How to Use Advanced Order Types to Invest: Part II May 12, 2021

At a glance:

- Advanced order types are risk-management tools that help investors and traders enter or exit the market according to their specified prices and quantities

- Advantages of using them include improved execution speed and minimised losses. Disadvantages include: order execution is not guaranteed and there’s a chance you end up paying higher prices

- Know your trading objectives in order to choose the right advanced order types

Reading time: 15 minutes

In Part I of our article on Advanced Order Types, we discussed six order types: Market Order, Limit Order, Market-On-Open, Market-On-Close, Fill-Or-Kill and Immediate-Or-Cancel. In this follow-up, we will touch on five other Advanced Order Types that you can leverage to trade with precision on POEMS.

What is Advanced Order Type?

Order types are tools that help traders enter or exit the market in a risk-managed manner.

There are many benefits of using Advanced Order Types in your trade, such as minimising losses when market conditions are unfavourable. Order types can also be used to execute orders when you are unable to monitor markets actively.

Have not read Part I of Advanced Order Types? Click here!

How to use Advanced Order Types to invest?

POEMS offers an array of order types that can help traders trade with precision and leverage market movements effectively.

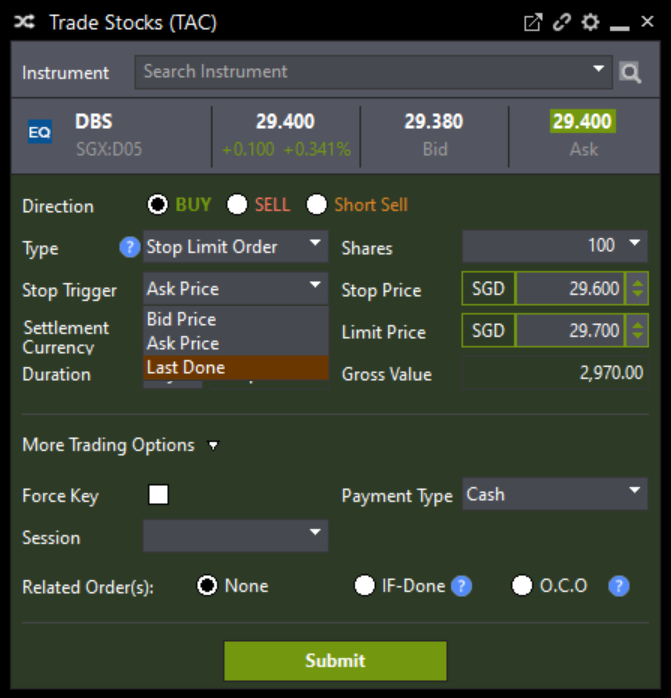

1. Stop Limit Order

What is a Stop Limit Order?

A Stop Limit Order is a combination of a stop order and limit order. It is an order to buy or sell a stock once the stock price reaches your specified trigger price. This is also known as the stop price. Once the trigger price is reached, a Stop Limit Order becomes a limit order and will be executed at the specified limit price.

SGX, AMEX, NASDAQ and NYSE stocks traded on POEMS are supported by Stop Limit Orders.

For Stop Limit BUY order, trigger price is a price that is above the current traded price while limit price is the highest price that a trader is willing to pay for, and vice versa. Generally, this order type is used to lock in profits or to limit downside losses.

For Stop-Limit Orders, you are able to select from three types of stop triggers: bid price, ask price and last done. The trigger price will depend on your selection.

Pro: This order type gives traders control over when the order should be filled. It also allows one to minimise losses on an existing long or short position.

Con: Order execution is not guaranteed in the event that the market price moves beyond the limit price. In such an event, the order will not be filled.

How it works?

There are two types of Stop Limit Orders:

- SELL Order, where the trigger price is placed below the current market price of the security

- BUY Order, where the trigger price is placed above the current market price of the security

Assuming that the stock price of ABC is trending up. It is currently trading at S$3.97.

A trader may place a Stop Limit Order to BUY ABC stock at a trigger price of S$4.01 and limit price of S$4.02. If the price of ABC reaches S$4.01, the order will be activated and turned into a limit order. However, if the stock gaps above S$4.02, the order may not be filled. Price gaps occur when the price of a stock moves sharply up or down, with little or no trading in-between.

When to use Stop Limit Orders?

This order type is commonly used when markets are volatile or when you are unable to monitor your portfolio actively. The stop feature helps traders stay on top of markets by automatically triggering an order if and when a stock reaches a specified price.

For more information about this order type, please visit: https://www.poems.com.sg/platforms/advanced-order-types/

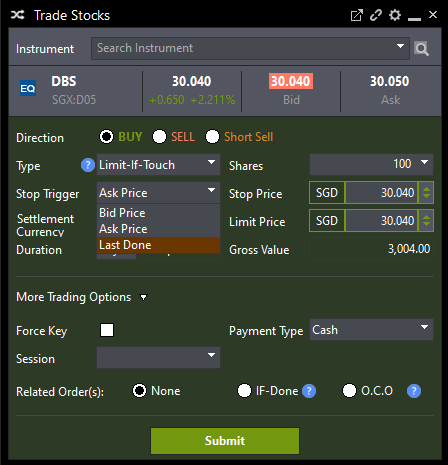

2. Limit-if-Touched (LIT) Order

What is a LIT?

Available for orders on the SGX, AMEX, NASDAQ and NYSE on POEMS Pro, and on the SGX on POEMS 2.0 and POEMS Mobile 2.0, LIT is an order to buy or sell a stock at a specific price. However, the order is only submitted when the trigger or stop price is reached.

LIT is similar to a Stop Limit Order, except that a LIT buy/sell order is placed below/above the current market price. A Stop Limit buy/sell order is placed above/below.

Traders would need to set two prices: the stop price and the limit price.

For a LIT BUY Order, the stop price is below the current traded price. The limit price is the highest price that a trader is willing to pay. In a LIT SELL Order, the stop price is above the current traded price. The limit price is the lowest price that a trader is willing to accept.

There are also three types of stop triggers to choose from: bid price, ask price and last done. The trigger price will depend on your selection.

Pro: This order type is useful in fast-moving markets, when traders may not be able to react in time to take advantage of buying or selling opportunities.

Con: Order execution is not guaranteed. This can be a drawback during market volatility when you may miss out on opportunities.

How it works?

There are two types of LIT Orders:

- SELL Order, where the trigger price is set higher than the current market price of the security

- BUY Order, where the trigger price is set lower than the current market price of the security

Assuming that a stock is trading at S$3.90. A LIT BUY Order trigger could be placed at S$3.85. A limit price could be set at S$3.80. When the stock price reaches S$3.85 or below, a limit order will be placed at S$3.80. The order will only be executed if there is a supply of stock asking for S$3.80 or less.

When to use Limit-if-Touched (LIT) Orders?

Generally, LIT is used to create new positions in anticipation of a reversing trend.

As this order type provides traders with the flexibility to buy and sell at specific price levels without the need to constantly monitor markets, it is handy in fast-moving markets when time is of the essence to take advantage of buying or selling opportunities.

For more information about this order type, please visit: https://www.poems.com.sg/platforms/advanced-order-types/

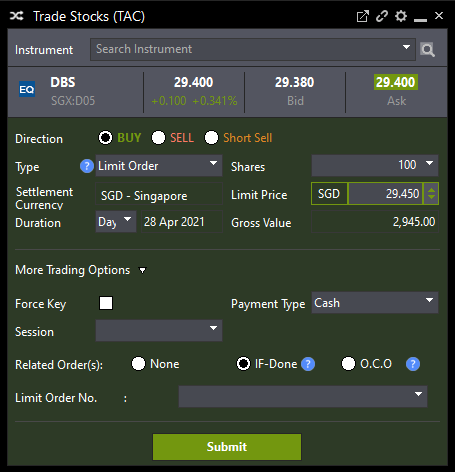

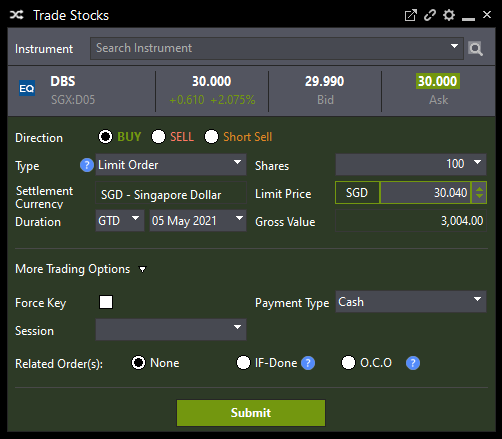

3. If-Done Order

What is an If-Done Order?

Available for orders across all markets on POEMS Pro, an If-Done Order is an order type that is made up of two orders: a secondary or “slave” order and a primary order. The secondary order takes effect only after the primary order is executed.

Pro: This order type removes the need to monitor markets all the time and is a great tool to protect investments from losses.

Con: An If-Done Secondary Order cannot take care of both profit and loss, only one of them. However, this can be overcome with a bracket order. Stay tuned as we will be introducing this on POEMS Pro in our upcoming release!

How it works?

An If-Done Order type simply means that the secondary order will only be executed if the primary order is filled.

Assuming XYZ is trading at S$9.30. After determining its support and resistance levels, a trader wants to BUY XYZ stock if its price drops to S$9. To take profit, the trader may wish to exit when its price goes up to S$9.50.

The trader can place two orders: 1) a primary order, which is a limit order to BUY XYZ at a limit price of S$9; and 2) a secondary order, which is a limit order with an If-Done instruction to SELL XYZ at S$9.50.

When to use If-Done Orders?

If-Done Orders are often used when traders are unable to monitor markets continuously but want to participate in market movements.

This order type is also commonly used in swing trading or pair trading.

Swing trading is taking trades in a stock that last a couple of days or up to several months in order to profit from anticipated price moves.

In swing trading, if a trader has determined a stock’s resistance and support levels, he can set up an If-Done BUY Order at the support level and a dependent sell order at the resistance level when the market price approaches the support level.

In pair trading, which involves different counters, if a trader has determined a negative correlation between the price movements of the two counters, an If-Done Order can be set up such that a buy/sell order of one counter is placed with a dependent sell/buy order of the other counter.

