The Social Media Giants February 21, 2020

Summary

- The transition of the World Wide Web (WWW) to Web 2.0 has democratised content creation and led to the rise of social media.

- The competitive advantages of the social media industry have made it an attractive advertising channel for businesses of all sizes.

- The social media industry is showing signs of maturity with slowing user growth rate and increased mergers and acquisitions.

- To counteract the slowing user growth, social media companies must come up with different monetisation strategies to supplement their core advertising income.

- Monetisation strategies could disrupt conventional industries and provide growth opportunities for investors.

- Investors can gain exposure to the social media and Internet industries through SOCL, 3072.HK, PNQI, FDN and 2812.HK

Introduction

The advent of the World Wide Web (WWW) in 1991 provided the public with access to the Internet and connected the world in a way that was “never before possible”.1 With the availability of the web browser and web server, it is now feasible for users to obtain and published information online.

WWW used to be a one-way communication; with content providers uploading static content online for users to view or download. The evolution of the traditional WWW to Web 2.0 in 1999 allowed users to participate in online content creation despite the lack of web designing or publishing skills.2 As a result, Web 2.0 is characterised by greater user interactivity, dynamic real-time content and enhanced communication channels.

Web 2.0 is therefore a contributing factor to the development and success of the social media industry. Social media refers to websites and applications that allow users to create and share content or to participate in social networking.

Brief History of Social Media

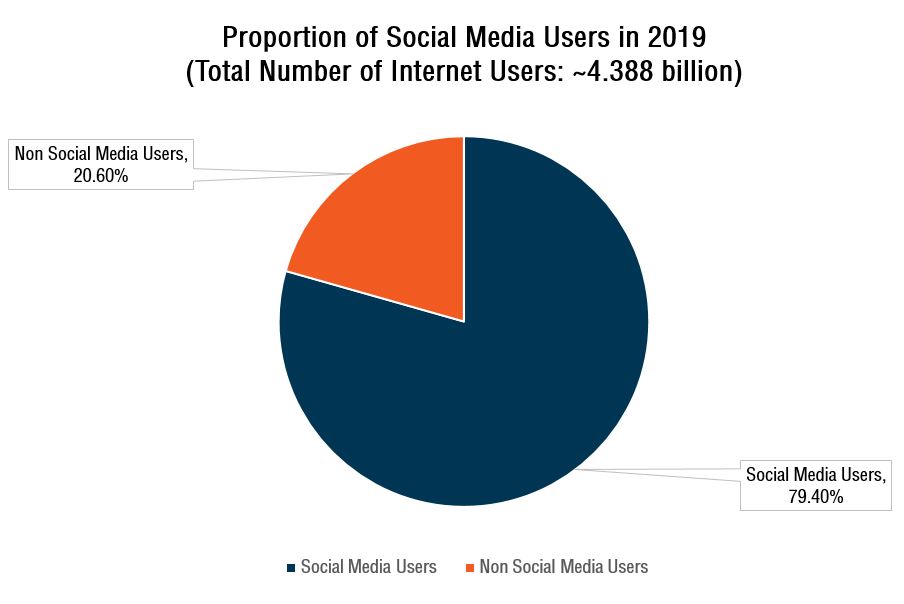

The first prominent social media site, Six Degrees, was launched in 1997 and it allowed its users to share their profiles with other users. As time passed, variants of social media sites, which have specialised features, emerged to serve the different needs of web users.3 Today, there are over 3.4 billion social media users worldwide.4

Figure 1:~79.4% of Global Internet Users Use Social Media4

Competitive Advantages of the Social Media Business Model

1. Network Effect and Bandwagon Effect

The phenomenon whereby more people improve the value of a good or service is known as the network effect. 5Social media users increase the value of social media sites primarily via content creation. Users contribute content, information and services as they gain access to social media sites. The improvement in the quantity and quality of content will attract new users to the social media sites as they look to benefit from the network.

Moreover, social media sites are not confined by physical constraints such as geographical boundaries. This helps to amplify the positive network effect because social media sites have the ability to reach out to a global audience.

The bandwagon effect refers to the tendency for people to conform to the majority because of social, psychological or economic reasons. When the number of people participating in certain social media sites increases, it will induce other individuals to begin using those sites to “fit in” with the society.6

Both the network effect and bandwagon effect help to draw new users to social media sites.

To illustrate, Facebook (NASDAQ: FB) managed to grow its user base from 1 million active users in 2004 to 2.4 billion active users in 2019 and became the largest social networking site in the world.7

2. Personalised Network

Unlike the traditional media model, social media allows users to receive personalised content from their individual networks. Personalised content helps create meaningful engagement because the audience is more receptive to user-generated content (UGC) from their families and friends.8 This results in a better content experience, which promotes user retention in social media sites.

Furthermore, the personalised network, which the user built up, functions as a lock-in mechanic to aid social media sites in retaining their users. The user may not be able to receive the same content feed that they are used to when they switch over to a competitor’s site unless all their contacts are ported over to the new site.

Hence, the switching cost may discourage users from closing their social media account. On the contrary, users are encouraged to experiment with multiple social media sites to gain access to the unique community or service that a particular site has to offer.

3. Specialisation and Segmentation

New market players have to be creative to carve out a niche segment for themselves and the social media industry allows companies to do just that.

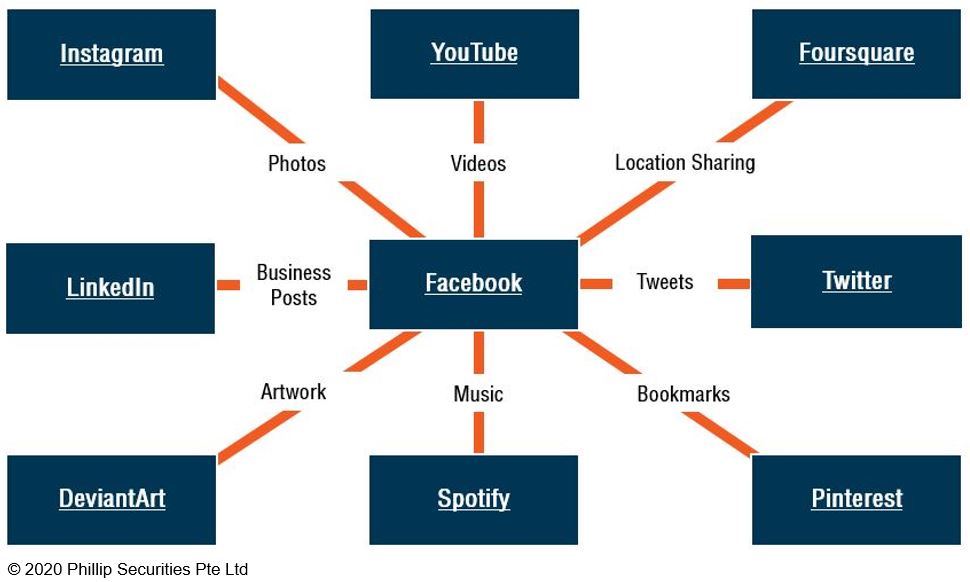

The digital landscape enables content information to be displayed in a multimedia format and participants can opt to specialise in a particular content form. For example, YouTube (NASDAQ: GOOGL) specialises in video content and Spotify (NYSE: SPOT) specialises in audio content. Alternatively, social media sites can also adopt a target marketing strategy by delivering multimedia content to communities with special interests.

The specialisation of content delivery and segmentation of target audience facilitate the sharing of content and network amongst different social media sites. This results in the formation of a complex interconnected network of social media communities.

Figure 2: How Social Media Sites Complement Facebook

4. Data Collection

Social media sites have the ability to produce Big Data and provide business owners with access to a wealth of information about their audiences. With proper data analytics tools, social media sites can get an idea of how its users feel about certain topics in order to provide a better content experience for its users.

Besides developing hyper-targeted content and advertising algorithm, social media sites can also sell this data to third parties such as advertisers and market research companies to generate additional income.

