How to use Ticker Streamer to Invest January 13, 2021

At a glance:

- POEMS Ticker Streamer helps traders quickly determine selling and buying pressure on a counter.

- It provides real-time order execution of counters in your watchlist, giving you clues on what other traders are doing and at what price.

- Trades are represented by red (sell) and green (buy) triangles.

- Bright triangles indicate a new bid/ask is cleared. Dark triangles indicate the price is still at the previous bid/ask.

Reading time: 6 minutes

Investors and traders rely heavily on data to make trading decisions. While there are many trading tools out there that provide valuable information, there is also an increasing amount of “noise” that makes it difficult for traders to sift out the most vital information.

A tool that can help traders break data into digestible bite-sized information and process it more quickly is Ticker Streamer. Read on to learn how you can determine selling and buying pressure on counters in your watchlist using this tool to aid your trading decisions.

What is Ticker Streamer?

Humans are visual creatures. Most of us process information based on what we see and Ticker Streamer is designed precisely for that.

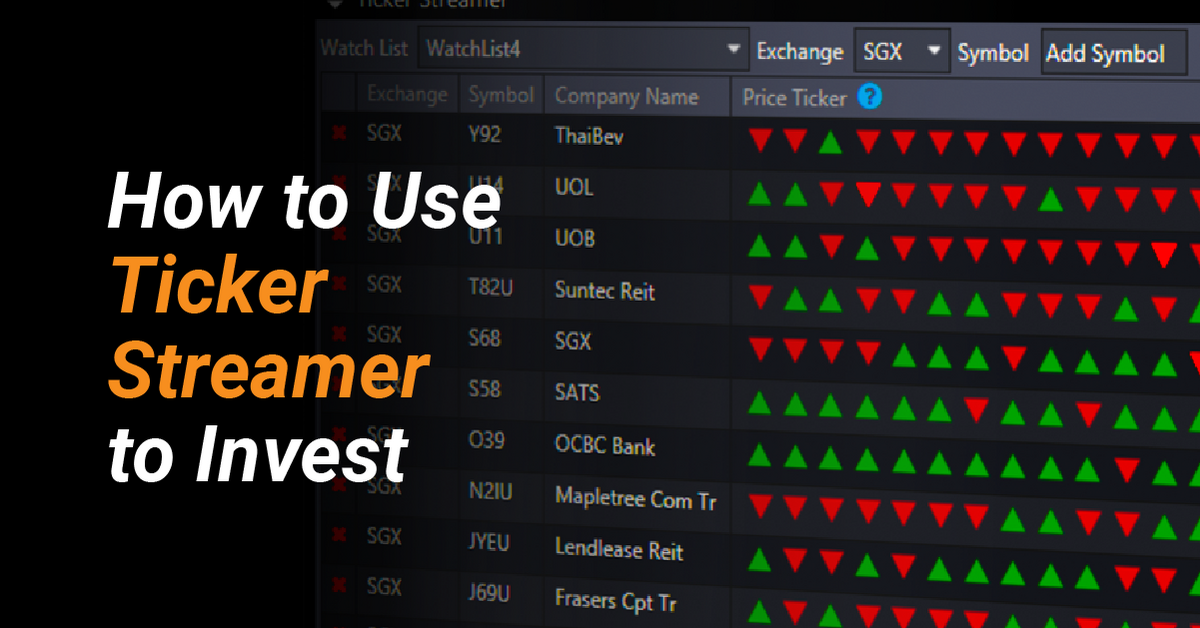

Ticker Streamer provides real-time order executions of counters in your watchlist. Basically, this tool is the visual representation of our Time & Sales tool. Similar to Time & Sales, it tells you when a trade is done, except that every line is now represented by a triangle.

Just by looking at the triangles’ colours, traders are able to determine the buying and selling pressure on counters. This makes it an ideal tool for those looking for aggressive trades. Not only does it allow you to track intraday market movements at a glance, it also gives you clues on what others are doing and at what prices.

How to use Ticker Streamer to invest?

The information above is meant for illustrative purposes and is not a recommendation to buy, sell or hold the securities. Figures are current as of December 2020.

The information above is meant for illustrative purposes and is not a recommendation to buy, sell or hold the securities. Figures are current as of December 2020.

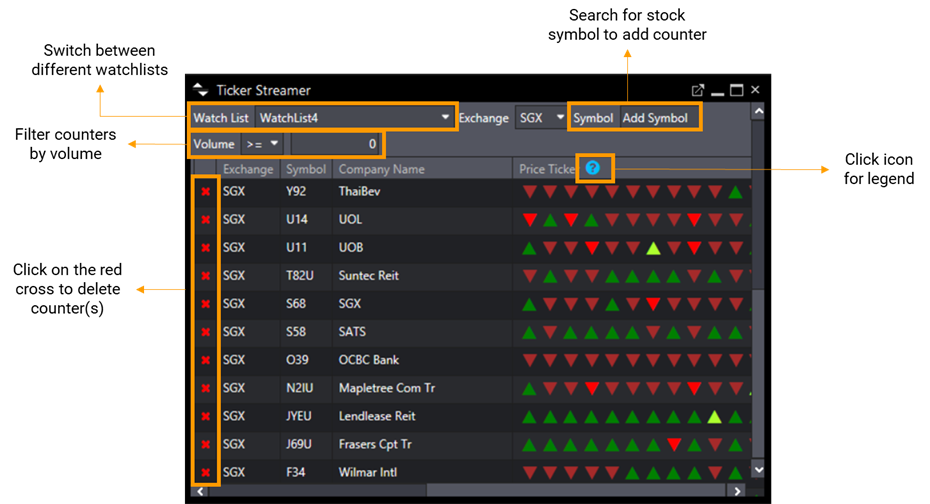

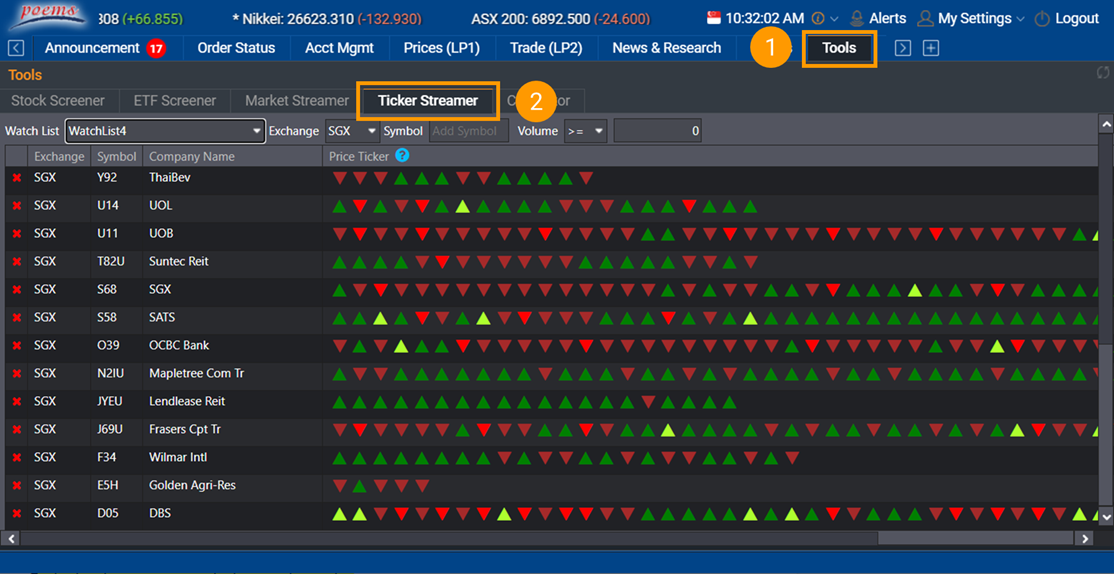

Ticker Streamer reflects the trade details of all counters in your watchlist. You can easily add or remove counters within this tool. Adding or removing counters will not affect your POEMS Watchlist. Interested in trades of a significant volume? Simply use the Volume Filter to change your display criteria.

To utilise this tool effectively, you would first need to understand what the triangles and their colours represent.

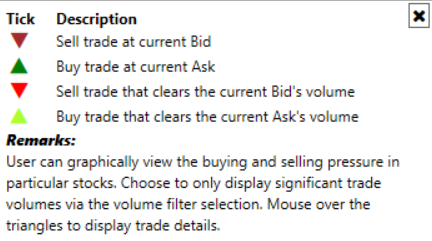

In Ticker Streamer, each triangle represents a trade done in the market. You can easily tell if the trade done is on the BID or ASK price by looking at the colour of the triangle. A green triangle symbolises a trade done on a ASK price, or a buy transaction. A red triangle symbolises a trade done on a BID price, or a sell transaction.

You will notice there are two shades to each colour – dark and bright. Dark indicates that a trade is done on the BID or ASK price, which is represented by a dark Red or Green triangle respectively. Bright Red or Green triangles let you know that a particular trade has cleared the remaining volume on the BID or ASK price, respectively.

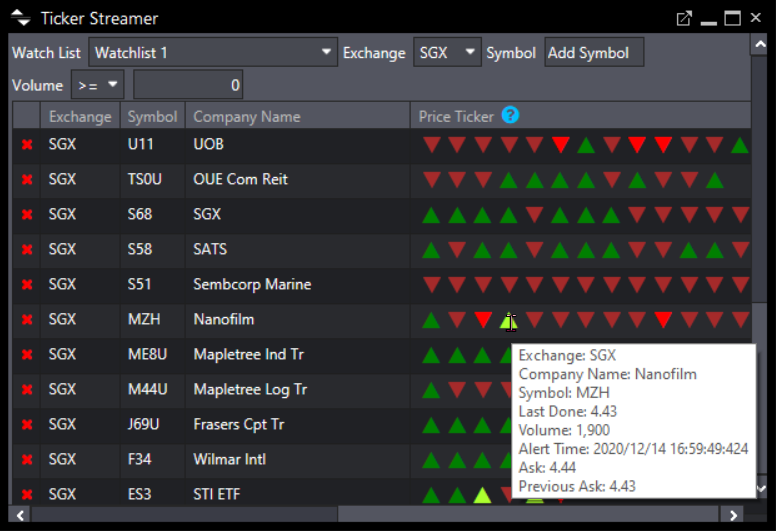

Need more information on the trades done? You can view trade details by hovering your mouse cursor over a specific triangle.

To help you better understand how this tool works, here’s an example of how you can interpret the trade details.

In the above illustration, you can see that a buy order of 1,900 Nanofilm shares was placed at S$4.43. At 16:59:49, it cleared the remaining volume on Ask at S$4.43, thus forming a new Ask price at S$4.44. This transaction is represented by a bright green triangle to inform traders that a transaction has been done on the price asked and the quantity on that price has been cleared.

Along with the colour of the triangles, you may also want to refer to the frequency and speed of it to gain trading insights and gauge the market direction. For example, multiple bright triangles could signal that there are transactions huge enough to move the market (i.e. more bright green triangles would likely send the market on an uptrend).

Fret not if you cannot remember the meaning of all the colours. A legend ![]() is available beside Price Ticker for your quick reference.

is available beside Price Ticker for your quick reference.

Tip: Interested in trades of a significant volume? Simply use the Volume Filter to change your display criteria. This can be used to identify indications of genuine demand.

Want a quick overview of the Ticker Streamer tool? Watch this video: https://bit.ly/3lmkjXI

Where can I find Ticker Streamer on POEMS?

POEMS 2.0

1) Go to Tools tab

2) Select Ticker Streamer

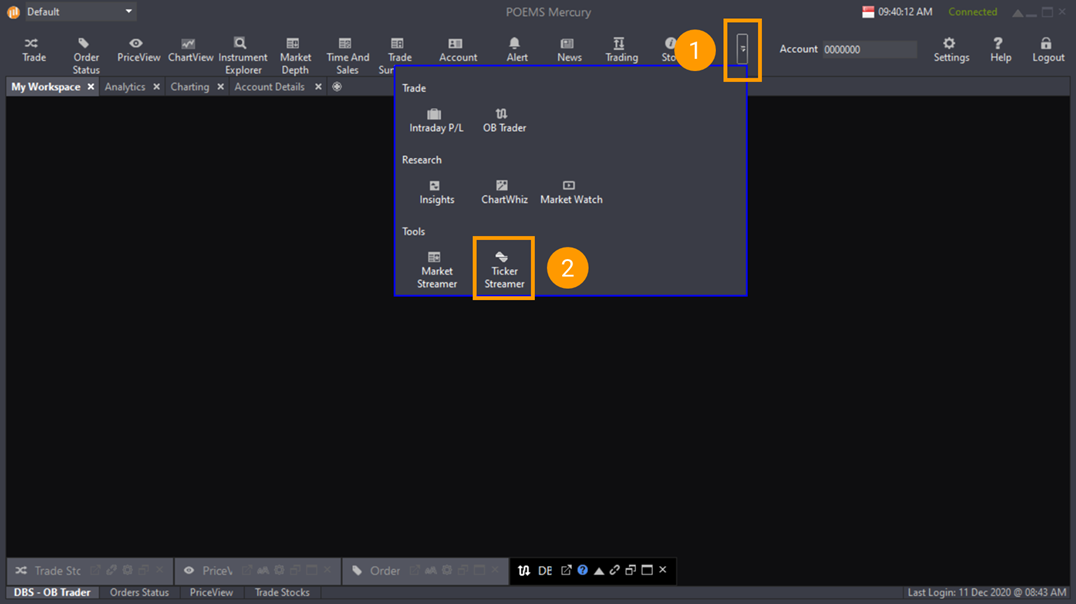

POEMS Pro

1) Expand the toolbar if you are unable to find Ticker Streamer

2) Select Ticker Streamer

Market Streamer is only available on POEMS 2.0 and POEMS Pro.

POEMS suite of trading platforms is made to suit the needs of all traders and investors. Open a Cash Plus Account to enjoy commission fee as low as 0.08%, no minimum* when you trade equities. Jumpstart your investing journey with POEMS now! *T&Cs Apply.

You may also interested in…

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.