Why is the Fed raising interest rates? March 16, 2022

At the December Federal Reserve meeting, members finally realised that the inflation in the economy was no longer transitory an acknowledged that prices were increasing rapidly.

So, in order to control inflation in the economy, the Fed signalled that it could raise interest rates soon with a possibility of three rate hikes in 2022.

With the market expecting an increase in Fed interest rates soon, US stock markets tumbled in the early days of 2022. The Dow Jones Index, or DJI, fell from 36,799 to 34,079 (as at 18 Feb 2022) and the NASDAQ index fell from 15,832 to 13,548 (as at 18 Feb 2022).

Many US tech stocks also fell from grace with the likes of Nvidia, Microsoft, Tesla and Apple tumbling around 20-30 percent.

Generally, there has been an inverse relationship between the Fed funds rate and the performance of the stock market. An increase in the Fed funds rate typically will result in a fall in the stock market.

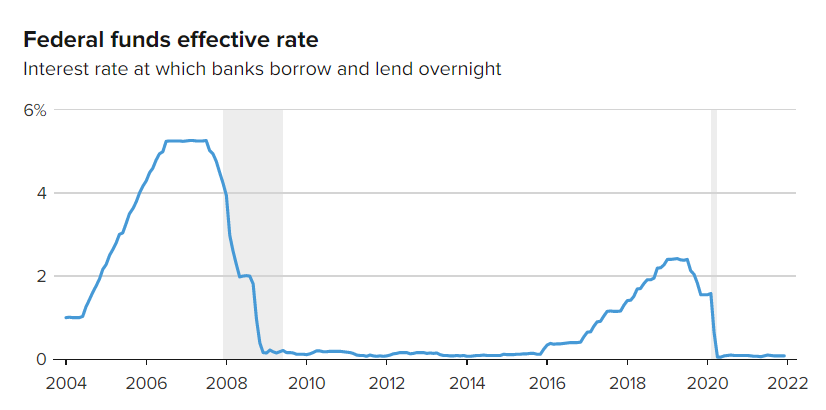

What is this interest rate?

This interest rate, also known as the federal funds rate, is the interest rate at which financial institutions borrow and lend their excess reserves to each other overnight. As stated by law, US banks must maintain a percentage of their deposits in an account with the Fed which is known as the required reserve ratio. This is to prevent a bank run from happening. A bank run occurs when many clients withdraw their money from the banks simultaneously, and this may affect the liquidity of the banks.

The required reserve ratio is calculated based on the end-of-day balances in the bank’s account averaged over a two-week reserve maintenance period.

So, if one bank finds that it has more than what is required, it can lend the excess to other banks that expect a shortfall in balances and earn interest from it. This interbank lending interest rate is based on the fed funds rate.

How will an increase in the Fed funds rate affect consumers?

When the Fed raises its interest rates, it also influences the prime lending rates that the banks charge their borrowers. Prime rates are the prevailing interest rates that banks charge their customers who have the best creditworthiness. As the fed rates increase, the prime lending rates move in tandem with the increase. This increase also affects consumers’ interest rates for bank loans, credit card loans and adjustable-rate mortgages.

The reason why there is this ripple effect of interest rates increases is because as the borrowing of excess funds increases, banks incur a higher cost to borrow to maintain the required reserve ratio.

The banks then pass on this increase in costs of borrowing to its consumers. Therefore, the prime lending rates increase. And since the prime lending rate sets the benchmark for interest rates of the loans, customers who did not have the best creditworthiness will face a higher interest rate than the prime lending rate as the banks experience more risk as the creditworthiness of customers drops.

Why is there a need to raise interest rates now?

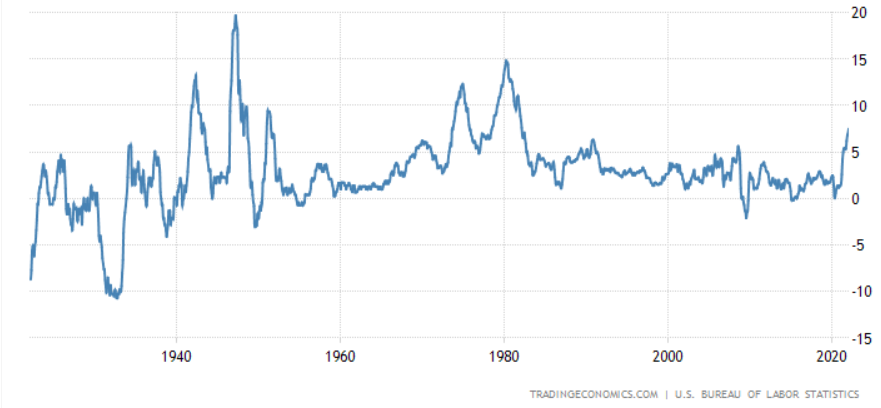

Inflation is the rate of increase in prices over a given period of time. Therefore, CPI is used as an indicator of inflation in a particular economy.

CPI is a measure that takes the weighted average of prices of a basket of goods and services which consumers require for their day-to-day life.

In January 2022, the US Consumer Price Index, or CPI, rose to 7.5% which was a 40-year high. This means that the US is facing high inflation as the overall cost of living has been increasing drastically.

Inflation is necessary for economic growth as it helps to increase consumption and consumer demand which eventually increases the GDP of an economy.

The estimated benchmark of inflation for a developed nation is around 2% and is meant to stimulate economic growth. However, anything above this could be damaging to the economy as it could affect the livelihoods of its population.

With the inflation rate at 7.5%, the US Federal Reserve which is the Central Bank for the United States is under pressure to curb it to prevent the economy from experiencing turmoil.

A good example of an economy experiencing turmoil is Turkey, where the inflation rate recently soared to 36.1%.

There, it was observed that the prices of vegetables had soared more than 50 percent.

The inflation was a result of the country’s president Tayyip Erdogan, aggressively depreciating its currency as well as his interest-rate cutting policies.

When prices of goods and services increase at an unsustainable level, this reduces the purchasing power of its population.

Then, in order to keep up with the increase in prices, the central bank starts to print more money and dump it into the economy.

Soon the currency becomes worthless, and this could lead to civil unrest.

This is known as hyperinflation which is evident in countries such as Venezuela and Zimbabwe.

As for the United States, the inflation rate in recent years before COVID-19 struck was around the 2% region. However, in 2020, COVID-19 ravaged the global economy and businesses globally were badly affected.

So, in an emergency move, the Fed has decided to drop its interest rate to a range of 0% – 0.25% and launched quantitative easing.

As the Fed funds rate drops, the interest rates for bank loans will also drop. This means that the cost of borrowing for consumers, which includes businesses, will drop as well.

When businesses are able to borrow money at a lower cost, the Fed expects this to encourage businesses to expand and grow.

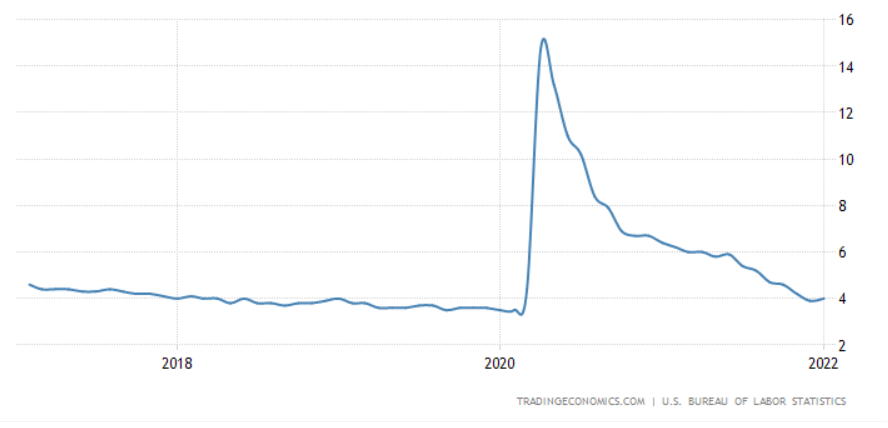

And when businesses expand, there is an increase in demand for labour and thus, unemployment rates will fall.

It was observed that the unemployment rate at the start of the COVID-19 pandemic was around 15%. However, this significantly reduced to around 4% in late 2021.

The combination of quantitative easing as well as the fed funds rate reduction did its job in reducing the unemployment rate amid the pandemic.

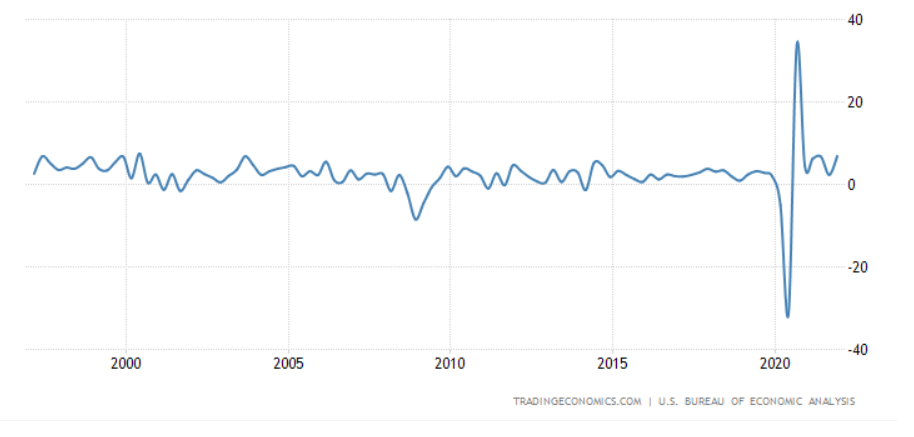

Also, with the policies implemented by the Fed, the US GDP growth rate recovered from the huge dip during the pandemic and it has been consistently growing at around 5%.

From the charts above, the GDP in the US is growing, and unemployment is falling.

So, it seems that the Federal Reserve has revived the economy and saved the United States from being wrecked by the pandemic.

However, the resulting effect of an increase in GDP growth rate that is unsustainable as well as an unemployment rate that is lower than the natural rate of unemployment will result in an inflation rate that is unhealthy for the economy.

Demand pull inflation

In economics, the basic formula to calculate GDP of an economy is:

Y – GDP of an economy

C – Consumption

I – Investment

G – Government Spending

(EX – IM) – Net trade

From the above, the GDP growth rate of the US has been increasing. And when the Fed reduces the Fed funds rate, it will directly impact Consumption (C) and Investments (I) in the GDP formula.

So, when firms are able to borrow at a lower cost, they are encouraged to invest and grow their businesses. This will increase (I) in the GDP formula. Similarly, when firms grow their businesses, they will need to hire more workers and pay them wages.

Therefore, the overall purchasing power of the economy increases, which will lead to an increase in consumption of goods and services (C).

Unfortunately, when consumption and investment increase at an unsustainable level, this will lead to demand-pull inflation.

Demand-pull inflation is the upward pressure on prices due to an increase in demand and a shortage in supply.

And when consumer demand outpaces the available supply of consumer goods, this will lead to an increase in prices and eventually lead to an overall increase in the cost of living.

As the economy grows, the disposable income of its population increases. Therefore, the purchasing power of the population also increases. And this will lead to an increased demand for goods and services as people are now more well off.

When demand rises more than the supply, this leads to a disequilibrium which in turn, results in an increase of prices.

Firms that want to capitalise on this increased demand, tend to ramp up production capacity by growing their labour force and invest in machinery to produce these goods and services.

As the employment rate increases, more people have the capacity to demand these goods and services.

Allocation of goods and services are always determined by prices as supply is not a never-ending resource.

This means that whoever can pay will receive the goods. Therefore, when supply is unable to play catch up with this never-ending increase in demand, prices of goods and services will continue to increase until the point of equilibrium where some demand is lost due to the high prices. This is the effect of demand-pull inflation.

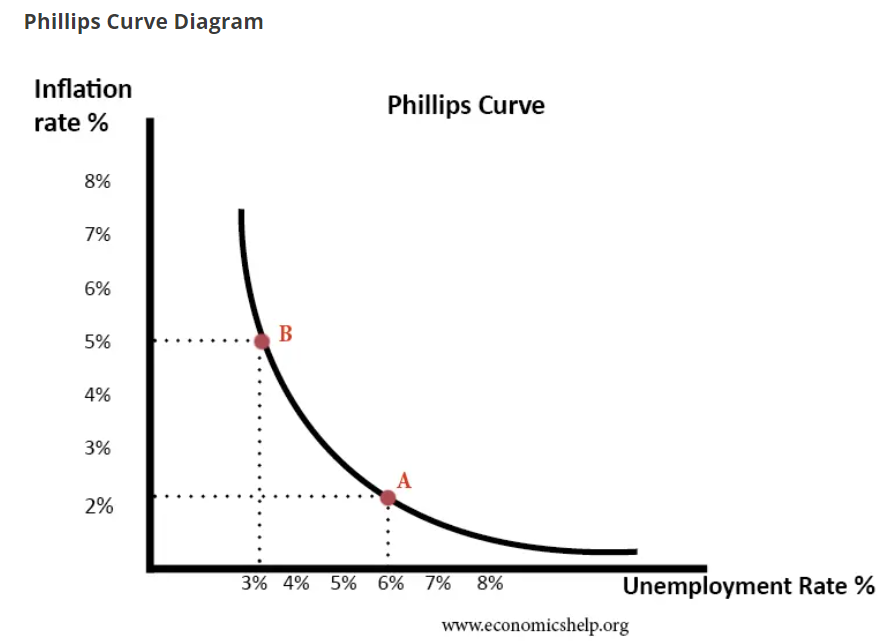

Phillips Curve

As aggregate demand increases, the economy sees an increase in real GDP as shown in the increase in GDP growth rate. Therefore, firms seek more workers, reducing the unemployment rate. However, there is a cap on how much an economy can produce due to a scarcity of resources. So, eventually, prices increase as supply is unable to cope with demand.

This can be seen from the Phillips Curve above, where the rate of unemployment is inversely related to the inflation rate of the economy. A lower rate of unemployment leads to a higher rate of inflation. So, in order to keep inflation rate at a steady 2%, the unemployment rate in an economy should be around 6%. This is the natural rate of unemployment to provide sustainable economic growth. Any value lower than 6% in unemployment will result in an unsustainable economy for a developed nation.

Cost-push inflation

When businesses expand due to an increase in investments, more workers are being hired. This reduces the unemployment rate in an economy. As the unemployment rate gets lower, the labour pool of available workers is reduced. Therefore, in order to attract workers to work for them, they will need to raise wages. Workers that are with the company will also demand higher wages as firms across the board start to increase wages to retain and attract workers to increase production to meet increased demand for goods and services.

In addition, the cost of producing these goods and services requires raw materials and machinery. And to cope with the increase in demand, firms have to purchase more raw material and machinery for production. As raw materials are not limitless; the increase in demand for them will lead to an increase in prices.

This will significantly affect profit margins of the firms if they were to sell at the same price as before. So, firms will tend to increase the prices of these goods and services so that they are able to pass on this increase in costs to the consumers. Therefore, this is known as cost-push inflation.

How does the increase in interest rate reduce inflation in an economy?

From what has been mentioned above, interest rates have an impact on both Consumption (C) and Investments (I) in the GDP formula. An increase in interest rate will reduce both consumption and investments. Therefore, this will lead to an overall decrease in the GDP of the economy. This will reduce the GDP growth rate in the US back to sustainable levels that will result in a healthy inflation rate.

Firstly, let us talk about investments (I). As what was mentioned previously, an increase in the Fed Funds Rate will eventually lead to an increase in the interest rate for loans. Firms will now be deterred from taking too much loan as this could affect their company’s financial health status. Therefore, firms tend to cut back on expansion which will lead to a decrease in investments.

Now, let us talk about Consumption (C). When firms cut back on expansion, they will not be as aggressive when it comes to hiring workers. This means that the unemployment rate will be expected to rise and return to the natural rate of unemployment in the economy. When the demand for labour decreases while assuming that labour supply remains constant, wages will decrease. Therefore, the population will experience a decrease in their purchasing power for goods and services. In addition, consumer loans such as credit cards and floating mortgages will see an increase in interest rates. Eventually, consumers will have to be prudent in their spending and this will result in decline in consumption of goods and services, especially consumption of discretionary goods such as luxury items.

Which sectors will be affected by this increase?

When the Fed raises its Fed Funds Rate, the financial sector will likely benefit from this. The profit margins of the financial sector expand when rates climb. Banks in particular, benefit from the spread between what they pay to their savers for their checking accounts and what they can earn from an increase in their loans to borrowers.

On the contrary, the technology sector which mainly consists of growth companies may likely be badly affected by the increase in interest rates. These companies rely heavily on borrowings to expand their business and keep themselves abreast of competitors. Therefore, when the lending interest rate provided by financial institutions increases due to an increase in the Fed Funds Rate, the cost of doing business for these companies will also increase. Eventually, this will affect their financial health which may affect their earnings.

Explore a myriad of useful features including Trading View chartings to conduct technical analysis, stock analytics from our in-house research analysts, and more available for you anytime and anywhere to elevate you as a better trader.

Reference:

- [1]https://www.economicshelp.org/blog/1592/economics/is-phillips-curve-still-relevant/

- [2]https://www.investopedia.com/articles/05/012005.asp

- [3]https://tradingeconomics.com/united-states/gdp-growth

- [4]https://tradingeconomics.com/united-states/unemployment-rate

- [5]https://tradingeconomics.com/united-states/inflation-cpi

- [6]https://www.thebalance.com/fed-funds-rate-definition-impact-and-how-it-works-3306122

- [7]https://www.schwab.com/resource-center/insights/content/sector-views

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Alvin Teo

Alvin Teo graduated from Nanyang Technological University with a Bachelor’s Degree in Economics. Coming from an Economics background, he strongly believes in the importance of understanding the macroeconomic policies before making investment decisions. Alvin started investing in Singapore equities at the age of 21 and thus, he has relevant experience in the Singapore market.

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry! ![[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close](https://www.poems.com.sg/wp-content/uploads/2024/03/Valerie-Lim-LI-X-SMART-Park-Article-300x157.jpg) [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close

[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close  Deciphering the Updates: Understanding the latest CPF Changes

Deciphering the Updates: Understanding the latest CPF Changes