YOMA STRATEGIC HOLDINGS LTD. - Shackled by politics and COVID-19

5 Feb 2021- Myanmar’s military junta has declared a state of emergency for a year. Expect business disruptions and political instability to affect medium-term investment sentiment and economic growth.

- Yoma’s fundamentals are intact. International lenders and investors still supportive of company.

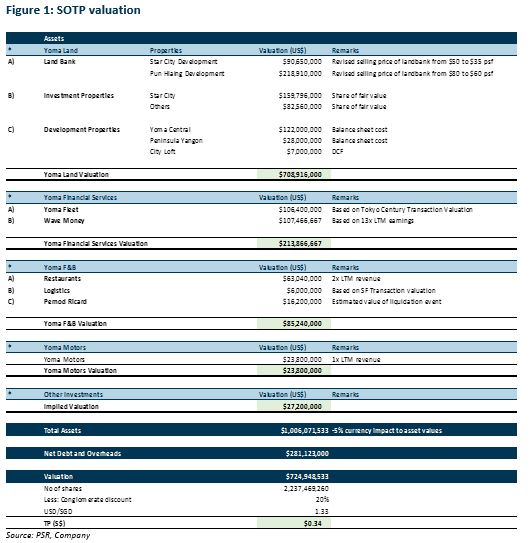

- Maintain BUY with a revised SOTP TP of S$0.34 (previously S$0.46) to reflect lower land bank prices for Yoma Land. We also cut FY21-22 earnings by 27% and 35% to capture impact of Covid-19 lockdowns and slower growth forecasts.

What’s new

Just three months ago in November 2020, Aung San Suu Kyi’s National League for Democracy achieved a landslide victory in elections, bagging 83% of the 1,171 the seats available. On 1 February 2021, the military alleged discrepancies of more than 10mn votes. It has declared a state of emergency to take control of the country for one year and dismissed 24 ministers and deputies, making 11 new appointments in their place. It has also pledged to hold fair elections in a year.

What’s next for Yoma

- Supportive lenders and investors amid unrest. While the coup came as a shock, international lenders and partners have not pulled out their funds. We believe that Ayala (AC PM, Not Rated) will proceed with its second-tranche equity investment in the company by 11 May 2021. Ant Financial’s transaction in Wave Money is also close to completion. Yoma’s deal to buy out Telenor in Wave Money is ongoing. Yoma will be deploying its cash conservatively.

- Business disruptions, near term. During the coup, state telecommunication services were disabled, the streets were quiet and all construction work ceased. Although most operations have returned, we are anticipating business disruptions in the short term. There could be fewer OTC and digital transactions through Wave Money as consumers conserve cash. F&B sales are also likely to be lacklustre due to weak consumer sentiment. Given the pause in construction at Yoma Central, we believe its completion may be delayed till 3Q22, from 1H22. This results in a 19% dip in FY22 topline.

- Political instability to affect investment sentiment and medium-term growth. FDIs into Myanmar largely stem from Southeast Asia, with Singapore and China contributing 46% and 14% to date. Although China may continue its investments given that Myanmar is a vital piece of Beijing’s Belt and Road infrastructure initiative, FDIs as a whole may drop due to political instability. This could affect the country’s economic growth.

- Covid-19 impact. Ahead of Yoma’s 1Q21 update, we cut FY21 forecasts to account for Covid-19 lockdowns implemented from October to December 2020. Our growth forecasts for all its business lines for FY21-22 have been trimmed from 5-7% to 0-2%. Wave Money’s contribution to FY21 income has been lowered by 20%, offset by higher contributions from an additional 10% stake acquired on 13 October 2020. Overall, FY21-22 earnings have been cut by 27% and 35% respectively.

- Possible depreciation of kyat (MMK). As of September 2020, Yoma had not entered into any currency hedging. Any MMK depreciation against US$ could result in an Other Comprehensive Income loss, which has a negative impact on Yoma’s net asset value. As of September 2020, US$ net debt was US$212mn.

Recommendation

Maintain BUY with a revised SOTP TP of S$0.34, from S$0.46. The change in our TP mainly captures downward adjustments in land bank prices for Yoma Land (Figure 1) to the lower end of the range guided by management in 4Q20. This reflects slower property development and sales in the near term. In addition, we estimate a 5% impact on asset values, assuming a 10% depreciation of MMK/US$ to spot levels of 1,470-1,500 (Figure 2). Our 20% conglomerate discount is unchanged.

Developments to monitor:

- Sanctions from foreign nations

- Ayala’s and Ant Financial’s investments

- MMK currency movements

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla Airbnb Inc - Solid results overshadowed by weak guidance

Airbnb Inc - Solid results overshadowed by weak guidance May 9th - Things to Know Before the Opening Bell

May 9th - Things to Know Before the Opening Bell Trade of the Day - Pfizer Inc. (NYSE: PFE)

Trade of the Day - Pfizer Inc. (NYSE: PFE)