Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It March 28, 2024

With the Federal Reserve (FED) finally indicating rate cuts in 2024, we witnessed a significant rebound in the US markets in the final two months of 2023. All three indexes – Dow Jones, S&P 500 and Nasdaq surged by more than 15%, with momentum continuing into 2024.

While 2024 appears bullish with markets attempting to surpass their previous highs from 2 years ago, recent inflationary pressure and delayed rate cuts by the Fed have led to market selloffs.

Despite the allure of the stock market, promising wealth and financial freedom, many investors may incur losses due to common mistakes. In fact, more than 80% of them make these errors unknowingly.

Understanding these pitfalls is crucial for navigating the stock market successfully in 2024, regardless of market conditions. Here, I’ll explore these pitfalls and share my insights on how to manage them.

1) Seeking quick and easy profits:

Pitfall: Many mistakenly anticipate rapid financial gains with minimal effort in the stock market. However, successful investing demands patience, research, and a long-term perspective.

Insight: Investing is not about making rapid profits one day only to incur significant losses the next. Instead, it requires consistency in your investing approach, with the understanding that occasional losses are inevitable. As the saying goes, “it is okay to lose a few battles to win the war”. To win in the game of investing, embrace a long-term investment strategy and focus on consistency over the allure of quick gains.

2) Overemphasis on a few stocks:

Pitfall: Some investors hope to strike it big with just one or two stocks, leading them to heavily invest in these few options with the hopes of securing their retirement. However, it’s crucial to recognise that this approach often leads to disappointment. More often than not, investors find themselves holding on to these stocks despite incurring substantial losses.

Insight: Essentially, it’s crucial not to put all your eggs in one basket; diversification is key. This principle works on the premise that different stocks perform differently under various economic conditions. By diversifying across different stocks, sectors, and geographical locations, you spread out your risk. A non-diversified portfolio tends to be more volatile, as it’s heavily influenced by the performance of a single asset class or sector. This increased volatility can lead to greater fluctuations in investment value, which may result in distress and poor decision-making.

3) Emotional decision-making

Pitfall: Emotional investing and trading often result in buying high and selling low—the opposite of what you intend. At times, it can seem like the stock market is actively working against you, playing games with your investments.

Insight: Have a proven strategy when you are trading the market, whether it is for the long term or short term. Avoid trading based on gut feelings, hearsay from friends about a stock, or reliance on random research reports. Instead, conduct your own research based on a proven strategy. If you have a system in place to guide you on your entry and exit for a trade, it can help you make informed decisions without involving your emotions.

4) Letting losses run and accumulate

Pitfall: For many of our clients, when they first approach us, we’ve noticed that most are sitting on significant losses because they are unsure on how to address them. Consequently, they hold onto their stocks blindly, hoping for a recovery that may never materialise. Unfortunately, this often leads to their continued losses.

Insight: Never be afraid to admit defeat or cut your losses. In the market, the goal is to keep our losses small and let our profits run, but most investors do the opposite. Before initiating a trade, establish your exit strategy in case the market or the stocks move against you, and then stick to your plan regardless of the circumstances. Even experienced traders occasionally hold onto losing positions, anticipating a market reversal. Yet, more often than not, the market persists in the opposite direction, resulting in further losses.

5) You are not keeping track of your progress.

Pitfall: Many investors overlook the importance of keeping a detailed record of their trading or invested stocks. The lack of a record means that investors might fail to capitalise on learning opportunities from their trading history. Often, they don’t remember why they initially bought a stock or why it remains in their portfolio.

Insight: A trading log or diary can be an incredibly powerful tool. Consider the value of being able to reflect on previous experiences: noting market trends, trades placed, reasons for placing them, profit/loss outcomes, and even your emotions during the trade. A trading log like this can highlight where you succeeded in the past, and where you made mistakes, which serves as a good reflection point for future trades. You’ll be surprised that neglecting a trading log or diary is one of the most common and costly mistakes investors make.

6) You lack a proven strategy or system

Pitfall: Relying solely on luck, gut feelings, or advice from friends is simply not enough. If you are someone who trades for short term gains, having a clear trading strategy is essential for success, period. Otherwise, failure is almost guaranteed.

Insight: As a mentor once wisely said to me: “Any fool can get into a trade, but it’s the real pros who know when to get out.” Every trade setup must have a clear reason, grounded by a proven set of criteria and coupled with a concrete execution plan. Remember, it’s essential to have a strategy that suits you and refine it. If you’re without one now, trend trading could serve as a simple starting point to explore.

And there we have it, understanding these top 6 pitfalls is vital for anyone seeking consistent profits in the stock market.

By approaching investing with patience, diligent research, and a well-thought-out strategy, you can enhance your chances of success. Remember, investing in the stock market carries risks, but with knowledge and caution, you can navigate these waters and work towards achieving your financial goals.

Contributor:

Joey Choy

Principal Investment Specialist

Phillip Securities Pte Ltd (A member of PhillipCapital)

https://bit.ly/JoeyInPhillip

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Joey Choy

Principal Investment Specialist

Phillip Securities Pte Ltd (A member of PhillipCapital)

Joey is a renowned mentor in Singapore, specializing in teaching individuals how to generate income through stock market trading. He is also an author and one of the most-watched, quoted, and followed stock trading trainers in Singapore. Joey's remarkable journey from a S$740k debt has been featured in the Business Times.

Joey is highly regarded as one of the top-tier Remisiers (Stock Brokers) and Traders, consistently receiving numerous prestigious awards. From 2014 to 2023, he has been recognized as the Top Trading Representative and Top CFD (Contract for Differences) Achiever every year by Phillip Securities.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

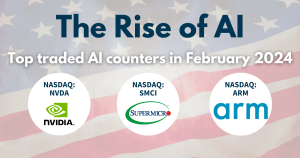

How to soar higher with Positive Carry!  The Rise of AI – Top traded AI counters in February 2024

The Rise of AI – Top traded AI counters in February 2024