Chinese New Year: Three Cases For CFD Trading February 6, 2024

The Chinese New Year is a festive season may be celebrated by some parts of the world, but the trading cycle during this period is not different in the other parts of the world. As families come together to celebrate, markets often experience unique trends and shifts, influenced by this global festivity. From increased consumer spending to shifts in market sentiments, the Chinese New Year opens the door to distinct trading patterns, making it a pivotal time for both traders and investors.

At the end of this article, I will share with you some trading opportunities and a free indicator I have developed, to help plan your trades more effectively. These insights and tools are designed to empower you to navigate the festive market with confidence and make the most of the opportunities that the Chinese New Year brings.

Before we dive in, let’s revisit our article from a year ago, where we outlined our trade plans.

We were bullish on China A50, bearish on USDCNH, and bullish on Gold. Given that China A50 and USDCNH are negatively correlated, our predictions for China A50 and subsequently for USDCNH did not pan out as expected. However, our outlook on Gold did materialise, with it reaching a peak of 2236.6 on 7 March 2022.

Effective trade planning often leads to higher profitability, as you would be more careful to only take trades that align with your strategy.

With this in mind, let’s explore potential trading opportunities this Chinese New Year. As we aim to capitalise on short-term market fluctuations, we recommend using Contracts for Difference (CFD), a financial instrument that is well-suited for short-term trading.

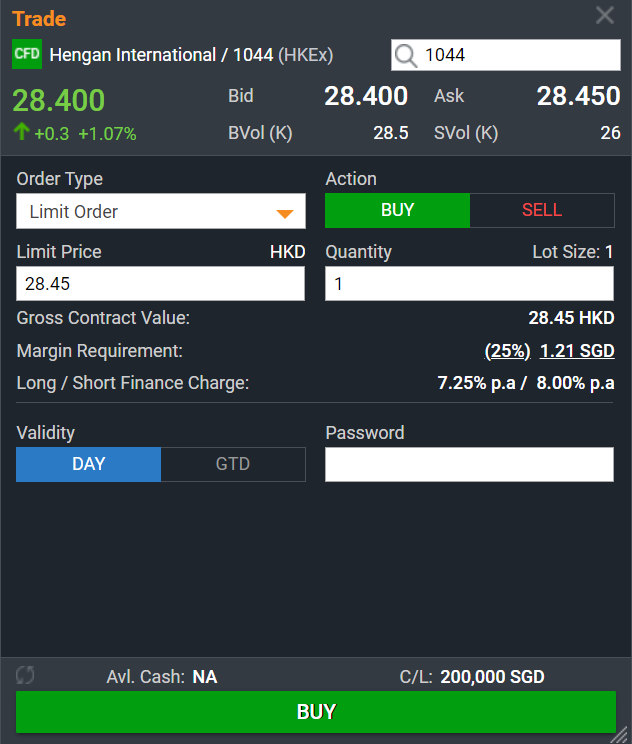

Hengan International CFD

Hengan International Group Co., Ltd. specialises in the trading of personal hygienic products including sanitary napkins, disposable diapers, and tissue paper products.

Source: Phillip CFD

Source: Phillip CFD

If you believe that the Chinese markets have reached their lowest point and are poised for a lift-off during the festive season, then Hengan International might be a company worth considering.

As a trader who prefers to follow the trend, I would approach this trade with caution.

With strict expectations, I’d like to see prices unfold as follows:

Source: Tradingview.com

Source: Tradingview.com

I typically prefer to see prices break above and then retrace to the red line before I consider entering a trade. This approach helps in identifying a potential entry point with a more favourable risk-reward ratio.

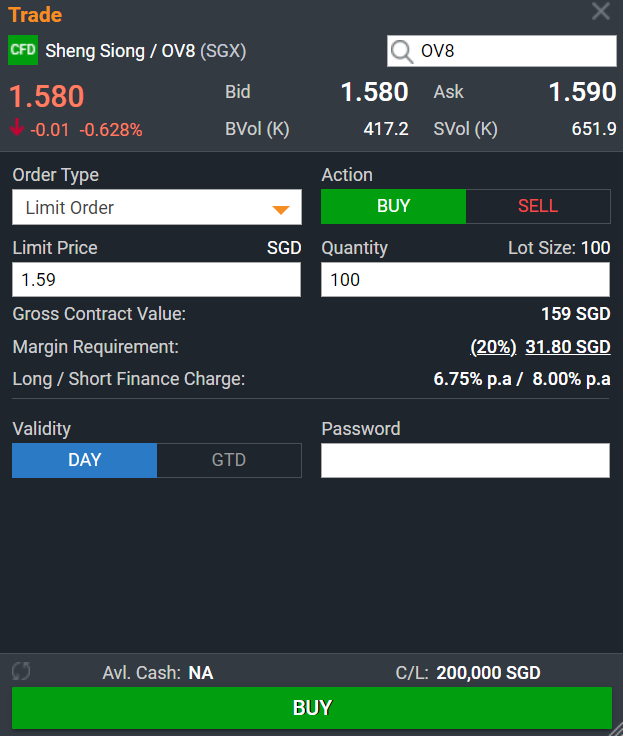

Sheng Siong CFD

Source: FreePik

Source: FreePik

A popular destination for Chinese New Year shopping is Sheng Siong, known for its supermarket supplies and operations. As we approach the Chinese New Year, locals will be purchasing festive goodies. With Sheng Siong’s earnings report due in mid-February, there may be an opportunity for prices to move up this season.

Source: Phillip CFD

Source: Phillip CFD

As of mid-January, Sheng Siong is on an uptrend with key levels at S$1.55 and within rectangle where the price low is at S$1.47. Traders can consider these 2 price points as they go about planning their trades. Given that this trade is seen as a short-term opportunity, lasting at most 2 months, trading Singapore CFD Sheng Siong could be a strategic choice to minimise cash outlay.

Source: Tradingview.com

Source: Tradingview.com

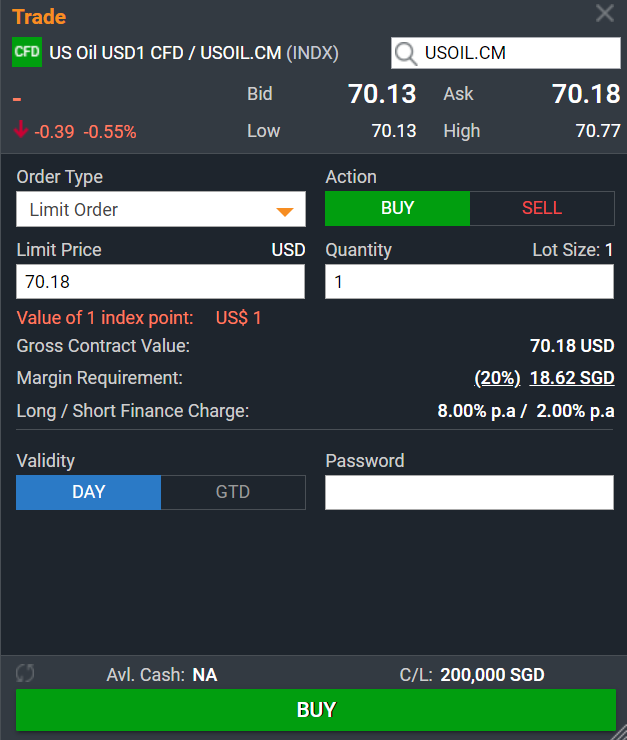

Oil CFD

Source: FreePik

Source: FreePik

Globally, the demand for oil is expected to rise. The Straits Times Index has noted that the Chinese New Year period is typically the busiest period for traveling, suggesting a potential bullish scenario for oil.

Source: Phillip CFD

Source: Phillip CFD

BONUS: Trade Planning Indicator Giveaway

In this section, I’ll share a trade plan for CFD trading, emphasising the importance of risk management.

Below is an image of my proprietary trade indicator, which I use to advise my clients on trade planning.

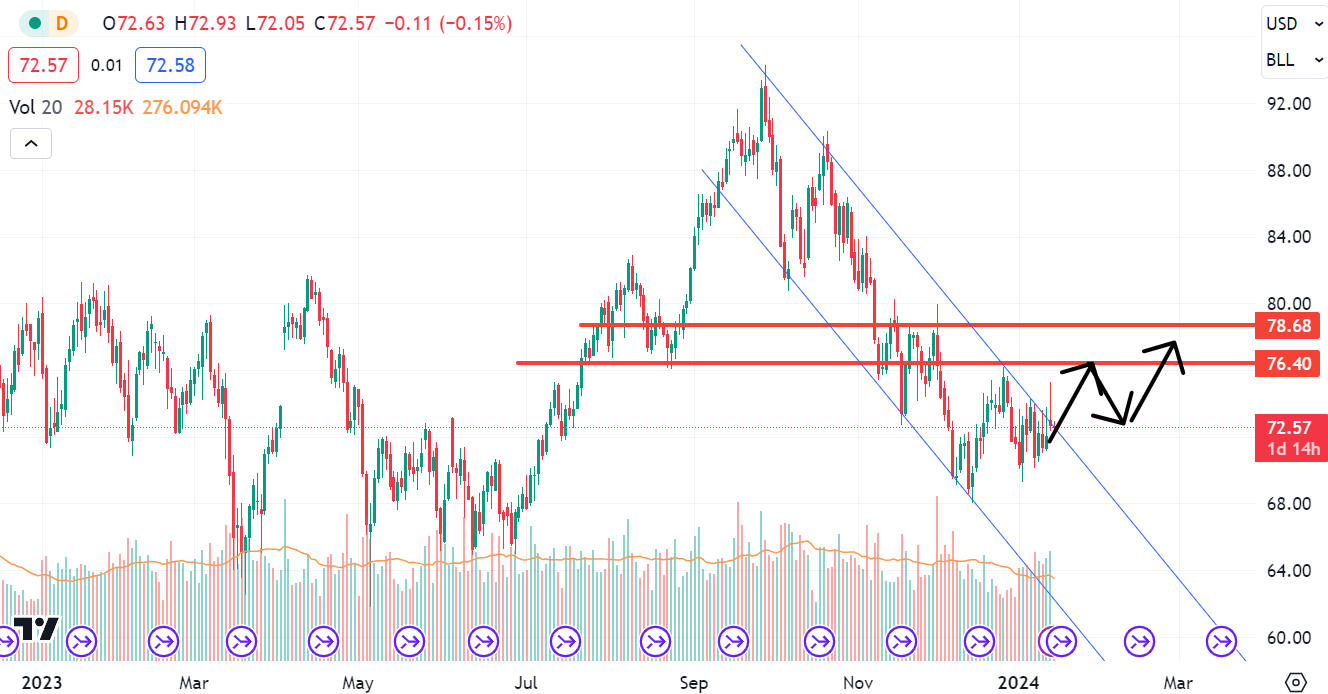

Let’s consider US Oil as an example.

Bullish Scenario

Source: Tradingview.com

Source: Tradingview.com

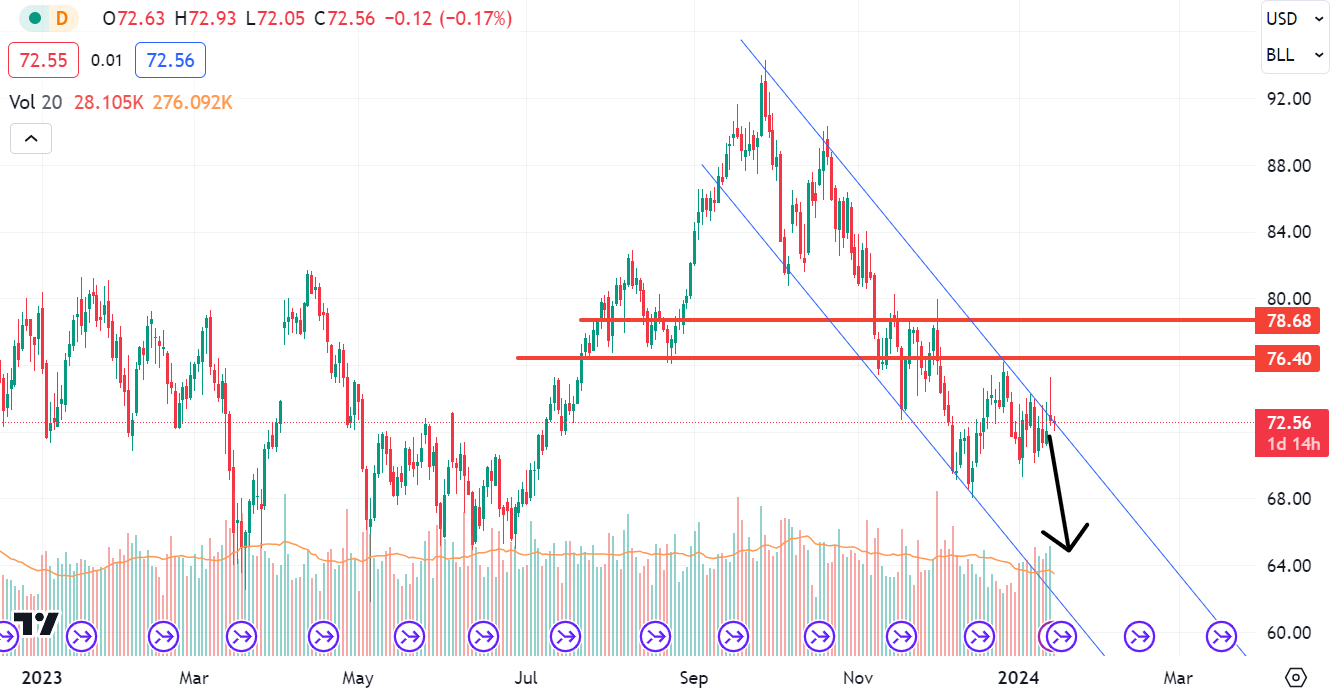

There is a visible downtrend channel. A breakout from this channel followed by a retracement, forming a second higher low, could present a trading opportunity.

Bearish Scenario

Source: Tradingview.com

Source: Tradingview.com

In the event that bullish scenario did not play out, a bearish play would be to the downside towards 68 area.

Budgeting

Source: Tradingview.com

Source: Tradingview.com

Above is a proprietary indicator which takes into account your CFD trading commissions and fees.

For a bearish scenario, with a S$10,000 account where a trader plans to risk 1% of his capital i.e. S$100 on this trade:

Entry price is US$71.5, stop loss at US$76.5, and target profit at US$66. By risking S$100, the trade indicator calculates that he should short 20 contracts.

Assuming a short-term trade of 20 days, the indicative cost of trading would be about S$$1.57.

The potential risk-reward ratio is approximately 1:2, which is very attractive.

The trade manager helps traders plan their trades and gives them a precise risk to reward ratio, taking into account the cost of trading.

If you are interested in this indicator, please contact me in my telegram group https://t.me/stocktradingandanalysis or email me at cfd@phillip.com.sg

If you are new to trading, open an Account with us and we’ll provide guidance to help you get started.

Conclusion

The examples presented above illustrate how traders can effectively plan their trades. The key steps include establishing a directional bias, preparing for various scenarios and carefully budgeting for each trade.

If you don’t have a POEMS account yet, you may visit here to open one with us today.

Lastly, trading within a community can significantly enhance the experience. You will get to interact with us, other seasoned investors and traders who are keen to share their knowledge and expertise.

In this community, you will also be exposed to quality educational materials and, stock analysis to help you apply the concepts. We look forward to sharing more insights with you in our growing and enthusiastic Telegram community. Join us now!

For more enquiries, please email us at cfd@phillip.com.sg.

Promotions

From now till 31 March, stand a chance to get S$88 Cash Credits and a chance to win a 43” Prism TV when you fund and trade with us! *

*T&Cs Apply.

For more information, click here.

How to get started with POEMS

As the pioneer of Singapore’s online trading, POEMS’s award-winning suite of trading platforms offer investors and traders more than 40,000 financial products across global exchanges.

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here (terms and conditions apply).

We hope that you have found value reading this article. If you do not have a POEMS account and are interested in trading, you may visit here to open an account with us today.

Lastly, investing in a community can be a highly rewarding experience. Here, you will have the opportunity to interact with us and other seasoned investors who are enthusiastic in sharing their experience and expertise whether it’s through listening or answering questions.

In this community, you will also gain exposure to quality educational materials and stock analysis, to help you appreciate the mindset of seasoned investors and apply concepts you have learned.

We look forward to sharing more insights with you in our growing and enthusiastic Telegram community. Join us now!

For enquiries, please email us at cfd@phillip.com.sg.

References:

- 1 Phillip CFD

- 2 Tradingview.com

- 3 https://img.freepik.com/free-photo/abstract-blur-shopping-mall_1203-8823.jpg?w=900&t=st=1705380479~exp=1705381079~hmac=748bacbea5e9a484516d6fc6915339cb0176c53b4be5f70a881ba1560fdce22f

- 4 https://img.freepik.com/free-vector/background-rising-oil-prices-world-illustration_1419-2253.jpg?w=740&t=st=1705380338~exp=1705380938~hmac=a6cc113fbea0f9b9115f6f0d8fc6f3b97bcced5ae7025e9507035f2245f99d9b

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chua Minghan

CFA | Senior Manager, Dealing

Phillip Securities Pte Ltd

Chua Minghan graduated from the National University of Singapore with a Bachelor’s degree in Economics. He is passionate about education and went on to get a post-grad Diploma in teaching. His vision is to educate clients to make informed decisions for their trading and investments.

Minghan enjoys learning fundamental analysis, technical analysis, and strives to use data analysis to improve his trading skills.

What is CFD? With 2 Practical Examples

What is CFD? With 2 Practical Examples  Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?