Money Market Fund

Why Phillip Money Market Fund (PMMF)?

*Based on Total Net Assets (TNA) figures reflected in FundSingapore.com (http://www.fundsingapore.com/screener/basic_search)

Return (7 Day) Annualised#

0.1633% p.a.

0.2661% p.a.

Rates updated as of 12 Apr 2021

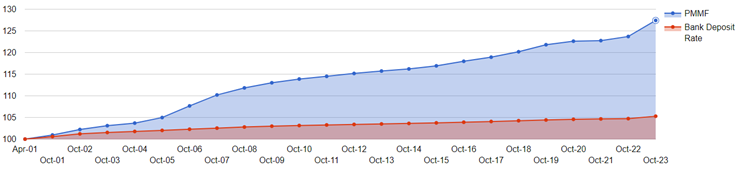

*Based on 1-year rolling return, NAV/NAV prices.

#Based on the average rate of annualised returns over the last rolling one month.

Past performance is not necessarily indicative of future performance. View disclaimer

For more information on Phillip SGD Money Market Fund, please click here

What is Money Market Fund (MMF)?

An open-ended mutual fund that invests in short-term (less than 1-year), and low risk debt securities for liquidity. It is a low risk place to park your cash awaiting investments.

Phillip Money Market Fund (PMMF) aims to preserve principal value and maintain a high degree of liquidity while producing returns comparable to that of Singapore Dollar savings deposits. The Fund will invest primarily in short term, high quality money market instruments and debt securities. Such investments may include government and corporate bonds, commercial bills and deposits with financial institutions.

The PMMF diversifies investments across deposits of varying tenures to enhance return. For a detailed breakdown of the current portfolio, please read the factsheet.

This Fund is only suitable for investors who:

- are seeking to preserve principal value.

- are seeking to maintain a high degree of liquidity while producing returns comparable to that of Singapore dollar savings deposits, notwithstanding the fact that the Fund is not a savings deposit.

How do I invest in PMMF?

You can opt-in for PMMF through the Excess Funds Facility (SMART Park). Excess funds in your trading account with a minimum balance of $100 will be automatically invested into the Phillip Money Market Fund.

This facility is available for Cash Management Account, Prepaid Account, Margin Account, Custodian Account and Cash Plus Account.

Alternatively, you can buy into PMMF on POEMS.

FAQ’s

MMFs pool together investor funds and invest them in money market instruments (MMIs) which are relatively low-risk, highly liquid and highly rated short-term debt instruments issued by governments (Treasury bills), financial institutions (certificates of deposit) and corporations (commercial paper). By definition MMIs have maturities which can range from 1day to 1 year but are often less than 90 days. The Weighted Average Maturity of the Phillip MMF as of Sep 2023 for example is just 53 days.

There is no one-size-fits-all answer to this as it will depend on the investor’s risk profile and investment objectives. However, MMFs are an ideal and safe place to park your excess cash while waiting for better opportunities in the market to present themselves especially with front end rates upwards of 3% at the moment.

There are MMFs of different currencies such as SGD, USD and even HKD. There are also ETF versions of MMFs that trade on an exchange.

Most MMF interest is accrued in the NAV, unless there is a distribution class where the MMF can be payout interest periodically.

It would depend on what you define as “good”. For investors with a shorter time horizon looking for capital preservation and higher interest than the bank’s current account deposits, MMFs would be a good place for the cash investment. Having said that with front end rates as high as 3% & 5% in the SGD & USD respectively, investors are able to achieve returns comparable to that of even stocks for a much lower risk.

MMFs can be used as a safe place to park your excess cash while riding out volatile markets.

They can also be used as a vehicle to diversify your deposits away from just bank deposits.

While nothing is guaranteed, the risk of losing money in an MMF is very low. Funds are invested in high credit quality instruments and the short-term nature of the instruments also means that they are not subject to much price risk form rising interest rates. The Phillip SGD MMF has been running for 22 years with a record of zero credit defaults and no drawdowns in the price.

A safe place to park excess cash while earning a decent yield.

A way to diversify deposits.

A mutual fund is a type of investment structure similar to a unit trust where investors’ monies are pooled together and invested into some underlying securities. There are stock mutual funds, bond mutual funds and even money market mutual funds too. Hence it is important not to confuse between the investment structure and the underlying asset type.

This demonstrates how MMFs such as the Phillip SGD MMF have far outpaced the bank deposit rate going back all the way.