Semiconductor: The Foundation of Modern Technologies February 1, 2021

What the report is about:

- Semiconductors are the foundation of modern technologies. They are ubiquitous in our daily lives.

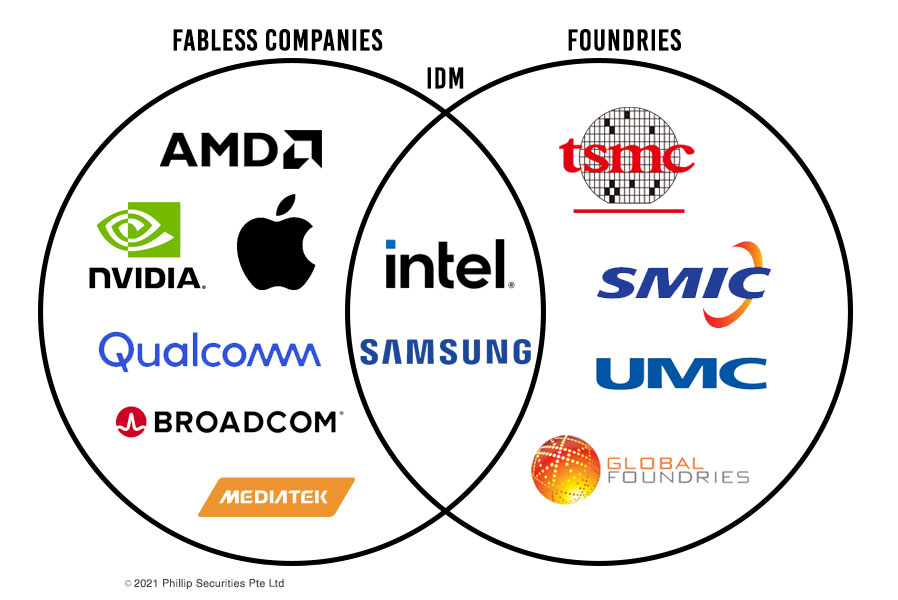

- The industry operates three business models: fabless, foundries and integrated device manufacturers (IDM).

- 5G promises to provide plenty of business opportunities to chip companies, by enabling a wide range of new industries and technologies.

- Investors can gain exposure to the industry via ETFs like SOXX, SMH, XSD, PSI and FTXL.

The Story of Semiconductors

From smartphones in our pockets to the laptops on our desks, from electric vehicles roaming the streets to the commercial jets flying above us, there is a common piece of material that enables the functionality of these modern marvels: semiconductors.

The world’s first working integrated chip (IC) – more commonly known as the microchip – was built on a piece of semiconductor material back in 1958.1 Today, semiconductors are the foundation of contemporary technologies.

These semiconductors are ubiquitous components of microchips, transistors and other electronic segments. Without semiconductors, numerous technological wonders will not be possible.

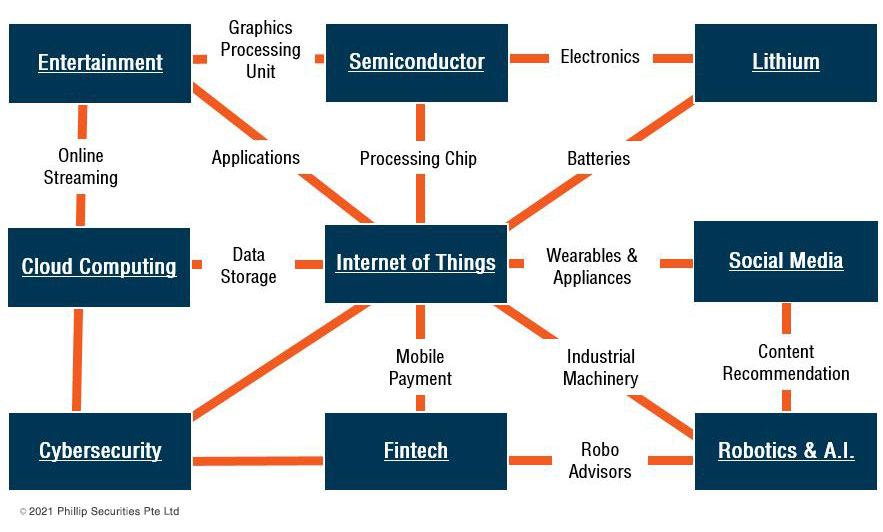

The opportunities are endless for semiconductor firms to profit from the rapidly changing technological landscape. The prolific growth of 5G, cloud computing, artificial intelligence (A.I.), electric vehicles and the Internet of Things (IoT) is expected to fuel the next demand spurt for chip-related products.

It is estimated that the semiconductor market will grow from US$513bn in 2019 to US$726bn by 2027.2

Types of Semiconductor Firms

There are three main business models in the semiconductor industry: fabless, foundries and integrated device manufacturers (IDM).3

The semiconductor supply chain fans across many stages, with some companies specialising in certain niches and others focusing on the verticalisation of the entire supply chain. On average, it can take up to three to five years to progress from initial research to final products.4

To remain competitive, semiconductor companies have to invest significant money in research and development (R&D ) for chip design and/or manufacturing each year.

1. Fabless Companies

A fabless company designs, markets and sells hardware while outsourcing the fabrication of that hardware to a third-party foundry. Examples of fabless companies include Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), Advanced Micro Devices (NASDAQ: AMD) and Qualcomm (NASDAQ: QCOM).

Fabricating hardware internally requires significant resources, which can lead to reduced profit margins. Specialisation allows fabless companies to channel their capital to the R&D of new technologies while benefitting from the expertise of external pure-play foundries.

For decades since its inception in 1969, AMD was involved in the entire production process of its microchips. However, in 2009, the company decided to divest its manufacturing operations and formed Globalfoundries. AMD eventually gave up its shareholding in Globalfoundries in 2012 and transitioned successfully to a fabless company.5

This strategic move was integral for underdog AMD to compete against semiconductor giant, Intel (NASDAQ: INTC), in the PC chip space. By outsourcing the fabrication of its Ryzen CPUs, AMD was able to undercut and wrest market share from rival Intel.

As of January 2021, AMD was on the cusp of overtaking and ending Intel’s dominance in the desktop CPU market. AMD’s market share stood at 49.8% while Intel had 50.2%.6

2. Foundries

Pure-play foundries are chip fabrication companies that do not have design capabilities. They focus solely on IC manufacturing. Many of these foundries are located in Taiwan and China, where skilled labour remains plentiful and cheap.

Presently, the cost of developing a new fabrication facility that could compete with the established players could cost more than US$10bn. Coupled with the economies of scale enjoyed by the existing foundries, barriers to entry for new entrants are formidable.7

This also provides an added incentive for semiconductor companies to adopt a fabless business model, to exploit the comparative advantages of foundries. Fabless and foundry companies have a symbiotic relationship and their strategic alliance is called the fabless-foundry model.

Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) pioneered the foundry business in 1987. Today, it is the largest independent manufacturer of microchips, with a market share of more than 50%.8

For instance, Apple is TSMC’s largest client, accounting for about one-fifth of its annual revenue. TSMC’s clientele comprises other technological titans like Nvidia, AMD, Broadcom and Qualcomm.9

Furthermore, TSMC’s continued investment in advanced wafer technologies and cutting-edge manufacturing processes has enabled it to be a leading producer of 5nm chips for its clients. Production of the 3nm chip by TSMC is forecast to commence in 2022.

As a result, TSMC is expected to strengthen its position in the highly competitive foundry industry for the foreseeable future.

3. Integrated Device Manufacturers (IDMs)

IDMs are companies that are engaged in the entire supply chain – from designing, manufacturing to the sale of IC products. Intel and Samsung Electronics (KRX: 005930) are two well-known IDMs.

