YOMA STRATEGIC HOLDINGS LTD. - Topline positive amidst COVID-19

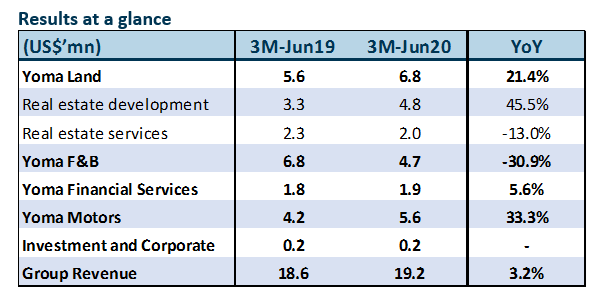

21 Aug 2020- Overall revenue saw 3.2% growth YoY underpinned by 21.4% and 33.3% growth in Yoma Land and Yoma Motors respectively, offset by -30.9% YoY performance by Yoma F&B.

- Yoma Land’s revenue is well supported by a backlog of unrecognized revenue, while Yoma Motors’ growth is attributable to pent up demand in the Heavy Equipment segment.

- Maintain BUY with an unchanged target price of $0.46.

The Positives

+ Yoma Land’s revenue is well supported by backlog of unrecognized revenue. Although sales were minimal this quarter (8 units of CityLoft and 1 unit of Peninsula Residence) amidst cautiousness in big-ticket expenditure and delays in paperwork, Real Estate Development registered a 45.5% YoY revenue increase. It is largely attributable to the revenue recognized from the completion of City Loft. Unrecognised revenue now amounted to US$17mn as at 3Q20 vis-à-vis more than US$20mn in 2Q20. Real Estate Services revenue was lower YoY due to lower occupancy levels and rental rates at Pun Hlaing Estate and StarCity. However, the lower rental rates and the amenities and services offered amidst COVID-19 had driven a partial recovery in occupancy levels in recent months.

+ Yoma Motors registered revenue growth of 33.3% largely attributable to the Heavy Equipment segment; Passenger and Commercial Vehicles (PCV) segment held up. Despite the COVID-19 impact from border closures and falling crop prices, more tractors and implements were sold due to pent up demand after many quarters of weaknesses arising from the exceptionally heavy monsoon last year. New Holland sold 124 tractors in the quarter compared to 61 tractors in 3M-Jun2019. Higher PCV revenue was driven by the sale of 16 Volkswagen vehicles and 22 Ducati motorbikes. Mitsubishi and Hino also saw significant improvements with 184 Mitsubishi vehicles (65 vehicles in 3M-Jun19) and 26 Hino trucks (9 trucks in 3M-Jun19) being sold. Mitsubishi sales were boosted by the popular Xpander model and there remains c.US$7.5mn backlog of unfilled orders.

+ Revenue from Yoma Financial Services increased by 5.6% YoY underpinned by an enlarged finance lease portfolio in Yoma Fleet; Wave Money remains EBITDA positive despite weaker transaction numbers. Vehicle numbers for Yoma Fleet grew by 11.1% year-on-year to 1,290 vehicles and third-party assets under management stood at US$45.6 million as of 30 June 2020. As finance leases carry higher gross profit margins, we are expecting a larger flow-through from Yoma Fleet to the bottom line in 2H20.

Due to the Thingyan holidays amidst the Myanmar New Year in April and COVID-19 measures, Wave Money’s OTC business was largely affected, which resulted in a decline in revenue and transaction numbers of 16.5% and 25.3% respectively from the previous quarter. However, its e-wallet business continued to record double digit growth rate month-on-month as more people opt for cashless transactions and is on track to reach its 1.3 million MAUs target by December 2020. EBITDA for Wave Money remained positive due to economies of scale and cost control.

The Negatives

– Yoma F&B revenue was down 31% YoY due to COVID-19 measures. 3Q20 revenue declined 31% YoY due to government-imposed lock downs, curfews and prohibitions on dine-in between April to mid-May and temporary store closures in severely affected trade zones. The month of April was most affected as revenue fell 50% YoY. During the initial stages of COVID-19 there was a large shift towards delivery, which mitigated some of the shortfall in dine-in revenue. Delivery accounted for 40% of the total sales in April at the peak, which normalised to 15%-20% as restrictions eased and some of these customers return to restaurants. June recorded a smaller decline of c.25% YoY since the Myanmar government allowed restaurants to resume operations conditional upon adherence to certain guidelines at the end of May.

Outlook

Pre-COVID, CityLoft has been recording a healthy booking rate at >50 units per month. Amidst COVID-19, interest in the property remained high as the team continued to engage customers through virtual show flats. However, CityLoft’s booking rate slowed significantly from April to May. As the economy started to reopen at the end of May, buying interest noted a recovery. Booking rate was nearing half of pre-COVID levels by July.

According to World Bank’s June report, the agriculture sector had been resilient and is expected to grow by 0.7% for the year. This is mostly due to an increase in production of crops, such as rice, and beans and pulses. Meanwhile, the Myanmar government and NGOs are also supporting the agricultural industry by providing lower-interest loans for buying inputs and giving greater flexibility on loan repayments. These initiatives will spur demand for tractors which is beneficial for Yoma Motors.

During this period, Wave Money will continue to work with various organisations such as Myanmar Agricultural development to disburse loans for farmers and Social Security Board to disburse medical and COVID-19 quarantine relief through the adoption of Wave Pay. We are expecting the growth of the e-wallet business to be fast-tracked by these schemes to make up for fewer transactions in the OTC business.

Yoma F&B witnessed improved performance MoM as business starts to recover in the coming quarter. Sales for July was nearing-pre-COVID level with same store sales growth recorded in certain days. The accelerated adoption of delivery services positioned Yoma F&B better to capture sales thwarted due to dine-in prohibitions. Yoma’s target of opening 2-3 KFCs by the end of 2020 remains unchanged.

Maintain BUY with an unchanged TP of S$0.460. Our target price translates to a total upside of 58.6%. Property and financial services will constitute 68% and 19% of the valuation respectively. A conglomerate discount of 20% has been applied (Fig.1).

The report is produced by Phillip Securities Research under the ‘Research Talent Development Grant Scheme’ (administered by SGX).

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla

Magnificent 7 Monthly: April 24 - Growth dragged by Apple and Tesla Airbnb Inc - Solid results overshadowed by weak guidance

Airbnb Inc - Solid results overshadowed by weak guidance May 9th - Things to Know Before the Opening Bell

May 9th - Things to Know Before the Opening Bell Trade of the Day - Pfizer Inc. (NYSE: PFE)

Trade of the Day - Pfizer Inc. (NYSE: PFE)