Facebook - Stock Analyst Research

| Target Price* | 510.00 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 2 May 2024 |

*At the time of publication

Meta Platforms Inc. - Solid results, but tough comparisons ahead

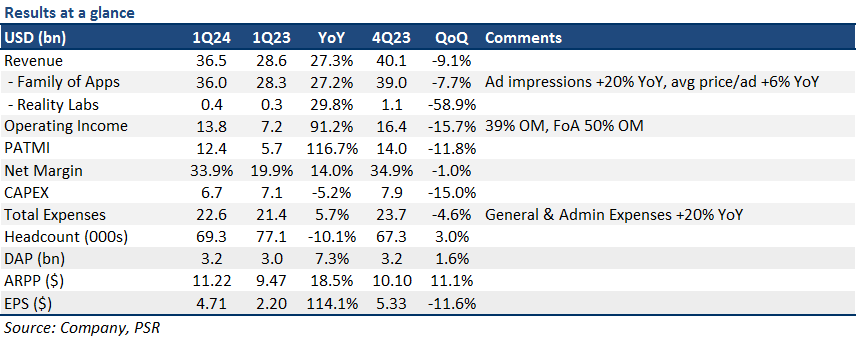

- 1Q24 results outperformed slightly, with META’s US$36.5bn revenue at the top end of its guidance range due to an acceleration in ad growth. PATMI was above due to lower network delivery costs. 1Q24 revenue/PATMI were at 24%/25% of our FY24e forecasts. 1Q is historically the weakest quarter of the year.

- +27% YoY ad revenue growth a result of increasing ad impressions (+20% YoY) and prices (+6% YoY), with AI-related content driving greater user engagement.

- Higher CAPEX spending over the next two years as META develops more advanced models, and builds out its own silicon capabilities (MTIA Chip).

- We keep our FY24e revenue/PATMI forecast unchanged but increase FY24e CAPEX by 10% (~US$3bn) to account for higher AI infrastructure spending. As a result, our DCF target price is lowered to US$510 (prev. US$520), while we maintain ACCUMULATE. Our WACC/growth rate assumptions remain unchanged at 7.1%/4.5%, respectively.

The Positives

+ AI content driving greater engagement, leading to higher ad revenue. META continues to leverage its AI capabilities to improve engagement on its apps, indirectly leading to higher ad revenue (+27% YoY). META’s AI recommendation system now contributes roughly half of all content users see on Instagram, driving more value for advertisers. The demand-supply dynamics of digital ads are also improving, with META seeing healthy 20+% YoY growth in impressions and a 2nd consecutive quarter of YoY advertising price increases. E-commerce companies remained the largest contributor to advertising revenue growth.

+ Positive momentum for Video/Reels. Video engagement continues to be a bright spot for META, contributing to >60% of viewing time on both FB and IG. Reels remain the key driver for this growth, with its strong ramp throughout FY23. Reels monetisation is also improving with META leveraging AI for more optimised ad loads and placements.

The Negatives

– Higher CAPEX spending moving forward. META is doubling down on scaling its AI capabilities to develop more advanced and compute-intensive models while also scaling its training and inferencing needs (custom silicon). As a result, FY24e CAPEX guidance was raised by ~US$4bn to a range of US$35bn-US$40bn. It expects this investment cycle to take at least 2 years to complete.

– Decelerating revenue growth for 2Q24e. META guided to 2Q24e revenue growth of ~18% YoY, implying a deceleration in growth as it: 1) laps a period of tougher comparisons due to China recovery from early-FY23, 2) slower increase in Reels’ advertising load after an initial aggressive ramp, 3) ~1% YoY impact from a strengthening USD.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

May 16th - Things to Know Before the Opening Bell

May 16th - Things to Know Before the Opening Bell Trade of the Day - AbbVie Inc. (NYSE: ABBV)

Trade of the Day - AbbVie Inc. (NYSE: ABBV) Thai Beverage PLC - Beer turning fresh

Thai Beverage PLC - Beer turning fresh StarHub Limited - Mobile competition intensifying

StarHub Limited - Mobile competition intensifying