Yoma Strategic Holdings Ltd. - Disruptions await

24 Aug 2021- 3Q21 revenue in line, at 55% of our 2H21e estimate. Yoma F&B and Motors performed better than expected, led by resumption of food delivery services and sale of automotive vehicles despite limited credit processing and closure of dealer showrooms in April.

- Third wave of Covid-19 led to stay-at-home orders from 17 July to 15 August 2021. Business was disrupted, especially for Yoma Motors, as automotive showrooms were shut.

- Maintain NEUTRAL with a lower TP of S$0.129, from S$0.147. We roll over to FY22e and lower our book value by 4.6%, after accounting for 10%/5% impact on trade receivables and investments in associate companies from closures, offset partially by FX. Our TP remains pegged at 0.45x P/BV, slightly above its 2007-2010 average P/BV of 0.41x during major conflicts, political upheavals and natural disasters.

The Positives

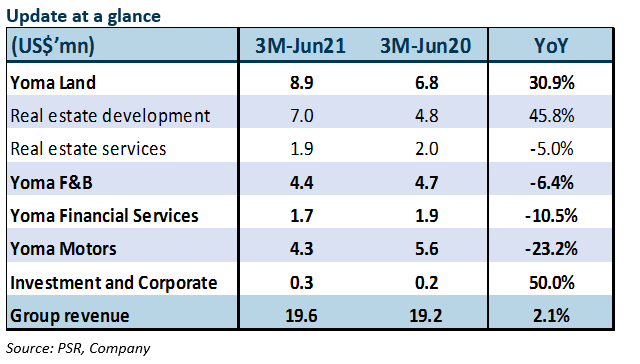

+ Held up by real-estate development; better-than-expected F&B and Motors. 3Q21 revenue in line, at 55% of our 2H21e estimate. This was held up by a 46% YoY increase in real-estate development, as construction resumed at StarCity and Pun Hlaing Estate. Conversion rates of bookings to sales at both Star Villas and City Loft @ StarCity were healthy. F&B and Motors performed better than expected, driven by a resumption of food delivery services and sale of automotive vehicles despite limited credit processing and the closure of dealer showrooms in April.

+ 3Q21 core operating EBITDA positive; cost-cutting in place. Core operating EBITDA remained positive in 3Q21, with gross profit covering interest expense. Yoma also paid down US$10mn of gross loans and extended several loans in 3Q21. It continued to cut operating expenses and defer non-essential capex. Staff costs were slashed by more than 60% through job cuts, furloughs and pay reductions. Consolidated cash balance improved QoQ.

The Negatives

– Lower real-estate service revenue. Revenue from real-estate services fell 5% YoY, attributable to lower occupancy at Pun Hlaing Estate as expatriate residents left. This was partially offset by higher leasing by locals, supported by lower rents, better amenities and security provided by the estate.

Outlook

The current third wave of Covid-19 in Myanmar could further disrupt business in the coming quarter. Public holidays were declared for 17 July-15 August 2021 and stay-at-home orders implemented in 86 townships in 10 regions and states. Only healthcare facilities, banks and shops selling essentials, medicines and medical supplies were allowed to remain operational. F&B establishments could only open for takeaways and/or deliveries.

These measures are expected to affect Yoma F&B and Motors. F&B sales are currently 30% below pre-pandemic levels. Most automotive showrooms were forced to close during this period. Revenue from real estate may be resilient as construction is still going on at StarCity, despite a slowdown in sales. Yoma financial services are likely to hold up as Yoma is looking at improving the efficiency of the asset base of Yoma Fleet. Wave Money’s monthly active users grew by double digits MoM in May, after the resumption of mobile 4G network services. However, people’s preference for physical cash in a tight credit environment is likely to affect transaction volumes for the coming quarter.

Yoma is rightsizing its restaurant platform to focus on its two main brands: KFC and YKKO. Previously guided at 30%, it is now looking to close around 25% of the restaurants permanently or temporarily if they can no longer be operated profitably. Yoma closed Little Sheep Hot Pot on 1 July 2021. Auntie Anne’s will cease operations by end-August. We are expecting revenue loss of about 1%. For Motors, Bridgestone tyres ceased operations as of end-July as the brand could no longer operate competitively in Myanmar after price hikes. Yoma Strategic has a 30% interest in the Bridgestone tyre business. We estimate that write-offs from closures will affect trade receivables and investments in associate companies by 10% and 5% respectively in 4Q21.

Maintain NEUTRAL with lower TP of S$0.129, from S$0.147. We roll over our estimates and lower our FY22e book value by 4.6%, after accounting for 10%/5% impact on trade receivables and investments in associate companies respectively due to write-offs from closures. This is partially offset by higher US$/S$ assumptions of 1.36 from 1.34.

Accordingly, our TP drops to S$0.129. This remains pegged at 0.45x P/BV, slightly above its 2007-2010 average P/B of 0.41x during major conflicts, political upheavals and natural disasters. What could turn us more positive are widespread Covid-19 vaccinations and a turnaround in Myanmar’s political situation.

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla Airbnb Inc - Solid results overshadowed by weak guidance

Airbnb Inc - Solid results overshadowed by weak guidance May 9th - Things to Know Before the Opening Bell

May 9th - Things to Know Before the Opening Bell Trade of the Day - Pfizer Inc. (NYSE: PFE)

Trade of the Day - Pfizer Inc. (NYSE: PFE)