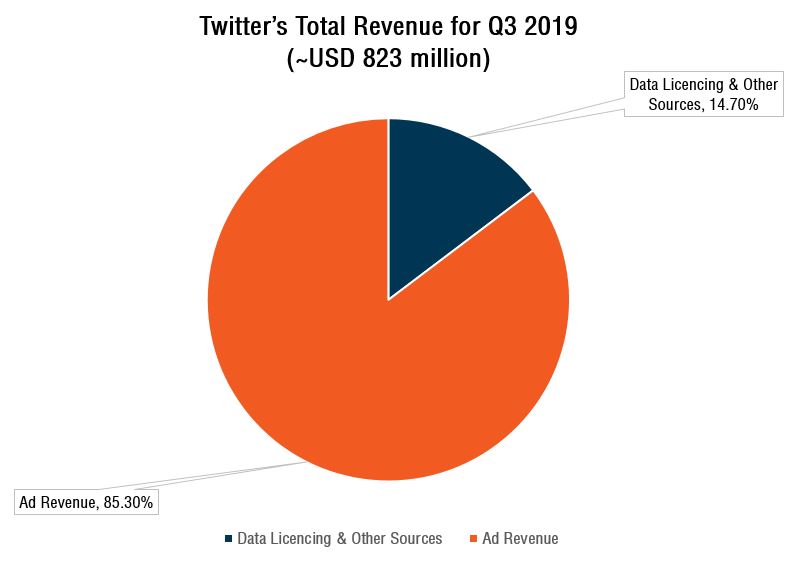

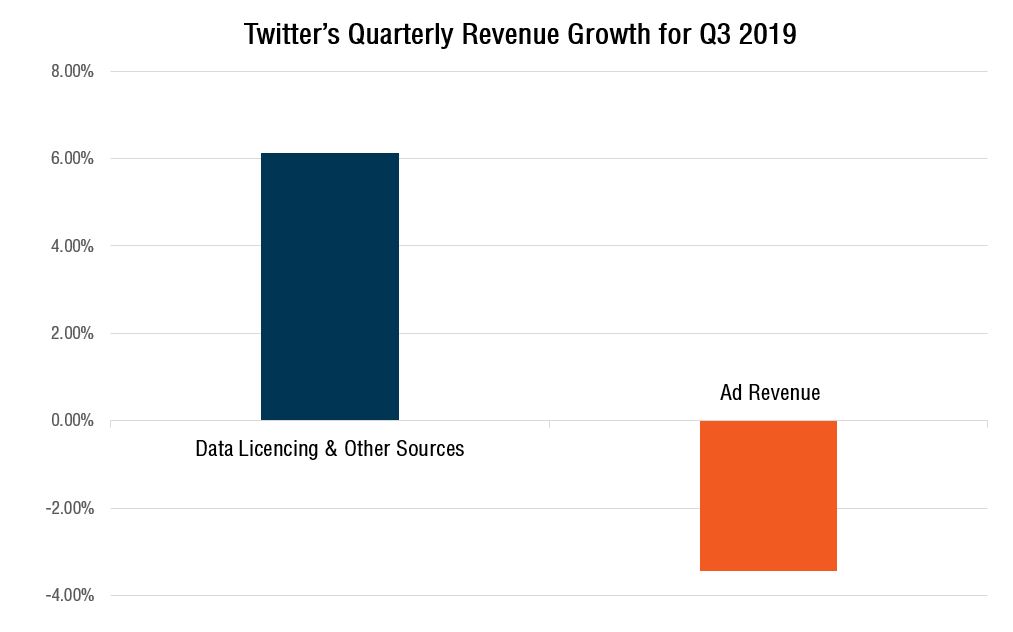

For instance, Twitter (NYSE: TWTR) generates its revenue through advertising and selling data streams of all public posts in real-time to companies across the world. In Q3 2019, Twitter generated 14.7% of its total revenue from data licencing and other sources. While Twitter’s quarterly growth for data licencing and other sources grew by 6.14%, its advertising revenue decreased by 3.44% in the same period.9

The figures imply that data related sales revenue could possibly take on a new significance for social media companies in the future.

