Phillip 2Q24 Singapore Strategy - Drifting sideways

1 Apr 2024|

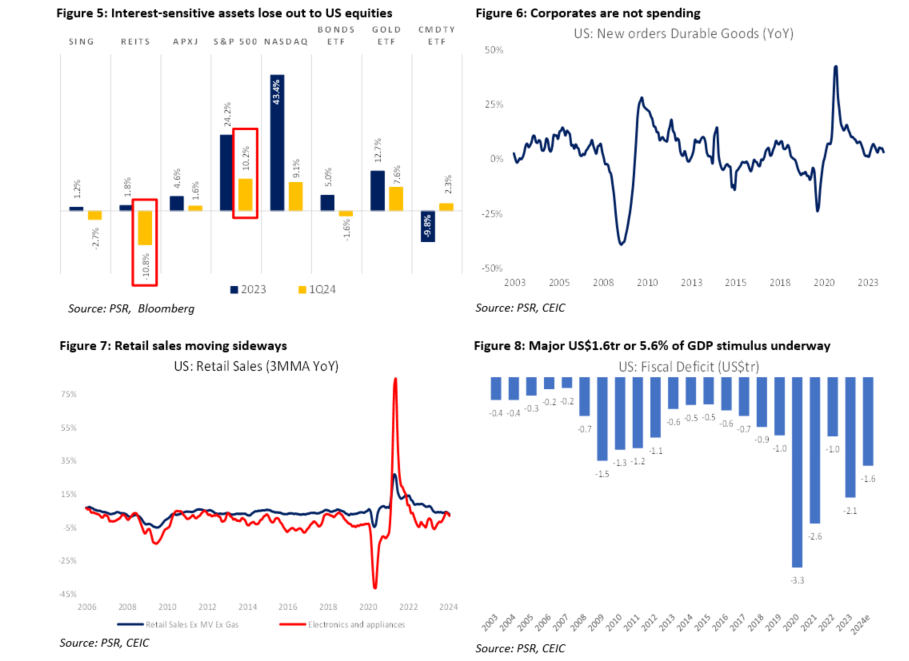

Review: Singapore’s equity market rose a modest 0.5% in 1Q24. Most sectors were down during the quarter except banks (Figure 1) and telecommunications. With their attractive yields and expectations of rate cuts extended, banks recovered strongly, especially in March. The consumer sector was a drag with high cost of living and weak economic growth (Figure 3). REITs suffered as expectations in the number of interest rate cuts by the Federal Reserve were lowered and delayed (Figure 4). Outlook: Economic indicators point to a US economy that is flatlining. Retail spending, PMI, industrial production, employment, and capital expenditure are sluggish (Figures 6 and 7). This is despite aggressive fiscal deficits to prop up the economy (Figure 8). The Congressional Budget Office forecasts another US$1.56tr (5.6% of GDP) deficit stimulus to the US economy in 2024. The huge deficit spending will cap the downside to economic growth. Apart from the government, consumer spending is holding up despite weakening disposal income (Figure 9). We believe higher borrowings (Figure 10) and wealth effect (housing and equity) are supporting consumption spending. The lagged impact of higher interest rates, diminishing pandemic savings, and repayment of student loans will persist as a drag on the economy. On interest rates, inflation is becoming stickier than expected (Figure 11). The deflation in goods prices has started to stall, and services are not turning down quickly enough. Inflation becomes a challenge in 2H24 as base effects will cap the downside. Another worry is creeping oil prices from supply cuts. Our base case of two rate cuts in 2H24 is unchanged. The Singapore economy is similarly drifting sideways. Exports are recovering but against a collapse in 2023 (Figure 12). Retail sales are stable, supported by rising wages and the availability of jobs. The key strength of Singapore equities is the dividend yield of 5.6% (Figure 13), and it is a steadfast currency. The Singapore dollar is supported by its rising foreign reserves (Figure 14), persistent current account surplus (Figure 15), and only AAA-rated sovereign in Asia. |

Recommendation: The lack of economic momentum and unclear path to rate cuts, keeps us cautious on Singapore equities. Dividends will again be the primary source of return for investors. REITs suffered this quarter as interest rate expectations climbed by 90bps since December (Figure 16). Despite interest rate cuts, REITs will still face sluggish dividends this year. Interest rate pressure will persist due to the unwinding of interest rate hedges. The domestic sectors with momentum are construction and tourism. Construction will ride on record-high and stable construction contracts. Tourism is surging again after the lull in 4Q23. Arrivals are up 50% in the first two months of this year. We replaced OCBC with DBS in our model portfolio for its dividend visibility. DBS surprised the market with aggressive dividend plans and a committed yield for 2024 of 6.7%, paid quarterly. The debate will be about DBS’s ability to sustain earnings as interest rates peak. Net interest margins will be supported by the higher proportion of fixed deposits, rolling over their fixed rate assets at higher yield and increasing the duration of their book. Other earnings drivers will be fee income as risk appetite in wealth management returns and modest loan growth. DBS is also well capitalised with the recapitalisation for new Basel rules plus management overlay in general provisions. Another stock we added was Cromwell European REIT. The REIT trades at an attractive yield of 10%. The portfolio occupancy has been stable, rental reversions of 6% and managed to dispose assets at a 15% premium. We still expect dividends to soften this year but remain attractive. An added positive is the prospect of a rate cut by the European Central Bank ahead of the Fed. Cromwell will replace Fraser’s Centrepoint Trust, which has already rallied with the inclusion into the Straits Times Index to replace Emperador. The weakest names in our model portfolio were CapitaLand Investment (CIL) and ThaiBev. CLI is building a valuable fund management franchise with the intention of double the fund size in five years. For ThaiBev, we expect the economy to revive, led by a US$14bn cash handout and export recovery.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

May 17th - Things to Know Before the Opening Bell

May 17th - Things to Know Before the Opening Bell Trade of the Day - Boeing Co. (NYSE: BA)

Trade of the Day - Boeing Co. (NYSE: BA) Singapore Banking Monthly - Fee income the driver

Singapore Banking Monthly - Fee income the driver May 16th - Things to Know Before the Opening Bell

May 16th - Things to Know Before the Opening Bell