US Election 2020: Understanding the Impact on the Tech Sector October 22, 2020

This article is part of the US Election series brought to you by POEMS. #USElection2020.

What our report is about:

- Both Biden and Trump intend to tighten regulations on the tech sector

- Spending on physical and telco infrastructure is also expected to increase

- Gain exposure to both the tech and infrastructure sectors through ETFs and CFDs

In our previous article, we compared the tax policies of Trump and Biden and their impact on markets. Today, we look at their views on the tech sector.

The US stock market has been fluctuating due to The Fed’s Monetary Policy. We have seen large fund inflows into the tech sector in recent months as tech was seen as “defensive” in a COVID-19 environment. However, we should be well aware of the risks of political instability and possibility of another market sell-off. Policies on tech have attracted much debate and it remains to be seen if tech stocks can continue their dizzying rally since March 2020.

Tightening Regulations on Tech Industry & Social Media

If they don’t agree on anything else, there is at least one area where Biden and Trump seem to see eye to eye on: the need to strengthen antitrust investigations and increase content-censorship obligations for Internet platforms.

Both have intentions to repeal Section 230 of the Communications Decency Act, which protects social-media companies such as Facebook and Twitter from legal liabilities for third-party content. Biden previously slammed these tech giants for “propagating falsehoods they know to be false” while Trump has aggressively pushed for a repeal of Section 230 on social media during his term.

Source: @realDonaldTrump (Twitter)

Source: @realDonaldTrump (Twitter)

In September, tech stocks led the price shrinking in US markets, as investors turned wary over overvaluations and became risk-averse. Election campaigning had raised concerns about antitrust regulations and a potential break-up of Big Tech.

“Big Tech” refers mainly to Alphabet, Amazon, Facebook, Apple and Microsoft. These are the five most valuable tech companies by market capitalization. They account for almost 20% of the S&P 500’s market value. Both Trump and Biden are worried that Big Tech may compress the growth space of small-cap tech companies and entrench oligopoly in the industry.

Trump

Congress started antitrust investigations of Facebook, Amazon, Apple and Alphabet during Trump’s current term. We expect Trump to continue these investigations and crack down on Big Tech companies. However, his loose corporate tax policies may help Big Tech recover from COVID-19 in the short term. This may boost Big Tech’s stock performances.

Biden

Biden has an even stronger impulse than Trump to break up Big Tech. Other than antitrust policies, his proposed reform of corporate taxes will require Big Tech names like Amazon to pay more taxes. At the same time, he intends to support the growth of small and medium-sized new tech companies. If he wins and the Democrats make a clean sweep of the House, higher taxes may squeeze Big Tech’s profitability. There is, however, another scenario. The market may not take an election of Biden negatively if the Democrats cannot totally control the Senate, as it will be more difficult to legislate higher corporate and capital-gain taxes.

Data Privacy

Data privacy is another political hot potato. This comes as no surprise as personal information is increasingly vulnerable to breaches due to a proliferation of apps and software that collects personal data. Two years ago, the EU launched the very first General Data Protection Regulation (GDPR). This raised global awareness of data privacy. Following its move, various governments began to take data-privacy regulation seriously. Biden does seem to support the idea of GDPR for the US while Trump is concerned that regulation may impede criminal investigations as the US government will not be able to access data easily. The backdoor fight between Apple and Washington DC is one example.

Trump has also been paying close attention to user-data outflow to foreign companies, purportedly on national-security grounds. Notably, he has banned popular apps such as Tik Tok and WeChat in the US. Foreign tech companies like Alibaba may thus face more restrictions in expanding in the US, which could significantly weaken their stock performances.

