A Ticket to Retirement with ETF and SRS November 8, 2022

Last updated 27 Sep 2023

According to the latest Supplementary Retirement Scheme (SRS) figures by the Ministry of Finance (MOF), more people have opened SRS accounts and a larger proportion of SRS account holders are now the younger generation (18 to 35 years old). Read more here

The number of accounts in 2022 amounted to about 387,000, a 25 per cent increase from the previous year, 2021 where there were only about 289,000 account holders. However, about 21 percent of the funds are sitting idle in the SRS accounts as cash balance.

The idle cash funds within the SRS accounts only earn a 0.05 percent interest annually, whereas the funds could enjoy the returns of the ETFs and equities they can buy with these funds.

With the global battle against high inflation, it makes much more financial sense to invest in ETFs now instead of letting SRS funds sit idle. ETFs serve as an effective low-cost investment tool with diversified exposure.

Top 5 ETFs Held by SRS Investors

– SPDR STI ETF (ES3)

– Hang Seng Tech ETF (HST)

– SPDR S&P 500 ETF (S27)

– Lion-Phillip S-REIT (CLR)

– SPDR Gold ETF (O87)

In this article, we will learn more about SRS and the reasons to invest in Exchange-Traded Funds (ETFs) with your SRS funds for your ticket to a better retirement.

What is Supplementary Retirement Scheme (SRS)?

SRS is a voluntary savings scheme that complements the Central Provident Fund (CPF) savings for retirement. It is a scheme by the government to help address the financial needs of an ageing population by enabling the population to save more for their retirement.

How can I participate in SRS?

Any Singapore citizens, Singapore permanent residents and foreigners who derive any form of active income and fulfil the following criteria are eligible to open a SRS account:

- At least 18 years of age

- Not an undischarged bankrupt

- Not suffering from a mental disorder

- Capable of managing self and own affairs

Qualified individuals can open an SRS account with any one of the three SRS operators in Singapore: DBS, OCBC and UOB. Account holders can contribute to their SRS account anytime, subject to a maximum yearly contribution of $15,300 for Singaporeans / PRs and $35,700 for foreigners.[2]

Components of SRS

| Contribution | Investment | Withdrawal |

| Contribute to your SRS account and earn dollar for dollar tax relief up to the maximum annual contribution | Invest the fund into SRS approved financial products (Shares, REITs, ETFs, Unit Trusts and Insurance) | Investors can withdraw from their SRS account upon reaching the statutory retirement age of 62 |

| Funds in SRS account earns 0.05% interest per annum | Investment returns will depend on the nature and characteristic of the respective financial products | Investors have up to ten years to withdraw the full amount and withdrawals are penalty free. 50% of the withdrawals from SRS are taxable at retirement |

| Gains made from investment through SRS have to be returned to the SRS account | Investors need not liquidate their assets upon withdrawal and can choose to withdraw the assets from their SRS accounts into their CDP accounts | |

| Accumulated investment gains are tax-free until withdrawal | Withdrawal before statutory age will be subjected to a 5% withdrawal penalty charge and 100% of the fund will be taxed accordingly. | |

| Penalty charge will be waived under exceptional circumstances[3] |

Unlike the CPF Investment Scheme where there are only six CPF approved ETFs (link), there is no restriction on the use of SRS funds to purchase more than 50 ETFs listed on SGX.

Below are five reasons why ETFs are suitable for investors looking for long-term investment products for their retirement needs.