Figure 3: Twitter’s Total Revenue for Q3 20199

Figure 4: Twitter’s Quarterly Revenue Growth for Q3 20199

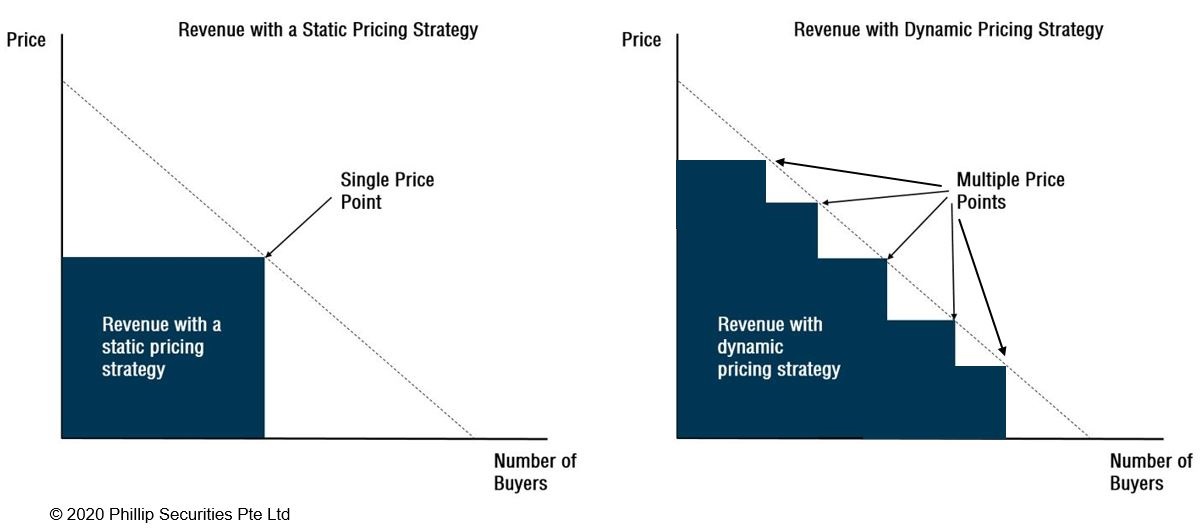

5. Dynamic Pricing

The online environment enables social media companies to introduce dynamic pricing for advertisers to maximise consumer and producer surplus. Instead of charging a single price point for all advertisers, social media companies allow businesses to tailor their ad spending based on their budget. The advertising algorithm of the social media site will then allocate the “ad space” to advertisers based on their audience demographics and ad spending.

Figure 5: Static Pricing Strategy vs Dynamic Pricing Strategy

The adoption of a dynamic pricing strategy helps social media companies attract a diverse pool of businesses to advertise on their platforms. Advertisers who have higher ad spending can increase the reach, frequency and impact of their ad messages. Advertisers with limited budgets can still employ social media to broadcast their ad messages albeit with less advertising effectiveness.

In fact, small businesses in the U.S. are the main growth drivers for global social media ad revenue. Facebook reported that an estimated 140 million businesses are using its suite of apps every month and the company’s top 100 advertisers accounted for less than 20% of its ad revenue.10

The Future of the Social Media Industry: Signs of Maturity

The social media industry is showing signs of maturity – with the plateauing of the growth rate for social media penetration and an increase in merger and acquisition (M&A) activities.

Given the high rates of social media penetration around the world, it is a natural phenomenon for user growth to slow down. Other than the over 65s age group, the user growth rate for the other cohorts has plateaued completely.11

As the industry matures, larger social media companies may look for smaller target firms with value potential and synergy to maintain growth or to eliminate competition. These deals allow the acquirers to integrate their user base and offer new complementary services to a wider range of audiences.

One prominent example will be Facebook’s acquisition of Instagram in 2012. The acquisition allowed Facebook to add 30 million Instagram users to its database and increase its product offering to cater to the younger demographics. Most importantly, Facebook gained technical and industrial knowledge to improve its mobile app design and photo-sharing features.12

Primary Revenue Source

Advertising revenue remains the primary revenue source for social media companies.

The competitive advantages of the social media industry create an ideal environment for advertisers to utilise the various online platforms to disseminate customised messages for their intended audience on a real-time basis.

By offering hyper-targeted advertising algorithms and budgeting flexibility for businesses of all sizes, social media companies have chipped away market share from traditional advertising channels.

2019 was the first year that social media ad spending outperformed print ad spending. It accounted for 13% of total global ad spending and ranks as the third-largest advertising channel, behind television advertisements and paid search advertisements.10

However, the maturing of the industry will level-out social media ad spending growth in the near future. The growth rate is expected to decline from 17% in 2020 to 13% in 2021.

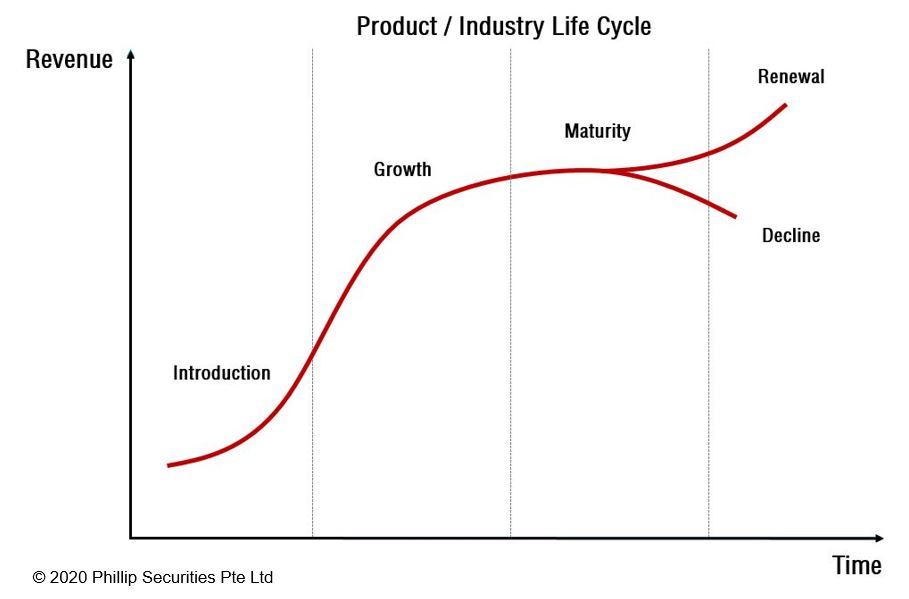

Sustaining Growth Rate after Maturity

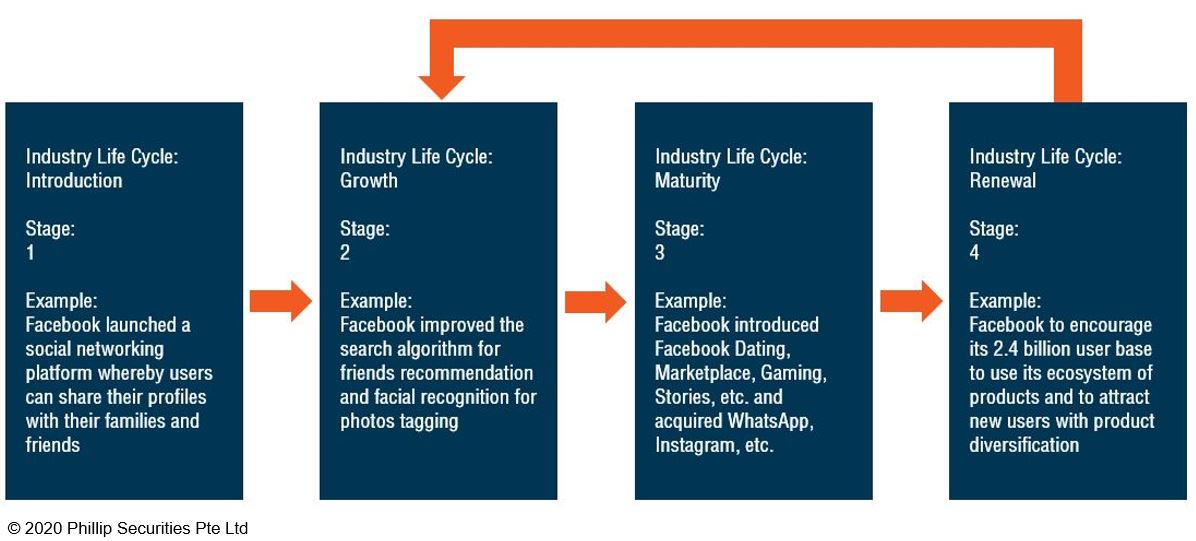

To prevent revenue growth from falling because of the decline in social media ad spending growth, social media companies must continuously innovate to improvise its existing products and to create new products. This allows the companies to enter into the renewal phase of the industry life cycle to rejuvenate its revenue growth.

Figure 6: Product / Industry Life Cycle

There is a systematic blueprint for social media companies to sustain scalable revenue growth. The growth formula is as follows:

- Create a core product that attracts a critical mass of users

- Continuously improve and optimise the core product to increase user growth, usage and retention

- Create new products based on users’ experiences and usage data to enhance and complement existing core product and/or diversify into new businesses by acquiring other companies

- Encourage existing user base to experiment with the company’s ecosystem of products and services and attract new users through product diversification

Figure 7 is an illustration of the positive feedback loop of the entire process.

Figure 7: Positive Feedback Loop of Facebook’s Life Cycle

By encouraging increased usage of the company’s different products and services, social media companies are able to diversify their revenue stream and increase their Average Revenue per User (ARPU) to counteract the slowing user growth. The addition of new products and services also provide new advertising channels for advertisers to reach out to their target audience and to display their contents in different formats.

The delivery of video snippets and photos slideshows via bite-sized stories format proved to be popular among social media users. The idea originated from Snapchat (NYSE: SNAP) in 2013 to cater for the shift towards interactive or visual content. Facebook managed to incorporate the same concept across its suite of products to mitigate the outflow of its younger users to competitors’ platforms.

Today, the stories ad format represents an attractive growth opportunity for Facebook – with more than 500 million daily active users posting content on Facebook Stories and 3 million advertisers using stories ads to reach customers across Instagram, Facebook and Messenger.13

Social Media’s Revenue Diversification Strategies

There are multiple avenues for social media companies to diversify their revenue sources and reduce their dependency on advertising income. Below are a few examples.

1. Subscription Model or In-App Purchases

Social media companies can offer a subscription-based model or in-app purchases for users to enjoy a premium level of service with a host of additional features. The freemium business model allows users to utilise basic features of a service for free and then charges for add-ons to the basic package.

Google (NASDAQ: GOOGL) notably introduced YouTube Premium and YouTube Music Premium services to allow subscribers to enjoy ad-free streaming, offline viewing and exclusive content. Moreover, YouTube Music Premium provides Google with a platform to leverage its partnership with various record labels and to compete against Spotify (NYSE: SPOT) for a share of the digital music streaming pie.

Comparatively, LINE (NYSE: LN) generates a portion of its revenue via the sales of digital stickers and themes on LINE’s Creators Market. Japan’s beloved messaging app has managed to monetise user-generated content (UGC) by initiating profit sharing with the content creators. The Creators Market represents a lucrative revenue source for LINE as the platform recorded 69 billion Japanese Yen in stickers’ sales over a five-year period.14

LINE also launched the Creators Support Program and Creators Studio to help ensure an endless stream of saleable digital content.

2. Social Commerce

As social media evolves, the line between social media and e-commerce is becoming blurred with the commercialisation of social media platforms. By integrating the in-app checkout feature across its family of apps, Facebook has created an efficient e-commerce environment that delivers seamless online transaction experiences for consumers and businesses alike.

Pinterest (NYSE: PINS) has even utilised Deep Learning in its “Shop the Look” feature to help consumers identify similar products shown in images.15

Specifically, building up e-commerce capabilities within the platforms is a justification for social media companies to upsell the platform to advertisers and a way to earn additional income through affiliate marketing.

Digital wallet and e-payment will inevitably come into play alongside social commerce.

3. Super Apps

As a result of China’s strict censorship law, the country operates in a separate technology ecosystem from the rest of the world. The environment gave rise to the development of super apps in China – whereby users can accomplish multiple unrelated functions with just a single super app. One prominent example of a super app will be Tencent Holdings Ltd’s (HKEx: 0700) WeChat.

WeChat has a monthly active user base of more than 1 billion and it is China’s de facto number one messaging app.16 But WeChat offers more than just messaging alone, it allows users to do everything from making payment to booking a taxi by using the Mini-Programs within the super app.

While ad-based revenue and in-app purchases help contribute to WeChat’s profits, the messaging app’s value lies in its ability to provide people with services and solutions to their specific needs in real-time This includes deciding which hotel to stay in or the type of food to order.

This service-based monetisation approach is an innovative business model that adds a brand new dimension to revenue generation by providing end-users with better incentives to use the app and a higher level of experience upon using the app.

Figure 8: How Social Media Apps Help Satisfy Maslow Hierarchy of Needs

Fundamental to the success of the super apps are the mobile payment systems within the super apps. These in-app mobile payments systems allow super apps to develop more monetisation opportunities for various platform users.

Exchange Traded Funds

There are various thematic Exchange Traded Funds (ETFs) that allow investors to gain exposure to the social media and Internet industry. Investors can adopt a forward-looking investment approach to take advantage of the growth opportunities that the different social media monetisation strategies have to offer.

Below are some examples of the ETFs that provide exposure to the social media and Internet industries.

| ETF | Global X Social Media ETF | Nikko AM Global Internet ETF | Invesco NASDAQ Internet ETF | First Trust Dow Jones Internet ETF | Samsung CSI China Dragon Internet ETF |

| Ticker | SOCL | 3072 | PNQI | FDN | 2812 |

| Exchange | NASDAQ | HKEx | NASDAQ | NYSE Arca | HKEx |

| AUM | USD 134.91 million | USD 22.27 million | USD 552.90 million | USD 8.11 billion | HKD 147.31 million |

| Net Expense Ratio | 0.65% | 0.88% | 0.62% | 0.52% | 1.80% |

| Number of Holdings | 42 | 31 | 82 | 42 | 30 |

| Top 3 Holdings | – Tencent Holdings Ltd– Facebook Inc (NASDAQ:FB)– Naver Corp(KRX:035420) | – Alibaba Group Holding Ltd ADR (NYSE:BABA)– Tencent Holdings Ltd (HKEx:0700)– Alphabet Inc Class A (NASDAQ:GOOGL) | – Netflix Inc(NASDAQ:NFLX)– Alphabet Inc Class C(NASDAQ:GOOG)– Facebook Inc(NASDAQ:FB) | – Amazon.com Inc(NASDAQ:AMZN)– Facebook Inc(NASDAQ:FB)– Cisco System Inc(NASDAQ:CSCO) | – Tencent Holdings Ltd(HKEx:0700)– Alibaba Group Holding Ltd ADR(NYSE:BABA)– Meituan Dianping Class B(HKEx:3690) |

ETF Information is accurate as of 10 January 2020

Conclusion

By offering hyper-targeting capabilities and unparalleled reach for businesses of all sizes, social media platforms have the potential to overtake traditional media sources to become the dominant advertising channel in the future.

Nevertheless, given the high penetration of social media users around the world, new user growth rate will likely plateau. This phenomenon will level-out the social media ad spending growth, which will affect the core revenue source for social media companies.

As a result, social media companies will need to come up with different monetisation strategies for the maturing industry in order to spur revenue growth. These monetisation strategies have the potential to revolutionise the social media industry and rejuvenate it into the renewal phase of the industry life cycle.

The renewal phase provides growth opportunities for investors as the social media giants look for ways to disrupt conventional e-commerce approaches and the consumption of digital media content.

Reference:

- [1] https://webfoundation.org/about/vision/history-of-the-web/

- [2] https://copyright.unimelb.edu.au/__data/assets/pdf_file/0011/1773830/wikisblogsweb2blue.pdf

- [3] https://smallbiztrends.com/2013/05/the-complete-history-of-social-media-infographic.html

- [4] https://www.smartinsights.com/social-media-marketing/social-media-strategy/new-global-social-media-research/

- [5] https://www.investopedia.com/terms/n/network-effect.asp

- [6] https://www.verywellmind.com/what-is-the-bandwagon-effect-2795895

- [7] https://edition.cnn.com/2014/02/11/world/facebook-fast-facts/index.html

- [8] https://vivipins.com/social-media-statistics/

- [9] https://www.businessofapps.com/data/twitter-statistics/

- [10] https://marketingland.com/social-media-ad-spend-to-surpass-print-for-first-time-268998

- [11] https://www.smartinsights.com/social-media-marketing/social-media-strategy/new-global-social-media-research/

- [12] https://www.forbes.com/sites/kashmirhill/2012/04/11/ten-reasons-why-facebook-bought-instagram/#309f3219d1b1

- [13] https://www.searchenginejournal.com/facebook-stories-have-500-million-daily-users-3-million-advertisers/305179/

- [14] https://linecorp.com/th/pr/news/en/2019/2699

- [15] https://venturebeat.com/2019/02/06/pinterest-fully-automates-ecommerce-with-shop-the-look/

- [16] https://www.businessofapps.com/data/wechat-statistics/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr. Joel Lim

ETF Specialist

Joel is the ETF Specialist from the ETF desk in Phillip Securities. He helps to provide sales support and trading ideas to retail investors, remisiers, in-house dealers, and fund managers. Joel also works closely with ETF issuers on new product and business development projects.

All-in-One Guide to Investing in China via ETFs

All-in-One Guide to Investing in China via ETFs  Everything you need to know on Bitcoin ETFs

Everything you need to know on Bitcoin ETFs  Maximising your Tax Savings & Retirement Funds with SRS in Singapore

Maximising your Tax Savings & Retirement Funds with SRS in Singapore  Is There a “Fairest of Them All”?

Is There a “Fairest of Them All”?