What you need to know about the new CareShield Life November 17, 2020

At a glance

- With the launch of CareShield Life, Singaporeans now have improved long-term care coverage for life.

- Scope and type of coverage have improved from the previous scheme, ElderShield. Payouts are now higher and last a lifetime.

- Long-term care, however, costs more than S$2,000/month today and is likely to rise further. Singaporeans would do well to enhance their payouts with supplementary plans.

If you are a Singapore citizen or permanent resident born between 1980 and 1990, you might have received this in your mail recently.

What is it exactly?

About CareShield Life

CareShield Life is a compulsory long-term care scheme administered by the Singapore government.

It was launched in October 2020 to provide lifetime cash payouts should you one day be unable to perform at least three out of six Activities of Daily Living (ADLs) and require physical assistance with these.

The ADLs are: transferring, walking or moving around, toileting, bathing, dressing and feeding or eating. Pause for a moment. These are what we do every day, from the moment we jump out of bed! We would probably accomplish all within 30 minutes of waking up – unless you are the type to skip breakfast.

Payouts start at S$600/month in 2020. They will increase annually until you turn 67 or when a claim is made, whichever is earlier. The rate of increase has been set at 2% per year until 2025. It will be reviewed after that. Premiums increase accordingly but are fully payable with your CPF Medisave Account.

CareShield Life is basically the next iteration of ElderShield. ElderShield was introduced in 2002 to cover those born in or before 1979. CareShield Life is an improved version in the following ways:

1. Its payouts are higher, in response to rising costs in Singapore of getting appropriate care and inflation

2. It covers you for a lifetime, to give your family peace of mind that you would have some financial support for as long as you live

3. Its entry age is lower, to ensure that more people are covered when they are younger and less likely to have pre-existing health conditions

Still, is S$600 a month enough? We highly doubt so.

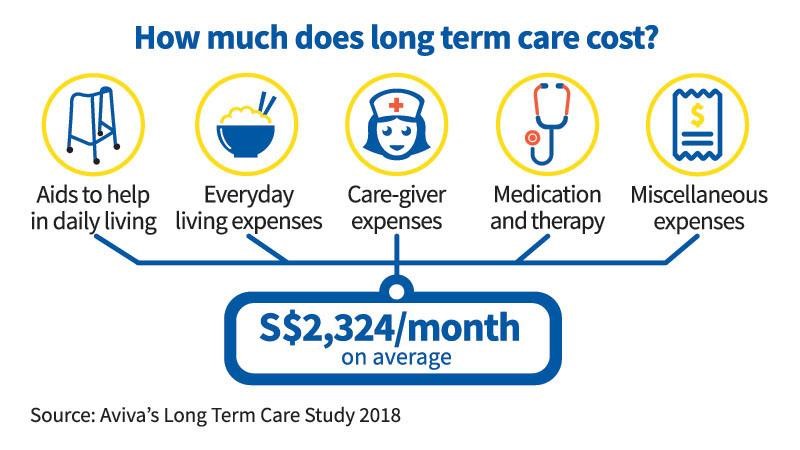

Aviva’s long-term care study in 2018 pegged the average cost of long-term care in Singapore at S$2,324/month1.

A Lien Foundation aged-care study in 2018 found that homecare for a severely disabled person could cost as much as S$3,100/month2. The median cost of staying in a voluntary welfare organisation nursing home was estimated at S$2,100/month.

My grandfather, who lived out his last years in a nursing home, ran up a bill of S$1,900 a month. This was 10 years ago, in 2010. And it was before the addition of extras such as adult diapers.

That S$600 monthly payouts may help to defray costs but are hardly sufficient in today’s context, let alone the future.

So what can you do about it?

Enhance your payouts – by getting a supplementary plan

CareShield Life addresses one key shortfall of ElderShield: it provides you with a lifetime of payouts. But as these payouts are not sufficient in themselves, there should be a supplementary plan to make up the difference.

The premium for supplementary plans can be paid using Medisave, capped at S$600 a year.

To give you an example. I will be turning 36 this year.

I can get S$1,600/month on top of CareShield Life if I have a supplementary plan that costs S$599.88/year, fully paid by Medisave. If I am unable to perform three out of the six ADLs, I will get a total of S$2,200/month: S$1,600 from my supplementary plan and S$600 from CareShield Life.

If I reckon now that I would need more coverage, I can go for a S$2,000/month supplementary plan that costs S$732.74/year. I would only need to pay S$132.74/year in cash and S$600/year using Medisave. In exchange, I can get S$2,600/month to cover my costs, and my cash outlay is quite minimal at about S$10/month.

Either way, this is a lot better than the basic S$600/month, no?

Contributor:

Elijah Lee

Financial Services Consultant

Phillip Securities Pte Ltd (A member of PhillipCapital)

Email address: elijahleest@phillip.com.sg

To find out more about CareShield Life and your supplementary plan options, you can register for a free, personalised consultation with Elijah here.

References:

1. https://singlife.com/en/money-banter/2020/common-questions-careshield-life-answered

2. https://www.lienfoundation.org/project/care-where-you-are

About the author

Elijah Lee

Financial Services Consultant

Elijah is a Financial Services Consultant with Phillip Securities. He joined the financial services sector after making a career switch in 2016. Over the last five years, he has helped to structure and implement sound and robust financial plans for his clients, helping them achieve their goals and aspirations. He has also received many accolades, including the Million Dollar Round Table (MDRT) accreditation. A strong advocate of financial literacy, he frequently conducts seminars to educate the public the basics of financial planning as he believes that the key to improving one’s financial position is a good financial education. He is also a co-trainer of an IBF-accredited course and has been invited to share his views on The Simple Sum Podcast as well as Money 89.3FM. In his spare time, he is a frequent contributor to the Seedly platform where he addresses questions relating to personal finance, insurance and retirement cashflow planning.

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry! ![[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close](https://www.poems.com.sg/wp-content/uploads/2024/03/Valerie-Lim-LI-X-SMART-Park-Article-300x157.jpg) [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close

[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close  Deciphering the Updates: Understanding the latest CPF Changes

Deciphering the Updates: Understanding the latest CPF Changes