YOMA STRATEGIC HOLDINGS LTD. - Cautiously optimistic

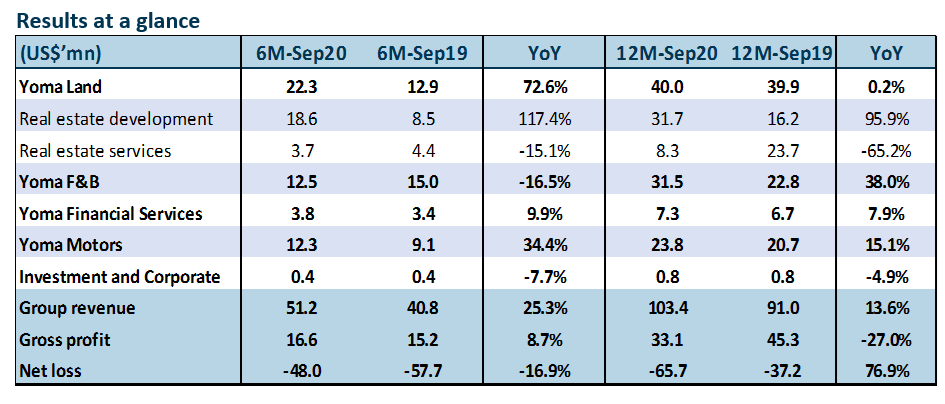

2 Dec 2020- 6M-Sep 20 and FY20 topline met expectations, at 98%/100% of our forecasts. Core operating EBITDA remained positive. FY20 double whammy from lower gross profit margins and net fair value losses for investment properties in Myanmar and China. As a result, net loss was 15x more than expected.

- Mid-term outlook remains mildly positive, underpinned by unrecognised real-estate revenue and new projects.

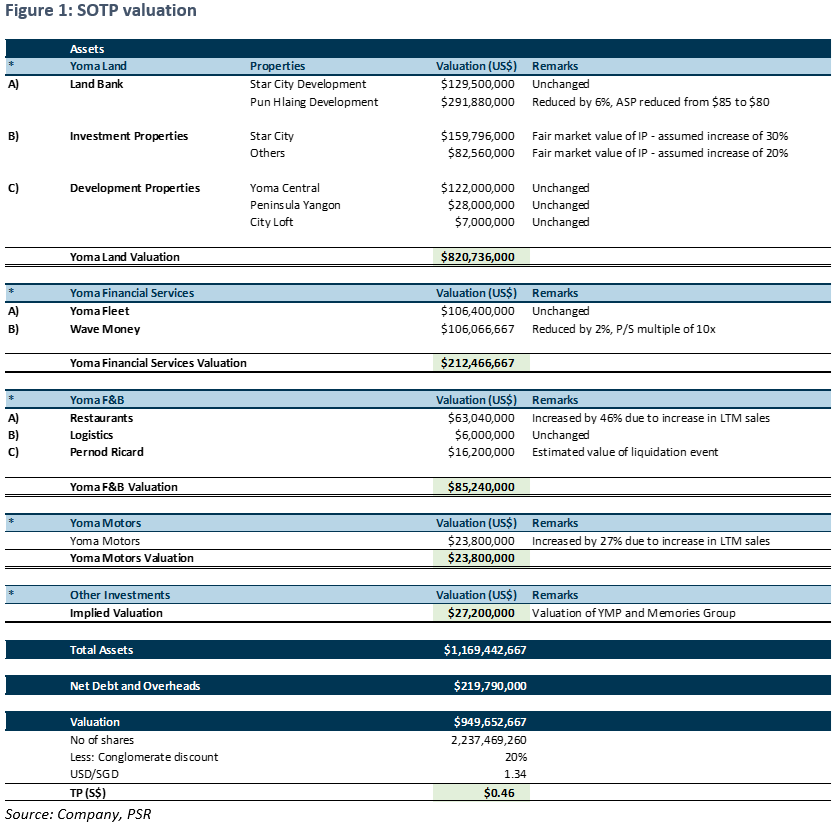

- Maintain BUY and SOTP TP at S$0.46.

The Positive

+ 6M-Sep 20 and FY20 topline met; core operating EBITDA remained positive. Despite Covid-19, revenue in 6M-Sep 20 increased 25% YoY. This was aided by real-estate development (+117% YoY) and automotive and heavy equipment (+34% YoY). Partially offsetting the gains was weakness in real-estate services due to competitive leasing and the consumer segment during lockdowns in April, May and September. Full year, the consumer segment held up, led by the consolidation of YKKO and KOSPA for the entire FY20. Real-estate service revenue was down 65% YoY due to lower operator fee income as a result of fair-value losses. 6M-Sep 20 and FY20 core operating EBITDA remained positive at US$2.9mn and US$2.6mn respectively.

The Negatives

– FX, impairment and associate losses. The bulk of 6M-Sep 20 losses came from subsidiaries’ conversion of US$ valuation into MMK (-US$34mn). An impairment loss on prepayments and operating rights for Yoma’s agricultural investments was also booked (-US$6mn). Netting off fair-value gains/losses and interest income, “other income” loss was US$16mn. Additionally, Yoma booked its share of losses from Memories Group, whose tourism operations were affected by Covid-19 and translation losses on borrowings (-US$7mn). All in all, net loss was US$48mn for the half year.

– FY20 double whammy from lower gross profit margins and net fair value losses. FY20 gross profit margins plunged from FY19’s 50% to 32%. This was blamed on lower real-estate service revenue. The segment contributes one of the highest gross profit margins to Yoma. Other culprits were lower-margin products at Star City and lower consumer margins following higher packaging and delivery costs. Coupled with net fair value losses of US$12mn vs net other gains of US$9mn in FY19, FY20 net loss increased 77% YoY.

Outlook

Myanmar is reeling from a second wave of the pandemic. Movements are now restricted within townships, with stay-home orders and prohibitions on restaurant dine-in. As the number of new cases slightly dwindles from its highs, the authorities are easing some of the measures. We are cautiously optimistic on a recovery in 2021

F&B and Yoma Motors are expected to be weak in the near term. That said, FY21 group topline should be supported by significant unrecognised revenue at Yoma Land and Yoma Motors. As of 9M-Sep 20, Yoma Motors had sold an estimated 200+ Mitsubishi units that are pending recognition (c.US$10mn). Over at Yoma Land, three out of its six City Loft buildings are 25-65% completed. Unrecognised revenue here amounts to c.US$12mn. Following its recent launch, Star Villas Phase 1 – Yoma’s first landed development in Star City – has sold 27 out of 32 units, accumulating c.US$15mn for recognition. Star Villas is expected to be completed in the next 12-15 months. Phase 2 will be launched in the coming months following the success of Phase 1. These projects are expected to support FY21’s topline.

We are looking at a turnaround in FY22, when Yoma Central and Star Hub will be completed. Yoma Central is in advanced leasing negotiations with anchor tenants for its office and retail space. Upon completion in mid-FY22, it is expected to generate US$90-110mn of recurring revenue – equivalent to FY20 revenue. Additionally, Yoma recently launched Star Hub, its first suburban commercial property at StarCity. Target date of completion is end-2021. Prominent technology and financial-service companies have already committed to more than 50% of its office space. Rental yields here are estimated in the mid-teens, to be generated from FY22.

Maintain BUY and SOTP TP of S$0.460. We updated our segmental assumptions following Yoma’s latest valuation guidance. Our valuation metrics and TP remain largely unchanged, including our 20% holding-company discount. Yoma Land constitutes 86% of its total valuation after net debt and overheads.

The report is produced by Phillip Securities Research under the ‘Research Talent Development Grant Scheme’ (administered by SGX).

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla Airbnb Inc - Solid results overshadowed by weak guidance

Airbnb Inc - Solid results overshadowed by weak guidance May 9th - Things to Know Before the Opening Bell

May 9th - Things to Know Before the Opening Bell Trade of the Day - Pfizer Inc. (NYSE: PFE)

Trade of the Day - Pfizer Inc. (NYSE: PFE)