US Presidential Election 2024: Embrace the Volatility & Trade the US Market with POEMS!

US Presidential Election 2024:

Embrace the Volatility &

Trade the US Market with POEMS

Open Account

Trade Now

US Presidential Election 2024:

Embrace the Volatility &

Trade the US Market with POEMS!

Open Account

Trade Now

Countdown to Election Day - 5 November 2024

Days Hours Minutes SecondsKamala vs. Trump: Which Stocks Stand to Gain the Most?

Kamala Harris

Democratic Party

Donald Trump

Republican Party

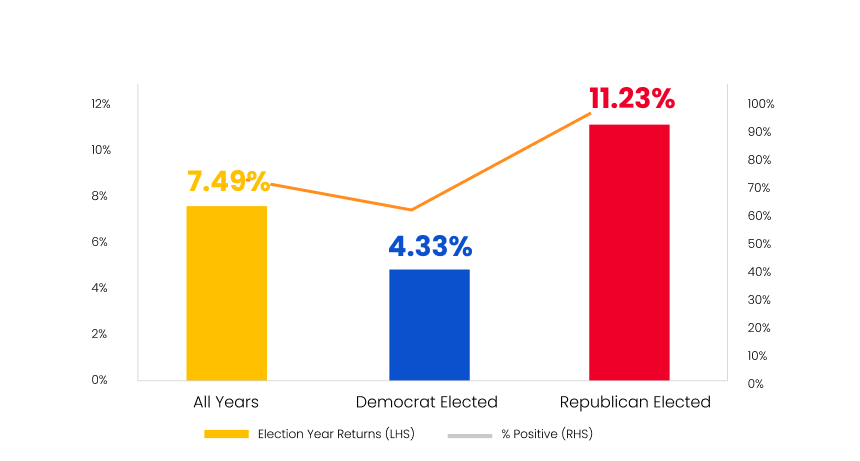

S&P 500 Average Returns in Presidential Election Year (Since 1928)

Source: Market Watch US Presidential Elections - Market Trends

Check out these News Articles covering the US Election & US Market!

What Happens After an Assassination Attempt

As with Reagan in 1981, the FBI will take the lead in investigating the shooting of Donald Trump.

Economists Say Inflation Would Be Worse Under Trump Than Biden

In a Wall Street Journal survey, economists see Trump’s plans to raise tariffs and crack down on illegal immigration as putting upward pressure on prices

Stock Futures Trade Slightly Higher as Investors Weigh Trump Shooting

Stocks are poised for a slightly higher open on Monday, the first look at how U.S. markets will react following the failed assassination attempt on former President Donald Trump.

Asia: Stocks mixed, dollar rises as traders weigh Trump shooting

Read our Articles onUpcoming Market Trends Ahead of the Elections

The ‘Golden Goose’ of Investments: Boost Your Wealth and Enjoy Guaranteed Returns with Smart Park!

Growing and preserving your wealth can be straightforward and stress-free!

Imagine leaving your idle fund alone to generate returns automatically, without you having to remember rollovers, unlike Fixed Deposits and Treasury bills! Sounds wonderful? Let me share how!

The Fed’s Rate Cuts: Impact on US Stocks

The Federal Reserve’s (Fed) interest rate policies are a critical driver of US financial markets, with profound implications for stock valuations and sector performance. As the Fed signals a potential interest rate cut towards the end of the year in response to diminishing inflation rather than economic weakness, it is essential to understand how these changes could impact the US stock market.

Upcoming US Market Trends: Must-Watch Webinars for You

US Election Webinar: Portfolio Implication

3 Sep, Tue 2024 08:30 PM - 09:30 PM

Thomas Taw | Head of the APAC Investment Strategy | BlackRock

Zoom

From Ballots to Bull Markets: The Financial Impact of US Elections

3 Sep, Tue 2024 08:30 PM - 09:30 PM

Roger Leng | Director, Intermediary Sales UOB Asst Mnagement | Wayne Lau | Vice Pesident UOB Asset Management | Quan Chengji | Portfolio Manager | Phillip Securities | Darius Lee | Manager, Business Development | Phillip Securities

Zoom

Watch our Past Analysis here

Open POEMS Account

Begin your trading journey with POEMS and enjoy a smarter way to manage your investments with the most trusted platform!

Open an AccountOpen POEMS Account

Begin your journey in trading the most trusted Platform, and experience a fresh way to manage your money!

Open an Account

Stay Informed, Access Our Daily Morning Notes Here!

Open an Account

Stay Informed, Access Our Daily Morning Notes Here!

Financial Products to look out for during the 2024 Presidential US Elections

US Shares

Trade Now Trade Now

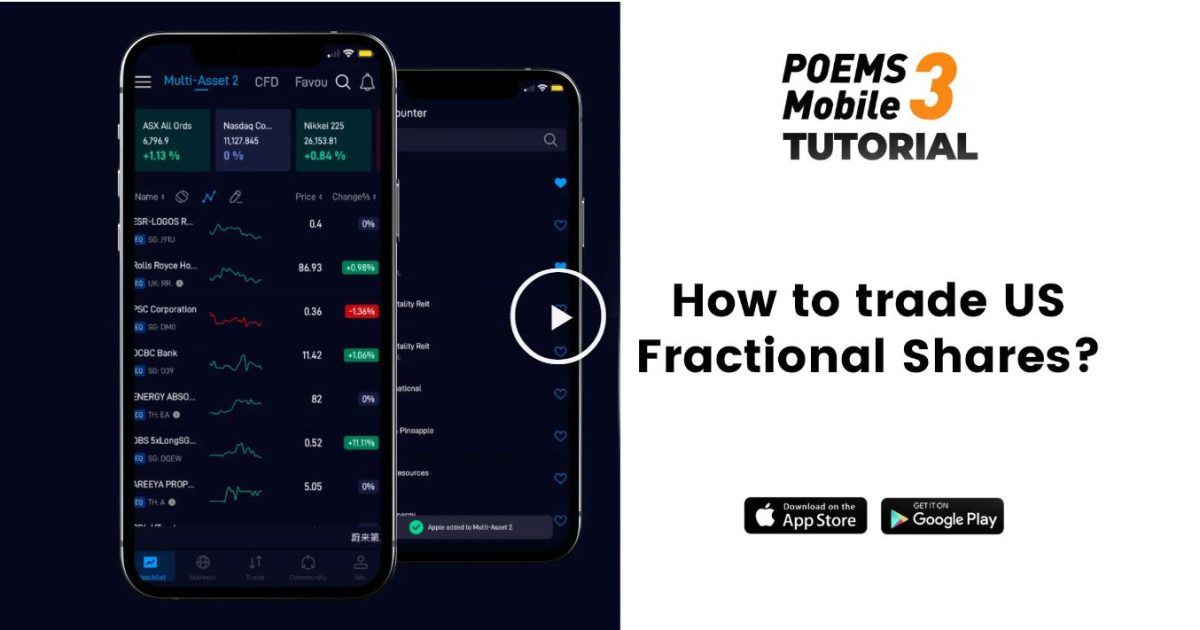

US Fractional Shares

Trade Now Trade Now

US Options

Trade Now Trade Now

US Exchange Traded Funds (ETFs)

Trade Now

US Shares CFDs

Trade Now

US Indices CFDs

Trade Now

Forex CFDs

Trade Now

Commodities CFDs

Trade NowWhy Trade the US Market with POEMS?

- Trade US Shares from USD 1.88 Flat with Cash Plus Account!

- NO Foreign Custody Fees

- NO Settlement Fees

- NO Platform Fees

- NO Hidden Fees

Not sure what to Invest?

Park your Cash with SMART Park to grow & earn USD 1.7065% p.a. while waiting for Investment Opportunities!

^Based on Total Net Assets (TNA) figures reflected in FundSingapore.com

Return (7 Day) Annualised*

Rates updated as of 5 September 2022

*Based on the average rate of annualised returns over the last rolling week.

Past performance is not necessarily indicative of future performance. View disclaimer

Why Trade the US Market with POEMS?

- Trade US Shares from USD 1.88 Flat with Cash Plus Account!

- NO Foreign Custody Fees

- NO Settlement Fees

- NO Platform Fees

- NO Hidden Fees

Not sure what to Invest?

Park your Cash with SMART Park to grow & earn USD 1.7065% p.a. while waiting for Investment Opportunities!

Fund Now^Based on Total Net Assets (TNA) figures reflected in FundSingapore.com

Return (7 Day) Annualised*

Rates updated as of 5 September 2022

*Based on the average rate of annualised returns over the last rolling week.

Past performance is not necessarily indicative of future performance. View disclaimer

Open Account &

Trade the US Market Now!

Need Assistance? Key your Details and we'll get back to you!

Contact us to

Open an Account

Need Assistance? Key your Details and we'll get back to you!

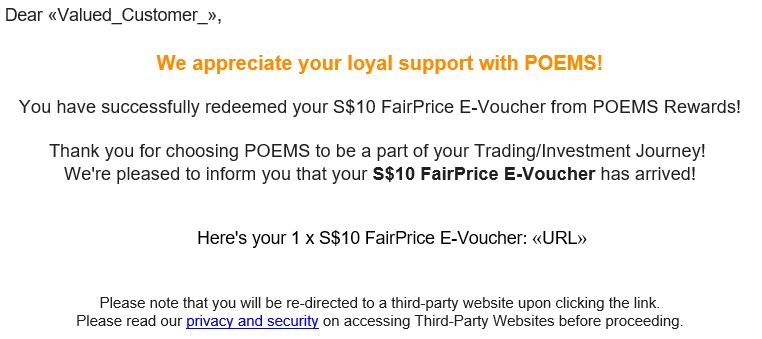

E-Vouchers

Redeem Now

Redeem Now

Redeem FairPrice & Shopee E-Vouchers with your POEMS Reward Points

Trade More to Earn More Points

Earn 1 POEMS Reward point for every S$1 in commissions when you trade equities* using POEMS 2.0, POEMS Mobile 2.0 App, POEMS Mobile 3 App, or POEMS Pro.

*Valid for both local and selected foreign markets.

For more information, please refer to our Terms & Conditions.

Redeem FairPrice & Shopee E-Vouchers with your POEMS Reward Points

Trade More to Earn More Points

Earn 1 POEMS Reward point for every S$1 in commissions when you trade equities* using POEMS 2.0, POEMS Mobile 2.0 App, POEMS Mobile 3 App, or POEMS Pro.

*Valid for both local and selected foreign markets. For more information, please refer to our Terms & Conditions.

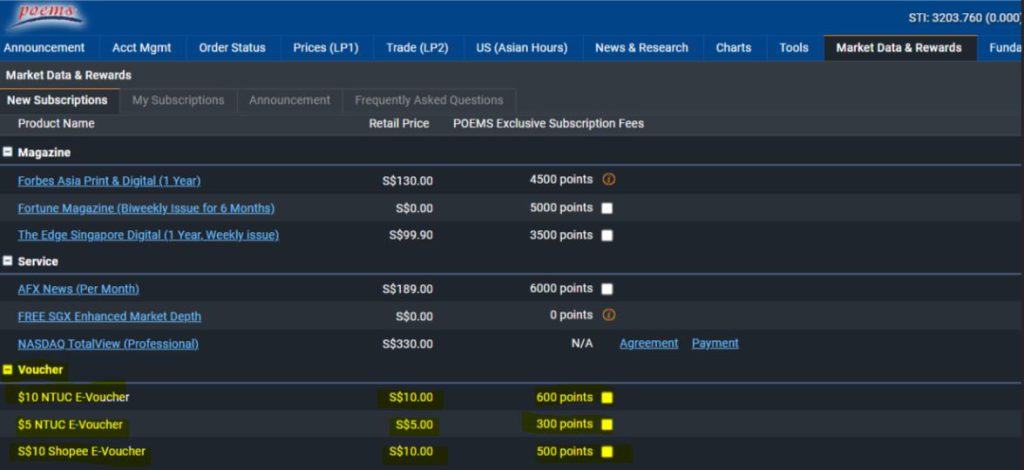

Redeem your POEMS Reward Points for various E-Vouchers as follows:

S$5 FairPrice E-Voucher - 300 POEMS Reward Points

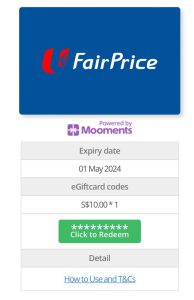

S$10 FairPrice E-Voucher - 600 POEMS Reward Points

S$10 Shopee E-Voucher - 500 POEMS Reward Points

Redeem NowRedeem your POEMS Reward points for various E-Vouchers as follows:

S$5 FairPrice E-Voucher: 300 POEMS Reward Points

S$10 FairPrice E-Voucher: 600 POEMS Reward Points

S$10 Shopee E-Voucher: 500 POEMS Reward Points

Redeem NowHow to Redeem?

On POEMS 2.0 Web- Login to POEMS 2.0 Web

- Head to ‘Markets & Data Rewards’ tab.

- Choose the desired e-vouchers under the “Voucher” section. You can select from:

- S$5 FairPrice E-Voucher

- S$10 FairPrice E-Voucher

- S$10 Shopee E-Voucher

- Tick the checkbox next to the e-voucher(s) you wish to redeem. Use 300 points for the S$5 FairPrice, 600 points for the S$10 FairPrice, or 500 points for the S$10 Shopee E-Voucher.

- Click the “Submit” button to finalise your redemption.

1. A redemption email will be sent to your email address (registered to your POEMS account) within 10 working days.

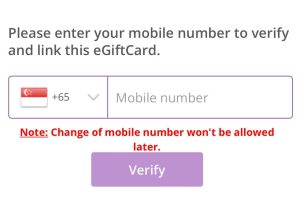

2. Click on the E-Voucher URL on the email.

3. Enter your mobile number to receive an OTP.

*Be ensured that Mooments will not send any of their marketing related materials to your mobile number.

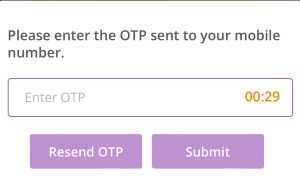

4. Enter the eGift card OTP.

5. Once verified, you can click on View Code and use the code on the merchant’s platform – Online / App or in-store, whenever applicable.

Frequently Asked Questions

1. Why am I unable to redeem the E-Voucher/s?This could be due to one of two reasons:

- Each account holder may only redeem one S$5 FairPrice, S$10 FairPrice, S$10 Shopee E-Voucher each month (30 days). You may have reached the maximum redemption limit for the month.

- You have insufficient POEMS Reward Points for redemption.

.

2. When will I receive my E-Voucher?The voucher code will be sent to your email address (registered to your POEMS account) within 10 working days (from the date of redemption). If you have yet to receive the voucher after 10 working days, kindly check your junk or spam folder.

IMPORTANT: Please ensure that the email address registered to your POEMS Account is accurate as there will be no re-issuance of voucher or refunds allowed if an incorrect email address is used.

3. How long is the validity for each E-Voucher?For the S$10 Shopee E-Voucher, it will be valid for 3 months from the date of redemption email received.

For the S$5/S$10 FairPrice E-Voucher, it will be valid for 6 months from the date of redemption email received.

4. I am a Cash Trading Account Holder, can I redeem the E-Voucher?To enjoy this redemption reward, you must convert your Cash Trading Account to a Cash Management Account here.

5. What is Mooments?Mooments is an online gift card platform that partners with well-known businesses.

6. I am having trouble redeeming the E-Vouchers. Who should I contact?In the event of any eGift card issues or Technical queries, please reach out to the support team at Mooments here: support@mooments.com.

Terms & Conditions

Terms & Conditions- Each Customer holding either a Cash Plus, Cash Management, Margin, Prepaid, Custodian or Share Financing Account may redeem up to S$25 worth of E-Vouchers per 30 day period.

- Redemption –

- S$5 worth of FairPrice E-Voucher per month, with 300 POEMS Reward Points, and/ or

- S$10 worth of FairPrice E-Voucher per month, with 600 POEMS Reward Points, and/ or

- S$10 worth of Shopee E-Voucher per month, with 500 POEMS Reward Points

- Shopee/FairPrice E-Vouchers are valid for 3/6 months from the date of redemption email sent respectively (thereafter referred to as “Redemption Period”)

- E-Vouchers are not refundable or exchangeable for cash or to other Account holders.

- E-Vouchers cannot be replaced if lost, damaged or expired.

- Each unique code from the E-Vouchers is applicable for single use.

- E-Vouchers that have not been redeemed by the end of the Redemption Period shall be forfeited automatically and will not be refunded.

- PSPL and its affiliates and their respective employees and agents shall not be liable to any person for any loss, damage, injury, costs or expenses incurred, suffered, borne or arising from this promotion.

- By redeeming this item, you acknowledge that you have read and consented to these Terms and Conditions.

- The following Customers are NOT eligible for this promotion unless approved by the management of Phillip Securities Pte Ltd (“PSPL”):

- Customers who have any existing Cash Accounts with PSPL

- All employees of PSPL’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

- By taking part in the promotion, you agree and consent to PSPL sending relevant information to third-party service providers to facilitate the delivery and redemption of the Rewards.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete these Terms and Conditions without prior notification (including eligibility; replacement of the prize; promotional mechanics, promotion duration without prior notification, qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

- Shopee E-Voucher –

- This E-Voucher is valid for redemption only at www.shopee.sg

- Must be fully utilised when making payment (Any unutilised amount will be forfeited and shall not be refundable)

- Only one E-Voucher code can be used per transaction

- E-Voucher code cannot be combined with other coupon codes and promo codes

- Not applicable on ‘Miscellaneous’ and ‘Tickets & Vouchers’ categories

- Not applicable on ‘Cash on Delivery’ orders. Valid for payments involving Shopee Guarantee (credit/debit card & bank transfer) only

- All other Terms and Conditions will be applicable as mentioned in www.shopee.sg

- Fairprice E-Voucher –

- FairPrice Group E-Vouchers are stackable for online purchases made via FairPrice Online and physical FairPrice store outlets.

- Not valid for purchase of lottery products.

- Not valid for redemption at Unity Pharmacy Changi Airport.

- Not valid for redemption at Cheers and FairPrice Xpress outlets.

- Non-renewable upon expiry. Expiry date is final.

- Not valid for checkout via Scan & Go.

- Voucher does not offset service and delivery fees on FairPrice Online orders.

This is provided by Mooments on 15 February 2023. Please refer to “How to Redeem” and “Terms and Conditions” of the gift card in the E-Voucher that you claimed for updated contents.

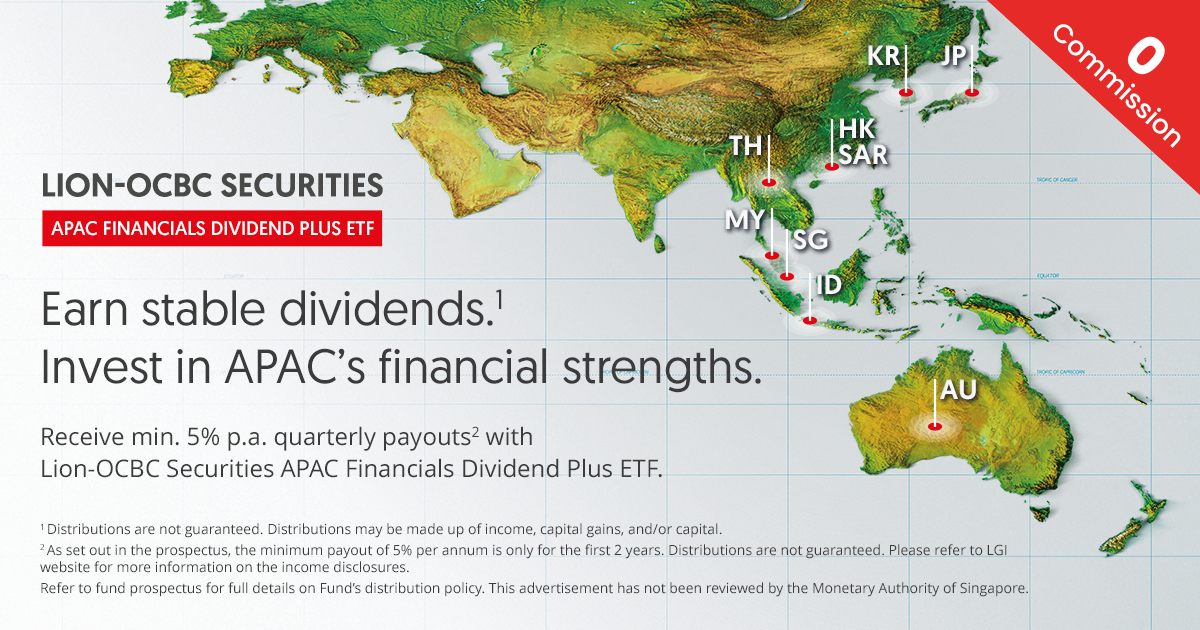

Lion-OCBC APAC Financials ETF

Lion-OCBC Securities APAC Financials Dividend Plus ETF

Invest Now How to Subscribe the ETF during the IOP via POEMS 2.0?- Login to your POEMS 2.0 account > Acct Mgt > Online Forms > IPO Subscription – Irrevocable Form

- Select the IPO that you wish to subscribe to

- Read and agree to the prospectus, terms and conditions before subscribing to the financial product

- Application closes on 2 May 2024, Thursday at 5pm

- Ensure sufficient cash is present in your POEMS account to complete the application process (inclusive of subscription amount, transfer fee and GST) by the settlement date on 2 May 2024, Thursday at 5pm

| Subscription Period | 11 April – 2 May 2024 |

| Listing Date | 13 May 2024 |

| Subscription price | S$ 1.00 |

| Minimum Quantity | 1,000 units |

| Commission Fees | Zero Commission |

| Transfer Fees | S$ 10.00 (Subject to GST) for Cash Management Account. Other Phillip Investment Account Types will not be subject to transfer fee charge |

| Settlement Currency | S$ |

| Trading Currency | S$, US$ |

| Allotment | Full Allotment |

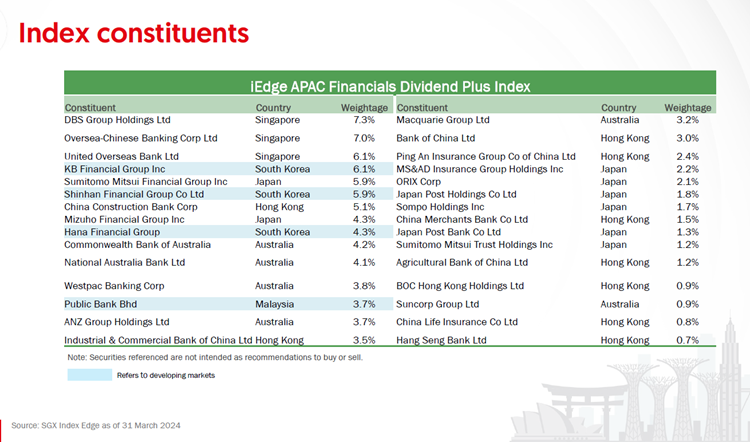

| ETF Name | Lion-OCBC Securities APAC Financials Dividend Plus ETF |

| Underlying Index | iEdge APAC Financials Dividend Plus Index |

| Issue Price | S$ 1.00 per unit |

| Target Listing Date | 13 May 2024 |

| Initial Offer Period (IOP) | 11 April 2024 to 2 May 2024 |

| Base Currency | S$ |

| Trading Currency | S$ and U$ |

| SGX Code | YLD (S$) and YLU (US$) |

| Bloomberg Ticker | FINSGD SP (SG$) and FINUSD SP (US$) |

| Trading Board Lot Size | 1 unit |

| Management Fee | 0.50% per annum |

| Dividend Policy^ | First 2 years: Quarterly distribution (min 5% pa of the Issue Price) in every March, June, September and December. First distribution expected in September 2024. Year 3 onwards: Intend to declare quarterly distributions of around 5% pa of the SGD Class NAV less the expenses of the Class in every March, June, September and December. |

| Replication Strategy | Direct Replication or Representative Sampling |

| Classification Status | Excluded Investment Product |

Promotion

Receive up to S$500 Cash Credit to Your POEMS Account when you subscribe to the Lion-OCBC Securities APAC Financials Dividend Plus ETF

- Clients will receive $20 cash credit for every $10,000 subscription into Lion-OCBC Securities APAC Financials Dividend Plus ETF

About the ETF

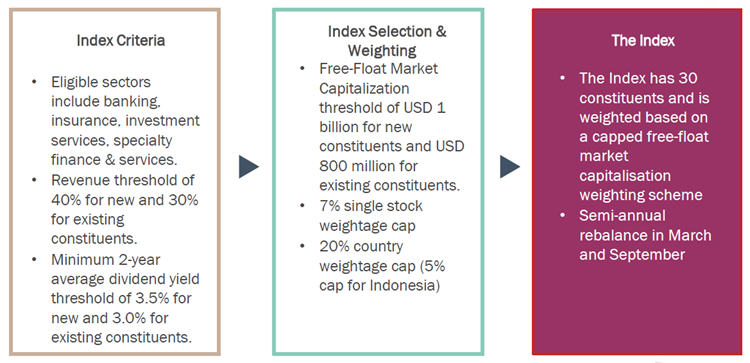

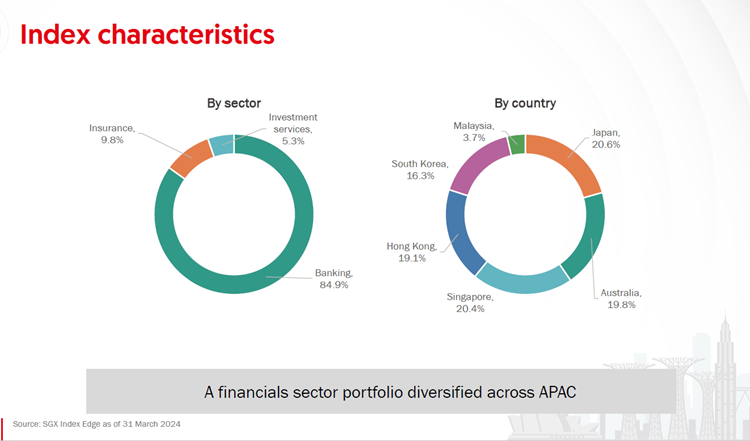

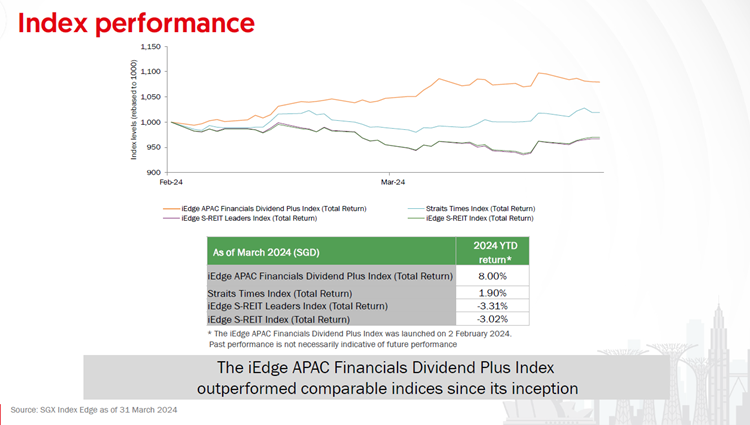

- The iEdge APAC Financials Dividend Plus Index aims to track the 30 largest and most tradable companies listed in Asia Pacific and is designed to provide access to stable dividend payout attributes and growth in the financial sector

- The index universe includes financial institutions listed in Australia, Hong Kong, Japan, Singapore, Korea, Indonesia, Malaysia and Thailand

For more information about the ETF, please check on the Pitch Book and Brochure below.

Overview: Lion-OCBC Securities APAC Financials Dividend Plus ETF

Check out more information of the ETF via the "Pitch Book" and "Brochure" below.

Pitch Book Brochure

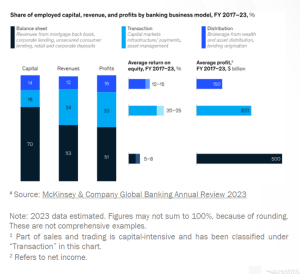

Why the Financial Sector?

- It continues to prosper through the centuries

- It is an essential capital provider for economies worldwide

- It provides products/services for the growth, storage or transaction of money and assets

- Beyond Banks, there are Investment Management, Insurance, Brokerages & Exchanges

Why APAC Financials?

^,*,# - Please refer to Pitch Book page 23

[FOCUS] Strong fundamentals, Immense opportunities- Financial services are among the world’s most profitable sectors, generating US$ 12.5 trillion revenue globally in 2022

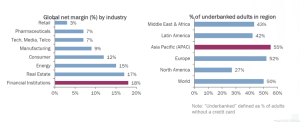

- 55% of adults in the Asia Pacific are underbanked (aduls without a credit card), which represents the largest proportion across regions

- APAC banks can further grow further by serving the underbanked in developing in Asia

- The APAC financials sector is a diversified mix of developed (e.g. Australia, HK, Japan, SG) and developing markets (e.g. Indonesia, Malaysia, Thailand)

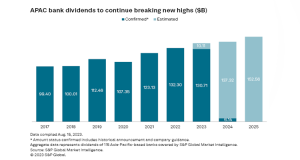

- APAC banks typically pay high dividends, laying the foundation for stable dividend income

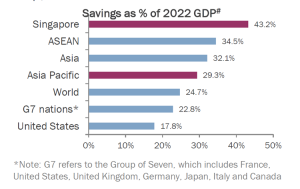

- Based on % of 2022 GDP, APAC savings rate is higher than the world average savings rate of 24.7%

- Within Asia Pacific, ASEAN and Singapore are the key drivers behind high savings rates

- Out of the world’s top 30 banks by market cap, 13 are APAC banks

- Capital-light models use less balance sheet but yield higher ROE and net income

- In 2017-23, transactions used 16% of capital but generated 33% of profits#

- Financial institutions are embracing digital transformation (e.g., AI, data analytics) to be capital-light.

- According to the DBS Annual Report 2022, “Digital customers are consistently more valuable with an increasing share of income, sustained higher income per customer, better efficiency and higher returns.”

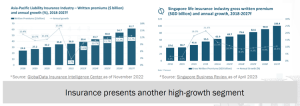

- The life insurance industry in Asia-Pacific (APAC) was the world’s largest in 2021, with five Asian countries featuring among the top 10 global markets by written premiums

- From 2021-26, China, India, Hong Kong and Singapore are expected to maintain a Compound Annual Growth Rate (CAGR^) of 5% to 10%*. Singapore’s life insurance industry# is expected to exceed S$100.4 billion in 2027

- From 2021-26, emerging markets in APAC such as Indonesia, Thailand and Malaysia are expected to grow at CAGR of 5% to 22%# respectively

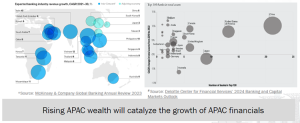

- Banks grouped along the Indian Ocean crescent* (stretching from Singapore, India to East Africa) are home to half of the world’s best-performing banks

- In the next decade, more APAC banks are expected to join the top global 100 banks#

- Global wealth is expected to surpass US$500 trillion in 2024#, nearly five times the global GDP. The biggest wealth source is from APAC (~40%)

Webinar Recording

Terms and Conditions

Terms and Conditions for Initial Offer Period for Lion-OCBC Securities APAC Financials Dividend Plus ETF

- The subscription period for Lion-OCBC Securities APAC Financials Dividend Plus ETF (“ETF”) is from 11 April 2024, Thursday at 9am to 2 May 2024, Thursday at 5pm

- The online subscription will close on 2 May 2024 at 5pm. No new applications, amendments, or withdrawals are allowed after this deadline.

- Eligible Accounts to subscribe for the ETF must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts. Cash Trading Accounts (T) are not eligible to participate in this subscription.

- An additional transfer fee charge of S$10 (subject to GST) per application for Cash Management Accounts will be applicable.

- Only one application is allowed per Account.

- Each ETF unit is priced at S$1 and the minimum order quantity is 1,000 units, with an incremental order size of 1,000 units.

- There are zero commission fees.

- The total amount payable is denominated in S$. The settlement currency will be in S$.

- Sufficient funds (including transfer fee and GST) must be present in the Customer’s Account by 2 May 2024 at 5pm

- Applications will be rejected if the Account does not have or reflect sufficient funds after 2 May 2024 at 5pm.

- ETF units will be credited to the clients’ CDP or clients’ sub-account with Phillip Securities Pte Ltd by 13 May 2024.

- Customers will receive the full allotment of the number of ETF units that they subscribe to.

- Customers can start trading the ETF units when the ETF is listed on SGX on 13 May 2024 at 9am.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

- Customers will receive S$20 cash credit for every S$10,000 subscription into Lion-OCBC Securities APAC Financials Dividend Plus ETF, and successful subscribers to fulfill 1 month holding period after the listing date.

- The Campaign period is from 11 April 2024, Thursday at 9am to 2 May 2024, Thursday at 5pm.

- The Cash Credit is capped at S$500 per POEMS account.

- The Cash Credit will be credited to your Account in one month after the listing date.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

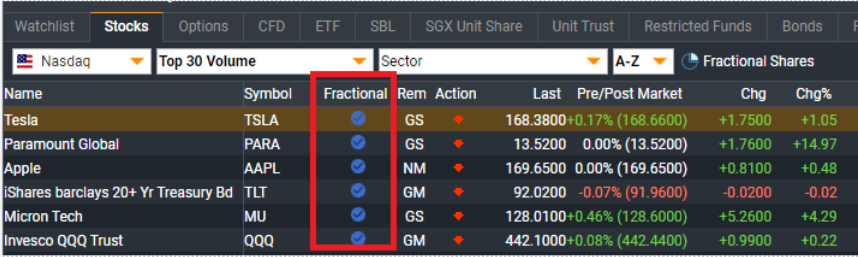

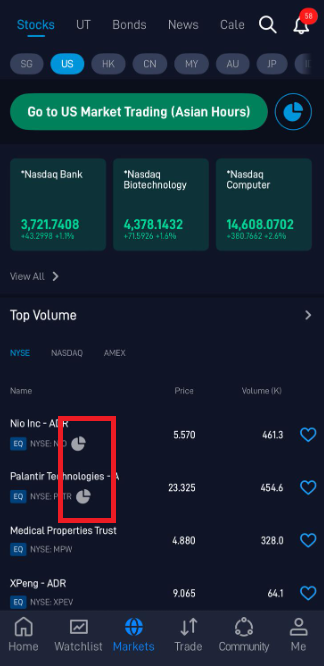

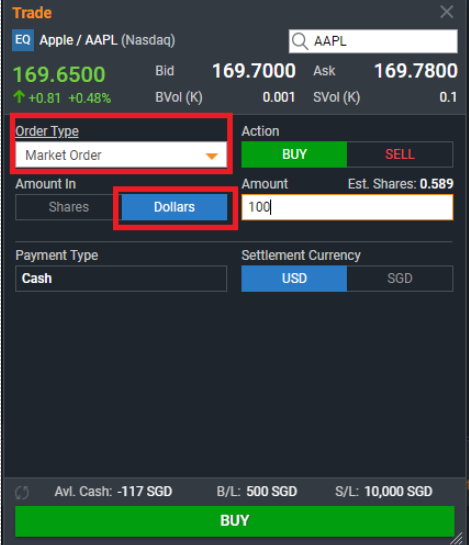

US Fractional Shares

Build your

US Portfolio at a Fraction of a Share!

Open an Account

Build your

US Portfolio at the Fraction of

a Share!

Open Account

Unlock the Potential of US Stocks

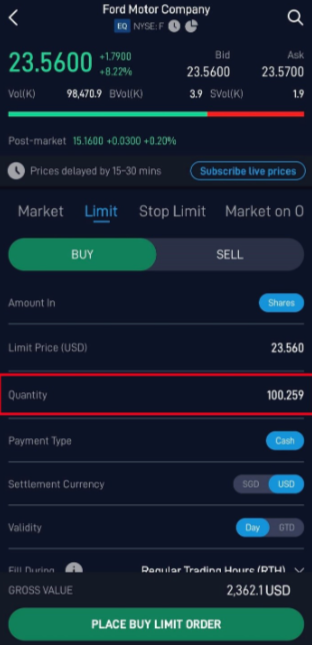

US Fractional Shares allows you to invest in any US blue chip stocks,

which instead of buying a whole share, you can purchase a fraction of it!

Gain Access To Your Dream Companies Within Your Budget!

This infographic is only for illustration purposes.

Open an Account Trade NowUnlock the Potential of US Stocks

US Fractional Shares allows you to invest in any US blue chip stocks, instead of buying a whole share, you can purchase a fraction of it!

Gain Access To Your Dream Companies Within Your Budget!

This infograpahic is only for illustration purposes.

Open an Account Trade NowWhy Trade US Fractional Shares with POEMS?

- Trade from as low as US$0.88 commission per fractional order*

- Dedicated Specialist available

- NO Platform Fee

*Only for less than 1 share order quantity, else existing brokerage will apply.

Why Trade US Fractional Shares with POEMS?

- Trade from as low as US$0.88 commission per fractional order

- Dedicated Specialist available

- NO Platform Fee

*Only for less than 1 share order quantity, else existing brokerage will apply.

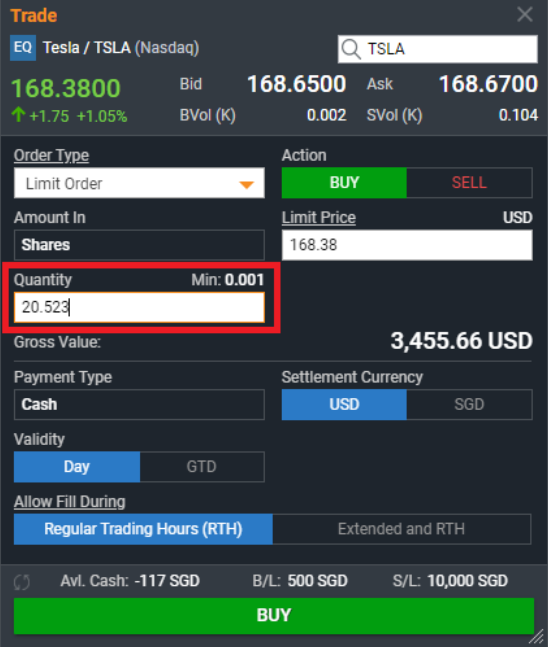

US Fractional Shares Order Details

Eligibility of Order Types

- Only Regular Trading Hours (RTH) Limit and Market orders are eligible.

- US Fractional Trading is not eligible for extended hours and GTD orders.

Minimum Order

- The minimum order for US Fractional shares orders is 0.001.

- US Fractional Shares notional value must be more than US$1 per order.

Corporate Actions

- US Fractional shares are still subject to corporate actions (e.g. stock splits, dividend distributions, and others)

- US Fractional shares are non-transferable and investors are not entitled to voting rights.

US Fractional Shares Order Details

Eligibility of Order Types

- Only Regular Trading Hours (RTH) Limit and Market orders are eligible.

- US Fractional Trading is not eligible for extended hours and GTD orders.

Minimum Order

- The minimum order for US Fractional shares orders is 0.001.

- US Fractional Shares notional value must be more than US$1 per order.

Corporate Actions

- US Fractional shares are still subject to corporate actions (e.g. stock splits, dividend distributions, and others)

- US Fractional shares are non-transferable and investors are not entitled to voting rights.

Check out our Tutorial Video on US Fractional Shares

Open an Account & Start Trading with POEMS!

Start your trading journey with POEMS and experience a smarter way to manage your investments on our reliable and user-friendly platform!

Open an AccountOpen an Account & Start Trading with POEMS!

Start your trading journey with POEMS and experience a smarter way to manage your investments on our reliable and user-friendly platform!

Open an Account

Open an Account

Frequently Asked Questions

1. What is the minimum order for US Fractional share orders?US Fractional Shares require a minimum notional value of US$1 per order.

US Fractional Shares are supported up to three decimal points (e.g. 0.001).

2. What are the eligible order types to trade US Fractional Shares?US Fractional Shares can only support Market and Limit orders.

3. Where can I trade US Fractional shares?US Fractional Shares can be traded under the normal trade ticket.

US Fractional shares are available on Cash, Cash Management, Margin, Cash Plus, Custodian, and Prepaid Custodian Accounts.

Client will need to acknowledge a Fractional Risk Disclosure Statement prior to Fractional shares trading.

5. Which are the POEMS trading platforms that US Fractional Shares are available to trade on?US Fractional shares are available for trading on POEMS 2.0 Web and POEMS Mobile 3 App.

6. What is the commission fee for US Fractional share?The commission for US Fractional shares (i.e. less than 1 share) is US$0.88 per order.

If it’s more than 1 share (i.e. 1, 1.5, 100 shares etc), the commission will follow the customer prevailing commission rate.

7. How can I identify shares available for US Fractional trading?US Fractional shares are indicated by a fractional tag displayed alongside their ticker symbol.

To place Dollar-based orders,

on POEMS 2.0, navigate to the desired US Fractional counter > select Market order > select Dollars > Buy

on POEMS Mobile 3 App, navigate to the desired US Fractional counter > select Market order > toggle to Dollars > Place BUY Market Order

9. Who do I contact directly if I have any enquiries?

You may contact your specialist/Trading Representative. Your Trading Representative’s contact information can be retrieved via the methods shown below:

1) Login to POEMS 2.0 > My Setting > Contact Us

2) On POEMS 2.0 Homepage, click Phillip Chatbot (Orange logo located on the right screen) and type ‘remisier details’ to retrieve your Trading Representative’s contact details.

3) Login to POEMS Mobile 2.0 app > tap on the Menu > Help > Call Broker.

4) Login to POEMS Mobile 3 app > Me Tab > Support > Help Service > Call Broker.

Alternatively, you may call us at 6531 1555 for assistance to retrieve your Trading Representative’s contact details.

Now you can own a Portion of a Stock with US Fractional Shares!

Open Account Trade NowT&Cs Apply.

Now you can own a Portion of a Stock with US Fractional Shares!

T&Cs Apply.

Open an Account Trade NowDisclaimer

This advertisement is intended for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell any investment products mentioned herein. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of any investments and the income from them may fall as well as rise. The risk of loss in leveraged trading can be substantial and you could lose in excess of your initial funds.

You may wish to obtain advice from a financial adviser before investing in any investment products mentioned herein. In the event that you choose not to obtain advice from a financial adviser, you should consider whether the investment product is suitable for you. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in investment products.

SDR Promo Aug 2024

Zero Brokerage with Singapore Depository Receipts (SDR) from

1 Aug to 31 Dec 2024

Zero Brokerage with Singapore Depositary Receipts (SDR) from

1 Aug to 31 Dec 2024

Click on the logo or the counter name to read more about the company.

Zero Brokerage with Singapore Depository Receipts (SDR) from

1 Aug to 31 Dec 2024

Zero Brokerage with Singapore Depositary Receipts (SDR) from

1 Aug to 31 Dec 2024

Click on the logo or the counter name to read more about the company.

AOT Airports of Thailand

Trade

AOT Airports of Thailand

Trade

CP All

Trade

CP All

Trade

PTT Exploration and Production

Trade

PTT Exploration and Production

Trade

Siam Cement

Trade

Siam Cement

Trade

The KASIKORNBANK

Trade

The KASIKORNBANK

Trade

Gulf Energy Development

Trade

Gulf Energy Development

Trade

Advanced Info Service

Trade

Advanced Info Service

Trade

Delta Electronics

Trade

Don’t have an Account?

Open An Account Now

Alternatively, visit any of our Phillip Investor Centres or contact your trading representives.

Frequent Asked Questions

What is SDR?

Singapore Depository Receipts (SDR) are instruments issued by the depository which represent beneficial interest of an underlying security listed on an overseas exchange. SDR facilitate investments into overseas listed companies without having to deal with the complexities of cross-border trading and settlement.

How does SDR work?

SDR provide investors beneficial interest in an overseas listed security without having to purchase the security directly on an overseas exchange. SDR is issued by the depository and each SDR is represented by a specific number of underlying securities, held with a custodian in the home market on trust for SDR holders.

What overseas markets and instruments are SDR are issued on?

Currently, there are SDR issued on Non-Voting Depository Receipts (NVDR) on shares of a company listed on the Stock Exchange of Thailand (SET). An NVDR is an instrument issued by the Thai NVDR Co., Ltd (Thai NVDR), a subsidiary of the SET, to facilitate trading by reducing barriers of foreign ownership limits. Generally, NVDR share the same prices and benefits as its underlying shares but do not carry any voting rights.

Who can invest in SDR?

SDR are classified as Excluded Investment Products (“EIP”) and are generally for investors who expect low to moderate likelihood of loss of principal investment amount, with generally smaller potential returns. Investors who invest in this product should have a basic understanding of financial instruments with standardised terms and no unusual or complicated features.

Investors should refer to the SDR programme disclosure document provided by the depository for the features, and characteristics including a description of how corporate actions or distributions will be handled, as well as risks and other information. The SDR programme disclosure document is provided on https://www.singaporedr.com/.

Why should I buy SDR, instead of Thai Stocks directly?

Besides the convenience, investing through SDR is significantly more affordable. Using the Cash Plus Account Privilege tier as an example, trading on the Stock Exchange of Thailand (SET) incurs a fee of 0.12% with a minimum amount of THB300, while trading Thai Stock under SDR is charged at 0.08% with no Minimum. It’s worth noting that the standard rate for the SET under the Cash Plus Account’s normal tier is 0.35%, with a mininum of THB500.

Where can I find the SDR counters (AOT, CPALL, PTTEP, SCC, KBANK, GULF, DELTA, ADVANC) on POEMS?

You can find the counter details by clicking on each individual name. (AOT, CPALL, PTTEP, SCG, KBANK, GULF, AIS, DELTA)

For more FAQs, you might refer here.

Terms & Conditions

Terms and Conditions

Delta Electronics

Trade

Don’t have an Account?

Open An Account Now

Alternatively, visit any of our Phillip Investor Centres or contact your trading representives.

Frequent Asked Questions

What is SDR?

Singapore Depository Receipts (SDR) are instruments issued by the depository which represent beneficial interest of an underlying security listed on an overseas exchange. SDR facilitate investments into overseas listed companies without having to deal with the complexities of cross-border trading and settlement.

How does SDR work?

SDR provide investors beneficial interest in an overseas listed security without having to purchase the security directly on an overseas exchange. SDR is issued by the depository and each SDR is represented by a specific number of underlying securities, held with a custodian in the home market on trust for SDR holders.

What overseas markets and instruments are SDR are issued on?

Currently, there are SDR issued on Non-Voting Depository Receipts (NVDR) on shares of a company listed on the Stock Exchange of Thailand (SET). An NVDR is an instrument issued by the Thai NVDR Co., Ltd (Thai NVDR), a subsidiary of the SET, to facilitate trading by reducing barriers of foreign ownership limits. Generally, NVDR share the same prices and benefits as its underlying shares but do not carry any voting rights.

Who can invest in SDR?

SDR are classified as Excluded Investment Products (“EIP”) and are generally for investors who expect low to moderate likelihood of loss of principal investment amount, with generally smaller potential returns. Investors who invest in this product should have a basic understanding of financial instruments with standardised terms and no unusual or complicated features.

Investors should refer to the SDR programme disclosure document provided by the depository for the features, and characteristics including a description of how corporate actions or distributions will be handled, as well as risks and other information. The SDR programme disclosure document is provided on https://www.singaporedr.com/.

Why should I buy SDR, instead of Thai Stocks directly?

Besides the convenience, investing through SDR is significantly more affordable. Using the Cash Plus Account Privilege tier as an example, trading on the Stock Exchange of Thailand (SET) incurs a fee of 0.12% with a minimum amount of THB300, while trading Thai Stock under SDR is charged at 0.08% with no Minimum. It’s worth noting that the standard rate for the SET under the Cash Plus Account’s normal tier is 0.35%, with a mininum of THB500.

Where can I find the SDR counters (AOT, CPALL, PTTEP, SCC, KBANK, GULF, DELTA, ADVANC) on POEMS?

You can find the counter details by clicking on each individual name. (AOT, CPALL, PTTEP, SCG, KBANK, GULF, AIS, DELTA)

For more FAQs, you might refer here.

Terms & Conditions

Terms and Conditions

- This promotion offers a commission rebate to trade Singapore Depository Receipt (“SDR”) with 0 brokerage from 1 Aug 2024 to 31 Dec 2024.

- SDR trades must be executed on our suites of the POEMS platform.

- Customers will be required to pay the prevailing SGX clearing fee, SGX access fee and other related fees, and the associated GST.

- Eligible Accounts used for trading of SDRs must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts.

- The rebate will be paid to your Trading Account in February 2025.

- The following persons are not eligible to participate in those promotions unless approved by the management of Phillip Securities Pte Ltd (“PSPL”): a. PSPL institutional Customers and Corporate Customers b. PSPL Account holders whose Accounts have been suspended, canceled or terminated

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

Don’t miss this opportunity!

Trade Now

Open an Account

Don’t miss this opportunity!

Trade Now

Open an Account

Don’t miss this opportunity!

Trade Now

Open an Account

For more information about Singapore Depository Receipts (SDR), please refer here.

Don’t miss this opportunity!

Trade Now

Open an Account

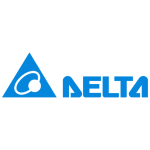

For more information about Singapore Depository Receipts (SDR), please refer here.Phillip-China Universal MSCI China A 50 Connect ETF IOP

Phillip-China Universal MSCI China A 50 Connect ETF

Trade Now (S$) Trade Now (US$)Why invest in China A-shares?

Strong track record of GDP and capital markets growthOver the past few decades, China has undergone unprecedented economic expansion and demonstrated a formidable track record of robust GDP and capital markets growth, establishing itself as a global economic powerhouse.

China’s implementation of market-oriented reforms and the opening up of its economy to foreign investments have been pivotal in fostering this growth. Its capital markets, including the Shanghai and Shenzhen stock exchanges, have seen remarkable development, attracting a diverse range of domestic and international investors. The government’s strategic focus on innovation, technology, and infrastructure development has further propelled the nation’s economic prowess. As a result, China has not only become the world’s second-largest economy but also significantly influenced global economic trends.

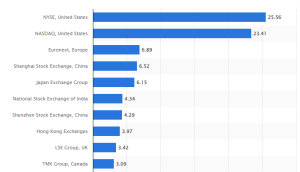

Global stock market valu by country (US$ trillions), Dec 2023

China’s A-shares, which represent shares of mainland Chinese companies listed on the Shanghai and Shenzhen stock exchanges, offer compelling opportunities for portfolio diversification. Incorporating A-shares into a portfolio provides exposure to a vast and dynamic market that is often less correlated with traditional global markets, such as those in the United States and Europe.

China’s growth and its transition towards a more consumption-driven economy contribute to the diversity of sectors available for investment, ranging from technology and e-commerce to healthcare and manufacturing. Additionally, the inclusion of A-shares allows investors to tap into the rising middle class and changing consumption patterns within the world’s most populous country. As China continues to open up its capital markets to foreign investors, A-shares can serve as a valuable component for investors seeking a well-rounded and diversified portfolio.

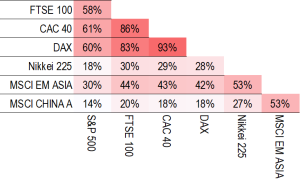

China’s equity index has low correlation with other main markets

Potential Catalysts: Increasingly pro-growth stance

Potential Catalysts: Increasingly pro-growth stance

In terms of capacity, China is well positioned to provide stimulus to boost economic growth. Notably, it boasts the largest foreign exchange reserves in the world, nearly three times larger than that of the second-largest holder.

In recent years, China had shown reluctance in providing massive economic stimulus, as policymakers were concerned about the potential risks associated with excessive debt and financial imbalances. The focus was on structural reforms, deleveraging, and maintaining financial stability. However, the stance has evolved, particularly in response to the economic challenges. China has shown an increasingly pro-growth policy stance to stimulate the economy, including fiscal and monetary policies aimed at boosting domestic consumption and investment. Notable recent measures include:

Monetary policy:

- Reductions in banks’ reserve requirement ratios

Fiscal policy:

- Proactive expansionary 2024 budget at 3% budget deficit

- 1 trillion yuan financing for affordable housing programs

Others:

- Tightening trading restrictions to limit short-selling

- Stock purchases by state-affiliated funds

Why invest in Phillip-CUAM MSCI China A50 ETF?

Exposure to core China A-sharesThe ETF tracks the benchmark MSCI China A 50 Connect index, with exposure to equities of leading and well-established companies within the Chinese market. These companies are often considered as the pillars of China’s economic landscape and are characterised by strong fundamentals, stable performance, and significant market capitalisation.

The ETF is a Feeder Fund, and will primarily invest its Net Asset Value in the mainland-listed China Universal MSCI China A50 Connect ETF.

Investing in these stocks is commonly viewed as a strategy to capitalise on the long-term growth potential of the Chinese economy. The exposure is also reflective of the country’s ongoing transition toward a more consumption-driven and innovation-focused economy. Investors looking for stability and long-term growth in the Chinese market often consider including core China stocks in their portfolios.

Mainland A-shares have demonstrated a solid performance track record, compared to their counterparts – China stocks that are listed in foreign markets, such as Hong Kong or in the US. One contributing factor is that domestic companies are less exposed to regulatory interventions from Chinese authorities which focus on big-tech companies that are generally listed abroad.

Examples of top ETF constituents:

| Name | Sector | Remarks |

| Kweichow Moutai | Consumer Staples | Leader in liquor industry |

| CATL | Industrials | Leader in power equipment and new energy |

| Zijin Mining | Materials | Leader in mining & minerals |

| Wanhua Chemical | Materials | Leader in chemical industry |

| Luxshare Precision | Information Technology | Leader in electronics manufacturing |

| BYD | Consumer Discretionary | Leader in auto industry |

| Foxconn Industrial Internet | Information Technology | Leader in precision equipment |

| China Yangtze Power | Utilities | Leader in hydropower generation |

| China Merchants Bank | Financials | Leader in banks |

| LONGi Green Energy | Information Technology | Leader in photovoltaic industry |

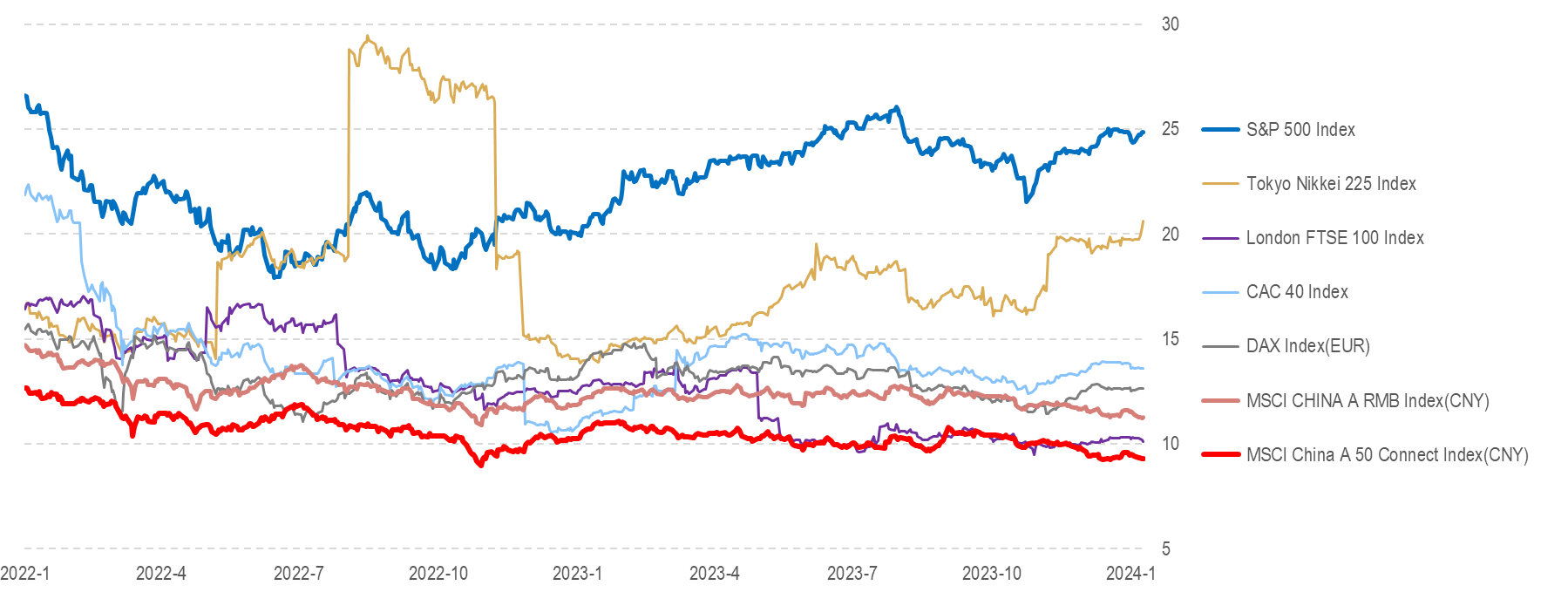

Note the outperformance of the benchmark MSCI China A 50 Connect index versus other comparable China stock indices, particularly against broad China indices that incorporate offshore-listed China shares.

Returns of different China related indices 2014-2023

Many broad China stock indices are disproportionately weighted towards ‘old economy’ sectors due to historical economic structures and the dominance of traditional industries in the early stages of China’s economic development. While China has been actively transitioning towards a more technology-driven and consumer-oriented economy, the legacy of these older industries continues to influence the composition of stock indices.

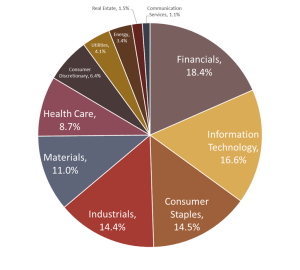

For the ETF and its tracking benchmark, the MSCI China A50 Connect Index, the largest sector weighting falls below 20% – much less than other products on the market. This balanced sector composition provides a more diversified exposure to China’s economy and prevents an overweight position in “old economy’ sectors, like financials and real estate, and averts an underweight position in the ‘new economy’ sectors, like technology and health care.

Balances sector exposure

The ETF has a very low management fee of 0.01%. Note that because it is a feeder into the mainland-listed master ETF (China Universal China A50 Connect ETF), the management fee of the master ETF (0.50%) should also be added to the total management fee that comprises the fund management expense to the investor.

This is the same approach as all other SGX-listed ETFs that utilise such feeder-master approach – essentially those ETFs that operate on the ETF link between Singapore and mainland China.

We believe by offering an extremely low management fee of 0.01% on the feeder level, we can essentially provide Singapore investors with costs comparable to what a mainland investor would incur when investing directly into the master ETF in mainland China.

Who is suitable for this ETF?

The ETF is well-suited for investors seeking:

Exposure to Mainland China’s equities market- An investment whose performance closely corresponds to the MSCI China A 50 Connect index

- Exposure to core China A-shares, with a well-balanced sector exposure

- The transparency and rules-based approach of ETFs for investing in emerging markets

- High liquidity and easy diversification across the Mmainland China’s stock market

- Ability to invest in China’s domestic market without the complexity of directly purchasing individual stocks

- Gain access to 50 leading companies in various industries in China’s A-shares through a single transaction

- ETFs that offer a lower expense ratio, enhancing cost-efficiency

Subscribe to Phillip-China Universal MSCI China A 50 Connect ETF during the Initial Offering Period (IOP) via POEMS 2.0

- Login to your POEMS 2.0 account > Acct Mgt > Online Forms > IPO Subscription – Irrevocable Form

- Select the IPO that you wish to subscribe to

- Read and agree to the prospectus, terms and conditions before subscribing to the financial product

- Application closes on 13 March 2024, Wednesday at 5pm

- Ensure sufficient cash is present in your POEMS account to complete the application process (inclusive of subscription amount, transfer fee and GST) by the settlement date on 13 March 2024, Wednesday at 5pm

| Subscription Period: | 4 March – 13 March 2024 |

| Listing Date: | 20 March 2024 |

| Subscription price: | SGD 1.00 |

| Minimum Quantity: | 1,000 unit |

| Commission Fees: | Zero Commission |

| Transfer Fees: | SGD 10.00 (Subject to GST) for Cash Management Account. Transfer fees will be waived for subscription of 5000 units and above. Other Phillip Investment Account Types will not be subject to transfer fee charge |

| Settlement Currency: | SGD |

| Trading Currency: | SGD, USD |

| Allotment | Full Allotment |

| Name | Phillip-China Universal MSCI China A 50 Connect ETF |

| Investment Objective | To replicate as closely as possible, before fees and expenses, the performance of the MSCI China A 50 Connect Index |

| Benchmark Index | MSCI China A 50 Connect Index |

| Index Methodology | The index aims to reflect the overall performance of the 50 leading companies in various industries in China’s A-shares (within the scope of Stock Connect). |

| Underlying Exposure | China mainland A shares market |

| ETF Replication Method | Physical Replication. The ETF is a Feeder Fund, and will primarily invest its Net Asset Value in the mainland-listed China Universal MSCI China A50 Connect ETF |

| Exchange Listing | Singapore Exchange Limited (SGX) |

| Base Currency | SGD |

| Trading Currency | Primary : SGD Secondary : USD |

| Launch price | S$ 1.000 per unit |

| Investment Product Type | Excluded Investment Product (EIP) |

| Board lot size | 1 unit |

| Management Fee | Management Fee 0.01% p.a. (master ETF management fee 0.50% p.a.) |

| Manager | Phillip Capital Management (S) Ltd |

| Investment Advisor | China Universal Asset Management (Hong Kong) |

| Designated Market Makers | Phillip Securities Pte Ltd |

| Participating Dealer | Phillip Securities Others TBC |

| Custodian and Administrator | BNP Paribas, acting through its Singapore Branch |

Contact your trading representative or visit your nearest Phillip Investor Centre for further assistance.

Alternatively, you can email us at etf@phillip.com.sg to find out how you can participate in this initial offer.

For more information on how to transfer funds to your POEMS account, please visit https://www.poems.com.sg/payment/

For more information about ETFs, please visit https://www.poems.com.sg/products/etf/

ProspectusPast Events

Unlock China's Market Potential: Why This ETF Outshines Its Competitors

精准出击, 投资中国50高手

| Date/Time | Title | Venue |

|---|---|---|

| 5 Mar, Tue 07:00pm-08:00pm |

Strike with Precision, Invest in China’s 50 Leading Companies Tan Teck Leng | Deputy Chief Investment Officer | Phillip Capital Management |

Raffles City Tower, 250 North Bridge Road Raffles City Tower #06-00 Singapore, 179101 |

| 5 Mar, Tue 07:00pm-08:00pm |

Strike with Precision, Invest in China’s 50 Leading Companies Tan Teck Leng | Deputy Chief Investment Officer | Phillip Capital Management |

Webinar |

| 7 Mar, Thu 01:00pm-02:00pm |

乐无穹 | 基金经理 | 汇添富基金 & 姜昕宏 | 业务拓展 | 辉立资金管理有限公司 |

Webinar |

| 8 Mar, Fri 07:00 PM - 08:00 PM |

Strike the precision, Investing in China's 50 leading companies Tan Teck Leng | Deputy Chief Investment Officer | Phillip Capital Management |

SGX Auditorium, Level 2, SGX Centre 1, 2 Shenton Way, Singapore 068804 |

| 11 Mar, Mon 01:00pm-02:00pm |

Strike the precision, Investing in China’s 50 leading companies Mr Tan Teck Leng | Deputy Chief Investment Officer | Phillip Capital Management |

Webinar |

Terms and Conditions

- The subscription period for this ETF is from 4 March 2024, Monday at 9am to 13 March 2024, Wednesday at 5pm

- The online subscription will close on 13 March 2024 at 5pm. No new applications, amendments, or withdrawals are allowed after this deadline.

- Six types of accounts namely, Cash Plus, Cash Management (KC), Prepaid (CC), Custodian (C), Margin (M) and Share Financing (V) accounts are eligible to subscribe for this ETF.

- An additional transfer fee charge of SGD 10 (subject to GST) per application for Cash Management Accounts will be applicable. The transfer fees will be waived for subscription of 5,000 units and above.

- Cash Trading Accounts (T) are not eligible to participate in this subscription.

- Only one application is allowed per account.

- Each ETF unit is priced at SGD1 and the minimum order quantity is 1,000 units, with an incremental order size of 1,000 units.

- There are zero commission fees.

- The total amount payable is denominated in SGD. The settlement currency will be in SGD.

- Sufficient funds (including transfer fee and GST) must be present in the client’s trading account by 13 March 2024 at 5pm

- Applications will be rejected if the account does not have or reflect sufficient funds after 13 March 2024 at 5pm.

- ETF units will be credited to the clients’ CDP or clients’ sub-account with Phillip Securities Pte Ltd by 20 March 2024.

- Clients will receive the full allotment of the number of ETF units that they subscribe to.

- Clients can start trading the ETF units when the ETF is listed on SGX on 20 March 2024 at 9am.

Accredited Investor

Unleash Your Investment Potential:

Access Exclusive Opportunities as an

Accredited Investor

Be an Accredited Investor TodayQualify as

Accredited

Investor

High-Growth Opportunities Reserved for Discerning Investors

Be an Accredited Investor TodayWhy become an Accredited Investor

Elevate Your Portfolio

Take the First Step to Unrestricted Investment Opportunities

Invest Like the Elite

Leverage Exclusive Access to Groundbreaking Ventures

Diversify Beyond Convention

Secure Your Financial Future with Innovation & Growth

Our Product Suite

Unit Trust

Access to restricted funds with a wide range of investment strategies that aim to preserve, diversify and accumulate wealth

Insurance

Tailored solutions to fulfil the needs of unique individuals looking to build and safeguard wealth for future generations

Bonds

Access to 200,000 bonds globally for a diversified bond portfolio

Financing

Tailored financing to fulfil the financial needs of individuals and corporates

Get in Touch with usHow do I qualify as an Accredited Investor

Minimum Income

S$300,000

In the last 12 months

Minimum Income

S$300,000

In the last 12 months

NET Personal Assets

S$2,000,000

of which net equity of the individual's primary residence is no more than S$1,000,000

NET Financial Assets

exceed

S$1,000,000

NET Personal Assets

S$2,000,000

of which net equity of the individual's primary residence is no more than S$1,000,000

NET Financial Assets

exceed

S$1,000,000

Your Partner in Finance

Full Service Broker & Wealth Advisory

Trust Broker for over 50 years

5,000+

Employees

1M+

Clients Worldwide

USD 2.5B+

Shareholder Funds

USD 65B+

Assets Under Management (AUM)

find out more about us

Regulated & Secure

Fully licensed and regulated in 15 countries

FAQs

Do I need to qualify as an accredited investor to purchase wholesale bonds, restricted unit trust, universal life policies, and participate in legacy planning?Yes, you need to be qualified as an accredited investor, in order to meet the requirements, set out by the Monetary Authority of Singapore (MAS).

What are the wholesale bonds that I can access?You can view our offerings here. Alternatively, email us at bonds@phillip.com.sg or call us at +65 6212 1818 to speak to our bond specialists.

What restricted unit trust funds do you offer?We offer funds from Invesco, Jupiter, Matthews Asia and more. You can view our offerings here.

What universal life policies and legacy planning do you offer?We offer Swiss Life, HSBC Life and more. You can view our offerings here.

How do I opt-in to be an accredited investor?Please complete the Accredited Investors Declaration here. Alternatively, you may email us a softcopy form together with the supporting documents:

Accredited Investor Application:

Supporting documents for

Net Financial Assets:

Latest bank account statement

Latest statement of investment holdings from CDP or brokerage firm(s) or insurers, including holdings with Phillip Securities

Net Personal Assets:

- A copy of the title deed of primary residence. (Singapore or overseas)

- Latest bank account statement or CPF statement

Except for the title deed, each statement must show the bank/CDP/broker logo, account holder name(s) and to be dated no earlier than 3 months before the date of submitting the form.

Supporting documents for Income (Supporting documents required (each to be dated no earlier than 3 months before the date of submitting the form):

- A copy of your pay slip;

- A copy of your employment contract stating your position and income; or

- A copy of your latest Income Tax Assessment

(Please note that the value indicated in any joint statements would be divided by TWO)

Are financial assets held with other financial institutions (FIs) in Singapore taken into consideration when computing total asset value?Yes, financial assets held by other FIs will be taken into consideration in determining one’s eligibility as an AI.

What do “Related liabilities" in the financial assets of the definition of AI refer to?As stated in paragraph 6.49 of MAS’ Response to Feedback Received on Proposals to Enhance Regulatory Safeguards for Investors in the Capital Markets dated 22 September 2015 (“MAS’ Response to Feedback Received”), “related liabilities” include a margin account and credit lines taken to finance an investment portfolio. FIs should collect adequate information on an investor’s liabilities to ascertain which are related to their financial assets.

What does "Primary residence" referred to?“Primary residence” refers to the home where the investor lives most of the time. This can be located in Singapore or overseas.

I have a joint account. I qualify as an Accredited Investor (AI), but the other account holder is not qualified. Can our joint account be eligible to trade AI products?Yes, your joint account can be eligible by signing our Accredited Investor Opt-In Form (Joint Account).

Click here to download Accredited Investor Opt-In Form (Joint Account)

Kindly print and mail both the completed forms to:

Attention: APU

250 North Bridge Road

#06-00, Raffles City Tower

Singapore 179101

The requirement for the entire share capital of the corporation to be owned by AIs may be applied at either the immediate shareholder level or at the ultimate owner level. For example, a corporation would be eligible as an AI if all its immediate shareholders are AIs. If one of the immediate shareholders, which is a corporation, does not meet the $10 million net assets threshold for corporate AIs, but the ultimate shareholder of this immediate shareholder is an AI, the client can still qualify as an AI.