The advantages of a vertically-integrated supply chain motivate large semiconductor companies to pursue an IDM model. By owning every stage of the process, production may be more efficient and cost-effective. IDMs are also not susceptible to shortages of production capacity imposed by external foundries, which have to allocate their finite manufacturing resources to their various clients.

Most importantly, the IDM model prevents the transfer of trade secrets to external parties. Fabless companies have to outsource the fabrication of their microchips to third-party foundries or IDMs. For that reason, there is potential for commercially valuable chip-design information to be leaked out.

Apple was one company which move gradually away from competitor Samsung Electronics as its chip manufacturer and outsource the production of its chips to TSMC.10

However, doubt remains over the economic feasibility of the IDM model today. In a mature semiconductor industry where product complexity is high, it is impractical and costly for one company to handle all the processes.

After suffering multiple setbacks in its manufacturing process, Intel’s share price plummeted in 2020 due to delays in the launch of its next-generation 7nm chips.11 Rival chipmakers, which rely on external foundries, had already forged ahead of the chip race with their 7nm chips and production of 5nm chips in late 2020.

These technological hurdles and the costs involved for IDMs have led to a restructuring of the industry value chain. Consequently, the fabless-foundry model was found to offer flexibility for semiconductor companies to focus on their individual competencies while tapping the expertise of their strategic partners.

Highly Cyclical, Yet There Are Imminent Structural Growth Drivers

The semiconductor industry is highly cyclical, based on the economics of derived demand. Semiconductor companies’ performances are highly dependent on end-market demand for chip-based products like personal computers, smartphones, electric vehicles etc.

Nonetheless, there are several emerging structural trends that could provide the next lap of growth for the industry. Structural trends tend to be longer term and can be significantly more impactful than cyclical trends.

One of the main technological innovations that could spur the semiconductor sector to greater heights is the development of the 5G mobile network.

5G: The Enabler of Future Technologies and The Chip Industry

5G is the fifth-generation mobile network and planned successor to 4G networks that currently provide connectivity to most mobile devices. The technology is meant to deliver higher data speeds, ultra-low latency and better reliability for users.12

Moreover, 5G is designed for forward compatibility. It has the ability to support future services that are unknown today. It is estimated that 5G’s full economic effects will be felt across the globe by 2035. It could purportedly support up to US$13.2tn worth of global economic output.

For semiconductor companies, 5G provides plenty of business opportunities by enabling a wide range of new industries and companies to use semiconductor technology in their products and services.

Generally, 5G is used for three main types of connected services: 1) enhanced mobile broadband; 2) mission-critical communications; and 3) IoT.

1. Enhanced Mobile Broadband

In addition to hardware improvements, 5G can usher in a new generation of mobile apps with new features made possible by the improved network technology. Semiconductor companies can expect to see a surge in demand for 5G handsets and products – potentially increasing 5G revenue from near zero in 2018 to US$31.5bn in 2023.13

2. Mission-Critical Communications

Current 4G network technologies are too unreliable for mission-critical applications. 5G’s extreme reliability and ultra-low latency promise to unlock vast new applications and use cases that could transform industries. Potential applications include the remote control of critical infrastructure, automotives and healthcare services.

Automotive applications and hardware, which utilise 5G and semiconductor technologies, are predicted to have a compound annual growth rate of 285% between 2021 and 2023.13

3. Internet of Things (IoT)

The smartphone market was a major growth propeller for the semiconductor industry in recent years. However, with at least 80% smartphone penetration rates in both developed and developing nations, their growth rate might be tapering off.14

Semiconductor firms must probe for new revenue sources and the IoT industry represents a major growth opportunity. This is evident from IoT products like smartwatches and smart TVs becoming mainstream among the global populace.

5G technology helps enable the expansion of the IoT industry by facilitating the development of new IoT products. These range from medical-monitoring systems to automatic sensors for self-driving cars. As new IoT devices are diffused to the market, the demand for semiconductor chips will proliferate.

According to the McKinsey Global Institute, the IoT industry could generate US$4tn to US$11tn in value globally for both consumer and business-to-business applications in 2025.15

Exchange Traded Funds

Due to the cyclical nature of the semiconductor industry, the share prices of semiconductor companies tend to experience big swings in either direction, based on market and industry-specific conditions.

Coupled with the extraordinary pace of technological advancements, laggard semiconductor firms are often severely punished for their innovation failures and inventory obsolescence.

Rather than trying to time entry or pick winning companies, semiconductor-themed Exchange Traded Funds (ETF) are convenient investment vehicles for investors to partake in the long-term growth potential of the sector.

They provide exposure to a basket of companies across the entire value chain, which reduces the volatility and concentration risks of the investment portfolios.

| ETF | iShares PHLX Semiconductor ETF | VanEck Vectors Semiconductor ETF | SPDR S&P Semiconductor ETF | Invesco Dynamic Semiconductor ETF | First Trust NASDAQ Semiconductor ETF |

| Ticker | SOXX | SMH | XSD | PSI | FTXL |

| Exchange | NASDAQ | NASDAQ | NYSE Arca | NYSE Arca | NASDAQ |

| AUM | US$5.47bn | US$4.7bn | US$1.21bn | US$498.3mn | US$76.4mn |

| Expense Ratio | 0.46% | 0.35% | 0.35% | 0.57% | 0.60% |

| Number of Holdings | 30 | 25 | 38 | 31 | 28 |

| Top 3 Holdings |

|

|

|

|

|

ETF information accurate as of 27 January 2021

No Let-Up

Semiconductors are the basic building blocks of modern computing. The industry has fabricated multiple generations of microchips for the past 60 years.

Rapid technological advancements are expected to unleash an onslaught of demand for semiconductor chips. This disruptive age confers unprecedented opportunities as well as challenges for semiconductor firms to develop innovative products and reconfigure their value chain to thrive in a highly competitive business environment.

Dependency on electronic computing devices is expected to create a multitude of tailwinds for the semiconductor industry, as consumption trends gain momentum in our digital society.

References:

1. https://anysilicon.com/history-integrated-circuit/

2. https://www.fortunebusinessinsights.com/semiconductor-market-102365

3. https://ieeexplore.ieee.org/document/7914779

4. https://www.amd.com/en/technologies/introduction-to-semiconductors

5. https://www.extremetech.com/computing/121069-the-dream-is-dead-amd-gives-up-its-share-in-globalfoundries

6. https://www.zdnet.com/article/amd-closing-in-on-intel-in-desktop-cpu-market-share/

7. https://www.investopedia.com/terms/f/fablesscompany.asp

8. https://seekingalpha.com/article/4378243-taiwan-semiconductor-manufacturing-company-undervalued-market-leader-multi-year-growth-runway

9. https://www.investopedia.com/articles/markets/012716/how-taiwan-semiconductor-manufacturing-makes-money-tsm.asp

10. https://www.wsj.com/articles/BL-DGB-27492

11. https://www.sdxcentral.com/articles/news/intel-shakes-up-exec-team-after-7nm-setback/2020/07/

12. https://www.qualcomm.com/invention/5g/what-is-5g

13. https://www.accenture.com/us-en/insights/high-tech/semiconductor-5g

14. https://www2.deloitte.com/content/dam/Deloitte/us/Documents/technology-media-telecommunications/us-global-mobile-consumer-survey-second-edition.pdf

15. https://www.mckinsey.com/industries/semiconductors/our-insights/internet-of-things-opportunities-and-challenges-for-semiconductor-companies

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Joel Lim

ETF Specialist

Joel is the ETF Specialist from the ETF desk in Phillip Securities. He helps to provide sales support and trading ideas to retail investors, remisiers, in-house dealers, and fund managers. Joel also works closely with ETF issuers on new product and business development projects.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  ETF Market Review: February Outlook Signals Strong Performance

ETF Market Review: February Outlook Signals Strong Performance  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?