5 Benefits of trading on US Asian Hours August 18, 2022

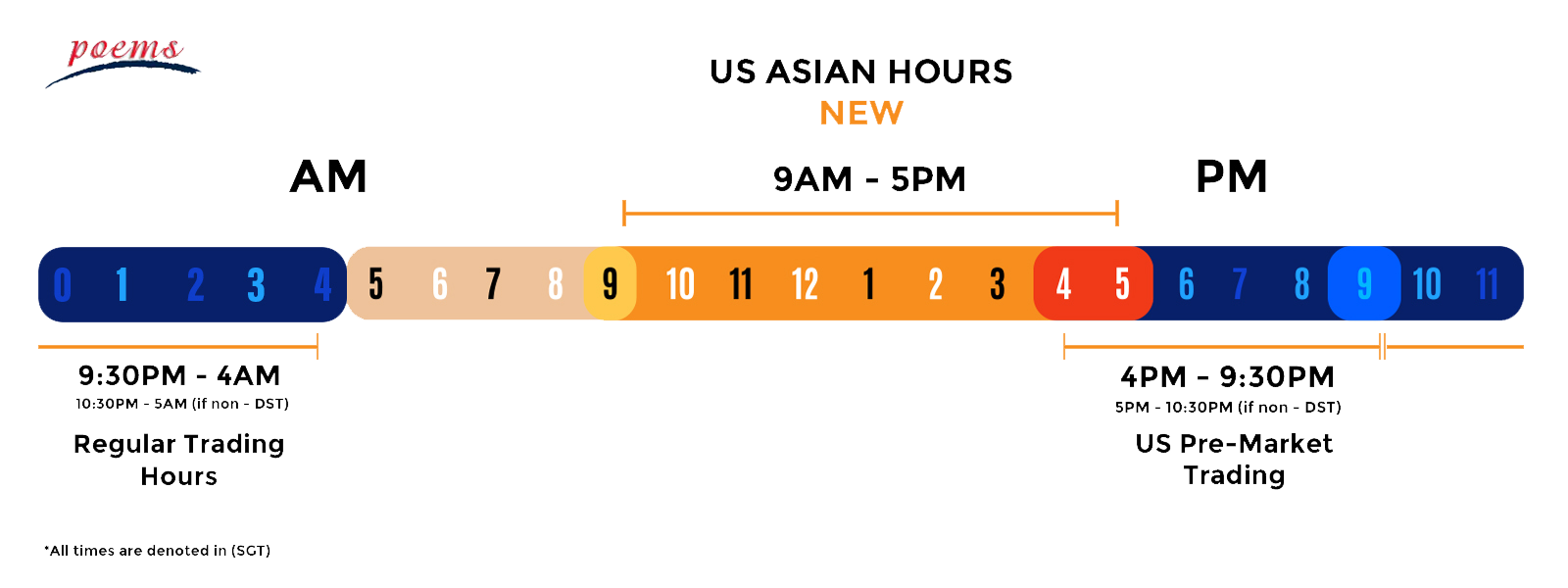

What is US Asian Hours? It is a new service where our clients are empowered with the capability to trade US equities during Asian hours (from 9.00 am SGT to 5.00 pm SGT). Phillip Securities Pte Ltd is the first brokerage firm in Southeast Asia to offer a US Market Making service during Asian market hours on its online trading platform, POEMS, enabling our clients to trade US equities at an even earlier time starting from 9.00 am Singapore time. Together with Pre-market and Regular trading hours, POEMS now offers 19 active hours of US trading for POEMS clients. For now, there are 35 stocks and 2 ETFs that are tradable.

Figure 1: US trading hours

Figure 1: US trading hours

What are the main features of US Asian Hours?

- Capability to trade US equities from 9.00 am SGT to 5.00 pm SGT

- Seamless trading between US Asian Hours, US Pre-Market and Regular Trading Hours

- Settlement period of T+2 market days

- Order placement via POEMS 2.0 web and POEMS mobile 3

- Minimum order size of USD 10 per order

- Market and limit orders supported

What are the benefits of using US Asian Hours?

1. Price in unexpected events

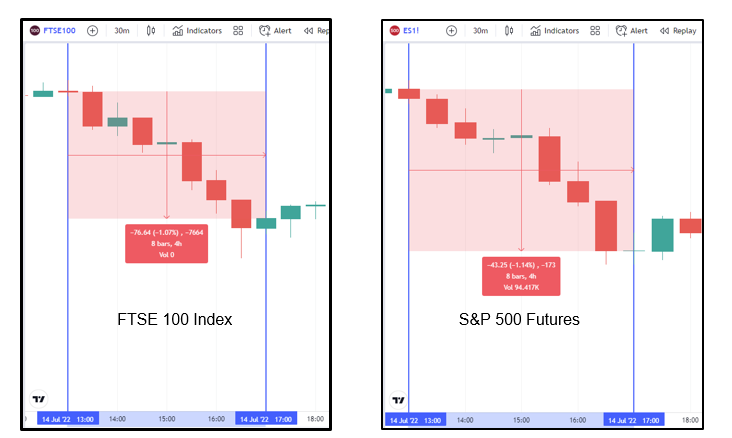

You will be able to act on any movements that occur during Asian Market hours. For instance, on 13 July 2022, the US Consumer Price Index (CPI) of 9.1% was higher than the estimate of 8.8%1, indicating higher inflation than expected. The higher than expected CPI may have caused the US Federal Reserve to be more aggressive in tightening their monetary policy.

The fear of a tighter monetary policy trickled into the European market. The FTSE 100, a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation, lost around 1% during Asian Market Hours as shown in Figure 2. The S&P 500 futures which is closely followed to gauge sentiment, also fell by 1.14%.

With US Asian Hours, investors who are worried that the bear sentiment will carry over to the pre and regular markets will be able to liquidate their positions way ahead of other market participants.

Figure 2: CPI effect on FTSE 100 Index and S&P 500 futures

Figure 2: CPI effect on FTSE 100 Index and S&P 500 futures

2. Leverage Earnings release momentum

Public listed companies release their earnings every quarter. These earning releases are important to investors as results show the company’s performance for the quarter and affect the share price. Due to the significant impact of the earning releases on stock prices, company earnings are normally released out of regular hours.

For earnings that are released after regular market hours, investors can ride on the momentum generated during post-hours trading. For instance, Tesla released its earnings at 4 am SGT on 21 July 2022 which was after the regular market hours. In post-market trading, the share closed at USD 742.50 and in the following pre-market it opened at USD 751.50, followed by an opening price of USD 765.32 during the regular market and closed at USD 815.12. This shows that the bullish momentum continued all the way from post-market trading to the regular market as shown in Figure 3. Thus, investors can make use of US Asian Hours to ride the momentum provided by earnings releases.

Figure 3:TSLA.US behaviour post earnings

Figure 3:TSLA.US behaviour post earnings

3. React to Insider Activities

Insiders according to the SEC are mainly the company’s directors and those who own more than 10% of a company2. Transactions done by insiders are important as the transactions are signals to the market about the value of the stocks. When insiders purchase stocks, insiders are showing that the stocks are undervalued, and the reverse is true for the sale of shares. Some of the filings for insider activities occur in post-market hours, and are yet to be reflected in the share prices. As such, investors have a first mover advantage when placing orders on US Asian Hours.

4. Gauge of sentiments

Clients can use the POEMS platform as a data point to appraise market sentiment. Although the quotes shown on US Asian Hours may not be a perfect gauge for regular trading hours, the sentiments observed during the Asian hours can be used to prepare for the pre-market session.

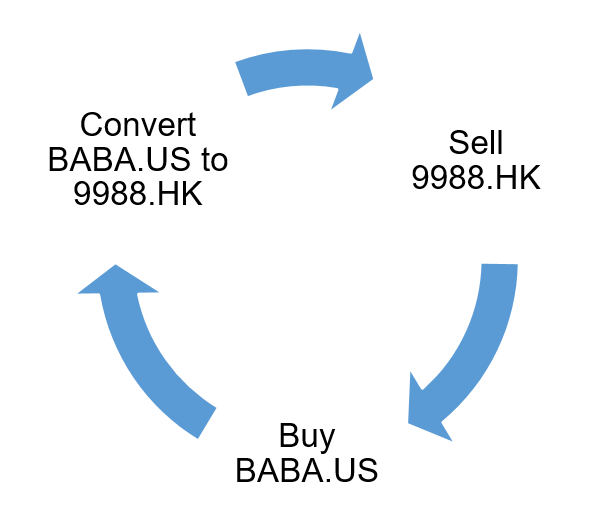

5. Potential arbitrage opportunity

An arbitrage opportunity is present when the price of the same asset differs in different markets3.

The US Asian Hours overlaps with the US pre-market between 4.00 pm SGT and 5.00 pm SGT. The price on US Asian Hours may differ from those quoted in the pre-market, which allow our clients to simultaneously buy and sell in the two markets for an arbitrage trade.

Figure 4: US Asian Hours overlaps with Hong Kong Exchange

Figure 4: US Asian Hours overlaps with Hong Kong Exchange

There are also opportunities in stocks that are dual-listed. For instance, Alibaba is listed on the Hong Kong stock exchange as 9988.HK and on the New York stock exchange as BABA.US. Investors holding both 9988.HK and BABA.US will be able to leverage this opportunity. When investors notice that 9988.HK is selling at a higher price than BABA.US, they can sell 9988.HK and buy BABA.US concurrently to ensure that they still have the same exposure to Alibaba. If clients wish to have the same ratio of HK and US Alibaba shares as before, they are then able to convert the share of BABA.US to 9988.HK. An illustration is shown on Figure 5.

Figure 5: Arbitrage process

Figure 5: Arbitrage process

Do note that there will be fees involved in the conversion. Additionally, American Depository Receipts (ADRs) represent a specified number of shares of the foreign company’s stock, as such investors must be aware of the conversion ratio of these ADRs. For Alibaba, one BABA.US consists of eight 9988.HK. On top of the conversion fee, clients should also take into account the foreign exchange difference when employing this strategy.

On top of the benefits shared, there are 2 points to take note of when trading on US Asian Hours:

1. Minimum trade size

The minimum trade size for US Asian Hours is USD 10 per order. For instance, when Ford Motor (F.US) is quoted at USD 9, investors will have to buy a minimum of 2 shares. Any amount that is lower will be rejected. Thus, unlike the regular and pre-market session, investors need to be mindful of the quantity on US Asian Hours.

2. Wider Bid-Ask spreads

Clients may be subjected to wider Bid-Ask spreads. The relationship of liquidity and spreads is interlinked. Generally with higher liquidity, the bid-ask spreads will be narrower. For US Asian Hours, the volume is significantly lower than that of regular hours which will lead to a wider spread. Hence, investors will have to take note of the spreads when trading on US Asian hours.

Learn more about US Asian Hours from our webinar here!

Ultimately, the access to trade on US Asian hours is a great advantage for investors. Being able to trade during Asian hours grants investors greater flexibility in their investing journey. As US Asian hours has its own uniqueness, do familiarise yourself with the factors that are different from the US pre market and regular hours trading. Knowing and understanding US Asian Hours’ capabilities can benefit investors when trading on US Asian hours.

Reference:

- [1] “Inflation rose 9.1% in June, even more than expected, as consumer pressures intensify” 13 Jul. 2022

- [2] “Officers, Directors and 10% Shareholders- U.S. Securities and Exchange Commission.”

- [3] “Arbitrage Definition – Investopedia.”

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chan Zi Quan

Dealer

Zi Quan is a US Equity Dealer in the Global Markets Team and specializes in the US and Canadian markets. He is an avid crypto fan and is adept in macro analysis.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It