From $50 to $100: Unveiling the Impact of Inflation April 12, 2024

In recent years, inflation has become a hot topic, evoking strong emotions as the cost of living worldwide continues to rise unabated. Daily expenses, such as meals and transportation, that previously cost S$50, now seem to be steadily escalating, due to persistent and compounded inflationary pressures. It may not be long before S$100 becomes the new norm for such daily expenses. This prospect has sparked palpable anxiety and heated discussions, particularly when income or wealth is not keeping pace. In fact, reports indicate that the median wage in Singapore dropped by 2.2% in 2023 after adjusting for inflation 1

Furthermore, the future remains uncertain as recent data suggests that inflation persists, while nominal wage growth in Singapore has slowed in 2023 and amid the emerging interplay of automation, innovation, and AI on the supply and jobs market. The question of whether we will become more productive or redundant looms large, particularly as inflation is intensely felt in the prices of necessities such as food, shelter, healthcare and transportation. This question would be even more pertinent for younger workers who have yet to build up their personal wealth through years of gainful employment.

For context, the last prolonged period of high inflation was in the 1970s, a time unfamiliar to a generation that grew up without experiencing such pressures. As inflation compels us to pay closer attention to economic indicators, it is also timely to delve deeper into the topic and understand its implications.

How is Inflation Measured?

Inflation is typically measured using two baskets: goods (e.g. televisions) and services (e.g. movies). Global supply chain factors, such as manufacturing and shipping costs, may affect prices of goods while domestic factors like rentals and labour costs may impact service prices.

Different governments use various methodologies to track inflation. For example, the Fed prefers the core Personal Consumption Expenditures price index (PCE) over the Consumer Price Index (CPI) as it adjusts for shifts in consumer spending habits. The CPI serves to measure prices in the marketplace. 2 Locally, the MAS Core Inflation index does not exclude the prices of food and energy items, which are commonly excluded in core inflation gauges elsewhere. In Singapore, these are included because MAS’ monetary policy can directly influence the pass-through from global prices to domestic prices. Instead, MAS Core Inflation strips out the costs of accommodation and private road transport.3Perhaps these adjustments can also be viewed in the context of Singapore’s highly open economy, high resident homeownership rate and drive to lower private transport usage.

Causes of Inflation:

Inflationary pressures stem from both supply/costs-push and demand-pull factors. For instance, supply chain shocks, such as the 1970s energy crisis, hot wars in commodity-exporting regions, clogged or troubled shipping lanes, lead to rising costs and prices. While necessary but less visible, the upfront costs of the accelerating green transition megatrend, such as the allocation of resources to refurbish old infrastructures and increase in carbon tax and water prices in Singapore, will also likely add to rising prices. These factors would likely compound the price pressures brought about by the recent rise in GST and public transportation fares.

On the demand side, factors like high employment rates, growing wages, and resilient demand, while signs of a healthy economy, can also lead to prices (including property) staying elevated, or worse drive prices further upwards as sellers face little pressure to reduce their selling prices and profit margins. Amidst all these, governments can and have unleashed loose monetary policies (e.g. low interest rates or quantitative easing), expansionary fiscal policies (e.g. major infrastructure developments or cash handouts), or protectionist policies (e.g. export quotas or import tariffs), that further fuel inflationary pressures domestically and globally.

With reference to the above, a modest food store can be affected in several ways such as rising production costs for raw materials, electricity, and water, high rental costs for their employees and the store itself. Moreover, if the store’s owner borrowed to fund their business, they have to contend with the higher interest rates on their loans as well. While I cannot resist griping about my favourite food store’s prices rising to unrecognisable levels (and have formed some new social bonds in the process), it may be time to start accepting that it is getting harder to find cheap lunches in this inflationary world.

What about Deflation?

On the other hand, is deflation good? While falling prices may generally be cheered by consumers as it means increased purchasing power at the same income level, it should be noted that there could be second-order effects on the psychology of consumers and companies. Consumers may try to limit spending in anticipation of even lower prices in future, which puts pressure on companies’ selling prices, profit margins and eventual viability. Companies, anticipating such conditions, may also choose to reduce output or close down, leading to lower employment. Lower employment will in turn lead to lower consumption and this forms a vicious cycle of falling demand and prices. China’s economy bears watching in this regard.

However, there are also viewpoints suggesting that globalisation, AI, technological innovations, process improvements, and increasing attention on ESG pillars are actually positive drivers of efficiencies that lead to falling prices, instead of a drop in aggregate demand. Perhaps in the future, we will see a scenario where we can conveniently call and hop onto a high-tech autonomous electric vehicle manufactured in the most cost-efficient corners of the world and designed with sensors and safety standards to save valuable resources and lives for the community. In this vision, the bumpy road of economic prosperity will be a smoother journey with fewer emissions and more consistent standards, less the vicious deflation cycle.