In the case of shareholders which are corporations themselves, they would be considered as AIs either because the corporation has S$10 million net assets or is owned by the AIs themselves.

Can an existing AI withdraw consent and choose not to be treated as AI?Yes. Existing AIs are given the choice to opt-out by submitting the AI opt-out form to confirm that they no longer wish to be treated as Accredited Investors as defined in section 4A of the SFA.

For an individual customer who has interest to be certified an Accredited Investor to invest in eligible products.

Attention: APU

250 North Bridge Road

#06-00, Raffles City Tower

Singapore 179101

Alternatively, login to POEMS 2.0 Web to opt in as an Accredited Investor.

I am an Accredited Investor with the bank/another broker, do I need to opt-in as an AI with PSPL?Yes, you will need to opt-in as an AI with PSPL to invest in eligible products with us. Your Accredited Investor status with PSPL will be valid for 2 years.

How do I qualify as an Accredited Investor using Net Personal Assets?To qualify as an Accredited Investor under the Net Personal Assets criterion, your total personal assets must exceed S$2,000,000.

This includes cash and savings, investment holdings (such as stocks, bonds, or unit trusts), CPF balances, and properties.

If you are including your primary residence, only up to S$1,000,000 of its net value can be counted towards the S$2,000,000 requirement. The remaining amount must come from other eligible assets.

Lion-Nomura Japan Active ETF

Lion-Nomura Japan Active ETF

Invest HereWhy invest in Lion-Nomura Japan Active ETF?

Gain Easy Access to Japan’s AwakeningThe Japanese economy has awakened from its slumber, with the Tokyo Stock Price Index (TOPIX) reaching a 33-year high in Nov 2023. Japan’s long-term growth story is now favourably shaped by structural catalysts like corporate governance reforms and inflation. As these catalysts take time to be priced in, the Japanese market is still at an attractive entry point now.

Utilise the Power of AI and Active Management to Select Quality Japanese StocksThe proprietary AI models evaluate hundreds of factors to assign scores to each stock in the investable universe. The investment team (consisting of both Lion Global Investors and Nomura Asset Management) then selects and assigns weights to the stocks based on their AI model scores. The result is a final portfolio of 50 to 100 quality Japanese stocks.

Tap into the Deep Expertise of Lion Global Investors and Nomura Asset ManagementCombining the strengths of both entities, we bring you the Lion-Nomura Japan Active ETF, which is both Singapore’s first actively managed ETF and Singapore’s first AI-powered ETF.

What is the investment objective?

The investment objective of the Fund is to achieve long-term capital growth through investment in an actively managed portfolio of Japanese equity securities, diversified across sectors and market capitalisation.

What is the difference between active and passive ETFs?

An actively managed exchange-traded fund (commonly known as an active ETF) is managed an investment team responsible for researching and making active decisions about the fund’s portfolio allocation.

Active vs Passive ETFPassive ETFs are designed to track a benchmark index and are constrained by the index rules and methodology. They do not track a benchmark index and are less constrained, which can potentially make them more flexible to outperform the broader market.

Active ETF vs Traditional Active FundsActive ETFs typically have lower management fees relative to comparable traditional active funds, making them more cost efficient for investors.

Webinar on Lion-Nomura Japan Active ETF

Subscribe to Lion-Nomura Japan Active ETF during the Initial Offering Period (IOP) via POEMS 2.0

- Login to your POEMS 2.0 account > Acct Mgt > Online Forms > IPO Subscription – Irrevocable Form

- Select the IPO that you wish to subscribe to

- Read and agree to the prospectus, terms and conditions before subscribing to the financial product

- Application closes on 24 Jan 2024, Wednesday at 5pm

- Ensure sufficient cash is present in your POEMS account to complete the application process (inclusive of subscription amount, commission, transfer fee and GST) by the settlement date on 24 Jan 2024, Wednesday at 5pm

Terms and Conditions

- The subscription period for this ETF is from 05 Jan 2024, Friday at 9am to 24 Jan 2024, Wednesday at 5pm

- The online subscription will close on 24 Jan 2024 at 5pm. No new applications, amendments, or withdrawals are allowed after this deadline.

- Six types of accounts namely, Cash Plus, Cash Management (KC), Prepaid (CC), Custodian (C), Margin (M) and Share Financing (V) accounts are eligible to subscribe for this ETF.

- An additional transfer fee charge of SGD 10 (subject to GST) per application for Cash Management Accounts will be applicable.

- Cash Trading Accounts (T) are not eligible to participate in this subscription.

- Only one application is allowed per account.

- Each ETF unit is priced at SGD1 and the minimum order quantity is 1,000 units, with an incremental order size of 1,000 units.

- There are zero commission fees.

- The total amount payable is denominated in SGD. The settlement currency will be in SGD.

- Sufficient funds (including transfer fee and GST) must be present in the client’s trading account by 24 Jan 2024 at 5pm

- Applications will be rejected if the account does not have or reflect sufficient funds after 24 Jan 2024 at 5pm.

- ETF units will be credited to the clients’ CDP or clients’ sub-account with Phillip Securities Pte Ltd by 1 Feb 2024.

- Clients will receive the full allotment of the number of ETF units that they subscribe to.

- Clients can start trading the ETF units when the ETF is listed on SGX on 31 Jan 2024 at 9am.

Sustainable Reserve Fund

Return (30 days) Annualised

4.60%*

Rates updated as of 1 July 2024

*The Return since inception of the Fund is calculated on a single pricing basis and on the assumption that all distributions are reinvested over the last 30 days. Past performance is not necessarily indicative of future performance. View Full Disclaimer.

Investments are subject to investment risks and is not the same as placing your money on deposit with a bank or deposit-taking company. This advertisement has not been reviewed by the Monetary Authority of Singapore. Important Information From Fund Manager

Learn more about The Fund HERE.

Invest Now0% Platform Fee, 0% Sales Charge, 0% Switching Fee

Why should you invest in the Sustainable Reserve Fund?

Net Weighted-average yield to maturity ~5%

Low volatility investment option with

short duration bond fund

Fund Manager with track record of managing one of Singapore’s largest money market fund

Allow smaller investors access to short duration bonds, with diversification

Comprehensive screening for risks

How It Compares to Other Funds?

| Sustainable Reserve Fund |

Fund A | Fund B | |

| Weighted Average Rating | A | BBB+ | BBB |

| Average Duration | 1.1 year | 1.2 year | 1.4 year |

| Gross Weighted Average Yield to Maturity | ~5.0% | 4.6% | 5.8% |

| % of Portfolio Comprising ESG-related Risk Isssuers* |

<30% | 24% | 36% |

| % of Portfolio Where Issuers Have no Relevant ESG Rating Data* |

<30% | 13% | ~19% |

*Based on PCM’s internal ESG risk categorization methodlogy.

4.60% Return p.a.? YES!

Invest NowDon't have an Account yet?

Open an Account

Structured Certificates

What are Structured Certificates?

Structured Certificates are third-party issued financial instruments designed to meet the specific needs of investors such as yield enhancements and growth payoffs. Commonly traded in Europe, the returns of these products are defined by their payoff profiles that are dependent on the performance of an underlying asset such as a single stock or equity index.

Structured Certificates are:

- Structured products based on an underlying asset (such as a single stock or equity index) and contain derivative components.

- Issued by third party financial institutions, usually investment banks.

- Listed and traded on SGX-ST.

- Some examples of Structured Certificates include Yield Enhancement and Participation certificates which offer investors choices depending on their market expectations, investment goals and risk profile.

Characteristics of Structured Certificates

Local and foreign exposure

Offer exposure linked to local and foreign stocks or benchmark indices

Ease of Access

Listed and traded on SGX with a continuous quotation by a Designated Market Maker (DMM), providing greater price transparency and liquidity

Capital at Risk

Structured Certificates are not capital protected and investors bear the risk of the issuer defaulting

3rd Party

Issued by third party financial institutions (e.g. investment banks)

Short-term Expiry

Short-term investment products with a finite lifespan usually between 3 months to 1 year

Cash or Physical Settlement

Some certificates may offer choice of physical settlement under certain conditions

Structured Certificates on SGX

SGX is the first exchange in Asia to offer trading in Structured Certificates, providing investors with enhanced access to a new range of products that cater to different investor profiles and needs.

Societe Generale

Structured Certificates Listed on SGX

Autocallable Certificates

| Code | SGX Counter Name | Expiry Date | Daily Theoretical | Underlying | Max. Distribution | Distribution | Autocall | Knock-In | Underlying | Initial Price | Strike Price |

YAL | 04/11/2024 | 1.009 | 16.140 | 10% | 6.7600 | 14.1960 | 10.9512 | Xiaomi Corporation | 13.52 | 13.2496 | ||

NIC | 04/11/2024 | 1.007 | 60.300 | 8.8% | 29.0250 | 61.5330 | 53.4060 | HSBC | 58.05 | 57.7598 | ||

QAC | 17/12/2024 | 0.971 | 201.80 | 12% | 103.7000 | 217.7700 | 176.2900 | BYD Company | 207.4 | 207.4 | ||

TDQ | 03/10/2024 | 0.935 | 102.70 | 10% | 56.7000 | 119.0700 | 86.1840 | JD.com | 113.4 | 102.06 | ||

EEJ | 03/10/2024 | 0.911 | 71.650 | 10% | 42.2500 | 88.7250 | 68.4450 | Alibaba | 84.5 | 81.965 | ||

WGX | 03/09/2024 | 0.882 | 71.650 | 10% | 43.7500 | 91.8750 | 70.0000 | Alibaba | 87.5 | 84 |

Discount Certificates

| Code | SGX Counter Name | Expiry Date | Daily Theoretical | Underlying | Max. Distribution | Distribution | Autocall | Knock-In | Underlying | Initial Price | Strike Price |

VID | 17/05/2024 | 0.929 | 71.650 | 15% | 41.0750 | - | - | Alibaba | 82.15 | 78.0425 |