From Boom to Bust: Lessons from the Barings Bank Collapse February 23, 2024

Barings Bank was one of the oldest merchant banks in England with a long history since 1762. Throughout the years, Barings Bank played a pivotal role in the banking industry, extending its influence from North America to Amsterdam and even Singapore. However, the most recent memory of this once cornerstone financial institution in Britain is its sudden collapse of Barings Bank in 1995, caused by fraudulent investments made by a rogue trader named Nick Leeson in Singapore.

To fully understand the cause of Barings Bank’s downfall, it is essential to examine the events leading up to the collapse closely. Leeson began his career as a settlement clerk in the bank’s back-office operations, mainly to support the trading division with the necessary back-end support. As a diligent and overall good employee, he rose through the ranks and was appointed as General Manager of Barings Securities in Singapore.

This marked the point where Barings Bank made their first significant error, by allowing Leeson to oversee both back-office and trading operations. The necessity for a clear separation between back-office and trading operations is paramount to preventing potential manipulation and ensuring proper checks and balances. As a result, Leeson was able to falsify records and conceal losses in fictitious accounts [1]. Typically, in other banks, two distinct individuals are appointed as head of back-office and head of trading operations to mitigate such risks.

Owing to Leeson’s remarkable track record of generating substantial trading profits, he was given a considerable autonomy and was even promoted as Head of Trading at Barings’ Singapore branch. This decision marked Barings Bank’s second major mistake as Leeson was seen as a legendary figure in the bank, leading higher management to overly trust Leeson’s words. Consequently, the bank lacked proper risk management and oversight over Leeson’s trading activities.

Despite the downturn in the Asian financial markets, Leeson was consistently generating unusually high trading profits [2]. Barings Bank’s senior management failed to identify potential red flags, blindly believing that Leeson was simply exceptional in his role. There was never any questioning or investigation into the sustainability of Leeson’s trading strategies.

To maintain his “legendary trader” status and fame, Leeson was under such immense pressure to perform and generate profits at any cost that he engaged in fraudulent trades that speculated on Japanese Nikkei 225 Index futures and options [3]. Initially, Leeson used an arbitrage strategy that aimed to profit from the small difference in price between futures contracts from Singapore International Monetary Exchange (SIMEX) and Japan exchanges [4]. In principle, arbitrage strategy has low to no risk as contracts are bought and sold simultaneously to profit from the price difference (as shown in the image below).

Increasingly, he began to take massive speculative positions on Nikkei 225 Index futures and options. Should these positions prove profitable, Leeson would be heralded as a genius. Conversely, in the event of losses, Leeson would resort to a doubling strategy. It was evident that Leeson was also influenced by a loss aversion bias, where the distress of loss significantly outweighed the pleasure of a comparable gain, leading to his illogical and unpredictable behaviour in the face of escalating losses [5]. Leeson’s approach closely mirrored that of a desperate gambler faced with significant losses and growing debts. A quote from Leeson himself succinctly captured this mindset:

“I was determined to win back the losses. And as the spring wore on, I traded harder and harder, risking more and more. I was well down, but increasingly sure that my doubling up and doubling up would pay off … I redoubled my exposure.”

There were instances when his doubling strategy temporarily converted losses back into profits. However, by exponentially increasing risk in an attempt to recoup losses, he introduced a significant systemic risk to the bank and potentially to the broader market as well.

The risky strategies employed by Leeson inevitably led to catastrophic losses. In 1995, the collapse of Barings Bank was precipitated by Leeson’s speculative trading, which resulted in losses amounting to approximately US$1.4 billion, far exceeding the bank’s available capital. This financial disaster highlighted the dire need for robust risk management and regulatory oversight within the banking sector.

Following the revelation of the losses, Leeson was arrested in Germany and extradited to Singapore. In 1995, he was sentenced to six and a half years in Changi Prison in Singapore for his role in the bank’s collapse, specifically for charges of forgery and fraud. His actions and the subsequent failure of Barings Bank served as a stark reminder of the vulnerabilities within the financial system and the potential consequences of unchecked speculative trading.

Key Takeaway from Barings Bank’s collapse

The Importance of Verification and Due Diligence in Finance

Investors must understand the importance of verifying and validating information within in the finance industry. It is essential for investors to conduct their own due diligence and independently verify any financial decisions, regardless of the credibility and trustworthiness of the analyst, expert, or institution involved. This principle applies across all financial activities, from investing and trading to even purchasing insurance products.

The Significance of Diversification

Barings Bank’s downfall was significantly attributed to its enormous exposure to a single trader, with substantial resources allocated to his activities. The failure of this strategy underscores the dangers of concentrating investments too narrowly. Investors are encouraged to diversify their portfolios to mitigate company-specific risk (unsystematic risk). Through diversification, investors can achieve a more favourable risk-adjusted return and create greater value over the long term.

Understanding your Investments

The complexity of an investment can often mask underlying risks. The collapse of Barings Bank served as a cautionary example, where, higher management failed to fully comprehend the methods by which Leeson was able to earn considerably large profits. This lack of understanding, coupled with blind faith in his strategies, highlighted a fundamental principle in finance: no risk, no reward. Leeson’s high returns were indicative of substantial risks being taken.

Caution Against High-Return Investments

The saying “If it is too good to be true, it probably is”, remains particularly relevant in the context of investments offering high returns with low risk. Such opportunities, exemplified by Leeson’s consistently exceptional performance and promises of high returns, are often either fraudulent or unsustainable. Investors are advised to evaluate investments not solely on the potential returns but also with a comprehensive risk management approach. Investing is a marathon, not a sprint, and requires a balanced perspective on returns and risks.

The Role of Financial Regulation

Financial regulation plays a crucial role in safeguarding both investors and the stability of the financial system. Following the collapse of Barings Bank, enhanced regulatory measures and scrutiny were implemented, leading to financial institutions being subject to more rigorous reporting and compliance requirements. As a result, customers should be prepared for, and understand the need for, increased due diligence processes when seeking to engage with more sophisticated investment opportunities. These regulations are designed to protect all parties involved and ensure the integrity of financial markets.

Conclusion

In conclusion, the collapse of Barings Bank in 1995 continues to serve as a stark reminder of how a single rogue trader can bring down a bank with over two centuries of history. The lessons to be learned from this event remain profoundly relevant in today’s financial landscape. They underscore the critical importance of verification and validation, the necessity of diversification, the wisdom of thoroughly understanding one’s investments, the caution required when approaching high-return investments, and the indispensable role of financial regulation.

These principles are not merely historical footnotes; they are essential guidelines that, if heeded, can prevent the recurrence of such financial catastrophes. As the financial world evolves, the saga of Barings Bank stands as a timeless reminder of the need for vigilance, wisdom, and prudence in investment and financial management.

Promotions

Now is a great opportunity to explore Equities CFDs! Fund S$5000 into your CFD account and trade 8 Equity CFDs to get S$88 Cash Credits and stand a chance to win a 43″ TV worth S$999!

For more information, click here.

How to get started with POEMS

As the pioneer of Singapore’s online trading, POEMS’s award-winning suite of trading platforms offer investors and traders more than 40,000 financial products across global exchanges.

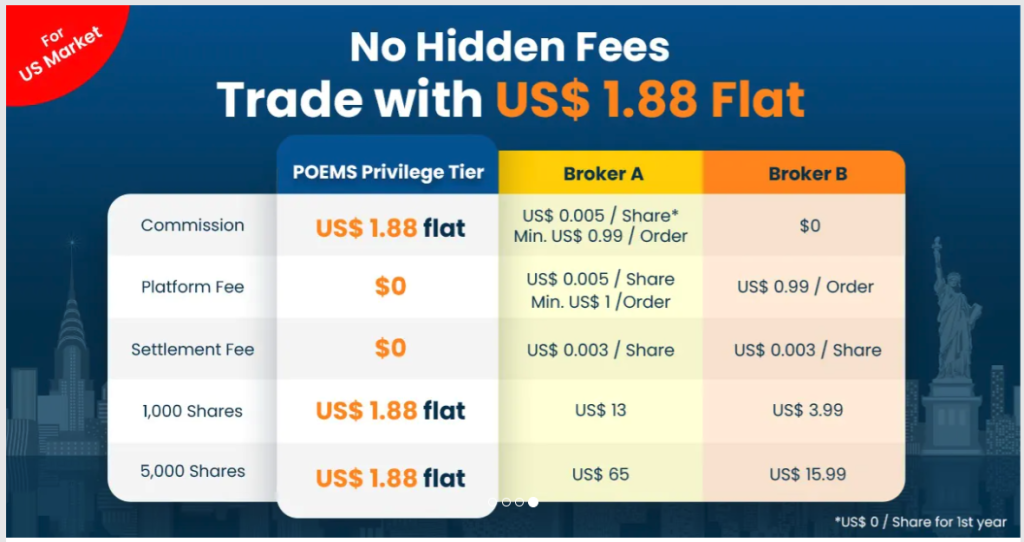

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here (terms and conditions apply).

We hope that you have found value reading this article. If you do not have a POEMS account and are interested in trading, you may visit here to open an account with us today.

Lastly, investing in a community can be a highly rewarding experience. Here, you will have the opportunity to interact with us and other seasoned investors who are enthusiastic in sharing their experience and expertise whether it’s through listening or answering questions.

In this community, you will also gain exposure to quality educational materials and stock analysis, to help you appreciate the mindset of seasoned investors and apply concepts you have learned.

We look forward to sharing more insights with you in our growing and enthusiastic Telegram community. Join us now!

For enquiries, please email us at cfd@phillip.com.sg.

References:

- 1 https://fastercapital.com/content/Behind-the-Scenes-of-Financial-Fraud–The-Nick-Leeson-Scandal.html

- 2 https://fastercapital.com/content/Inside-the-Singapore-Exchange–Nick-Leeson-s-Infamous-Trades.html

- 3 https://www.investopedia.com/ask/answers/08/nick-leeson-barings-bank.asp

- 4 https://pages.stern.nyu.edu/~sbrown/leeson.PDF

- 5 https://thedecisionlab.com/biases/loss-aversion

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Sam Hei Tung

Senior Dealer

Phillip Securities Pte Ltd

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Mooncakes: The Hidden Environmental Cost of Gifting

Mooncakes: The Hidden Environmental Cost of Gifting  Factor-Based (Smart-Beta) ETFs: How They Work, Selection Criteria, and Practical Uses for Singapore Investors

Factor-Based (Smart-Beta) ETFs: How They Work, Selection Criteria, and Practical Uses for Singapore Investors  What is an Active ETF?

What is an Active ETF?  100% Spenders in Singapore: How to Break Free from Living Paycheck to Paycheck

100% Spenders in Singapore: How to Break Free from Living Paycheck to Paycheck