Three Defensive Sectors for a Volatile 2019 March 8, 2019

2018 was the worst performing year for the stock market in a decade since the Global Financial Crisis in 2008. The Dow Jones Industrial Average, S&P 500 and NASDAQ were down 5.6%, 6.2% and 4% respectively.1 After the volatile end to 2018, investors are bracing themselves for an unpredictable new year, with the US-China trade war and the uncertainty of Brexit weighing heavily on their minds.

During uncertain times like these, investors may try to adopt a defensive investment strategy aimed at minimising the risk of losing their investment principal. Besides allocating a greater proportion of the portfolio into conservative asset classes like bonds and cash equivalents, investors may also consider investing in defensive sectors.

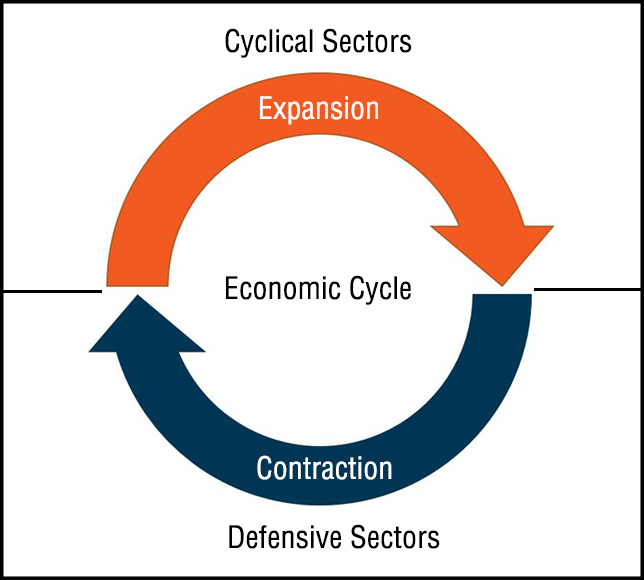

Cyclical Sectors vs Defensive Sectors

Before we introduce you to the defensive sectors, let us discuss the differences between cyclical sectors and defensive sectors. In financial terms, a sector refers to an area of an economy in which the businesses share the same operating characteristics, related products or services.

Cyclical sectors are highly responsive to the economic cycle. These sectors usually have high earnings volatility and operating leverage. Their products and services are generally expensive non-necessities. The purchase of these products and services can be delayed until the economy improves. One good example is the automobile sector. Many consumers will be unwilling to buy a new car when the economy is spiralling downhill, and this in turn affects car manufacturers’ revenues.

In contrast, defensive sectors produce goods and services for which demand is relatively stable. Food producers and basic services, such as supermarkets or drug stores, are examples of defensive industries in which revenues are less dependent on the economic cycle. An individual may have decreasing income but he/she is unlikely to reduce his/her food or medical spending significantly.

Examples of Cyclical Sectors and Defensive Sectors

| Cyclical Sectors | Defensive Sectors |

| – Consumer Discretionary– Materials– Technology– Industrials– Financials– Communication Services | – Consumer Staples– Utilities– Healthcare– Energy |

You may find more details regarding the classification of the different sectors by reading MSCI’s Report.

Exchange-Traded Funds

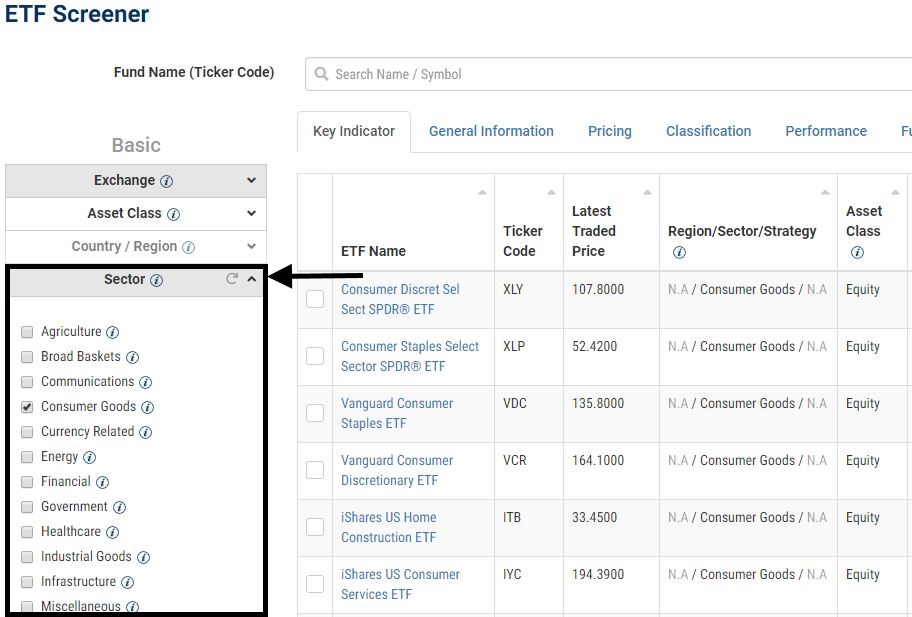

Even though it might seem easy to rotate between sectors based on the economic cycle, identifying individual stocks within the respective sectors is a more complex activity. Exchange-Traded Funds (ETFs) provide a convenient vehicle for investors to gain access to specific sectors for their investment strategies, without the need for stock selection.

In addition, the exposure to a basket of underlying stocks in an ETF reduces the concentration risk and volatility of the investment portfolio.

You may explore different ETFs with different sector exposure using our ETF Screener.

So what are the defensive sectors that investors may consider in a volatile market for 2019?

Healthcare

The healthcare sector did not just survive a volatile 2018. It thrived. Healthcare was the top performing S&P 500 sector last year, with a respectable gain of 6.5%.2 It is projected that global healthcare spending will reach US$10.059 trillion by 2022. Driven by a global ageing population and clinical technological advancement, the healthcare industry is estimated to have an annual growth rate of 5.4% from 2018 to 2020.3

| ETF | Health Care Select Sector SPDR Fund | Vanguard Healthcare ETF | Fidelity MSCI Healthcare ETF |

| Ticker | XLV | VHT | FHLC |

| Inception Date | 16 Dec 1998 | 26 Jan 2004 | 21 Oct 2013 |

| AUM (US$) | 19.58 billion | 9.27 Billion | 1.66 Billion |

| Expense Ratio | 0.13% | 0.10% | 0.08% |

| Number of Holdings | 64 | 384 | 356 |

| Top 3 Holdings | – Johnson & Johnson– UnitedHealth Group Inc– Pfizer Inc | – Johnson & Johnson– Pfizer Inc– UnitedHealth Group Inc | – Johnson & Johnson– UnitedHealth Group Inc– Pfizer Inc |

Utilities

Amidst some chaos seen by markets last year, the utilities sector has been slowly creeping back into the spotlight. The sector fell out of favour from 2016, broadly underperforming compared to other sectors within the S&P 500. However, the utilities sector has historically outperformed the broader market index in a down market. To illustrate, the utilities sector had an average yield of 4% on 31 October 2018, outperforming all the other S&P 500 sectors. It managed to record a positive gain after the stock market lost nearly US$2 trillion in the month of October.5

With the utilities industries leveraging new technologies to serve increasingly sophisticated customers and to improve operational efficiencies, we can expect utility capital expenditure in 2019 and 2020 to continue to stream in.6

Besides, utilities like water, gas and electricity are necessities during all phases of the economic cycle and consumers are unlikely to cut out these products and services from their daily lives.

| ETF | Utilities Select Sector SPDR Fund | Vanguard Utilities ETF | Fidelity MSCI Utilities ETF |

| Ticker | XLU | VPU | FUTYC |

| Inception Date | 16 Dec 1998 | 26 Jan 2004 | 21 Oct 2013 |

| AUM (US$) | 9.38 billion | 3.15 Billion | 0.601 Billion |

| Expense Ratio | 0.13% | 0.10% | 0.084% |

| Number of Holdings | 28 | 69 | 67 |

| Top 3 Holdings | – NextEra Energy Inc– Duke Energy Corp– Dominion Energy Inc | – NextEra Energy Inc– Duke Energy Corp– Dominion Energy Inc | – NextEra Energy Inc– Duke Energy Corp– Dominion Energy Inc |

Consumer Staples

Consumer Staples refer to essential products such as food, beverages, tobacco and household items. They are goods and services that people are unable or unwilling to cut out of their budgets, regardless of their financial situation. The consumer staples sector is typically viewed as a safe haven during periods of market volatility and economic downturn.

Increased geopolitical tensions and political anxiety arising from the US-China trade war may drive nervous investors to seek short-term shelter in the consumer staples sector and then rotate out of this sector once the global economic situation improves.

| ETF | Consumer Staples Select Sector SPDR Fund | Vanguard Consumer Staples ETF | Fidelity MSCI Consumer Staples ETF |

| Ticker | XLP | VDC | FSTA |

| Inception Date | 16 Dec 1998 | 26 Jan 2004 | 21 Oct 2013 |

| AUM (US$) | 10.00 billion | 4.43 Billion | 0.432 Billion |

| Expense Ratio | 0.13% | 0.10% | 0.08% |

| Number of Holdings | 34 | 93 | 94 |

| Top 3 Holdings | – Procter & Gamble Co– Coca-Cola Co– PepsiCo Inc | – Procter & Gamble Co– Coca-Cola Co– PepsiCo Inc | – Procter & Gamble Co– Coca-Cola Co– PepsiCo Inc |

All ETF Information is accurate as of 20 February 2019

Conclusion

2018 has been a roller coaster ride for investors, with steep drops on one day followed by sharp rebounds on the next. The market volatility is unnerving for investors but that does not mean that one should bypass the equity market in 2019 entirely.

Defensive sectors offer investors an interesting option to stay in the market and participate in any potential upside gain while providing some buffer against a downturn in market performance.

Past performance is not a guarantee of future results, but defensive sectors have often outperformed their cyclical counterparts during an economic downturn. It is also important to note that defensive sectors may not necessarily grow during down markets but they tend to “lose” less as compared to cyclical sectors that are more sensitive to the economic cycle.

ETFs with exposure to defensive sectors can be an important stabiliser to an investor’s portfolio during periods of market volatility or economic downturn. Alternatively, investors may utilise them as an investment tool for their sector rotation strategy and swap to cyclical sectors once market conditions improve.

Reference:

- [1] https://edition.cnn.com/2018/12/31/investing/dow-stock-market-today/index.html

- [2] https://novelinvestor.com/sector-performance/

- [3] https://www2.deloitte.com/content/dam/Deloitte/global/Images/infographics/lifesciences-healthcare/gx-lshc-hc-outlook-2019-infographic.pdf

- [4] https://www.fidelity.com/viewpoints/investing-ideas/2019-outlook-utilities

- [5] https://www.cnbc.com/2018/10/31/the-stock-market-lost-more-than-2-trillion-in-october.html

- [6] https://www.spglobal.com/marketintelligence/en/news-insights/research/utility-capital-spending-forecasts-for-2018-2019-surge

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr. Joel Lim

ETF Specialist

Joel graduated from Singapore Institute of Management, University of London with a First Class Honours in Business. He was the recipient of SIM University of London’s Top Student Bronze Award in 2017 and was the worldwide examination topper for the “Financial Management” module in 2016. Joel was also commended by University of London for his excellent performance in the 2014 Examinations.

Joel is involved in ETF education, providing trading ideas and support to traders, dealers and fund managers. Joel also works closely with ETF issuers to educate retail investors about new ETFs during the Initial Offering Period.

All-in-One Guide to Investing in China via ETFs

All-in-One Guide to Investing in China via ETFs  Everything you need to know on Bitcoin ETFs

Everything you need to know on Bitcoin ETFs  Maximising your Tax Savings & Retirement Funds with SRS in Singapore

Maximising your Tax Savings & Retirement Funds with SRS in Singapore  Is There a “Fairest of Them All”?

Is There a “Fairest of Them All”?