Infrastructure & 5G

While both intend to bump up infrastructure spending, their focus differs. Biden’s infrastructure stimulus package is part of a US$2tr Climate Plan which emphasizes the Green Economy and Smart City. Trump plans to introduce a new US$1tr infrastructure plan designed for 5G wireless and rural broadband. No matter who gets elected, the telco sector (e.g. AT&T) is expected to benefit from both broadband and 5G infrastructure construction. Chip suppliers such as Qualcomm may also benefit from a 5G push.

| Biden | Trump | |

| Stance | Support infrastructure expansion, emphasis on green-economy related infrastructure | Support infrastructure expansion, emphasis on 5G-related infrastructure |

| Infrastructure | US$2tr Budget:1. US$50bn in first year for maintenance of roads, highways and bridges, total investment of about USD300bn.2. US$100bn to be used for modernization and renovation of schools.3. US$40bn for large-scale transformational projects such as water-conservancy projects.4. US$20bn for rural broadband construction.5. US$10bn for public transportation in poverty areas with inconvenient traffic.6. US$10bn for rejuvenation of troubled cities.7. US$1bn for Smart City Project every year. | Plans to publish a US$1tr infrastructure stimulation project.Most funds will be used for traditional infrastructure projects such as roads and bridges. Part of the funds will be used for 5G infrastructure and rural broadband. No details yet.Since 2016, Trump has consistently made increasing infrastructure spending his policy focus. In 2018, he announced a US$1.5tr infrastructure stimulation plan but this was postponed due to his impeachment. This year, he had planned to publish a new US$2tr infrastructure stimulation plan. This ended nowhere. |

Gain exposure through ETFs & CFDs on POEMS

Who do you think will win the election?

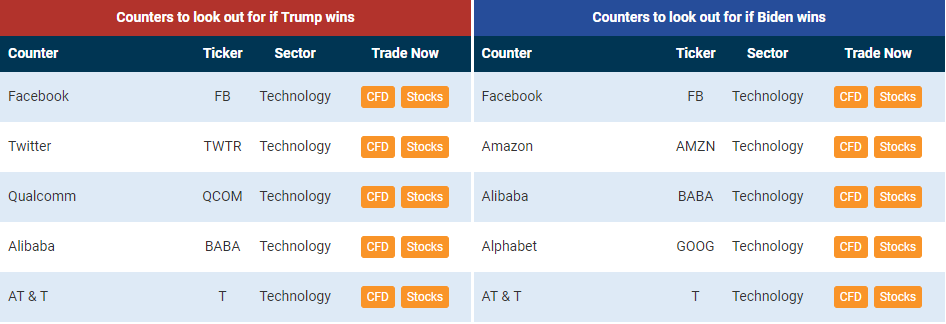

Have a calculated guess but not sure how to invest? Why not gain exposure to selected investment themes via ETFs or CFDs? Table 1 illustrates the different thematic counters that POEMS offers.

Table 1

Table 1

As the US election draws near, market volatility is expected to increase. Traders can consider trading CFDs to hedge their portfolio positions.

Contrary to popular opinion, Contracts for Differences (CFDs) are not just for technical traders. Long-term investors can utilize them to hedge against unforeseen events and uncertainties. When one foresees rising uncertainty and volatility in the market, one can enter into a CFD contract to hedge his or her investment positions.

CFD World Indices and Commodities are ideal hedging tools for equities. This is due to their cost effectiveness and correlations.

One can use CFDs as a hedge in the following two scenarios:

1) When the price of your existing position has already moved / is moving against you.

2) When you anticipate future gains in your existing positions to be marginal due to increasingly negative market sentiment.

For a guide on using CFDs for hedging, check out our detailed example at the bottom of this article.

Before one hedges, it is important to know which assets to use to hedge. Assets that have a positive correlation to your positions are used as an opposing hedge (Short). Assets with a negative correlation to your positions are used as a same-side hedge (Long). However, do note that it is not possible to perform a perfect hedge.

Stay tuned for our next US Presidential Election series on the Energy sector!

References:

1. https://graphics.reuters.com/USA-ELECTION/POLICY/ygdpzwarjvw/

2. https://www.reuters.com/article/us-usa-election-tech-factbox-idUSKBN23839S

3. https://www.cnet.com/news/microsoft-can-identify-deepfakes-now-just-in-time-for-the-2020-us-election/

4. https://www.wsj.com/articles/what-a-biden-harris-white-house-could-mean-for-tech-policy-11597358935

5. https://www.wsj.com/articles/where-trump-and-biden-stand-on-big-tech-11600335000

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Sun Wanxin

Dealer

Sun Wanxin graduated from Singapore Management University with a Bachelor’s Degree in Business Management. As a member of the largest dealing team in Phillip Securities, she focuses on the Hong Kong market and analyses products from both a technical and fundamental perspective. She also researches on the Fintech industry during her free time.

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap