Ban-Luck, In-Between, Poker and the Market? February 3, 2020

What do Ban-Luck, In-Between and Poker have in common with trading in the market? Quite a bit, it seems. As this Lunar New Year approaches, we draw parallels between these games and the market to derive lessons that are applicable to the stock exchanges.

Whether you are gambling or trading, why not try your luck alongside these lessons learnt to boost your ang-bao collections this Lunar New Year!

It’s all about Probabilities

All forms of trading and gambling involve uncertainty. To make better decisions, we start by forecasting all possible outcomes along with its associated probabilities and payoff. Take for example the game of In-Between where each player is given a spread consisting of two random upward facing cards. A bet is then made on whether the third card falls “In” or “Out” of the spread. In an “In”, the player makes a 1:1 gain. If it is “Out”, the player loses his original bet. If the third card turns out to be same as either of the earlier two cards, a “Post” happens, and the player loses twice his bet amount.

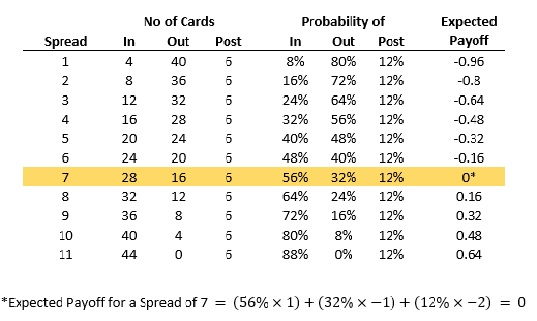

As the game is self-containing within a deck of cards, we can determine all possible outcomes with its probabilities and payoff:

A spread of 7 means there are 7 individual cards that fall “In” the range of the two upward facing cards (e.g. Ace and Nine, Two and Ten). Based on the calculations above, a spread of 7 has an expected payoff of zero, suggesting that the player breaks even over time. Spreads of 6 and less provides a negative expected payoff. An optimal strategy to adopt is therefore to bet only if the spreads are at least 8 or more, giving the player a positive expected payoff given that the player plays enough rounds.

What is your Edge?

Ban-Luck (or Blackjack) is relatively simpler and straightforward. An initial blind bet is made before the players receive their hand of two cards. Players sum the face value of the cards in their hands as points and may “hit” (ask the dealer for additional cards) during their turn to increase their points. They must “hit” if they have less than 16 points and go bust if their hands exceed 21 points. Kings, Queens and Jacks are worth 10 points. Aces may be 1, 10 or 11 points depending on the size of the player’s hand. Once the players pass their turn, their hands are fixed and they may not draw any additional cards. To win, players need a greater sum of points than the dealer without going bust.

The dealer goes last after all players are satisfied with their hands. When the dealer has a minimum of 16 points, he may selectively open the hands of players he deems weaker to make an immediate collection or payoff. After eliminating such players, the dealer may continue to hit and better his hand against remaining players.

If a player goes bust, he loses his bet amount to the dealer. If the dealer goes bust, he pays all surviving players their respective bet amounts.

It is easy to see that the dealer has two advantages over the players. The first, by going last, he merely has to survive and identify busted players to collect his winnings. The second advantage happens when he reveals the hands of the other players, and gains more information, allowing him to make a better guess on the cards he may hit for his own hand.

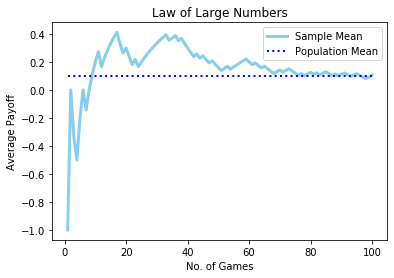

With this edge, we can apply the Law of Large Numbers to see that the dealer is likely to be profit-making over the long run. The Law of Large Numbers in statistics states that as a sample size grows larger, its mean will approach the population mean.

If the dealer has a 55% chance of getting an even payoff, his expected payoff is the population mean, i.e. 55% × 1 +45% × -1 = 10%. While the initial average payoff may be volatile, it converges towards the expected value of 10% as more games are played. For a group of evenly skilled players, it seems that the winning strategy for the dealer is to just keep playing more rounds! However, for most games, dealers typically rotate after a few rounds.

What is your edge in the market? Are your strategies robust enough to constantly provide a profit? If not, consider applying the Law of Large Numbers to your portfolio. Ramp up the holdings in your portfolio or repeat your strategies more than enough times to allow the virtue of sheer numbers to provide diversification benefits and showcase your edge alongside less volatile results.

Asymmetrical Payoffs

Aside from probabilities, another factor that affects your winnings is the payoffs. An asymmetrical payoff happens when the player wins more than the amount he bets and the reward to risk ratio exceeds one. The name ‘Ban-Luck’ refers to wins twice the initial bet and a Ban-Ban (when a player draws 2 Ace cards) offers three times the payoff. It goes without saying that we want to risk as little as possible to earn as much as we can. Who wouldn’t like to draw a Ban-Ban every single round?

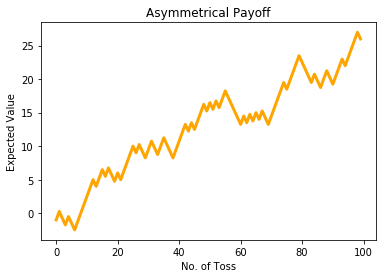

Keeping probability constant at fifty-fifty, we see that a simple coin toss simulation with an asymmetrical payoff of 1.25 per dollar results in an upward sloping equity curve. This suggests that even if we fail to predict market movement and reduce it to sheer luck, the winnings more than offset the losses and our portfolio should still grow over time.

Realistically, high payoffs are usually accompanied by low probabilities. The probability of drawing a Ban-Luck (2:1 payoff) is 4.8%. Striking the lottery (60:1 and above) is a mere 0.01%. The best thing we can do is to synthetically create our own asymmetrical payoffs using stop loss orders and risk less than a dollar for every dollar of profit made.

The expected payoff for a trade is P(Win)×$(Win)-P(Lose)×$(Lose). Historical probabilities of up and down movements can be observed from the market. Assuming these probabilities remain constant, rearranging the equation gives us a minimum required payoff of (P(Lose)×$(Lose))/P(Win)∶1 to break even. Inversing the figure gives us a stop loss target. If the standard deviation of price movement falls within the stop loss target, then we may have found ourselves a winner.

Getting the Right Size

Suppose you drew a Three and a King in a game of In-Between, giving you a spread of 9 and a positive expected payoff of 0.32 per dollar, how much should you commit to the bet to maximise your winnings over the long run?

Kelly’s Criterion suggests betting (pb-(1-p))/b of your capital where players have a p probability of winning b times their bet. Given a 72% chance of an even payoff and assuming probabilities stay the same, it follows that we should bet 44% of our existing wealth each bet.

Risk adverse players may scorn at the thought of committing this much capital in a bet and risk losing two thirds of their capital via a string of just two consecutive losses. A more conservative approach is to adopt Fractional Kelly and bet a fixed fraction (1/8,1/4,1/2 etc.) of what Kelly’s Criterion suggests. Returns may be sub-optimal but standard deviation of returns are lowered to suit the individual’s risk appetite.

Bailing Out

Poker has simple rules but is a complex gameplay. Each player receives a hand of two face-down cards (Hole) and starts a round of betting. Three face-up community cards (Flop) are then dealt to the table, followed by a new round of betting. Thereafter, one community card (Turn) is dealt along with one round of betting, and the last community card (River) is dealt along with the last round of betting.

During each round of betting, players make decisions relating to behavioural sciences and risk-return trade-off as new information is drawn from the community cards, players’ reaction, bets and pot size. Bets are non-compulsory and players may choose to “Check” during each of the betting rounds. However, if any of the players “Raise” a bet, all other players either “Call” and match it or “Fold” and forfeit their game.

The winner is the sole surviving player when all other players have folded or the player with the best poker hand out of the seven cards (Hole and five community cards) at the Showdown, winning the prize pot of all prior bets in the game.

An important distinction between Poker, Ban-Luck and In-Between is when and how the bets are placed. In Ban-Luck, players place compulsory blind bets before being dealt their hand. No adjustments to the bets are allowed after players see their hand.

Betting is ex-post and optional in In-Between. Each player is shown his spread before placing his bet. If the spread is wide and attractive, he may exercise his right to bet and decide on a bet amount to maximise his winnings. If he deems the spread to be too narrow, he may choose to pass the opportunity and not bet at all.

There is no Fear of Missing Out in trading. The ability to say no is a blessing, especially when the reward is not worth the risk. It is easy to let our losses run when we have already invested money into a position. What we often don’t realise is it is much more difficult to break even after each loss!

| % Loss | % Gain required to break even |

| 10% | 11% |

| 20% | 25% |

| 30% | 43% |

| 40% | 67% |

| 50% | 100% |

Saying no and protecting ourselves against losses is just as important as trying to make profits.

Unfortunately, market conditions are constantly changing and never binary. Elements of uncertainty in forecasting will always be present. While we cannot ensure we will never lose money in gambling or trading, we can limit our losses to pre-determined amounts to make every venture worth the risk and every payoff asymmetrical in our favour. Engage only in opportunities that provide positive expected payoffs and bail if things turn south.

Staying Prudent

While it is always easy to get hooked on the hopes and dreams of scoring a big payoff, there is always a possibility of losing. Even a 95% probability of winning comes attached with a 5% chance of losing. The very definition of uncertainty is that it is uncertain!

We should always be mindful of our financial limitations and cut the coat according to the cloth, in gambling, trading and essentially all things we do, lest the consequences become too much for us to bear. If so, throw away all these mathematical intuitions. Abstaining is the winning outcome.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Contract for Differences (CFD) Team

Phillip CFD offers more than 5000 CFD contracts and provides the largest number of Singapore CFDs available for shorting with round-the-clock trade support. Visit our CFD website to find out more.

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap