Deciphering the Updates: Understanding the latest CPF Changes March 5, 2024

The latest changes to the Central Provident Fund (CPF), as unveiled in the 2024 Budget by Singapore’s Deputy Prime Minister Lawrence Wong, bring forth two significant modifications. Let’s examine how the removal of the Special Account (SA) for members aged 55 and above, and the increase in Enhanced Retirement Sum (ERS) may affect us.

1. Removal of Special Account (SA) at age 55

At the age of 55, your CPF Retirement Account (RA) is created. The savings from your Ordinary Account (OA) and Special Account (SA) will be transferred to your RA account to meet the prevailing Full Retirement Sum (FRS). The system will first draw from the member’s SA, followed by the OA if necessary.

SA Shielding

Prior to the change, if you have excess funds over the FRS at 55, you may prefer to keep them in the SA because the interest rate in the SA is 4% (4.08% from 1 Jan to 31 Mar 2024), while the interest in the OA is 2.5%. Due to the difference in interest rate, there exists a strategy, known as “SA Shielding” where members invest their money in their SA just before their 55th birthday, and then unwind their position shortly after they turn 55. The system will draw the money in the OA for RA. When the investment is liquidated, , the money returns to the SA account to earn a higher interest. Since SA is withdrawable after 55, it functions similarly to a high-yield savings account.

The closure of SA after age 55 means that this strategy will not be viable. This will impact members who have surplus funds in their OA/SA in excess of the FRS when they turn 55, as well as members above 55 who currently have funds in their SA, or are still employed. In the absence of the SA option, individuals must choose whether to commit the excess funds into their RA for a potentially higher CPF life payout, or explore alternative investments if they wish to seek higher returns.

2. Increment of Enhanced Retirement Sum (ERS)

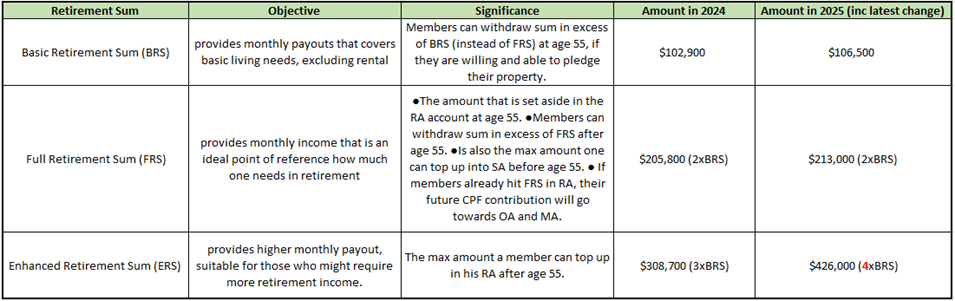

CPF Life is our national retirement plan designed to assist members in meeting their financial needs during their golden years by providing a lifelong income starting from age 65. The “Retirement Sum” serves as a guide on how much monthly income one can expect and this amount is adjusted to account for inflation. The following table can help you better understand the various “Retirement Sum” options.

The payout is still subjected to the actual amount in RA, payout age and the plan you chose. You can use the CPF life estimator here: CPFB | Calculators

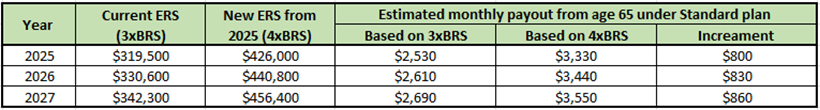

How much income can I generate with the higher ERS?

Source: https://www.mof.gov.sg/docs/librariesprovider3/budget2024/download/pdf/annexf1.pdf

Source: https://www.mof.gov.sg/docs/librariesprovider3/budget2024/download/pdf/annexf1.pdf

The ERS increment will generate an additional $800 (2025 figure) in retirement monthly payout. To further increase this income, members can consider delaying their payout age from age 65 up to age 70. With every year of delay, members can potentially increase the monthly payout by approximately 7%

For members who prefer CPF Life, this increment gives you the option of building a bigger stream of passive retirement income to meet your retirement needs. Conversely, members who aren’t as keen to commit more to CPF Life, may need to look for alternative investments due to the removal of the SA.

Members may be hesitating to contribute more to their Retirement Account (RA) for reasons beyond delayed gratification. Let’s examine those reasons.

Is it true that interest earned in the RA is not yours?

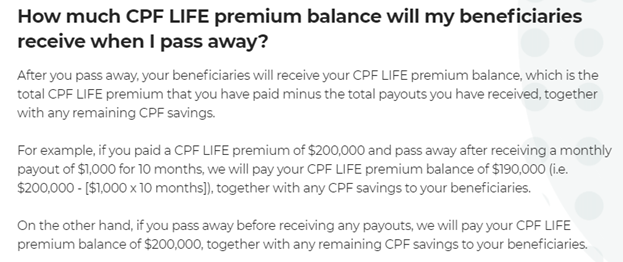

CPF life is meant to provide members with a retirement income for life. However, in the event of a member’s early passing, the total “CPF Life premium” less payout received will be returned, along with any remaining CPF savings in your OA and Medisave Account (MA). So suppose you top up your RA to the FRS of $205,800 just before 65, the entire sum of $205,800 will be used as CPF Life Premium if you choose the “Standard” plan or “Escalating” plan.

Source: CPFB | How much CPF LIFE premium balance will my beneficiaries receive when I pass away?

Source: CPFB | How much CPF LIFE premium balance will my beneficiaries receive when I pass away?

This begs the question, what about the interest earned from the $205,800? Unknown to many, all accumulated interests are actually consolidated to support members who live longer. Thus, CPF Life essentially functions as an insurance product, wherein you are exchanging the 4% return on your funds for the possibility of a longer payout period due to increased longevity.

Now let us consider sticking to the “Basic” plan, instead of choosing the “Standard” or “Escalating” plan.

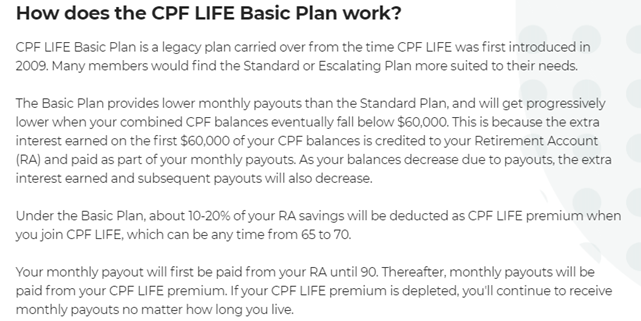

Source: CPFB | How does the CPF LIFE Basic Plan work?

Source: CPFB | How does the CPF LIFE Basic Plan work?

As opposed to the “Standard” or “Escalating” plans, opting for the “Basic” plan entails a deduction of only 10-20% of your RA savings as CPF Life Premium. The remaining 80-90% remains in your RA, and continues to accrue interest at 4%, while providing the monthly income drawdown until the age of 90. It is only after reaching this age that your monthly income switches to the CPF Life fund pool.

In the event of a member passing away before reaching the age of 90, the bequest amount comprises the remaining RA account balance, including the interest earned on the RA, and the unused CPF Life Premium, which constitutes the 10-20% of RA savings deducted at age 65. The “Basic” plan allows individuals to retain the majority of the interest earned, albeit resulting in a reduced monthly income compared to the “Standard” plan.

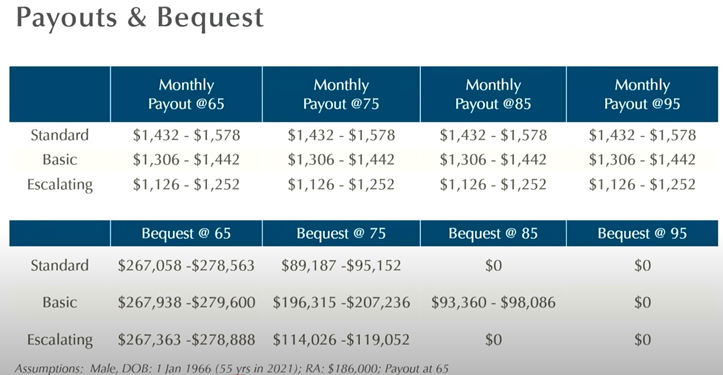

*Extracted from a video CPF LIFE Standard, Basic or Escalating Plan: Which Should You Choose? (youtube.com)

*Extracted from a video CPF LIFE Standard, Basic or Escalating Plan: Which Should You Choose? (youtube.com)

To put things in perspective, let’s study the table above. By choosing the “Basic” plan instead of the “Standard” plan, one gets about $130 less each month, but the difference in the bequest amount between age 75-85 is significantly different. Based on the average life expectancy of 83.7 years old (Singstat.gov), 18.7 years of $130 equates to $29,172 less in payouts, but the difference in the bequest amount is about 93-98K.

Conclusion

When it comes to retirement planning, there are no one-size-fits-all solutions, nor are there absolute right answers. The decision-making process is influenced by numerous factors, including individual circumstances, beliefs, risk tolerance and the array of available options. Individuals should reach out to their financial advisors should they be uncertain about making any financial commitments.

As a Wealth Manager, my role is to help my clients understand their options, evaluate their individual circumstances, and make informed decisions regarding their retirement planning. By providing personalised guidance and insights, I aim to empower my clients to choose the approach that best aligns with their goals and aspirations for retirement.

Contributor:

Lieu Teck Hua

Wealth Manager

Phillip Securities Pte Ltd (A member of PhillipCapital)

https://bit.ly/TTPlieuth

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Lieu Teck Hua

Wealth Manager

Phillip Securities Pte Ltd (A member of PhillipCapital)

Teck Hua, a Wealth Manager at Phillip Securities, brings extensive experience in advising on insurance and investment products. Starting as a Remiser in 2009, he swiftly transitioned into a dual-licensed role in financial advisory.

With a degree in Finance and certifications as a Chartered Financial Consultant and Associate Estate Planning Professional, Teck Hua is dedicated to providing quality financial advice. He has led seminars on topics like investment portfolio construction and will-writing, empowering over 700 clients with financial literacy.

From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It