China Bond ETFs: A Good Diversification Option? April 20, 2018

The recent geopolitical tension between the US and China has resulted in a spike in volatility within the stock market. The CBOE volatility index has surged from record low levels to 21.4 and several major indices like Dow Jones Industrial index has also declined about 10% from their January 2018 peak.

For the first quarter of 2018, growth stocks such as Facebook, Tesla and Alibaba have underperformed due to negative news and growth concerns due to the rising trade protectionism sentiments. It is usually during these periods that investors see the need to diversify their investment portfolio. Besides diversifying into the usual commodities such as gold ETF (O87.SI), investors can explore China bond ETFs. Some of the China bond ETFs are the US listed PowerShares Chinese Yuan Dim Sum Bond ETF (NYSE: DSUM) and KraneShares E Fund China Commercial Paper ETF (NYSE: KCNY).

What’s Good – Resilient performance

For the first quarter, DSUM and KCNY posted a return of about 5% and proved to be resilient during the February and March equity sell-down. The resilient performance was partly aided by RMB appreciation. RMB has appreciated 3% against USD year-to-date and may continue to appreciate given the pressure from US to reduce the trade deficit. This will help to lift the price performances of the ETF.

What’s Good – Political Stability

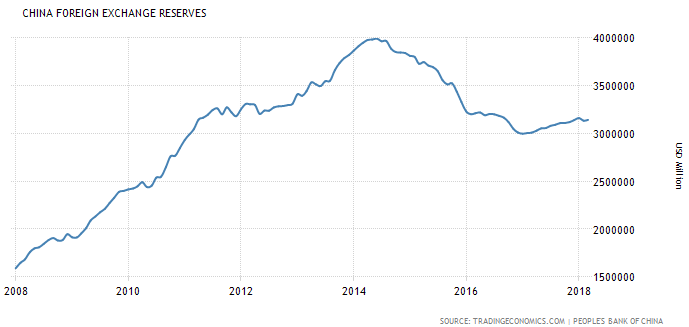

The recent removal of China presidential term limit has also instilled control and stability for the Chinese government in the long run. Coupled with the government’s current account surplus and strong foreign exchange reserves, these will put China in a better position to withstand potential financial shocks.

What’s the Risk – Illiquidity

Compared to major ETFs, these ETFs are slightly more illiquid and will be more costly to buy or sell due to wider bid-ask spreads.

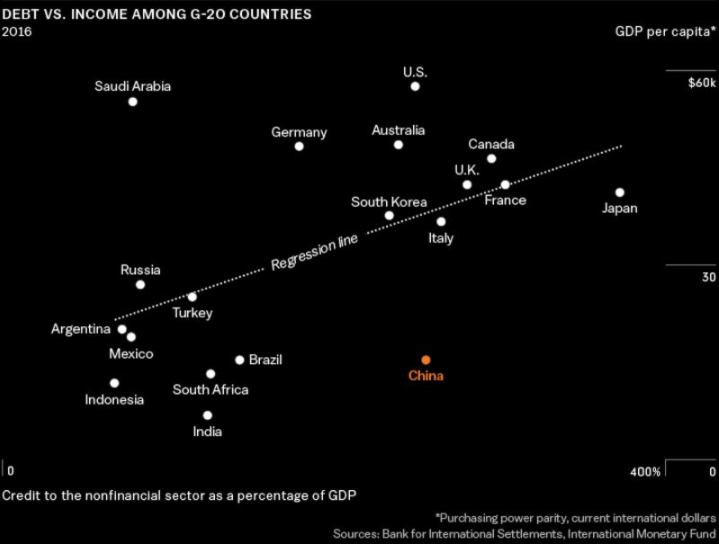

What’s the Risk – China’s high debt to GDP ratio

China’s high ratio is a key concern and the majority of this debt mainly comes from corporates. Investors should keep in mind of the financial risk and avoid overexposing your investment portfolio into China.

The following table shows the comparison of expenses and performances of DSUM & KCNY:

| YTD Performance | Expense ratio | Performance since inception (per annum) | Investment grade exposure | |

| DSUM | 6.33% | 0.45% | 3.08% | Approximate 50% |

| KCNY | 5.55% | 0.57% | 2.31% | Minimum 80% |

As of 31 Mar 2018

Clients will be able to access the ETFs mentioned in the article through Phillip’s award winning multi-market trading platform. As an ETF is classified as a Specific Investment product by the Monetary Authority of Singapore, clients looking to invest in such assets will need to pass an online Customer Assessment Review (CAR) assessment before they are allowed to place any orders. To participate in the US market, clients will need to submit W8-BEN form for US withholding tax purpose.

If you wish to know more about investing, feel free to approach your designated Trading Representatives or our friendly Representatives at a Phillip Investor Centre near you.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chiang Jin Liang

POEMS Dealer

Jin Liang is currently providing dealing services to over 8000 trading accounts and is part of the POEMS Dealing, the core in-house dealing department of Phillip Securities Pte Ltd.

Jin Liang believes in applying both fundamental and technical analysis in equities investing. He likes companies that can grow their earnings, stay relevant in an ever-changing landscape and focus on investor relations. Jin Liang frequently conducts educational seminars with the objective of imparting financial knowledge to the general public.

Jin Liang holds a Bachelor Degree in Electrical Engineering from Nanyang Technological University (NTU) and passed Level II of the Chartered financial Analyst (CFA) exam.

All-in-One Guide to Investing in China via ETFs

All-in-One Guide to Investing in China via ETFs  Everything you need to know on Bitcoin ETFs

Everything you need to know on Bitcoin ETFs  Maximising your Tax Savings & Retirement Funds with SRS in Singapore

Maximising your Tax Savings & Retirement Funds with SRS in Singapore  Is There a “Fairest of Them All”?

Is There a “Fairest of Them All”?