Know Before the Opening Bell

May 9th - Things to Know Before the Opening Bell Trade of the Day - Pfizer Inc. (NYSE: PFE)

Trade of the Day - Pfizer Inc. (NYSE: PFE)