Five Reasons to Invest in ETF Using SRS Account

1. Wide Variety of ETFs Available

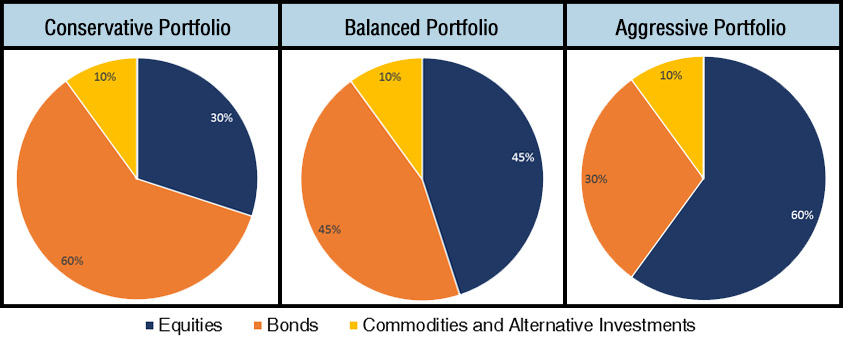

The wide variety of different asset classes of ETFs (Fixed Income, Equities, Money Market, REITs and Commodity) available on SGX allow investors to choose the ETF that best suit their investment needs. Investors who are looking for capital gain can consider Equity ETFs (eg. STI ETF, S&P 500 ETF). Investors desiring passive dividend income can opt for REIT ETFs or Bond ETFs (eg. ABF SG Bond ETF, DBXT Au Govt Bond). Novice investors can use ETFs to build up their investment portfolio whereas experienced investors can use ETFs to complement their existing portfolio.

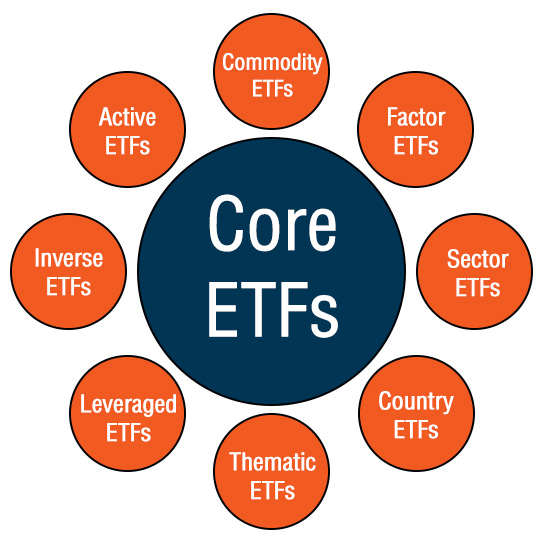

Investors can adopt the Core-Satellite Approach towards portfolio construction via the use of ETFs. For the core portion of the portfolio, low-cost Broad Market Index ETFs of various regions and ETFs of different asset classes are utilised to diversify and modify the portfolio’s characteristics according to the investors’ objectives. The ETFs will be strategically allocated and are intended to be passively managed by the investors.

Figure 1: Sample Strategic Allocation of Asset Classes Based on Risk Profiles

Investors can learn more about strategic asset allocation at “A Guide to Portfolio Construction with ETFs”.

Unlike the core portion of the portfolio, the goal of the satellite portion is to provide a tactical opportunity for investors to earn greater returns than those generated by the passive portion of the portfolio. ETFs are ideal vehicles to be used as “Satellite” because they allow investors to gain exposure to specific market trends or themes rapidly.

Figure 2: An illustration of the Core-Satellite Approach using ETFs

2. Liquidity and Flexibility

ETFs offer liquidity and flexibility to investors as they are traded intraday on the stock exchanges with full price transparency. Investors can enter the market whenever they spot an investment opportunity or exit the market whenever they wish to liquidate their assets.

The yearly contribution for SRS is capped at S$15,300 for locals and S$35,700 for foreigners. Hence, the capital available for investors in their SRS account is limited to this yearly contribution. With ETFs, investors’ SRS funds are not locked into a financial product (eg. Fixed Deposits) and they can have the flexibility to better allocate their limited capital whenever the need arises.

3. Low Expense Ratio

Expense ratio refers to the total cost of managing and operating an investment fund. It is also a measure of the total cost of a fund to investors. It comprises of management fees, legal fees, auditor fees, trading fees and other operational costs.

The total expense ratio of ETF is generally lower as compared to other professionally managed funds like Unit Trusts. This is because ETFs follow a passive strategy by replicating the performance of the index that it is tracking. For example, The Straits Times Index ETFs (SPDR STI ETF and Nikko AM STI ETF) comprise of the 30 constituents that make up the STI and the ETFs’ performance will be correlated to the performance of the STI.

To illustrate, if 20% of the funds invested in Unit Trusts in Singapore were to be invested in ETFs instead, the cost savings from the differential in expense ratio between the two different financial products would amount to around $60m per annum for investors.[4]

Thus, with a low expense ratio, ETFs are ideal for investors who wish to hold their investment over a longer-term period. High expense ratio will erode the investment returns over the long term.