Multifaceted Impacts of Inflation:

In policy considerations, for consumption-driven economies like the US (around two-thirds of GDP)4, interest rate hikes are commonly used to rein in inflation. However, this can lead to knock-on effects on asset prices such as the re-pricing of the bond and stock markets seen in 2022. Additionally, the Fed Funds Rate (FFR) affects several adjustable-rate consumer debt products in the US, and it remains to be seen if the resilient demand and economy witnessed are a result of increased borrowing and delinquency, as credit card delinquencies surged by more than 50% in 2023 in the US.5 As for the all-important FFR after inflation normalises, while there is no official rate, it is thought that 0.5% above core PCE is an acceptable neutral rate.6 In Singapore’s highly open economy, MAS uses the exchange rate instead of interest rate to mitigate the effects of imported inflation, as observed in the relative strength of the SGD (and the causeway crowd) lately.

On the corporate front, “winners” and “losers” inevitably emerge from the inflationary environment and policy changes. Quality companies capable of defending their price margins or benefiting from rising rates such as banks are faring better than highly leveraged or high-growth, loss-making companies like commodity firms or start-ups, which previously enjoyed strong market performance in a low interest rate era. Companies that had astutely refinanced a large portion of their debt before the spike in rates are also in a favourable position. On the flip side, REITs, a popular investment in Singapore for a long while, are currently underperforming as they may struggle to pass on their higher interest expenses and operating costs in a high inflation, weak growth backdrop. Moreover, higher interest rates are likely to lead to lower prices and property valuations as risk-free rates, capitalisation rates and discount rates rise. Some analysts project that the situation may worsen before improving, as some of the REITs have to refinance their expiring loans in a higher interest and tighter credit environment in 2024.

On a personal level, aspiring first-time homeowners have been anguished by higher mortgage rates and property prices fuelled by inflation. Yet, savers are enjoying attractive returns not seen in a decade on risk-free savings, and individuals with unleveraged property are witnessing substantial increases in their property values. Conversely, borrowers are grappling with lesser disposable income due to the pressures of higher interest payments for floating mortgages and credit card bills even as the value of their debt diminishes due to inflation. Nonetheless, savers benefiting from higher interest income may be inclined to increase their consumption.

Conclusion:

Given the multifaceted and broad impacts of inflation, central banks in many developed markets have adopted inflation targeting and price stability as important policy objectives. Inflation is commonly targeted at 2%, as seen in the US. 7 In Singapore, although there isn’t an explicit inflation target, MAS has concluded that, “on average, a core inflation rate of just under 2%, which is close to its historical mean, is consistent with overall price stability in the economy.” 8 Therefore, a low and stable long-term inflation rate of 2% could be seen as an “acceptable” level of inflation that consumers and producers can rationally ignore 9, thereby not inducing any adverse economic cycles as we go about our lives.

As highlighted in this article, inflation is a complex phenomenon with many shifting and interconnected parts and impacts, most of which are beyond the control of the average person and even challenging for those in power, as recent times have shown. As inflationary pressures compel us to scrutinise our personal finances, it is also an opportune time to take control and seek guidance from trusted financial advisors. Discussing, understanding and crafting comprehensive wealth preservation and growth solutions can help manage the effects of price and policy changes in the short and long term. The value of a well-considered financial plan that allows us to sleep soundly at night should not be understated in these uncertain times.

For an overview of common wealth management solutions in Singapore, you may also like to refer to my previous article “Is There a ‘Fairest of Them All’?”.

Contributor:

Cheong Cheok Hon

Wealth Manager

Phillip Securities Pte Ltd (A member of PhillipCapital)

http://bit.ly/TTPCheokHon

Reference:

- [1] https://www.businesstimes.com.sg/singapore/economy-policy/singapores-median-income-falls-22-real-terms-2023-own-account-workers

- [2] https://www.cnbc.com/2024/01/26/pce-inflation-december-2023-.html

- [3] https://www.mas.gov.sg/monetary-policy/Singapores-Monetary-Policy-Framework/faqs/section-1#S01.1

- [4] https://blogs.cfainstitute.org/investor/2023/11/30/the-weakening-us-consumer/

- [5] https://www.cnbc.com/2024/02/06/credit-card-delinquencies-surged-in-2023-indicating-financial-stress-new-york-fed-says.html

- [6] https://www.cnbc.com/2023/02/20/the-federal-reserves-2percent-inflation-targeting-policy-explained.html

- [7] https://www.cnbc.com/2023/12/12/heres-everything-the-fed-is-expected-to-do-wednesday.html

- [8] https://www.mas.gov.sg/monetary-policy/Singapores-Monetary-Policy-Framework/faqs/section-1#S01.1

- [9] https://www.northerntrust.com/canada/insights-research/2022/weekly-economic-commentary/rational-inattention

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Cheok Hon

Wealth Manager

Phillip Securities Pte Ltd (A member of PhillipCapital)

Cheok Hon is a Wealth Manager at Phillip Securities with extensive experience in advising on insurance and investment products. He is dedicated to using his expertise and knowledge to become a trusted partner and advisor on his clients' personal finance journey. In his free time, he enjoys reading articles related to current affairs and finance.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

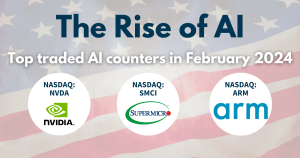

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It  The Rise of AI – Top traded AI counters in February 2024

The Rise of AI – Top traded AI counters in February 2024