How to Use Time & Sales to Invest? November 6, 2020

Reading time: 10 minutes

With thousands of transactions performed every single day, it can be difficult for investors and traders to sift the signals from the noise and gather relevant information for decision-making.

To identify shifts in supply and demand in stock markets, investors and traders often use the Time & Sales tool to observe significant trades and track the price movements of counters.

What is Time & Sales?

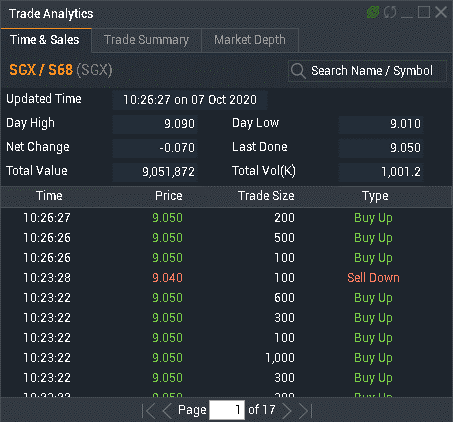

Time & Sales is a trading tool that provides real-time data feed of trade orders for a counter. Whenever anyone buys or sells counters, you will be able to see that transaction on Time & Sales.

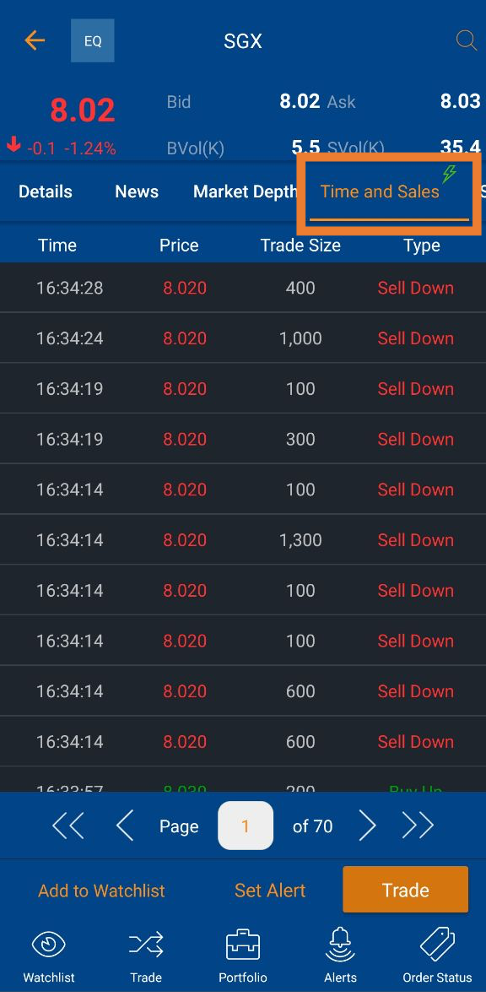

The information above is meant for illustrative purposes and is not a recommendation to buy, sell or hold this security. The figures are current as of October 2020.

The information above is meant for illustrative purposes and is not a recommendation to buy, sell or hold this security. The figures are current as of October 2020.

POEMS Time & Sales provides trade-by-trade details of counters, allowing you to track their price movements closely. Trades done are shown in reverse chronological order, with the latest displayed at the top of the list.

This tool contains four vital pieces of information:

- Time refers to the exact time a trade was executed

- Price refers to the dollar value at which the trade was completed

- Trade Size refers to the number of shares traded

- Type refers to whether it was a buy or sell trade

Live and available immediately, the trades on POEMS Time & Sales are colour-coded for your quick analysis. Green represents a buy, red indicates a sell. On top of the day’s high, low and net change in price, you can also check the total transaction value and volume of the day.

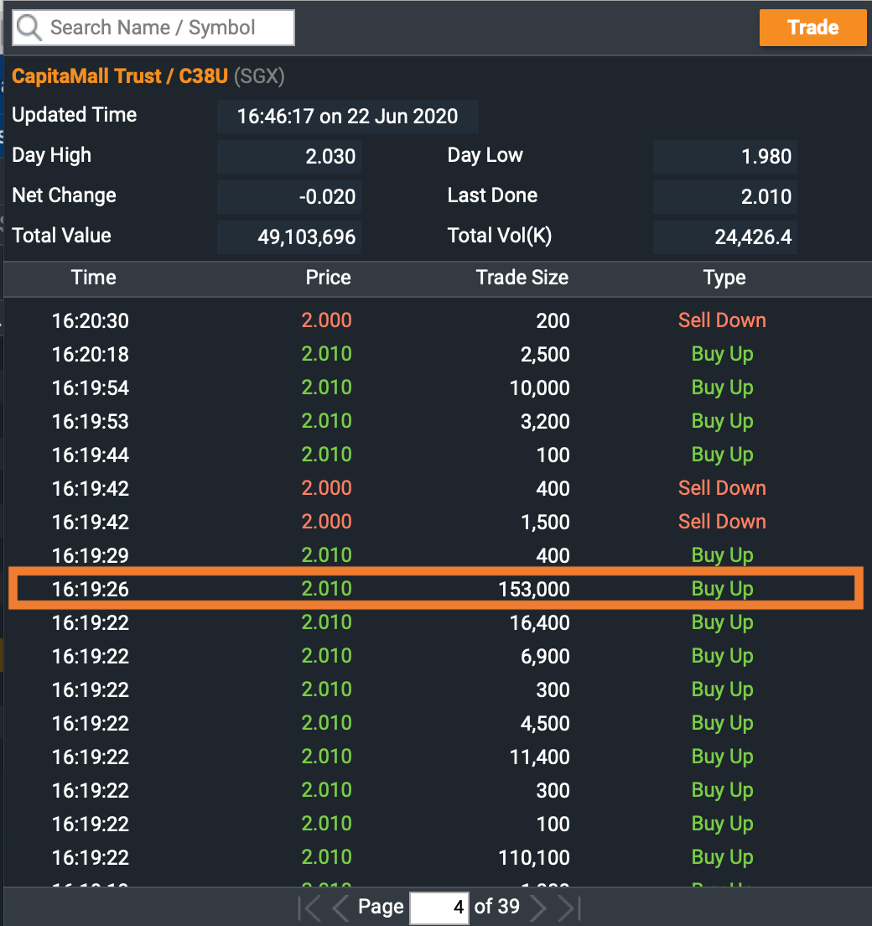

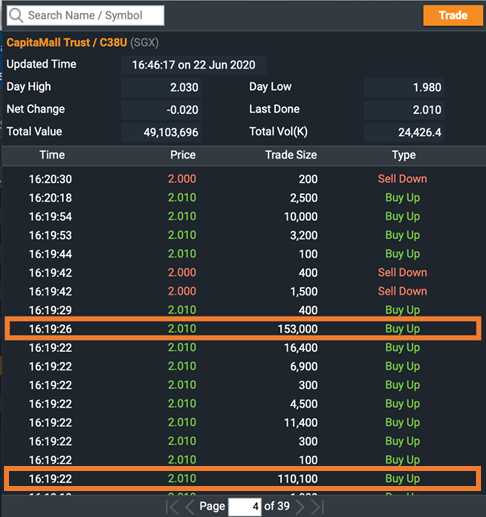

The information above is meant for illustrative purposes and is not a recommendation to buy, sell or hold this security. The figures are current as of June 2020.

The information above is meant for illustrative purposes and is not a recommendation to buy, sell or hold this security. The figures are current as of June 2020.

How to read Time & Sales transactions: for example, at 16:19:26, 153,000 shares at S$2.01 each were bought

How to use Time & Sales to invest?

This tool can reveal three things about a counter: trade direction, volume and speed of transaction. Such information can give you insights into the potential direction of the counter.

1. Trade direction: are traders buying or selling?

Generally, trade direction suggests who has initiated the trade – the buyer or the seller. On this tool, you will find two types of trade, Sell Down and Buy Up in red and green, respectively. To identify the price trend, you can use these colours to sense the urgency of trades in the market.

For example, if there are many recent transactions in green, chances are there are more buyers in the market. The demand will push prices up while creating a bullish trend. Conversely, many transactions in red indicate more sellers in the market. The oversupply may push the price down and create a bearish indication.

On top of trade direction, it is important to consider the volume and speed of trades to confirm a trend.

2. Volume: how significant are trade sizes?

While trade direction tells you if there are more buyers or sellers in the market, trade volume tells you about the players – whether they are retail or institutional traders.

By observing volume, you can gauge the supply and demand of the counter. Generally, the larger the volume, the more it can influence the stocks’ future price trend.

A significant volume may suggest institutional participation. Smaller trades are usually bought or sold by retail investors. A combination of large volume and multiple transactions may also further confirm the trend of the counter, based on its trade type.

The information above is meant for illustrative purposes and is not a recommendation to buy, sell or hold this security. The figures are current as of June 2020.

The information above is meant for illustrative purposes and is not a recommendation to buy, sell or hold this security. The figures are current as of June 2020.

In the above illustration, you can observe many buying activities, with several significant trades done at 16:19:26 and 16:19:22. This can suggest a potential uptrend.

3. Speed of transaction: are the trades done rapidly?

Trade execution speed helps investors and traders understand the level of interest in a counter. This can help you forecast its future market direction.

Typically, when a stock moves beyond its support or resistance levels following an increase in trade sizes and speed of transaction, it indicates that interest in the counter is growing.

However, the speed of transaction alone is not sufficient to confirm a market trend. It is best used in conjunction with other indicators, including volume and trade direction.

To make sense of the Time & Sales tool, you would need to watch the direction, volume, and speed to interpret a counter’s movements. The use of these three indicators concurrently is helpful in predicting up or down price trends.

Used in technical analysis, the Time & Sales data complements the use of charting tools for reading price movements. Unlike stock charts which provide an overview of market price movements, Time & Sales details each price movement of the stock.

On their own, stock charts and Time & Sales are useful trading tools. When used together, investors and trades can form a more holistic picture of a counter’s price actions.

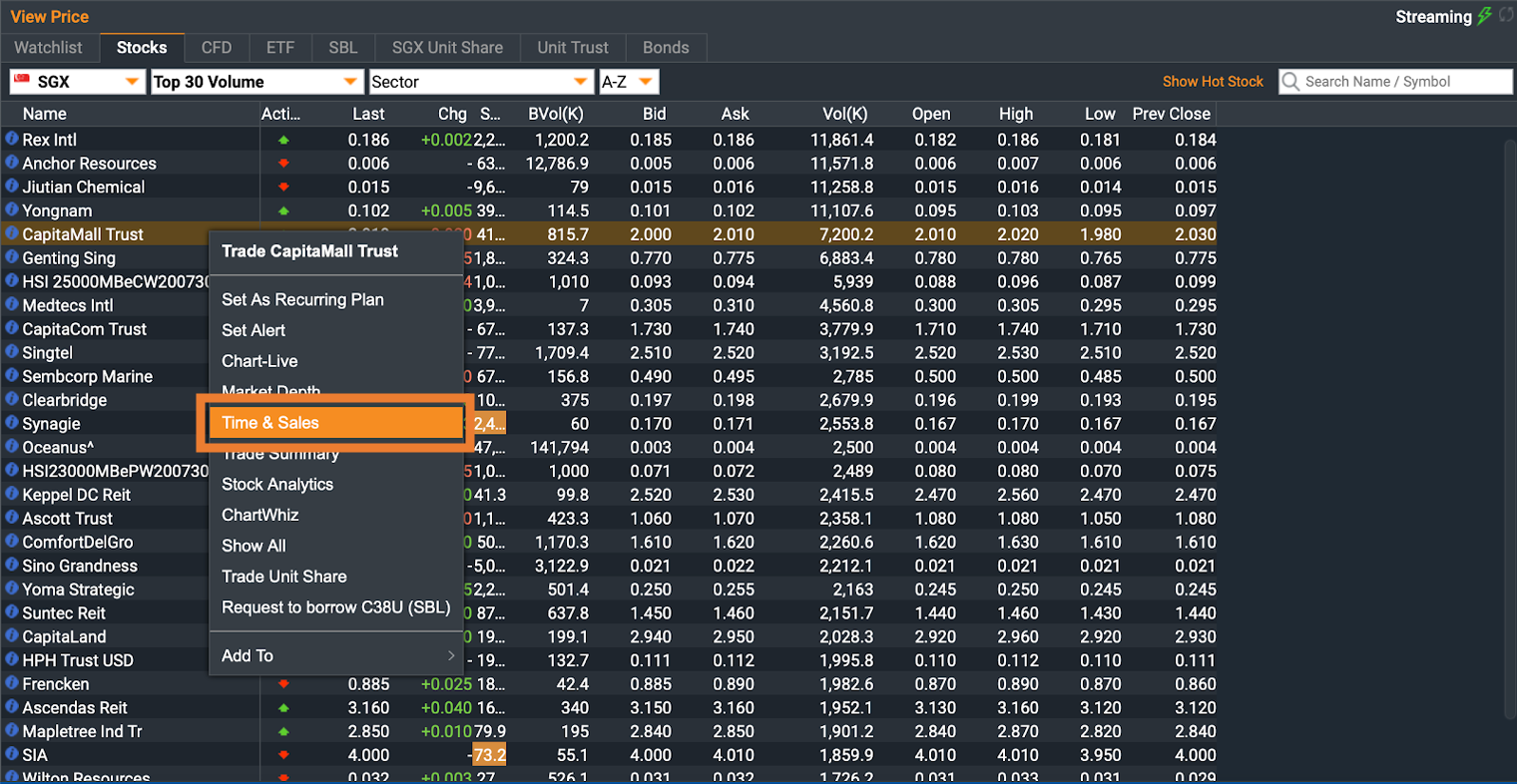

Where can I find Time & Sales on the POEMS suite of trading platforms?

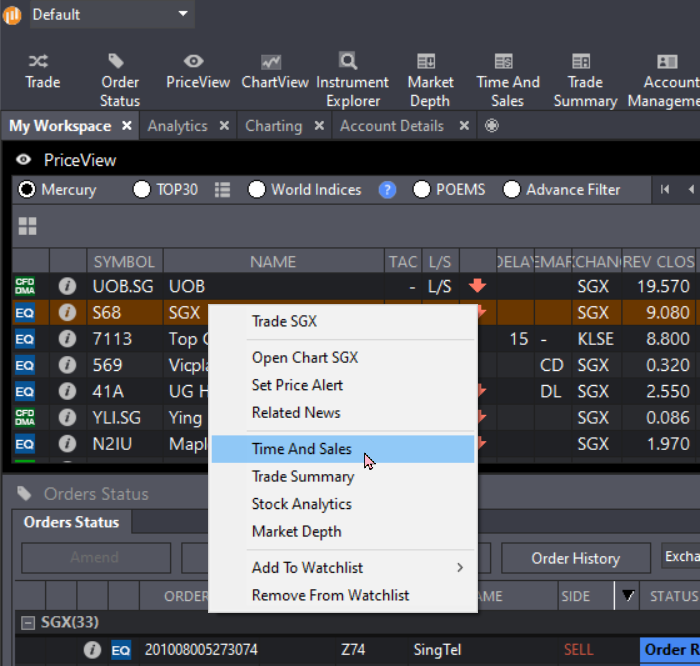

POEMS 2.0

On the POEMS 2.0 platform, simply right click on your desired counter and select Time & Sales.

POEMS Mobile 2.0

Method 1:

1) Select your desired counter

2) Select Time and Sales

1) Select and hold your desired counter

2) Select Time and Sales

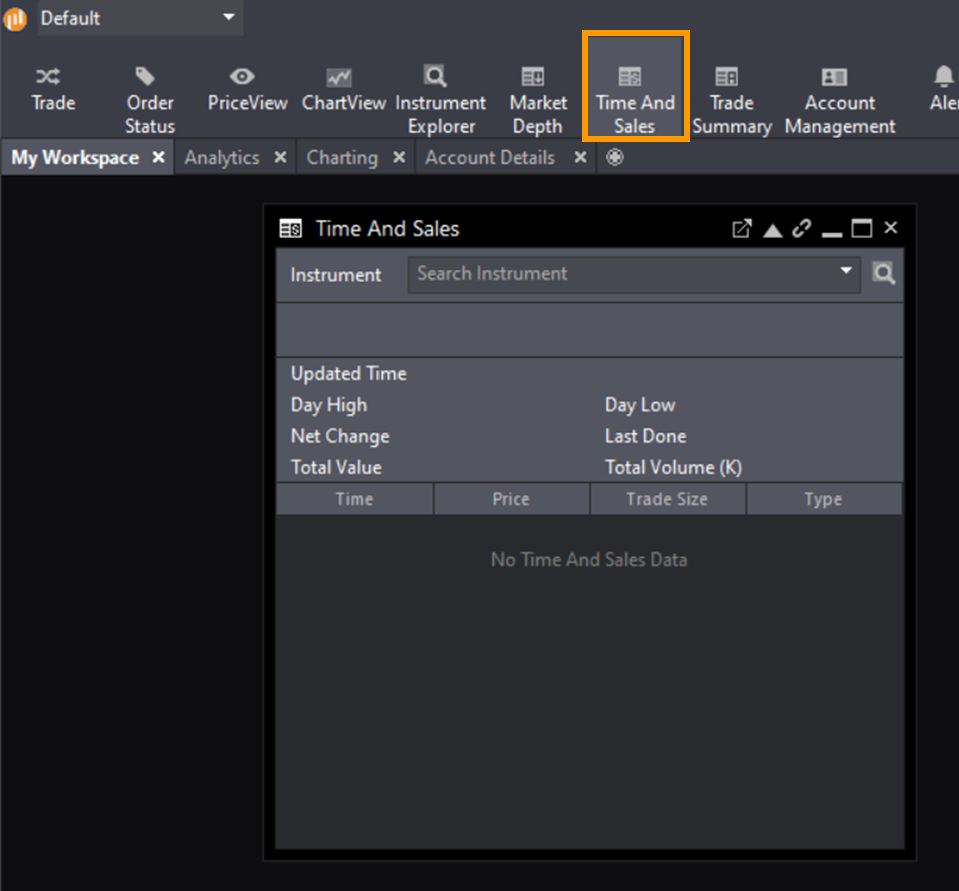

POEMS Pro

Method 1:

1) On the POEMS Pro platform, select Time And Sales

2) Search for your desired counter using the search instrument bar

Method 2:

1) In PriceView, right click on your desired counter

2) Select Time And Sales

Available on POEMS 2.0, POEMS Mobile 2.0 and POEMS Pro, use POEMS Time & Sales to know when to enter or exit a trade!

POEMS suite of trading platforms is made to suit the needs of all traders and investors. Open a Cash Plus Account to enjoy commission fee as low as 0.08%, no minimum* when you trade equities. Jumpstart your investing journey with POEMS now!

You may also interested in…

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

The 5 Levels of Mindset to Achieve FIRE

The 5 Levels of Mindset to Achieve FIRE  Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!