4. Longevity of Index

ETF’s fund managers will rebalance the constituents of the ETFs to achieve the goal of replicating the performance of the index. Better-performing companies will replace weaker companies to conform to the objective and criteria of the index. In summary, conglomerates may rise and fall but the index will always remain.

For example, the Dow Jones Industrial Average Index (DJIA), which comprised of only twelve industrial companies, was constructed on 28 May 1896. Today, all of the original companies in the index have been replaced by other conglomerates like Apple, Nike, and Coca-Cola.

Hence, ETF is a suitable investment instrument for investors who do not have the time nor the expertise to monitor their investment. They can adopt a passive approach towards investing, as fund managers will rebalance the ETFs accordingly to the investment objectives of the ETFs on behalf of the investors.

5. Investment Option for Idle SRS Funds

The current interest rate for the SRS account is 0.05% per annum. Compared to CPF Ordinary Account’s interest rate of 2.5% and CPF Special Account’s interest rate of 4%, the opportunity cost of using SRS funds to invest is lower. Instead of letting their funds lay idle, investors desiring a higher return on their SRS funds can consider investing in ETFs for its potential long-term capital appreciation and/or for its dividend yield.

However, unlike the SRS risk-free interest rate, investors must prepare for the possibility of paper loss if market conditions are unfavourable. To compensate for the additional risk undertaken by investors, ETFs generally provide a higher return than the risk-free interest rate offered by SRS.

Conclusion

ETFs allow investors to diversify and gain exposure to the respective indices. Investors can allocate different asset classes of ETFs to their portfolio according to their investment needs, risk profile and time horizon.

The low expense ratio and longevity of index make ETFs suitable for long-term investment and retirement preparation. Investors can keep their ETFs indefinitely for as long as the ETF is listed and there is no maturity date for the ETF.

For example, most bonds have a maturity date when the investors will receive their principal amount invested. Investors are thus subject to reinvestment risk when they reinvest their principal into another financial asset. Unlike bonds, bond ETFs rebalance constantly by replacing matured bonds with new bonds and are suitable for investors to buy-and-hold indefinitely.

With listings on the stock exchange, ETFs offer investors the opportunity to enter or exit the market whenever they deem fit. Gains made from investing in ETFs are returned to the SRS account allowing investors to further use their SRS funds to grow their retirement nest egg.

If you are interested in investing your SRS Funds, you can visit our POEMS SRS Page https://www.poems.com.sg/srs/

More information on SRS can be found on the page – Eligibility, Benefits, FAQ, and Products Offered

Reference:

- [1] http://www.straitstimes.com/business/srs-funds-can-be-put-to-work-harder

- [1A] https://www.businesstimes.com.sg/banking-finance/over-25-of-retail-investors-srs-amounts-still-untapped

- [2] https://www.iras.gov.sg/irashome/Individuals/Locals/Working-Out-Your-Taxes/Special-tax-schemes/Supplementary-Retirement-Scheme–SRS-/SRS-contributions/

- [3] http://www.mof.gov.sg/Portals/0/MOF%20For/Individuals/SRS/SRS%20Booklet_summarised.pdf

- [4] https://www.dealstreetasia.com/stories/etf-market-has-high-growth-potential-in-singapore-67882/

- [5] https://www.straitstimes.com/singapore/more-people-voluntarily-contributing-to-retirement-scheme amid-economic-uncertainties

- [6] https://www.sgx.com/research-education/market-updates/20210106-investors-flock-etfs-2020

- [7] https://www-mof-gov-sg-admin.cwp.sg/docs/default-source/default-document-library/schemes/individuals/supplementary-retirement-scheme/compiled-srs-statistics.pdf

- [8] https://www.sgx.com/campaign/etf-investing-srs

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

ETF Desk

The ETF Desk is part of the Global Markets Team of Phillip Securities. The ETF Desk is responsible for the ETF business of Phillip Securities. The desk works closely with ETF issuers for distribution purposes, and on curating educational materials to retail investors such as seminars, webinars, market journal and video production.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It