2023 Recap: Triumphs and Trials in the US Stock Market and Beyond January 17, 2024

The year 2023 proved to be bullish for the US stock market, marking its strongest performance since 2019. All three major indices closed the year with double-digit growth.

| NASDAQ | DOW JONES | S&P 500 | |

| Month Open | 10,562.06 | 33,148.90 | 3,853.29 | Month Close | 15,011.35 | 37,689.55 | 4,769.82 | Monthly return | 42.13% | 13.70% | 23.79% |

Source: Bloomberg as of 29 Dec 2023

Notably, the technology-heavy NASDAQ composite index led the surge, while the Dow Jones Industrial Index reached an all-time high, and the S&P 500 came close to achieving a record peak. The surge in the market was largely attributed to the last two months of 2023, driven by investor optimism that the Federal Reserve (Fed) had concluded its rate hikes, with expectations of rate cuts in 2024.

Three significant topics stirred the market in 2023: interest rates, Artificial Intelligence (AI), and the collapse of banks.

Interest rates

At the beginning of the year, there was widespread concern about inflation rising higher. The Fed was not confident that inflation was decreasing and sought more evidence to be assured that inflation was on a sustained downward path. At this point, the common consensus supported a “higher for the longer” environment as the Fed continued hiking rates in the first four meetings of the year.

| FOMC Meeting Date | Rate Change (bps) | Federal Funds Rate |

| 26 July 2023 | +25 | 5.25% to 5.50% |

| 3 May 2023 | +25 | 5.00% to 5.25% |

| 22 Mar 2023 | +25 | 4.75% to 5.00% |

| 1 Feb 2023 | +25 | 4.50% to 4.75% |

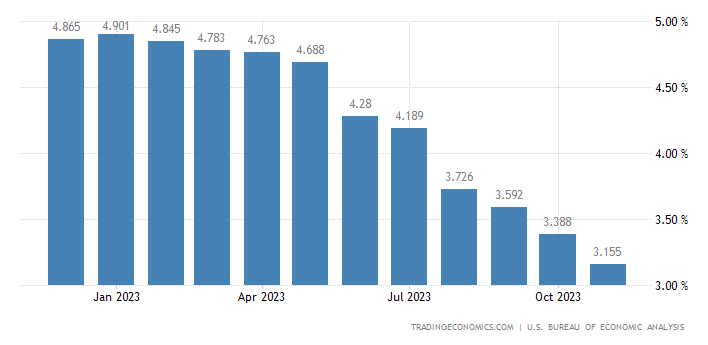

The annual core PCE inflation rate in the early months of 2023 was significantly above the Fed’s target of 2%. However, with the aid of tightening monetary policy, inflation figures started getting closer to 2% over the months, from 4.9% in January 2023 to 3.15% in November 2023. With inflation figures falling, the Fed gained confidence that they had taken adequate measures and decided to hold the rates to prevent over-tightening while waiting for the monetary policy to impact the economy fully.

Core PCE Price Index Annual Change

At the final Fed meeting of 2023, the Fed decided to keep its key interest rate steady, maintaining it within the range of 5.25%-5.5% for the third consecutive time1. This decision came as inflation showed signs of easing and the economy remained stable. The Fed unanimously voted to hold the rate but signaled at least three rate cuts in 2024, each in quarter-percentage-point increments. The committee’s “dot plot” indicates a possibility of an additional four rate cuts in 2025, with the markets anticipating a more aggressive rate-cutting trajectory. The statement highlighted the potential for easing high-interest rates. Inflation, still described as “elevated,” has eased over the past year. GDP growth has slowed, and the economy is on track to expand by around 2.5% for the year. The Fed’s projections include a GDP growth of 2.6% in 2023. While officials advocate for patience, they remain willing to hike rates should inflation surge again.

Artificial Intelligence (AI)

AI has gained increasing popularity in recent years, driven by technological advancements and the growing availability of data. It utilises algorithms, data analytics, and advanced computational techniques to generate the insights needed for various applications.

