Rise of the China Internet Dragons October 24, 2019

Summary

- There are almost three times more Internet users in China than in the US even though the Internet penetration rate in China is only 59.6 per cent as of December 2018.

- China’s “Great Firewall” of Internet censorship has inevitably allowed China Internet companies to establish market dominance in China.

- Structural trends like rapid urbanisation, technological development, shifting of economic power, demographic and social changes will continue to fuel the growth of China Internet and tech industries.

- China Internet companies can shape the future economy through the use of super apps, data, 5G mobile networks and technology.

- Investors can gain exposure to China Internet and tech industries via thematic ETFs. Examples of the relevant thematic ETFs include KWEB, 2812.HK, 2826.HK and CQQQ.

Introduction

We may be familiar with the usual American tech giants like Google (NASDAQ: GOOGL), Facebook (NASDAQ: FB) and Amazon (NASDAQ: AMZN) but the rapid technological revolution underway in China has been gaining global attention. The middle kingdom has emerged on the world stage with a number of global tech companies, like Alibaba (NYSE: BABA), Baidu (NASDAQ: BIDU) and Tencent (HKEx: 0700), which are blazing the trail with technological innovations and breakthroughs.

An Overview of China’s Internet Community

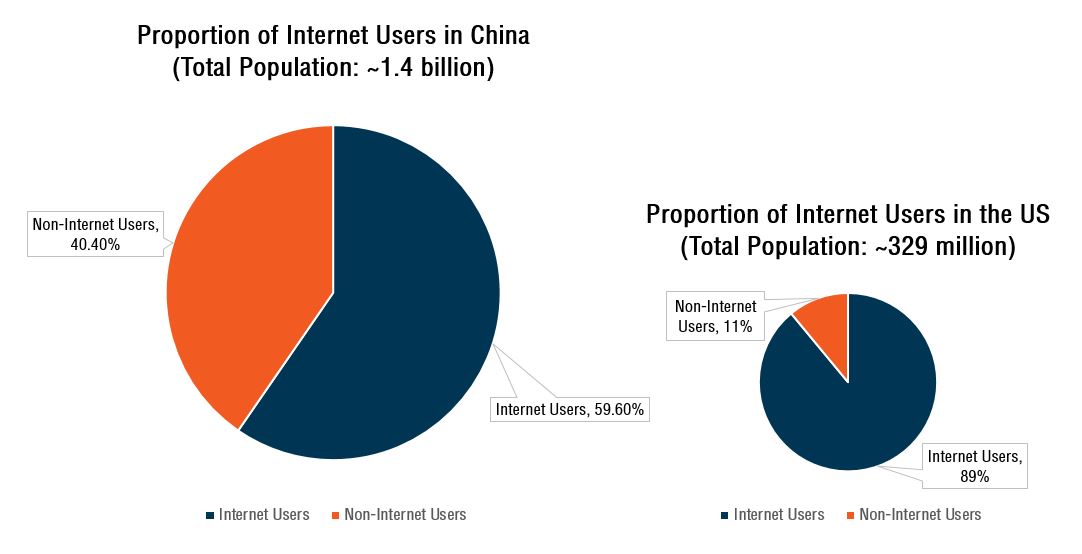

The total number of Internet users in China reached 829 million as of December 2018.1 Even though the Internet penetration rate in China is only 59.6 percent when measured against its 1.4 billion population, the sheer scale of China’s population means that there are almost three times more Internet users in China than in the United States.2

Figure 1: Proportion of Internet Users in China and the US2

China’s “Great Firewall”

China’s strict regulations and censorship prevent US tech companies such as Facebook and Google from accessing China’s 800 over million Internet users and establishing a foothold in the country, thereby allowing China internet companies to establish market dominance in China.

As a result, China and the United States operate in two separate technology ecosystem.

Examples of Internet Products and Services in China and the US

| Search Engine | |

|---|---|

| China | United States |

|

|

| Shopping | |

|---|---|

| China | United States |

|

|

| ePayments | |

|---|---|

| China | United States |

|

|

| Videos | |

|---|---|

| China | United States |

|

|

| Social Media | |

|---|---|

| China | United States |

|

|

Structural Trends Fuelling the Growth of China’s Internet Industry

China experienced structural trends that opened up growth opportunities in the technological industries and allowed China Internet companies to rise to prominence. Some of these trends include rapid urbanisation, technological development, shifting of economic power, demographic and social changes.

Rapid Urbanisation

China’s urbanisation rate for the permanent resident population was 59.58 percent in 2018 and is expected to reach 70 percent by 2030. Migration to urban centres is likely to increase given China’s ongoing economic development in its cities.

As the move into cities continues, people get better jobs and wages; the disposable income earned by China’s urban population is almost thrice that of their rural counterparts. This brings about an increase in consumption, investment and employment.

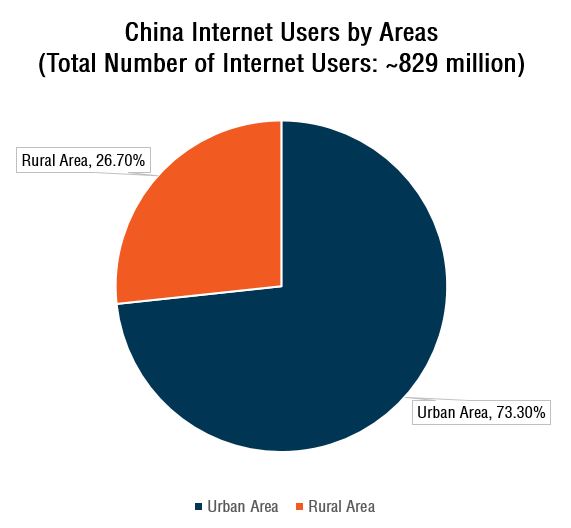

The number of China’s Internet users in urban areas stood at 607 million as at December 2018, which is 73.3% of the China Internet users. This number is set to increase along with a rise in urbanisation rate.

Figure 2: China Internet Users by Area 1

Historical data has suggested that cyclical sectors such as the technology sector, are highly correlated with economic growth.

Technological Development

In 2007, Google joined forces with the mobile industry to form the Open Handset Alliance (OHA). The consortium was formed to establish Android as an open source mobile Operating System (OS)3 that allows smartphone manufacturers to install and customise Android on their devices for free, without the need to develop or licence their own proprietary OS.

This facilitated the reduction of development costs incurred by manufacturers, and hence prices of smartphones, thereby prevent Apple’s iOS from monopolising the smartphone industry.

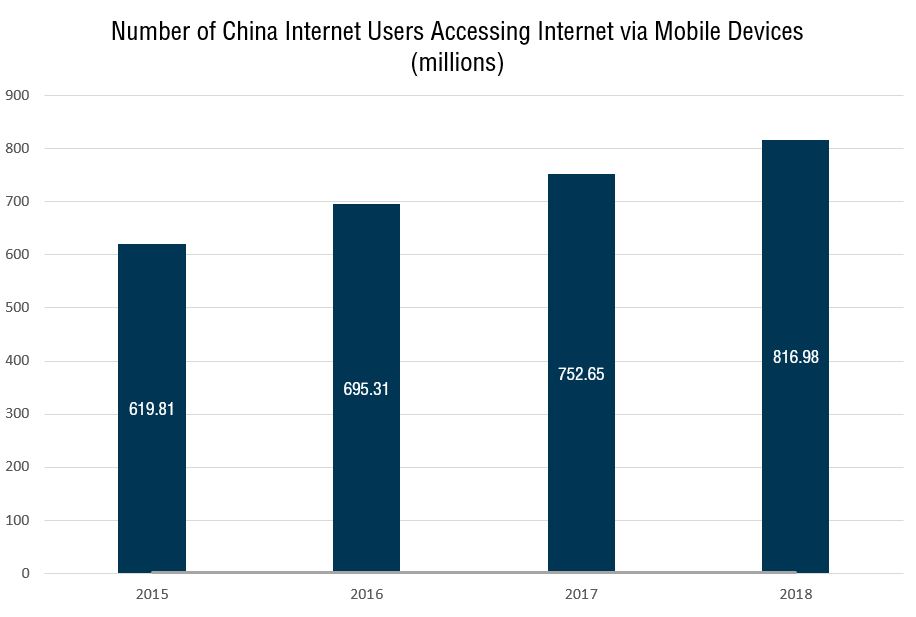

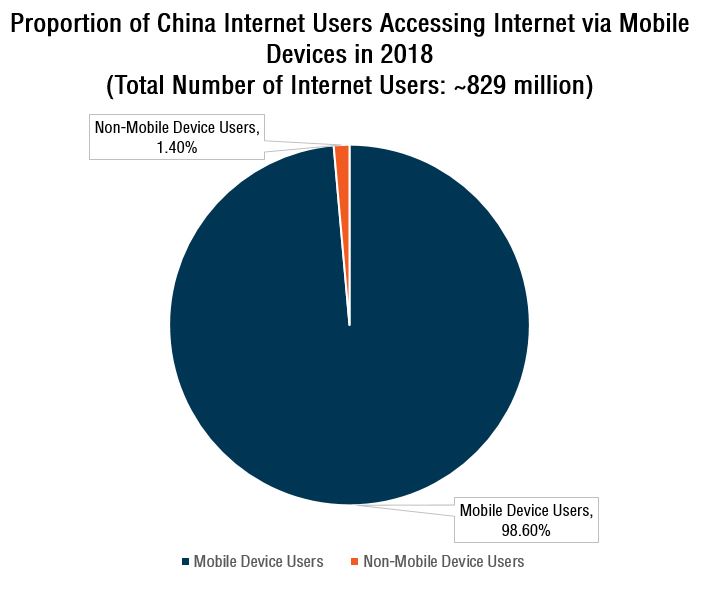

The proliferation of low cost smartphones has made smartphones accessible to those from developing countries and emerging markets. In China, 98.6 percent of Internet users access the Internet through their mobile devices.4

Figure 3: Number of China Internet Users Accessing Internet via Mobile Devices1

Figure 4: Proportion of China Internet Users Accessing Internet via Mobile Devices in 20181

China has their customised version of Android for the China market where smartphone manufacturers use Android as a base OS without any Google services.

Since apps like Gmail, Google Maps, and Google Play Store are not accessible in China, China tech companies are better able to reach out to China’s market and fill in the void left by the American tech giants.

Shifting of Economic Power

China’s per capita GDP has grown from 8 percent of US per capita GDP in 2000 to almost 30 percent of US per capita GDP this year.5 This exponential growth can be attributed to the significant infrastructure investment, support for an export-focused manufacturing base and increased spending on innovation.

Furthermore, the Chinese government will accelerate the construction of Internet infrastructures such as 5G, artificial intelligence and Internet of Things (IoT) in a bid to achieve its goal of high quality economic development for the nation. China’s digital economy was worth US$4.5 trillion and accounted for 34.8 percent of the nation’s GDP in 2018.6

The ongoing economic development has lifted hundreds of millions of Chinese out of poverty and resulted in a ballooning middle class who have disposable income for other uses after satisfying their basic needs.7 Higher disposable incomes have allowed more Chinese consumers to be able to afford Internet access and mobile subscription.

Demographic and Social Changes

China’s one child policy was introduced in 1979 and lasted for almost four decades before being officially abolished in 2016. The policy has led to a notable demographic and social phenomenon. Those born in the 1990s and 2000s will make up 36 percent of China’s population in 2027 and they are often dubbed as China’s “little emperors”.8

This younger generation of single children, who are pampered to a hilt, are different from their predecessors in two ways. Firstly, they received financial support from their parents and grandparents and they are likely to be the sole recipients of the intergenerational transfer of assets from their parents. Secondly, they grew up in a period of blistering improvements in the quality of life empowered by technology and digitalisation.

Therefore, these young and tech savvy consumers are likely to have higher spending power and are more responsive to innovations than older consumers are. The consumption patterns of the younger Chinese demographics help create a conducive environment for Chinese tech and Internet companies to launch new products and services to cater to the needs of this audience.

How China Internet Companies Can Shape the Future Economy?

With significant investment and support from the Chinese government and China tech companies, China’s economy will undergo massive changes that will transform how people consume goods and services. It is predicted that China will evolve from being a manufacturing powerhouse to become a leading innovator in the digital age.

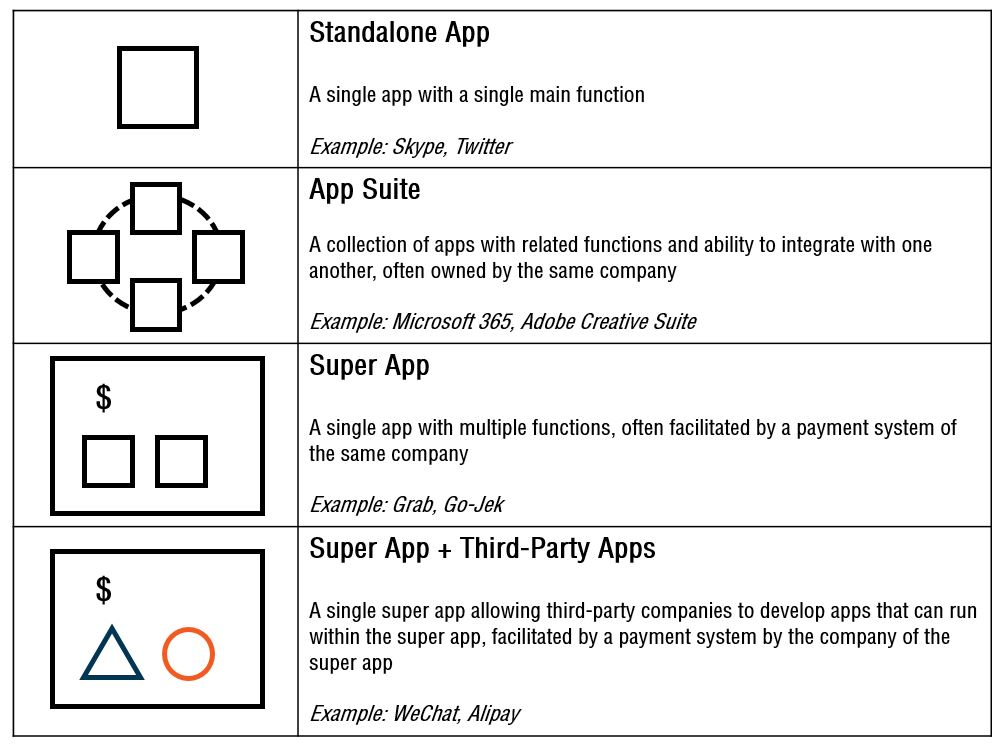

The Rise of the Super Apps

While we are accustomed to using dedicated mobile apps for specific tasks, mobile users in China are already accomplishing multiple unrelated functions with just a single super app. Tencent Holdings Ltd’s WeChat and Ant Financial’s Alipay are two examples of super apps.

These super apps allow users to utilise the services of third party companies without the need to download separate apps.9 The third parties apps are officially referred to as “Mini-Programs” in China and they formed an ecosystem of products and services within the super app.

Fundamental to the success of the super apps are the mobile payment systems within the super apps. These in-app mobile payments systems allow Tencent and Ant Financial to develop more monetisation opportunities with various businesses, merchants and vendors.

Figure 5: Traditional Apps vs Super Apps 9

Data is the New Oil

The quote “data is the new oil” by Mathematician Clive Humby in 2006, suggests that data will replace oil as the most valuable resource in the 21st century. As China shifts to a consumption based economy, the ability to identify and respond to consumers is becoming a key factor to increasing a company’s competitive advantage.

The widespread usage of the super apps in China allows companies to extract vital information on consumers’ behaviour, preference and spending habits. Emerging technologies like cloud computing, artificial intelligence, and machine learning will improve the data analytical capabilities of companies and result in better insights generated by the rich dataset.

By collecting and analysing consumers’ data, China Internet companies are better able to deliver personalised content, products and services to the end users. The improvement in user experience in turn facilitates acquisition and retention of customers. Moreover, insights generated from consumers’ information and adoption of 5G technology can assist in the development of new products and services, which can provide growth opportunities in the future.

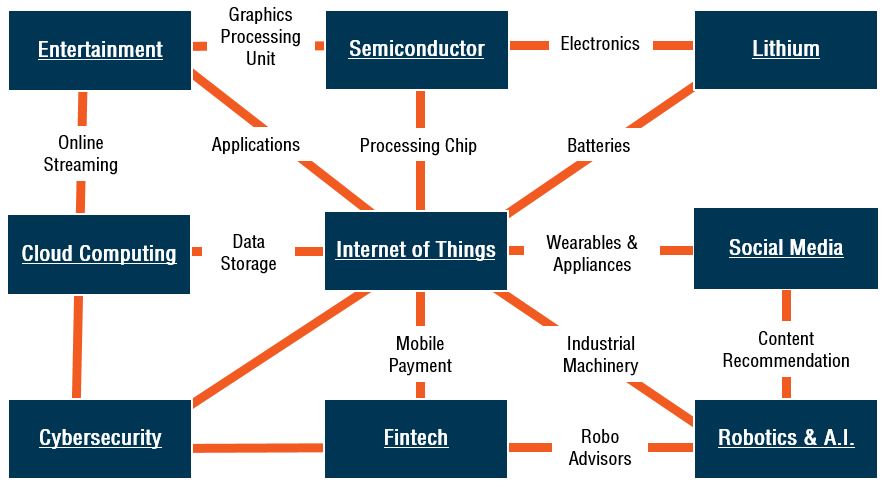

The Race Ahead for 5G Technology

5G is the fifth generation of mobile technology and networks, which offers faster data rates, reduced latency, cost reductions and higher system capacity.

Total investment in 5G technology could reach US$411 billion in China from 2020 to 2030.10 The number of 5G subscribers in China is expected to increase from 31.9 million in 2019 to 588.3 million by 2022.11

However, 5G means more than just faster data speed; it lays the foundation for the creation of new products and services. The new industries are complementary and interlinked; their linkages enhance the compatibility of the various products and services, which helps facilitate the adoption rate for the new technology.

Figure 6: Industries Complemented by 5G Technology and the Inter-Industries Linkages

One of the main industries that is likely to benefit from China’s 5G infrastructure buildout is the China Internet Companies and Application Developers. 5G technology will power real-world applications like augmented and virtual reality entertainment, machine-to-machine communication for IoT devices and reliable, low-latency communication for innovations like self-driving cars.

Other than the commercial benefits of 5G technology, the fifth generation mobile technology and networks could be militarised to revolutionise the future landscape of warfare and cybersecurity.12 Hence, the new technology has been the centre of attention in US efforts to contain China’s rise as a technology powerhouse and its allegations against Chinese tech companies’ data espionage practices.

Exchange Traded Funds

There are various thematic Exchange Traded Funds (ETFs), listed on exchanges that allow investors to gain diversified exposure to the China Internet and technology industries. These thematic ETFs, are convenient tools for investors to adopt a forward-looking investment approach that identifies companies, which will benefit from structural changes in China.

Below are some examples of the ETFs that provide exposure to the China Internet or technology industries.

| ETF | KraneShares CSI China Internet ETF | Samsung CSI China Dragon Internet ETF | Mirae Asset Horizons China Cloud Computing ETF | Invesco China Technology ETF |

| Ticker | KWEB | 2812 | 2826 | CQQQ |

| Exchange | AMEX | HKEx | HKEx | AMEX |

| AUM | USD 1.48 billion | HKD 95.25 million | HKD 384.13 million | USD 493.8 million |

| Net Expense Ratio | 0.70% | 0.65% | 0.68% | 0.70% |

| Number of Holdings | 42 | 30 | 20 | 96 |

| Top 3 Holdings |

|

|

|

|

ETF Information is accurate as of 9 October 2019

Conclusion

Even though there are over 800 million Internet users in China, this figure made up of only 60 percent of China’s entire population. As urbanisation rate accelerates and Internet infrastructure becomes more readily available, we can expect to see the number of Internet users in China to increase exponentially in the future.

The emergence of 5G technology will help fuel the growth of various industries. The interconnectedness of various industries will continue to help Chinese tech titans to diversify and reduce their dependency on core businesses.

For example, Alibaba’s cloud service is one of its fastest growing revenue sources. The newer strategic business unit, along with its core e-commerce business, is helping to bolster the company’s total revenue. Alibaba’s diversification strategy ensures that the company stays competitive and insure its sustainability in today’s digital landscape.

The large Internet user base in China, coupled with technological advancements, propels the growth of Chinese Internet companies and encourages research and development by Chinese tech giants in view of the growing needs of Chinese consumers.

Reference:

- [1] https://www.chinainternetwatch.com/29010/china-internet-users-snapshot/

- [2] https://www.internetworldstats.com/top20.htm

- [3] https://www.android.com/everyone/enabling-opportunity/

- [4] https://www.chinainternetwatch.com/29010/china-internet-users-snapshot/

- [5] https://www.ishares.com/ch/individual/en/literature/whitepaper/megatrend-en-emea-whitepaper.pdf

- [6] https://www.chinadailyhk.com/articles/157/197/4/1562735428505.html

- [7] https://chinapower.csis.org/china-middle-class/

- [8] https://www.bain.com/insights/consumption-in-china-ten-trends-for-the-next-ten-years/

- [9] https://www.spglobal.com/marketintelligence/en/news-insights/blog/china-leads-rise-of-mobile-super-apps

- [10] https://www.scmp.com/tech/china-tech/article/2098948/china-plans-28-trillion-yuan-capital-expenditure-create-worlds

- [11] https://www.barrons.com/articles/the-real-5g-winner-could-be-china-51570228459

- [12] https://www.scmp.com/news/china/military/article/2184493/why-5g-battleground-us-and-china-also-fight-military-supremacy

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr. Joel Lim

ETF Specialist

Joel graduated from Singapore Institute of Management, University of London with a First Class Honours in Business. He was the recipient of SIM University of London’s Top Student Bronze Award in 2017 and was the worldwide examination topper for the “Financial Management” module in 2016. Joel was also commended by University of London for his excellent performance in the 2014 Examinations.

Joel is involved in ETF education, providing trading ideas and support to traders, dealers and fund managers. Joel also works closely with ETF issuers to educate retail investors about new ETFs during the Initial Offering Period.

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap