Cleaning Up with Renewable Energy March 2, 2021

What the report is about:

- The unprecedented collapse of oil prices in 2020 has decimated investors’ confidence in the traditional energy sector.

- In contrast, new investments into renewable technologies and infrastructures have resulted in an overall increase in renewable energy demand in 2020.

- Growth drivers like scalable renewable technologies, government policies, and population growth are accelerating the adoption of renewable energy.

- Investors can gain exposure via ETFs like ICLN, PBW, QCLN, CNRG, and SMOG.

2020: The Inflection Point for the Energy Sector

2020 was a devastating year for the energy sector. The COVID-19 pandemic and the Saudi Arabia-Russia oil price war have triggered a catastrophic combination of demand and supply shocks in the industry, which resulted in the unprecedented collapse of oil prices.

Global oil demand plummeted as several countries locked down and closed their borders to contain the spread of COVID-19. Adding fuel to the fire were disagreements over supply cuts that led to fissures between OPEC and Russia. The resulting supply glut caused oil futures to tumble into negative price territory for the first time in history.1

While the implosion was temporary, oil price volatility and unpredictable demand massacred investors’ confidence in the traditional energy sector. Energy investment was down a record US$400bn in 2020 from 2019 levels.2

Furthermore, the continuing uncertainties surrounding the pandemic could continue to impose downward pressure on oil prices and generate headwinds for the traditional energy industry in 2021. As of February 2021, the sector’s weighting in the S&P 500 was only 2.33% – its lowest level in more than 20 years.3

In stark contrast, the renewable energy industry has been gaining traction. Worldwide, renewable industries accounted for 72% of new capital expenditure in the energy sector in 2019. The new investments in renewable technologies and infrastructures have underpinned the strong growth in renewable electricity and caused renewable energy demand to grow by 1% YoY in 2020.4

Valued at US$928bn in 2017, the market for renewable energy is expected to touch US$1.5tn by 2025.5

But what is renewable energy?

Non-Renewable vs Renewable Energy

Non-renewable energy includes fossil fuels such as oil, gas, and coal. These are finite resources and take a long time to replenish. Many non-renewable energy sources are detrimental to the environment and human health.

In 2018, the burning of fossil fuels accounted for 87% of the world’s carbon-dioxide emissions. It was the biggest culprit of global warming.6 The same energy sources cause air pollution which kills 3.6mn people on earth every year.

All these make a world fuelled by non-renewable energy neither safe nor sustainable.

Renewable energy, or clean energy, on the other hand, comes from natural sources or sources that are naturally replenishing.7 Examples are:

- Solar energy

- Wind energy

- Hydro-electricity

- Geothermal energy

- Biomass and biofuel energy

Throughout history, the world has been harnessing nature’s power for heating, transportation, lighting, etc.

Today, renewable energy is the fastest-growing energy source in the U.S., increasing 100% from 2000 to 2018.6 Globally, it is estimated that electricity generation from renewable sources will expand from 26.2% in 2018 to 45% by 2040.8

Renewable energy is not a fad to appease the global community in the pursuit of a greener environment. Several structural trends are powering the displacement of fossil fuels by clean energy.

Cost of Renewable Energy

The costs of non-renewable energy depend on two things: the price of fossil fuels and power plants’ operating costs.

For the world to transition away from non-renewable energy, the energy produced from renewable sources has to be cheaper than fossil fuels.6 In the past, non-renewables were the primary energy source because they were much cheaper than renewables.

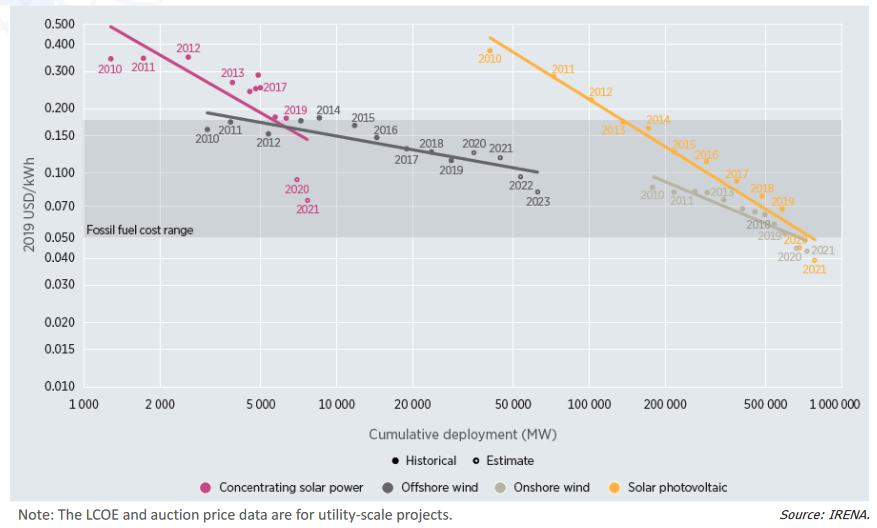

Just 12 years ago, wind energy was 22%, and solar energy 223% costlier than coal. Coal is the least expensive of all fossil fuels.6 But over the last decade, the cost structure of renewable industries has changed completely.

Most renewable-energy plants are not affected by fuel costs because their energy sources can be harnessed naturally from the sun, wind, earth, river, ocean, etc. The primary determinant for the cost of renewable energy is the cost of the power plant itself, or rather the cost of developing, implementing, and operating the renewable technologies.

According to Bloomberg, the global average cost of solar energy is down by more than 80% from 2010 levels. There is potential for another 25% drop by 2025,10 as material costs shrink for solar panels and innovations are forged across the solar photovoltaic (PV) supply chain.

These technological advancements enhance the efficiency of solar panels. An accumulation of small improvements across the supply chain can help drive the continuous cost decline of solar energy.

Onshore wind power is now one of the cheapest energy sources. The price of onshore wind electricity has retreated by more than 70% since 2009.6

With R&D and technological improvements, solar and wind energy costs have reached grid-parity with traditional fossil fuels.

Due to the scalability of renewable technologies, the marginal benefits of constructing additional non-renewable power plants will gradually diminish and renewable energy will, in turn, be more economically-feasible in the future.11

Global Demand for Energy

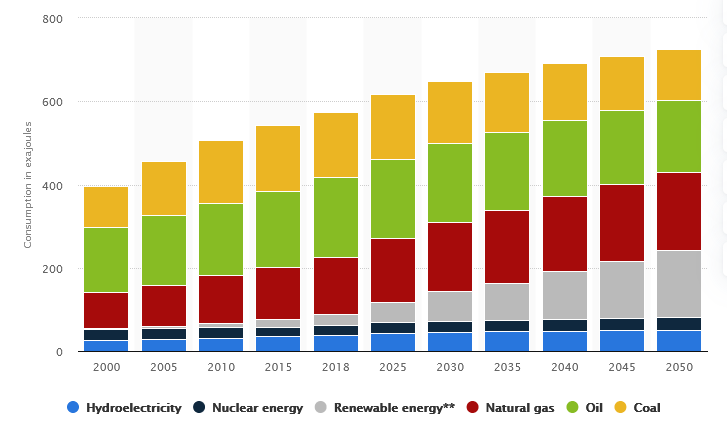

The world’s population is projected to increase by 2bn from 7.8bn in 2020 to 9.9bn in 2050.13 Accordingly, the demand placed on power, transportation, and utilities facilities is set to rise in tandem with the growing population.

Some forecasts put energy consumption growth at nearly 50% between 2018 and 2050.14 To cope with the surging demand, the world has to transform its energy system.

Renewable energy offers practical solutions to our energy crisis and reduces the burden on the national grid system. For example, residential apartments can install solar panels which reduce their dependence on electrical grids and shield them from energy price fluctuations.

Energy Security

Threats to the energy sector can arise from natural disasters, cyber-attacks, geopolitical tensions, and fuel price fluctuations, among others. Disruptions to the energy systems can have dire consequences on the industrial, agricultural, healthcare, and other critical services of a nation.15

The interruptions of these essential services can have cascading negative impacts, which will inhibit the economic and social developments of the society. Therefore, energy security is vital to many sectors of the economy and the well-being of a country.

Renewable energy plays an indispensable role in supporting energy security by adding diversity to the power generation portfolio and reduces the reliance on fossil fuels.

Energy systems with high percentages of renewable sources are also less susceptible to global shocks than those based on fossil fuels. This is because energy systems which are controlled locally are less vulnerable to the negative effects of external crises.19

Regulatory Policies

The Paris Agreement is an international accord established in 2015 to alleviate the adverse effects of climate change. It aims to reduce global greenhouse gas emissions and provide a pathway for developed nations to assist developing nations in their climate mitigation and adaptation.

To date, 189 countries have endorsed the Paris Agreement.21 The agreement signifies the beginning of a shift to a low-carbon world whose sustainability will hinge heavily on renewable energy.

Under the Biden administration, the U.S. has re-joined the Paris Agreement. The renewable-energy market is expected to receive a shot in the arm from the administration’s intention to spend US$400bn on clean energy and innovation over the next 10 years.22 The new administration is expected to exercise its executive authority to facilitate the deployment of renewable infrastructures.

Additionally, China – responsible for around 28% of global greenhouse gas emissions – is targeting to achieve carbon neutrality before 2060.23 The Chinese government has been prioritising the transitioning of its labour force towards a less energy-intensive economy, with a greater focus on modernised digital service industries.

Exchange Traded Funds

There are various thematic Exchange Traded Funds that provide investors with diversified exposure to the renewable energy supply chain, from clean energy producers to technology providers and equipment manufacturers.

| ETF | iShares Global Clean Energy ETF | Invesco WilderHill Clean Energy ETF | First Trust NASDAQ Clean Edge Green Energy Index ETF | SPDR S&P Kensho Clean Power ETF | VanEck Vectors Low Carbon Energy ETF |

| Ticker | ICLN | PBW | QCLN | CNRG | SMOG |

| Exchange | NASDAQ | NYSE Arca | NASDAQ | NYSE Arca | NYSE Arca |

| AUM | US$6.41bn | US$3.34bn | US$3.28bn | US$424.7mn | US$318.6mn |

| Expense Ratio | 0.46% | 0.70% | 0.60% | 0.45% | 0.62% |

| Number of Holdings | 30 | 58 | 44 | 40 | 30 |

| Top 3 Holdings |

|

|

|

|

|

ETF information accurate as of 23 February 2021

Irreversible and Inexorable

The declining cost of solar and wind energy is expected to stimulate demand for renewable energy. Supportive government policies could also help progress the expansion into renewable technologies and coerce companies into the adoption of renewable energy.

Together, these trends may foster collaboration that bring about new business models and hasten the transition into renewable energy for a greener future.

References:

1. https://www.bbc.com/news/business-52350082

2. https://www.iea.org/reports/world-energy-investment-2020/key-findings

3. https://www.thebalance.com/what-is-the-sector-weighting-of-the-s-and-p-500-4579847

4. https://www.iea.org/reports/renewables-2020

5. https://seekingalpha.com/article/4407854-alps-clean-energy-etf-disruptors-of-megatrend

6. https://ourworldindata.org/cheap-renewables-growth

7. https://www.eia.gov/energyexplained/renewable-sources/

8. https://www.c2es.org/content/renewable-energy/

9. https://www.statista.com/statistics/222066/projected-global-energy-consumption-by-source/

10. https://kraneshares.com/chinas-renewable-push-should-benefit-solar-and-wind-companies/

11. https://www.mckinsey.com/industries/electric-power-and-natural-gas/our-insights/the-decoupling-of-gdp-and-energy-growth-a-ceo-guide

12. https://www.irena.org/-/media/Files/IRENA/Agency/Webinars/2020/Jun/IRENAinsight-webinar_RPGC-in-2019-Overview.pdf?la=en&hash=80A08A29C8807989DC9DBA8E78E55B6124DC5E42

13. https://sdg.iisd.org/news/world-population-to-reach-9-9-billion-by-2050/

14. https://www.eia.gov/todayinenergy/detail.php?id=41433

15. https://www.eia.gov/todayinenergy/detail.php?id=41433

19. https://www.ren21.net/renewable-energy-resilient/

21. https://www.un.org/en/climatechange/paris-agreement

22. https://joebiden.com/9-key-elements-of-joe-bidens-plan-for-a-clean-energy-revolution/

23. https://www.bbc.com/news/science-environment-54256826

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Joel Lim

ETF Specialist

Joel is the ETF Specialist from the ETF desk in Phillip Securities. He helps to provide sales support and trading ideas to retail investors, remisiers, in-house dealers, and fund managers. Joel also works closely with ETF issuers on new product and business development projects.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  ETF Market Review: February Outlook Signals Strong Performance

ETF Market Review: February Outlook Signals Strong Performance  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?