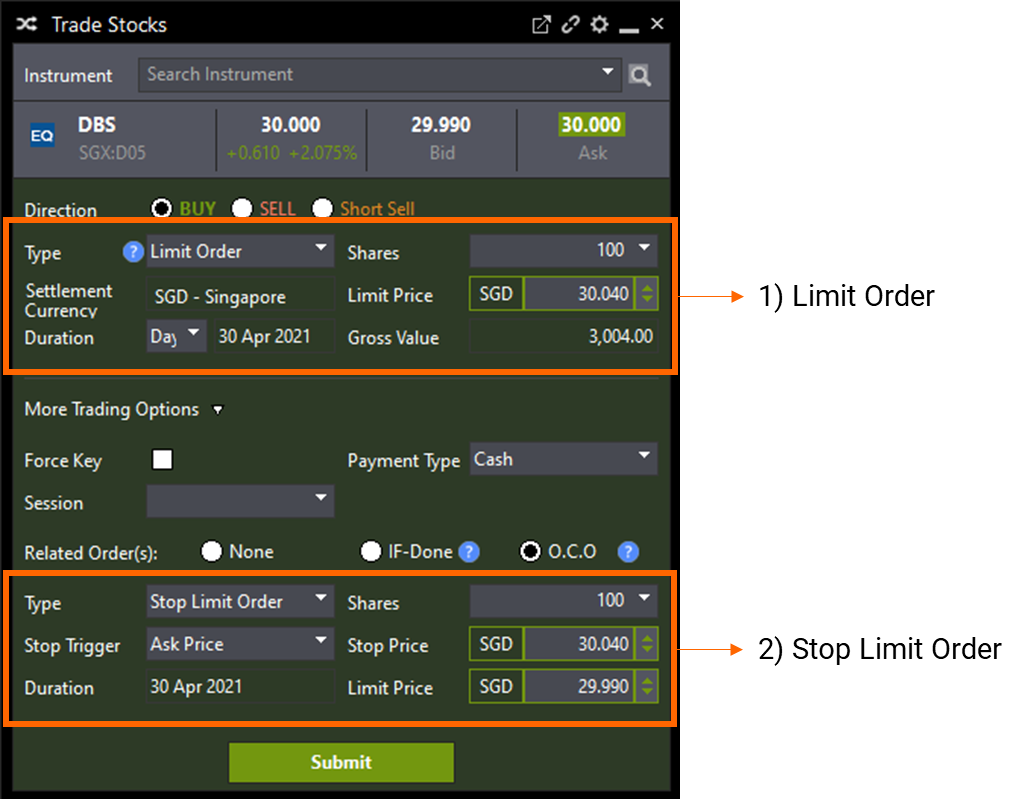

4. One-Cancels-The-Other (OCO) Order

What is an OCO?

Currently available for SGX orders on the POEMS Pro platform, OCO is an order type that combines stop and limit orders. Both orders are placed simultaneously to help a trader take profit or minimise loss. If one of the orders is fully or partially executed, the other will be cancelled.

Pro: OCO allows traders to combine buy orders and sell orders in a single order in order to protect their investments from losses or take advantage of price fluctuations.

Con: OCO orders require skilful execution and a deep understanding of the market, since traders need to place two types of orders.

How it works?

For this order type, traders would need to prepare one limit order and one Stop Limit Order.

Assuming that a trader is holding ABC stock at S$10 apiece and is expecting a bullish trend. To minimise loss and take profit, the trader can SELL his shares by setting a stop price of S$8 and limit price of S$12.

If ABC’s price falls below S$8, a stop loss order will be triggered and the limit order will be cancelled. The shares will be sold at S$8. However, if the stock trades up to S$12, a limit order to sell is executed. The shares will be sold at S$12. Concurrently, the S$8 stop-loss order gets cancelled.

When to use OCOs?

Generally used to take profits or cut losses, OCO orders are used when markets are volatile and stocks are trading in a wide price range. They are also particularly useful when a trader is unable to predict market directions or does not have the time to watch charts and react to markets constantly.

To better leverage OCOs, traders can utilise support and resistance levels to gauge the price trends of a counter.

5. Good-Till-Date (GTD) Order

Currently supporting orders on the NASDAQ, NYSE, AMEX, HKSE, BURSA and SGX on POEMS Pro, and SGX on POEMS 2.0 and POEMS Mobile 2.0, GTD is a type of order that is active until its specified date, unless it has been fulfilled or cancelled. If the order is not executed, it will be cancelled on the specified date of the order.

This order type allows traders to select an expiration date. Before this date, the order will remain valid. However, for SGX GTD orders, traders can only place orders for up to 30 calendar days. Calendar days start from the day the order is received by the SGX. For example, for orders submitted on the POEMS platform on Saturday, calendar days start from the following Monday, when the orders are released to the SGX.

GTD orders can be used in combination with many order types such as limit orders, Stop Limit Orders and LITs.

Pro: Traders can choose more extended time frames to execute trades.

Con: When an order is forgotten, it can become unfavourable when market conditions change.

How it works?

Assuming that a trader wants to BUY 5,000 XYZ shares at S$10 each before the month ends. A limit order can be placed at S$10 and a GTD instruction given to cancel the order if it cannot be filled by month-end. The order will only be fulfilled if there is a supply of XYZ shares at S$10 or less before the month ends. Otherwise, the order will be cancelled.

When to use GTD?

Generally, GTD is used when a trader knows what their stop-loss and profit targets are. As this order type is intended to alleviate the need to resubmit orders manually, traders can easily keep their orders open until a date of their choice.

Moreover, GTDs allow traders to get their orders filled based on the conditions they have set or cancelled as and when they wish.

For more information about this order type, please visit: https://www.poems.com.sg/platforms/advanced-order-types/

Available on POEMS 2.0, POEMS Mobile 2.0 and POEMS Pro, click here for more information on POEMS’ Advanced Order Types!

Have not read Part I of Advanced Order Type yet? Click here!

POEMS suite of trading platforms is made to suit the needs of all traders and investors. Open a Cash Plus Account to enjoy commission fee as low as 0.08%, no minimum* when you trade equities. Jumpstart your investing journey with POEMS now! *T&Cs Apply.

You may also be interested in…

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It