The Russia-Ukraine conflict: The impact on stocks, gold and oil March 9, 2022

The escalation of the conflict between Russia and Ukraine continues. This has led Western leaders to impose sanctions on Russia. As the conflict rages on, it has created several implications to the global markets.

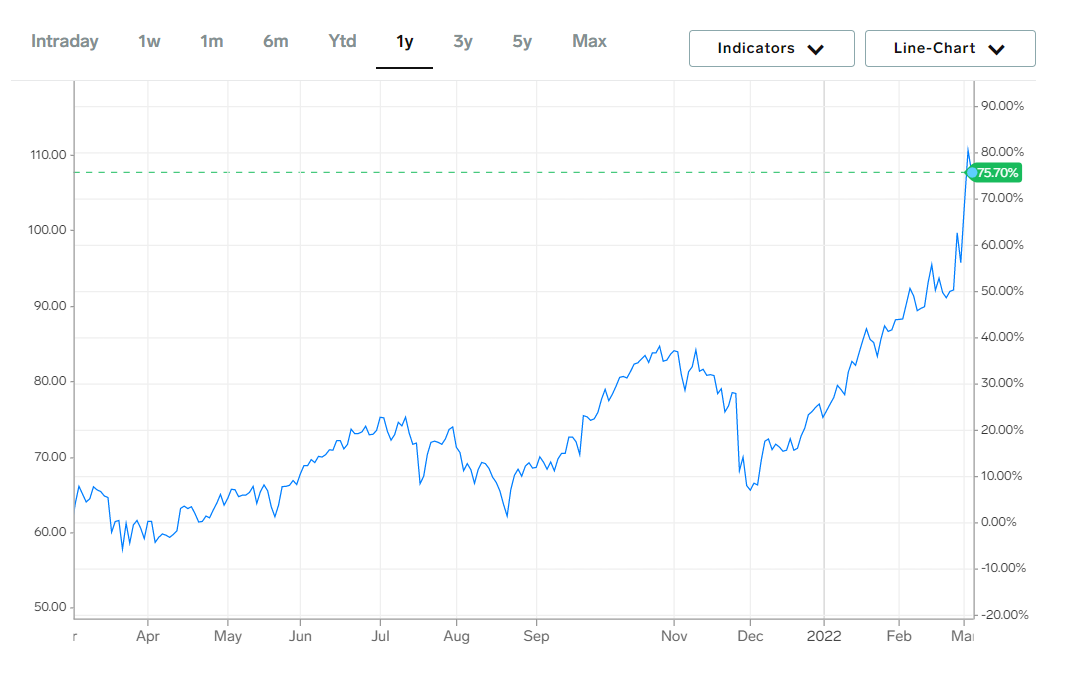

Impact on global Indices

Risky assets such as stocks tend to retreat when geopolitical crises dominate the headlines. Due to the short-term uncertainty and volatility within the stock markets, investors then tend to move their assets from equities into save havens such as gold and bonds.

Therefore, as the demand for stocks declines during geopolitical crises, it creates a downward pressure on global indices.

The Dow Jones Industrial Average (DJIA) fell more than 270 points, the S&P 500 Index fell about 0.6%, and the tech-heavy Nasdaq Composite traded down nearly 1% on Tuesday 22 February 2022.

Gold

In times of uncertainty, gold tends to be a safe investment and a desirable asset for investors. Gold’s safe haven appeal attracts investors during a period of heightened geopolitical tensions and war.

Other asset prices are affected immediately in the event of war or even the threat of it, and wars also mean excessive money printing and accelerated government spending.

Spot gold prices climbed from USD1800.80 as of (00:00 NY Time) on 1 Feb 2022 to USD1941.14 as of 4 March 2022. In less than one month, spot gold prices have seen an increase of about 6% due to the continued escalation of the conflict.

Oil

Before the tensions between Ukraine and Russia started, the demand for oil surged tremendously as economies were recovering from the COVID-19 pandemic. However, there was a fundamental mismatch between supply and demand as some OPEC members did not produce as much oil as they agreed. Therefore, the price of oil was increasing even before the conflict escalated.

Now the conflict has impacted energy markets, as Russia is one of the world’s largest producers of oil and natural gas, accounting for 17% of the world’s natural gas and 12% of its oil.

Coupled with the recent sanctions imposed on Russia by the Western leaders, there are worries that Russia might retaliate by cutting back its oil exports.

As shown in the charts above, both US West Texas Intermediate (WTI) crude and Brent crude have reached a high of USD 110.60 and USD 112.93 on 2 March 2022, their highest since September 2014.

Conclusion

With the conflict escalating, global indices will continue to face downward pressure while oil and gold prices will continue to rise.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Alvin Teo

Alvin Teo graduated from Nanyang Technological University with a Bachelor’s Degree in Economics. Coming from an Economics background, he strongly believes in the importance of understanding the macroeconomic policies before making investment decisions. Alvin started investing in Singapore equities at the age of 21 and thus, he has relevant experience in the Singapore market.

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry! ![[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close](https://www.poems.com.sg/wp-content/uploads/2024/03/Valerie-Lim-LI-X-SMART-Park-Article-300x157.jpg) [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close

[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close  Deciphering the Updates: Understanding the latest CPF Changes

Deciphering the Updates: Understanding the latest CPF Changes