Generative AI, familiar to many, refers to a class of artificial intelligence systems with the capacity to create new content, including images, text, audio, and other data forms. Unlike traditional rule-based AI systems operating within predefined parameters, generative AI models produce novel outputs by learning patterns and structures from existing data. A notable application of generative AI is evident in ChatGPT, which has achieved significant success.

The triumph of ChatGPT has spurred a race among numerous firms to introduce their own AI products. Major Chinese corporations such as Alibaba, JD.com, and Tencent are actively developing ChatGPT-like offerings. Microsoft has seamlessly integrated ChatGPT into its Bing Search engine and Edge web browser, while Apple and Amazon are venturing into the AI space.

This surge in demand for AI is not only driving growth in the tech sector but is also influencing the semiconductor chip industry. AI Investment necessitates technological hardware, especially semiconductor chips, which are crucial in determining the speed and effectiveness of AI algorithms. Currently, only a select few chipmakers are capable of producing chips suitable for running AI algorithms, with Nvidia standing out as a leader. Nvidia’s superior chip technology has played a significant role in its success, leading it to join an elite group of companies in the trillion-dollar club2.

While Generative AI showcases remarkable capabilities in creative tasks, it also brings forth ethical considerations, notably the potential for generating misleading or malicious content. As the AI landscape continues to evolve, addressing these ethical concerns becomes paramount to ensuring responsible and constructive use of this transformative technology.

Performance of some Technology stocks:

| Counter | Year Open (US$) | Year Close (US$) | Returns |

| Alibaba Group Holdings Ltd (NYSE: BABA) | 91.11 | 77.51 | -14.93% |

| JD.com Inc (NASDAQ: JD) | 57.97 | 28.89 | -50.16% |

| Microsoft Corp (NASDAQ: MSFT) | 243.08 | 376.04 | 54.70% |

| Nvidia Corporation (NASDAQ: NVDA) | 148.51 | 495.22 | 233.46% |

| Amazon.com Inc (NASDAQ: AMZN) | 85.46 | 151.94 | 77.79% |

Source: Bloomberg as of 29 Dec 2023

Collapse of Banks

From the period of the subprime mortgage crisis to early 2022, major financial economies enjoyed the benefits of low-interest rates. However, the landscape shifted when the Fed abruptly increased rates, leading some banks to struggle with adjusting to the new environment, leading to their downfall.

Silicon Valley Bank became the first casualty3. The primary cause of its collapse stemmed from losses incurred through investments in long-dated bonds4, causing depositors to question its financial stability. This skepticism triggered a bank run, forcing regulators to intervene and place the bank under receivership. Silicon Valley Bank’s collapse represented the most significant bank failure since the 2008 Financial Crisis, prompting US President, Joe Biden to reassure depositors of the safety of their funds through the Deposit Insurance Fund5.

The contagion fear emanating from Silicon Valley Bank’s collapse led to the downfall of Signature Bank, marking the third-largest bank failure just two days after Silicon Valley Bank’s demise6. Subsequently, depositors redirected their concerns toward banks with similar backgrounds featuring large proportions of unsecured deposits. First Republic Bank, with 70% of its deposits unsecured, ranked third highest in terms of unsecured deposits among medium-sized banks, following Silicon Valley Bank7. The stock of First Republic Bank plummeted from US$115 on March 8, 2023, to below US$20 on March 16, 2023. To prevent the collapse of First Republic Bank, 11 banks including Bank of America (BAC.US), JPMorgan Chase (JPM.US), and Goldman Sachs (GS.US)8 deposited a total of US$30 billion in it. These deposits were required to be held within the bank for 120 days, demonstrating the confidence of America’s largest banks in First Republic Bank.

Despite reporting strong quarterly performance and receiving funds from major banks, investors remained dissatisfied with the losses incurred. Amidst uncertainty about the risk of First Republic Bank being seized by US regulators, the regulators solicited bids from banks to take over. A takeover by a financially stable bank would reassure First Republic Bank depositors based on the new owner’s ability to manage deposit outflows. Eventually, on Labour Day, JPMorgan acquired First Republic Bank9, marking it as the third American bank to fail since March 2023.

In Europe, Switzerland faced its fair share of banking issues. Credit Suisse (CS) found itself in a dire state, prompting regulators to pressure UBS to acquire CS. Swiss authorities were concerned that CS’s failure could become a new point of global stress due to its strong global presence. Ultimately, UBS acquired CS for more than 3 billion Swiss francs10. To facilitate this deal, the Swiss government provided over 9 billion Swiss francs to UBS to cover deal-related losses, and the Swiss National Bank contributed over 100 billion Swiss francs in liquidity to aid in the acquisition. The acquisition process involves merging Credit Suisse’s parent bank with UBS, resulting in the unification of the two entities. Consequently, Credit Suisse will cease to operate as an independent bank11.

Performance of troubled banks:

| Counter | Year Open (US$) | Year Close (US$) | Status |

| First Republic Bank (OTC: FRCB) | 123.34 | 0.0410 | Taken Over |

| SVB Financial Group (OTC: SIVBQ) | 232.17 | 0.0331 | Taken Over |

| Signature Bank (OTC: SBNY) | 117.14 | 1.60 | Shut Down |

| Credit Suisse | 3.12 | NA | Taken Over |

Source: Bloomberg as of 29 Dec 2023

Performance of selected Financial stocks:

| Counter | Year Open (US$) | Year Close (US$) | Returns |

| JP Morgan Chase & Co (NYSE: JPM) | 135.24 | 170.10 | 25.78% |

| Bank of America Corporation (NYSE: BAC) | 33.23 | 33.67 | 1.32% |

| Goldman Sachs Group Inc (NYSE: GS) | 345.50 | 385.77 | 11.66% |

| UBS Group AG Registered (NYSE: UBS) | 19.02 | 30.90 | 62.46% |

Source: Bloomberg as of 29 Dec 2023

Performance of selected ETFs affected in 2023

| Sector | Security | Year Open (US$) | Year Close (US$) | Returns |

| Inflation | Invesco DB Commodity Index Tracking Fund (NASDAQ: DBC) | 24.36 | 22.04 | -9.52% |

| Inflation | ProShares Inflation Expectations ETF (NYSE-ARCA: RINF) | 32.76 | 31.45 | -4.00% |

| Technology | iShares U.S. Technology ETF (NYSE-ARCA: IYW) | 75.28 | 122.75 | 63.06% |

| Technology | Fidelity MSCI Information Technology Index ETF (NYSE-ARCA: FTEC) | 95.44 | 143.64 | 50.50% |

| Technology | iShares Global Tech ETF (NYSE-ARCA: IXN) | 45.32 | 68.18 | 57.39% |

| Financial | Financial Select Sector SPDR Fund (NYSE-ARCA: XLF) | 34.45 | 37.60 | 9.14% |

| Financial | Vanguard Financials ETF (NYSE-ARCA: VFH) | 83.32 | 92.26 | 10.73% |

| Financial | iShares U.S. Financials ETF (NYSE-ARCA: IYF) | 75.95 | 85.41 | 12.46% |

Source: Bloomberg as of 29 Dec 2023

Bloomberg analysts’ recommendations

The table below shows the consensus ratings and average ratings of all analysts updated on Bloomberg in the last 12 months. Consensus ratings have been computed by standardising analysts’ ratings from a scale of 1 (Strong Sell) to 5 (Strong Buy). The table also shows a number of analysts’ recommendations to buy, hold or sell the stocks, as well as their average target prices.

| Security | Consensus Rating | BUY | HOLD | SELL | 12 Mth Target Price (US$) |

| JP Morgan Chase & Co (NYSE: JPM) | 4.38 | 22 (66.8%) | 10 (31.3%) | 0 | 177.98 |

| Bank of America Corporation (NYSE: BAC) | 4.00 | 16 (53.3%) | 13 (43.3%) | 1 (3.3%) | 35.48 |

| Goldman Sachs Group Inc (NYSE: GS) | 4.14 | 17 (58.6%) | 12 (41.4%) | 0 | 392.39 |

| UBS Group AG Registered (NYSE: UBS) | 3.70 | 14 (51.9%) | 9 (33.3%) | 4 (14.8%) | 30.32 |

| Alibaba Group Holdings Ltd (NYSE: BABA) | 4.71 | 45 (86.5%) | 7 (13.5%) | 0 | 123.57 |

| JD.com Inc (NASDAQ: JD) | 4.54 | 40 (80.0%) | 9 (18.0%) | 1 (2.0%) | 43.56 |

| Microsoft Corp (NASDAQ: MSFT) | 4.78 | 59 (90.8%) | 6 (9.2%) | 0 | 415.73 |

| Nvidia Corporation (NASDAQ: NVDA) | 4.80 | 59 (90.8%) | 6 (9.2%) | 0 | 647.92 |

| Amazon.com Inc (NASDAQ: AMZN) | 4.90 | 68 (97.1%) | 2 (2.9%) | 0 | 181.75 |

Source: Bloomberg as of 29 Dec 2023

Conclusion

In summary, the year 2023 brought both triumphs and challenges to the US stock market, leaving an indelible mark on the financial landscape. The impressive rally in market indices, underpinned by robust performances in technology stocks, demonstrated the resilience and adaptability of investors amidst evolving economic conditions. The Fed’s nuanced approach to interest rates, shifting from a period of hikes to a more cautious stance with the promise of future cuts, reflected a delicate balancing act aimed at sustaining economic growth while managing inflationary pressures. This strategic manoeuvring by the central bank played a pivotal role in shaping the market’s trajectory and bolstering investor confidence.

Simultaneously, the year was defined by transformative developments in the realm of Artificial Intelligence, with generative AI taking centre stage. The success of ChatGPT and the subsequent proliferation of AI initiatives across major corporations underscored the technological revolution underway. However, the growth of AI also raised ethical considerations, particularly around the potential for generating misleading or malicious content.

In the banking sector, the cascading collapses of major institutions highlighted the vulnerability of financial systems to rapid adjustments in interest rates, highlighting the need for robust risk management and regulatory oversight. As the year concluded, these multifaceted dynamics served as a compelling reminder of the interconnectedness of global financial markets and the imperative for stakeholders to navigate uncertainties with vigilance and foresight.

Get yourself educated! Join our free webinar here!

With our newly launched POEMS Mobile 3 Trading App

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Alternatively, you can reach out to our Night Desk representatives at globalnight@phillip.com.sg or (+65) 6531 1225. Join us today and embark on a thrilling adventure in our lively Telegram community, where we’re eager to share even more enlightening insights!

Open an account and trade the US market today!

Reference:

- [1] “Fed holds rates steady, indicates three cuts coming in 2024” 14 Dec. 2023

- [2] ” Nvidia Touches $1 Trillion Mark After Beating Rivals to AI” 30 May. 2023

- [3] “The rise and fall of Silicon Valley Bank: Timeline of tech lender’s collapse” 14 Mar. 2023

- [4] “Goldman Sachs bought the SVB bonds whose $1.8 billion loss set off the startup lender’s meltdown” 15 Mar. 2023

- [5] “‘That’s how capitalism works,’ Biden says of SVB, Signature Bank investors who lost money in failed banks” 13 Mar. 2023

- [6] “Why regulators seized Signature Bank in third-biggest bank failure in U.S. history” 13 Mar. 2023

- [7] “First Republic shares dive on contagion fear, dragging U.S. regional banks” 14 Mar. 2023

- [8] “Wall Street rides to the rescue as 11 banks pledge First Republic $30 billion in deposits” 16 Mar. 2023

- [9] “JPMorgan Chase takes over First Republic after biggest U.S. bank failure since 2008” 1 May. 2023

- [10] “UBS Agrees to Buy Credit Suisse for More Than $3 Billion” 19 Mar. 2023

- [11] “UBS moves to merge parent banks” 7 Dec. 2023

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Global Markets Desk US Dealing Team

The Global Markets Desk US Dealing team specialise in handling the US Markets in the Global Markets Desk.

Their responsibilities and capabilities extend from managing and taking orders from clients trading in the US market, to content generation, Technical Analysis and providing educational content to POEMS clients.

Hong Kong Value Stocks Q2 2024

Hong Kong Value Stocks Q2 2024  The 5 Levels of Mindset to Achieve FIRE

The 5 Levels of Mindset to Achieve FIRE  Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation