Popular traded US Stocks on POEMS in September 2021 October 28, 2021

The following lists some of the more popular stocks – not in any order of ranking – traded by POEMS customers amidst with major stock announcements in the month of September.

At a glance:

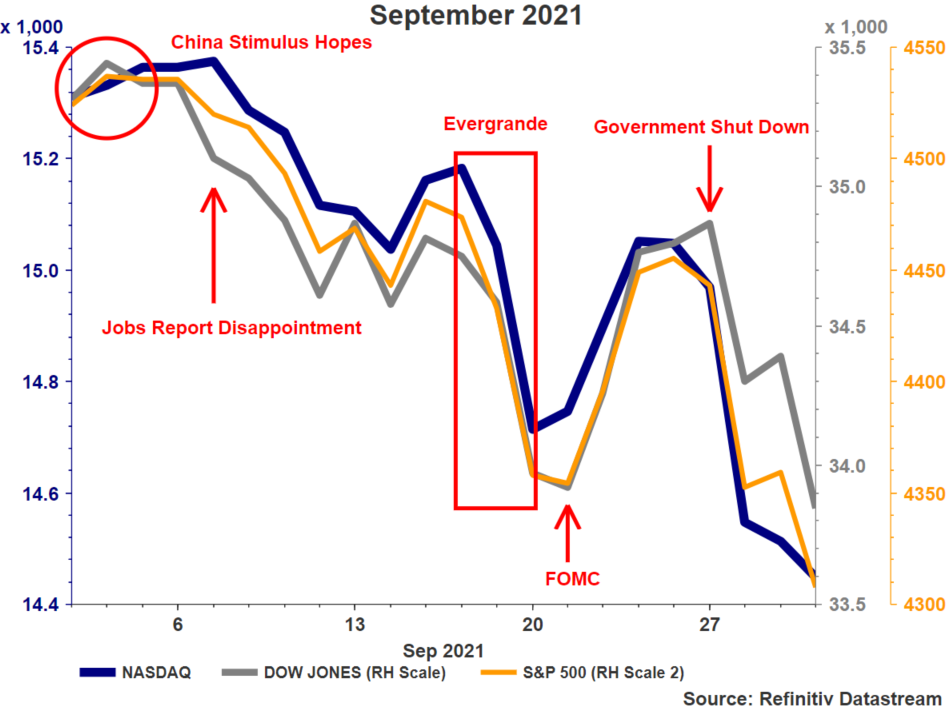

- After a long rally, the three major indices closed lower in September..

- Market sell-offs were a result of poor job market report, the Evergrande debt issue and a potential Government shutdown.

- The Federal Reserve announced that tapering might start soon without any rate hikes this year.

Traditionally, September is a bad month for Equities, possibly due the quadruple witching event where stock index futures, stock index options, stock options, and single stock futures expire simultaneously1.

The three US major indices – Dow Jones, S&P 500 and Nasdaq Composite opened the month on a positive note with hopes on China Stimulus2. The hope came about when Chinese manufacturing activities slowed for the first time since April 20203. This spurred investors to speculate that the Chinese government might have plans to implement fiscal policies to boost growth.

Subsequently, the three indices dipped following the disappointing results in August’s job report4. Economists were expecting a payroll increase of 720,000 in August. However, the market was greeted with an increase of 235,000 instead. This signalled that the economy was not recovering at the expected pace; the COVID-19 pandemic remains the limiting factor.

Shortly after, the Evergrande debt issue emerged due to a liquidity crunch. Evergrande is one of the largest real estate developers in the world. It is also however, the most indebted of them all. The Evergrande liquidity crunch came about from Beijing’s tightening of property developers’ borrowings5. Evergrande has an offshore debt of US$20 Billion and has missed two of its bond coupon payments.

Subsequently, Jerome Powell announced after the Federal Open Market Committee (FOMC) that tapering “may soon be warranted” and interest rate hikes will not be happening this year. This announcement put the market at ease but soon faced the uncertainty of the US government shutting down. A shutdown typically occurs when politicians fail to agree on a budget. When the government shuts down, debts that are deemed as risk-free will be defaulted which could be devastating on a global level6. Despite a few occurrences of the US government shutting down in the past, there were no instances of them defaulting on the loans.

Overall, the 3 major US indices ended the month on a negative note.

| NASDAQ | DOW JONES | S&P 500 | |

| Month Open | 15,637.13 | 35,387.55 | 4,531.57 | Month Close | 14,689.62 | 33,843.93 | 4,307.53 | Monthly return | -6.05% | -4.36% | -4.95% |

Tilray Inc (NASDAQ: TLRY)

Tilray Inc (TLRY) traded downwards for this month. They opened at US$13.74 and closed for the month at US$10.95, representing a loss in value of 21.3%.

The future looks bright for TLRY as the Federal Marijuana Legalization Bill clears with the House Committee7. With democrats controlling the Presidency and both chambers of congress, passing a bill that democrats favour will be easier.

This blue wave worked well for TLRY as all democrats supported the bill, suggesting that democrats may be in favour of legalising Marijuana at the Federal level. With that being said, trying to gain a piece of the US$17 Bil8 market in the US may prove challenging. TLRY will have to take the domestic US operators into consideration as they may have a strong foothold in the country, having instilled brand loyalty in US consumers. Thus, TLRY may need to invest in differentiating itself from its competitors.

TLRY released its quarter ending August 2021 results on 7 October 2021. The reported EPS for the same quarter last year was US$-0.27 which is lower than the current quarters of US$-0.08. Despite the improvement from last year, the latest quarter EPS was worse than the consensus EPS of US$-0.06. Moving forward, TLRY has plans to work in new product categories like wine in cans9.

Technical analysis:

Status: Bearish momentum

Support: US$8.90

Resistance: US$10.63

Immediate resistance must be broken for more upside

BIONANO GENOMICS (NASDAQ: BNGO)

BIONANO GENOMICS (BNGO) analyses long segments of DNA, detecting genetic diseases. BNGO traded downwards for this month, opening at US$5.79 and closed at US$5.50 which is a loss of 5%.

BNGO did a few gene research, including the largest clinical research for muscle weakness10 and scientific study on biomarkers for Lung Cancer11. Additionally, they were recently added into the Russell 2000 list which is closely followed by investors worldwide to measure the overall performance of small-cap to mid-cap stocks. This will add trading volume to the stock as funds that follow the index will need to mimic the index composition.

The latest revenue figure for Q2 2021 was US$3.9 million which is 229% higher than Q2 of 202012. Their current gross margin is at 37% with expectations for gross margins to remain. For EPS, they reported US$-0.06 which was lower than the estimated US$-0.05. Their goal for 2021 is to install 150 units of Saphyr, an optical genome mapping instrument. They have installed 121 units of such systems as of 30 June this year and are confident of hitting their goal.

Earnings for 3Q21 will be released on 11 November 2021 and the EPS forecast is at -0.0613.

Technical analysis:

Status: Neutral

Support: US$5.12

Resistance: US$5.99

Range-bound

Moderna Inc (NASDAQ: MRNA)

September has been a volatile month for Moderna Inc (MRNA). MRNA started off the month at US$382.84 and climbed 21% to a high of US$464.12 before closing the month flat at US$384.86.

The movement for the month was mainly due to a few factors.

MRNA’s announcement to develop a two-in-one vaccine for COVID-19 and Flu14 caused MRNA to rally. The newly developed vaccine provides a booster against both COVID-19 and flu with a single dose. Phase 2/3 of the study is planned to launch by the end of 2021.

The second rally rooted from the possibility of having booster shots15. Given that millions may need Booster shots, this could potentially boost MRNA’s revenue considerably. However, accurate estimation of the volume of booster shots required remains unknown in this equation.

The downward pressure resulted from Food and Drug Administration (FDA)’s support for the booster shots to be administered only to those aged 65 and above. This information came as a blow to the vaccine maker as investors were expecting a wider range of individuals needing the booster jab. The FDA panel voted against booster shots for those under the age of 65, hence limiting the demand for booster shots severely.

Technical analysis:

Status: Neutral

Support: US$292.03

Resistance: US$330.33

Range-bound

Lucid Group Inc (NASDAQ: LCID)

Lucid Group Inc (LCID), formerly known as Atieva, was founded in 2007 as an American electric vehicle manufacturer.

LCID announced that production of its US$169,000 Air Dream Edition luxury sedan has begun from 28 September 2021. They also announced cashless redemption of its public warrants. Furthermore, the US Environmental Protection Agency officially gave LCID a record 520-mile battery range rating. The above-mentioned factors contributed to the bullishness on LCID stock, which saw shares of LCID soar 27.2%.

LCID delivered 577 units of its first and newly launched Lucid Air in 2021. They are aiming to deliver a further 20,000 units in 2022.

The company mentioned that it has received more than 13,000 reservations for Lucid Air models as of September 2021.

The share price of LCID is currently trading towards a high for the month at US$24.01 as at 20 September 2021. The highest in the month was traded at US$27.85 and the lowest was traded at US$18.93.

Technical analysis:

Status: Neutral

Support: US$21.91

Resistance: US$24.56

Immediate resistance must be broken for more upside

TESLA INC (NASDAQ: TSLA)

Tesla Inc (TSLA), the maker of electric vehicles with the largest market cap in the auto industry, continued its winning streak from last quarter when it surpassed the 200,000-car delivery figure for the first time since it began reporting earnings. Pandemic-induced supply chain bottlenecks and global chip shortages slowed operations in the automobile industry as a whole. Hence, it is extremely impressive that TSLA managed to thrive even in such harsh environments.

TSLA produced a total of 237,823 vehicles in the third quarter of 202116, nearly 3.6% more than anticipated. Out of that figure, 228,882 vehicles were Model 3 or Model Y cars—its mid-range cars targeted at price-conscious customers. The company also produced 8,941 editions of its pricier best-seller sedans Model S and Model X.

With tailwinds from the Biden administration through the legislation to make electric cars cheaper and announcements of further plans to build infrastructure to support electric vehicles, TSLA is positioned to benefit even through this pandemic-laden period.

The increase in prices for important materials essential to the auto industry, like steel and aluminium, will see a massive cost increase, Tesla is experiencing an inventory shortage causing its car prices to rise as a result.

TSLA has been on a bullish run for 7 consecutive weeks since August 2021. It’s share price is trading towards a high for the month at US$782.75, the highest in the month was traded at US$806.97 and the lowest was traded at US$712.73.

Technical analysis:

Status: Bullish Momentum

Support: US$798.64

Resistance: US$830.49

Immediate resistance will turn support once broken once bullish candle close

Ideanomics Inc (NASDAQ: IDEX)

Ideanomics Inc (IDEX) provides opportunities for investors in the financial technology (fintech) and electric vehicle(EV) industries. The company aims to manufacture zero-emission commercial vehicles like trucks and buses, and provide wireless charging17.

In the month of September, IDEX announced that they will be further supporting Energica Motor by employing their Capital and Mobility divisions18. This partnership will create a new Dealer Floor Plan financing arrangement that will help to double the number of in house EV car dealers in the United States. IDEX deems that this collaboration can help with scaling and growing their revenue and also increase brand awareness among consumers.

Thus, with IDEX taking steps to gain market share in the EV industry, the current dip in price may be a good buy for investors. IDEX closed 20.8% lower for September, from the opening price of US$2.49 to a closing of US$1.9719.

Technical analysis:

Status: Neutral

Support: US$1.89

Resistance: US$2.15

Range-bound

Nio Inc (NYSE: NIO)

Nio Inc (NIO), a major player in the electric vehicle (EV) industry reported their monthly quarterly deliveries for Q3. Results showed that NIO delivered 10628 vehicles globally in September 2021, which is about an 80% increase from August 5880 deliveries and is also the highest number of deliveries that Nio has completed. There was a total of 24,439 vehicles delivered in Q3, beating estimates of 22,500 to 23,500 by about 6% and an increase in deliveries by 11.6% compared to the previous quarter of 21,896.

NIO has also announced that they have completed delivery of their first batch of vehicles to Norway, opening the doors for them to compete for market shares in the Europe market. With continuous increase in deliveries that lead to an increase in revenue, analysts believe that NIO might turn into a profit by 2023. As of September closing, NIO is trading at US$35.63, which is about a 5% drop from the opening of US$37.49.

Technical analysis:

Status: Bullish Momentum

Support: US$36.33

Resistance: US$39.62

Immediate support has to hold for more upside

Xpeng Inc (NYSE: XPEV)

Dropping from a month opening at US$41.10 to close at US$35.54 (13.5% drop), Xpeng Inc (XPEV); another major player in the Electric Vehicle (EV) industry appealing to a large growing base of technology-savvy middle-class consumers in China, announced vehicle delivery results for September and Q3 2021. There was a total of 10,412 deliveries made in September a record high, 44.3% higher than the previous month of 7,214. This brings the total deliveries made for Q3 to 25,666 vehicles.

In the month of September, XPEV also launched P5, their new model with lidar sensors. These sensors distinguish pedestrians, cyclists and other objects in different locations and weather. With the advancement of technology, self-driving might become a norm. The continuous increase in deliveries as well as the newly launched model could potentially attract consumers who appreciate technology with unique features.

Technical analysis:

Status: Bullish Momentum

Support: US$39.73

Resistance: US$44.15

Immediate support has to hold for more upside

Palantir Technologies Inc (NYSE: PLTR)

Palantir Technologies Inc (PLTR), a software company that provides enterprise data platforms that are mainly used by organisations with complex and sensitive data, closed at US$24.04 for the month of September, a 9.15% drop from its opening price of US$26.46. PLTR announced that they have been selected by the US Army for intelligence Systems and Analytics to deliver intelligence data and analytics foundation. PLTR was also selected for the US Army’s US$823 million indefinite delivery and quantity contract.

While this sheds some light on their revenue levels, it also signifies the capabilities and trustworthiness of PLTR’s branding for big data analytics. The collaboration between PLTR and the US Army serves as a good springboard for the company to leverage, attracting potential collaborations with other corporate enterprises.

Technical analysis:

Status: Neutral

Support: US$23.59

Resistance: US$25.07

Range-bound

Apple Inc (NASDAQ: AAPL)

Closing at US$141.50 for the month of September, a 7.4% drop from an opening of US$152.83, Apple Inc (AAPL) launched their new iPhone model, iPhone 13 Pro. The new iPhone model offers a number of new features that should catch the attention of consumers. The latest A15 Bionic processor operates 50% faster than its competitors’ phone models. As consumers continue to seek for newer and faster technology, the new iPhone could potentially catch the attention from both new and existing users.

According to survey results, 65% of current iPhone users are looking to upgrade their mobiles, while around 50% of Android users have the desire to make the switch over to iOS. Additionally, 54% of respondents showed interest in the iPhone 13 Pro model. The evidently high demand for the new iPhone 13 model could potentially boost revenues for AAPL. However, supply chain blockages might result in delays in deliveries, hence a slower revenue is expected.

Technical analysis:

Status: Neutral

Support: US$140.61

Resistance: US$144.78

Immediate resistance must be broken for more upside

Bloomberg analysts’ recommendations

The table below shows the consensus ratings and average ratings of all analysts updated on Bloomberg in the last 12 months. Consensus ratings have been computed by standardising analysts’ ratings to a scale of 1 (Strong Sell) to 5 (Strong Buy). The table also shows the number of analysts’ recommendations to buy, hold or sell the stocks as well as their average target prices.

| Security | Consensus Rating | BUY | HOLD | SELL | Target Price (US$) |

| Ideanomics Inc (NASDAQ: IDEX) | 5 | 1(100%) | 0 | 0 | 7 |

| BIONANO GENOMICS (NASDAQ: BNGO) | 5 | 4(100%) | 0 | 0 | 11.5 |

| Xpeng Inc (NYSE: XPEV) | 4.68 | 17(89.5%) | 2(10.5%) | 0 | 55.6 |

| Nio Inc (NYSE: NIO) | 4.62 | 25(86.2%) | 3(10.3%) | 1(3.4%) | 60.4 |

| Apple Inc (NASDAQ: AAPL) | 4.46 | 37(77.1%) | 9(18.8%) | 2(4.2%) | 166.76 |

| Lucid Group Inc (NASDAQ: LCID) | 3.67 | 2(66.7%) | 0 | 1(33.3%) | 23.33 |

| TESLA INC (NASDAQ: TSLA) | 3.36 | 22(46.8%) | 12(25.5%) | 13(27.7%) | 662.92 |

| Tilray Inc (NASDAQ: TLRY) | 3.29 | 5(23.8%) | 14(66.7%) | 2(9.5%) | $14.36 |

| Moderna Inc (NASDAQ: MRNA) | 3.25 | 6(37.5%) | 6(37.5%) | 4(25%) | 341.08 |

| Palantir Technologies Inc (NYSE: PLTR) | 2.75 | 2(25%) | 3(37.5%) | 3(37.5%) | 24.83 |

To round up

September was a volatile month with many unforeseen events. Majority of the stocks had a lower month closing and hence might be a good opportunity for investors to pick up stocks with good potential at a discounted price. Despite the setbacks faced in September, the Bloomberg analysts are still bullish in the near term. Based on the latest FOMC, tapering is expected to take place by year end and the first-rate hike is expected in 2022 which could lift some uncertainty off the market.

The Core Personal Consumption Expenditures (PCE) price index scheduled for on release on 29 October 2021, is the upcoming data release that warrants attention. to zoom in on. This will be used as one of the data points in determining the start of tapering during the next FOMC meeting in November.

Reference:

- [1] “Quadruple Witching.” 6 Sept. 2021, https://www.investopedia.com/terms/q/quadruplewitching.asp. Accessed 16 Oct 2021.

- [2] “Stocks push higher on US and China stimulus hopes | Financial Times.” 1 Sept. 2021, https://www.ft.com/content/09798d7d-8aae-4ea5-83b7-eaba902ef321. Accessed 9 Oct. 2021..

- [3] “China manufacturing activity slows for first time since April 2020.” 31 Aug. 2021, https://www.ft.com/content/c6c4d528-e699-4291-b05c-3ea01c620bbc. Accessed 9 Oct. 2021.

- [4] “Jobs report August 2021 shocker: Only 235,000 new jobs – CNBC.” 3 Sept. 2021, https://www.cnbc.com/2021/09/03/jobs-report-august-2021.html. Accessed 9 Oct. 2021.

- [5] “Evergrande on brink of collapse: 4 things to know – Nikkei Asia.” 22 Sept. 2021, https://asia.nikkei.com/Business/Markets/China-debt-crunch/Evergrande-on-brink-of-collapse-4-things-to-know Accessed 9 Oct. 2021.

- [6] “Can the US avoid another government shutdown? – BBC News.” 30 Sept. 2021, https://www.bbc.com/news/world-us-canada-58732793. Accessed 9 Oct. 2021.

- [7] “Federal Marijuana Legalization Bill Clears House Committee – Filter.” 1 Oct. 2021, https://filtermag.org/federal-marijuana-legalization-bill/. Accessed 6 Oct. 2021.

- [8] “U.S. Cannabis Sales Hit Record $17.5 Billion As Americans … – Forbes.” 3 Mar. 2021, https://www.forbes.com/sites/willyakowicz/2021/03/03/us-cannabis-sales-hit-record-175-billion-as-americans-consume-more-marijuana-than-ever-before/. Accessed 6 Oct. 2021.

- [9] “Tilray, Inc. (TLRY) Q1 2022 Earnings Call Transcript | The Motley Fool.” 8 Oct. 2021, https://www.fool.com/earnings/call-transcripts/2021/10/08/tilray-inc-tlry-q1-2022-earnings-call-transcript/. Accessed 10 Oct. 2021.

- [10] “Largest Clinical Research Study to Date Evaluating Optical Genome ….” 29 Sept. 2021, https://www.bloomberg.com/press-releases/2021-09-29/largest-clinical-research-study-to-date-evaluating-optical-genome-mapping-for-analysis-of-facioscapulohumeral-muscular-dystrophy. Accessed 6 Oct. 2021.

- [11] “Study Finds the Combination of Optical Genome Mapping and Short ….” 16 Sept. 2021, https://www.bloomberg.com/press-releases/2021-09-16/study-finds-the-combination-of-optical-genome-mapping-and-short-read-sequencing-provides-a-comprehensive-genome-analysis-for. Accessed 6 Oct. 2021.

- [12] “Bionano Genomics, Inc (BNGO) Q2 2021 Earnings Call Transcript.” 5 Aug. 2021, https://www.fool.com/earnings/call-transcripts/2021/08/05/bionano-genomics-inc-bngo-q2-2021-earnings-call-tr/. Accessed 7 Oct. 2021.

- [13] “Bionano Genomics, Inc. Common Stock (BNGO) Earnings Report Date.” https://www.nasdaq.com/market-activity/stocks/bngo/earnings. Accessed 7 Oct. 2021.

- [14] “Moderna Is Developing 2-in-1 Vaccine for Covid and Flu. Its Stock ….” 9 Sept. 2021, https://www.barrons.com/articles/moderna-stock-covid-flu-vaccine-51631189754. Accessed 8 Oct. 2021.

- [15] “COVID-19 vaccine boosters could mean billions for drugmakers.” 25 Sept. 2021, https://www.independent.co.uk/news/pfizer-covid-joe-biden-moderna-britain-b1926927.html. Accessed 8 Oct. 2021.

- [16] “Tesla (TSLA) Shares Pop on Record Delivery Numbers – Investopedia.” 5 Oct. 2021, https://www.investopedia.com/tesla-tsla-shares-pop-on-record-delivery-numbers-5204436. Accessed 10 Oct. 2021.

- [17] “Ideanomics and Subsidiaries WAVE, US Hybrid to Highlight ….” 27 Sept. 2021, https://finance.yahoo.com/news/ideanomics-subsidiaries-wave-us-hybrid-120000454.html. Accessed 5 Oct. 2021.

- [18] “Ideanomics to Fuel Growth of Energica Motor Company’s Elect….” 20 Sept. 2021, https://finance.yahoo.com/news/ideanomics-fuel-growth-energica-motor-110000239.html. Accessed 15 Oct 2021.

- [19] “Ideanomics Subsidiary WAVE to Collaborate with Kenworth on 1 ….” 28 Sept. 2021, https://www.hjnews.com/news/state/ideanomics-subsidiary-wave-to-collaborate-with-kenworth-on-1-megawatt-wireless-charging-pads/article_a43e230e-1822-54a4-ba9d-843c42beb993.html. Accessed 5 Oct. 2021.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jonah Sim Hong Chee

Dealer

Jonah Sim is a US Equity Dealer in the Global Markets Team and specializing in US and Canadian markets. He graduated from University of Essex with a bachelor’s degree in Banking and Finance.

Lee Ying Jie

Dealer

Ying Jie is a US Equity Dealer in the Global Markets Team and specializing in US and Canadian markets. He is proficient in trading using Technical Analysis, placing emphasis on supply and demand, and price action.

Chan Zi Quan

Dealer

Zi Quan is a US Equity Dealer in the Global Markets Team and specializes in the US and Canadian markets. He is an avid crypto fan and is adept in macro analysis..

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap