How to derive passive income from stocks? July 15, 2021

This article was first published in The Edge on 25 June 2021.

Reproduced by permission of The Edge Publishing Pte Ltd. Copyright © 2021 The Edge Publishing Ptd Ltd. All Rights Reserved Worldwide.

Would you like to own shares in a business that consistently gives you income even in bad times? Are you overwhelmed by stock recommendations in the market and on the Internet?

Fret not. Read on to learn how to select stocks that can give you steadfast passive income through the years.

Dividend stocks are one of the simplest ways for investors to get passive income. Dividends are part of the earnings of a company that are given to shareholders.

Below are six pointers to help you identify businesses that can potentially give you a steady stream of passive income.

Stable net profits margins

A good business is able to earn money consistently. Track this by looking at a company’s net profit margins. A company’s net profit margin is calculated by net profit divided by revenue. By plotting a company’s net profit margins over several years, you will be able to see the margin trend and form an idea of whether its earnings are sustainable.

Dividend history

With stable net profits, businesses can afford to pay consistent dividends. Choose a business that not only earns stable net profits but has a history of consistently rewarding its shareholders with dividends.

In the market, there are stocks known as dividend stocks with a track record of paying regular dividends to shareholders. These are usually well-established and creditworthy companies with strong management teams and consistent earnings growth. Their dividends are most commonly issued as cash distributions at regular intervals such as every quarter, every half a year or every year.

Dividend payout ratio

When businesses pay out dividends, you want to make sure that they are not paying beyond what they can bear. Dividend payout ratios are calculated by dividing annual dividends per share by earnings per share.

Some businesses pay more than 100% of their earnings in a year to shareholders. This is not always appreciated by investors, as cash flowing into the business is less than what is being paid out. The high dividends, therefore, may not be sustainable in the long run. Ensure that the company you choose pays out less than 100%. By doing so, it can use its remaining cash to reinvest in the business for growth or keep it for rainy days.

Stable free cash flow

If you are a dividend investor, pay particular attention to a company’s free cash flow. Earnings are not always a good indicator of dividend sustainability. A company can be profitable but have little cash available for distribution.

As dividends are paid in cash, it is necessary to make sure that the company is generating more than enough free cash to pay dividends.

Free cash flow is the cash available to a company after accounting for cash outflows to support its operations and maintain its capital assets.

Companies with sufficient cash tend to be able to maintain or expand their business as well as pay consistent or growing dividends to shareholders.

Interest coverage ratio

Interest coverage ratio is calculated by dividing EBIT over interest expense.

EBIT refers to earnings before interest and taxes and can be found in the annual reports of companies. As a business borrows money to fund growth, it is required to pay interest on its borrowing. This is an interest expense. A business with solid, consistent earnings is generally able to service its interest payments comfortably.

You may select businesses with interest coverage of 2.5 or more which indicates a company has more than enough cash to pay off its interest.

Type of industry

In good times, consumers are more willing to spend on goods and services such as branded goods or overseas holidays. These boost the revenue of businesses that sell luxurious items or are in the tourism trade.

In bad times, consumers will cut down on their discretionary spending and conserve cash. They will spend only or largely on essentials.

But good times or bad, we all need to buy essential items such as toiletries and food staples. Hence, you may look for companies that supply essentials to invest in.

Putting it altogether

A good example of a business that meets our criteria is Sheng Siong Group. Practically all Singaporeans know about this supermarket operator.

But before we start, please note that this example is for education purpose only and not a call to buy or sell.

Sheng Siong’s grocery stores are scattered over various heartlands in Singapore. It runs the third-largest supermarket chain in Singapore, backed by an extensive distribution network and food-processing and warehousing facilities.

Let us look at how Sheng Siong fares in the six indicators.

Firstly, there is stable net profit margins. As illustrated in Chart 1, Sheng Siong’s net profit margins have been stable. They are, in fact, increasing.

Secondly, the chain pays consistent dividends. As illustrated in Chart 2, dividends per share —which give you passive income — are also rising.

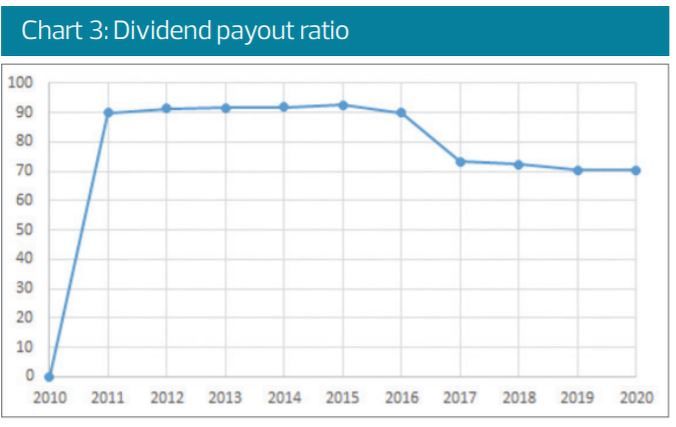

Finally, the dividend payout ratio is less than 100% (see Chart 3).

Sheng Siong shares whatever profits it makes with shareholders within its means.

Its dividend payouts have been below 100%. Another appeal is that as its dividends increase, its payout ratio is decreasing. This signifies that its earnings are increasing at a faster rate.

Sheng Siong is thus able to use its excess cash to grow its business or keep cash reserves for the rainy day. Sheng Siong’s interest coverage ratio meets our criterion of more than 2.5 (see Chart 4). In fact, there were years when Sheng Siong had no interest expenses. It did not have to borrow huge amounts of money to fund or develop its business.

Chart A: Market opening gap

Chart A: Market opening gap

Last but not least, recall that people need to buy groceries and necessities through thick and thin.

During the pandemic last year — which forced many to work and eat at home — Sheng Siong reported bumper earnings. This was thanks to its sales of fresh and chilled produce as well as general merchandise such as toiletries and household products, whose demand skyrocketed.

This brings us to our last indicator, which is non-cyclical industries.

Are you ready for the dive? Now that you have our guide on stock selections for passive income, take action immediately. Look up company annual reports to begin your investing journey!

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mike Ong (Senior Dealer) & Chua Minghan (Assistant Manager, Dealing)

Mike is a member of the largest dealing team that specialises in Equities, ETFs, CFDs & Bonds, and manages >50,000 client accounts in Phillip Securities. He believes in investing long-term for passive income and evaluates stocks using fundamentals.

He is currently the chief editor of the HQ education series that aims to equip clients with tools and skill sets to make better investing and trading decisions.

Chua Minghan graduated from the National University of Singapore with a Bachelor’s degree in Economics. He is passionate about education and went on to get a post-grad Diploma in teaching. His vision is to educate clients to make informed decisions for their trading and investments.

Minghan enjoys learning fundamental analysis, technical analysis, and strives to use data analysis to improve his trading skills

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap