DAILY MORNING NOTE | 3 March 2023

Singapore stocks extended their decline for the fourth day on Thursday (Mar 2), as traders raised expectations of a higher terminal interest rate. The Singapore market lost 0.6 per cent or 20.18 points to 3,234.90. Losers outnumbered gainers 332 to 223, after 2.7 billion securities worth S$1.3 billion changed hands.

The S&P 500 and the Nasdaq opened lower on Thursday (Mar 2) as the 10-year Treasury yield surged above 4 per cent on bets of tighter monetary policy for a longer period, while Tesla fell after it gave few details on its affordable electric vehicle. The Dow Jones Industrial Average rose 119.13 points, or 0.36 per cent, at the open to 32,780.97. The S&P 500 opened lower by 12.71 points, or 0.32 per cent, at 3,938.68, while the Nasdaq Composite dropped 105.72 points, or 0.93 per cent, to 11,273.77 at the opening bell.

SG

Jardine Matheson Holdings on Thursday (Mar 2) posted an underlying net profit of US$1.6 billion for the financial year 2022, up 5 per cent from underlying earnings of US$1.5 billion in 2021. The company attributed this to strong showings by Astra and its other South-east Asian businesses held by Jardine Cycle and Carriage. Astra reported a 51 per cent increase in underlying earnings, excluding the unrealised net fair value loss on investments in GoTo and Hermina, with improvements across most of its divisions, supported by Indonesia’s economic recovery and higher commodity prices.

DFI Retail Group on Thursday (Mar 2) posted underlying earnings of US$29 million for the fiscal year 2022 ended December, down 72 per cent from earnings of US$105 million in FY2021. The group’s net loss for the year stood at US$114.6 million versus earnings of US$102.9 million in the prior year. The loss was primarily due to a US$171 million impairment loss related to the group’s investment in Robinsons Retail. Underlying earnings distinguishes between the group’s ongoing business performance and non-trading items, DFI said in its financial results posted on the bourse on Thursday (Mar 2). Total revenue for the year – which included all of DFI’s associates and joint ventures – fell 1 per cent to US$27.6 billion from US$27.9 billion.

Property group Hongkong Land on Thursday (Mar 2) reported underlying earnings of US$766.1 million for 2022, down 20 per cent from earnings of US$966 million in the prior year. Net profit came in at US$203 million for the year, after including net non-cash losses of US$573.4 million due chiefly to lower valuations of the group’s investment properties. In 2021, Hongkong Land booked a net loss of US$349 million, which included a US$1.3 billion reduction in property valuations mainly due to lower market rents for the Hong Kong central portfolio. The board of directors has recommended a final dividend of US$0.16 per share, unchanged from 2021.

Asset manager BlackRock is Mapletree Logistics Trust’s (MLT) latest substantial shareholder, the trust announced in a bourse filing on Thursday (Mar 2). The filing stated that BlackRock on Feb 28 – through one of its subsidiaries – acquired just under 1.8 million units of MLT for a total consideration of about S$3 million via a market transaction. This works out to a unit price of S$1.69 for each MLT unit. With the purchase, BlackRock’s deemed interest in MLT was lifted to about 242.1 million units or a stake of 5.02 per cent, from about 240.3 million units or a stake of 4.99 per cent previously.

The auction of Singapore’s latest six-month Treasury bill (T-bill) closed with a cut-off yield of 3.98 per cent on Thursday (Mar 2). The T-bills – a risk-free fixed-income product, backed by the Singapore government – were around 2.8 times subscribed for the S$4.7 billion allotment in the latest auction. The total value of applications in this auction was S$13 billion, up from the S$11 billion applied in the previous auction.

US

The number of Americans filing new claims for unemployment fell again last week, pointing to sustained labour market strength that could keep the Federal Reserve raising interest rates. Initial claims for state unemployment benefits dropped 2,000 to a seasonally adjusted 190,000 for the week ended Feb 25, the Labor Department said on Thursday (Mar 2). It was the seventh straight week that claims remained below 200,000. Economists polled by Reuters had forecast 195,000 claims for the latest week.

Shares of the cloud security company Zscaler tumbled more than 11% in after-hours trading. Though the company trounced analysts’ estimates on the top and bottom lines for the fiscal second quarter, it narrowly beat expectations for billings, according to FactSet. Billings for Zscaler came in at $493.8 million, compared to FactSet’s estimates of $491.4 million. Revenue grows 52% year-over-year to $387.6 million. GAAP net loss of $57.5 million compared to GAAP net loss of $100.4 million on a year-over-year basis.

Dell shares gained nearly 3% after its fourth-quarter earnings and revenue topped Wall Street’s estimates. The tech company’s adjusted earnings were $1.80 per share, higher than the consensus estimate of $1.63 from analysts polled by Refinitiv. Dell’s revenue also exceeded expectations, coming in at $25.04 billion versus analysts’ estimates of $23.39 billion.

Oil prices rose on Thursday, boosted by signs of a strong economic rebound in top crude importer China and easing worries of aggressive US rate hikes. Brent crude futures settled at US$84.75 a barrel, gaining 44 cents, or 0.5 per cent. US West Texas Intermediate (WTI) crude futures settled at US$78.16 a barrel, rising 47 cents, or 0.6 per cent. Manufacturing activity in China grew last month at the fastest pace in more than a decade, data showed on Wednesday, adding to evidence of a rebound in the world’s second-largest economy after removal of strict Covid-19 curbs.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Technical Pulse: Baidu, Inc. (Current Price: US$143.66)

Analyst: Zane Aw

Recommendation – TECHNICAL SELL

Sell price: US$143.66 Stop loss: US$155.00 Take profit 1: US$122.00 Take profit 2: US$107.00

Technical Pulse: Nasdaq Golden Dragon China Index (Current Price: US$7252.775)

Analyst: Zane Aw

Recommendation – TECHNICAL SELL

Resistance Zone: US$7400-7650 Support Zone 1: US$6500-6750 Support Zone 2: US$6000-6250

Block Inc – Booming Cash App business

Recommendation: ACCUMULATE (Upgraded); TP: US$91.00

Analyst: Ambrish Shah

– FY22 revenue was in line with expectations at 100% of our forecasts, but net loss was worse than expected at 108% of our FY22 forecasts due to higher loan losses. 4Q22 revenue grew 14% YoY (33% YoY ex-bitcoin) to US$4.7bn driven by strong momentum across the Cash App division.

– Cash App division gross profit grew by 64% YoY reflecting a 16% YoY surge in monthly active users (MAUs) to 51mn. Spending per active user was driven by Cash App debit card and new savings feature. Square division gross profit and gross payment volume (GPV) increased by 22% YoY and 14% YoY, respectively, with continued demand for its point-of-sale solutions.

– We upgrade to ACCUMULATE with a raised DCF target price of US$91.00 (prev. US$70.00) using a WACC of 7.1% and terminal growth rate of 4%. We lower our FY23e revenue by 1% to reflect lower consumer discretionary spending, and we increase our net loss forecasts by 100% to reflect higher expenses. However, we model a net positive working capital position of US$66mn in FY23e that should help drive the company’s FCF generation. We believe Block is well-positioned to benefit from its robust platform of consumer banking services, resurgence of in-person activities, and ongoing shift to cashless payments.

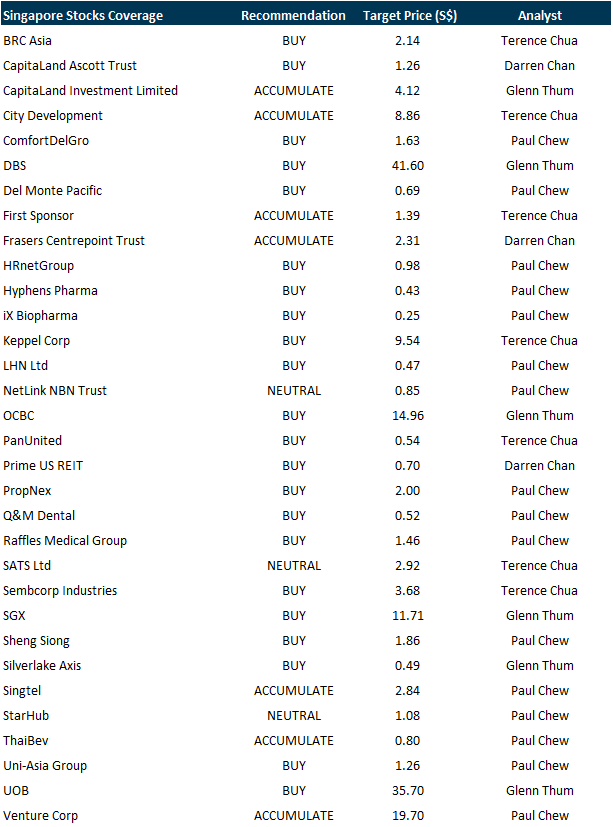

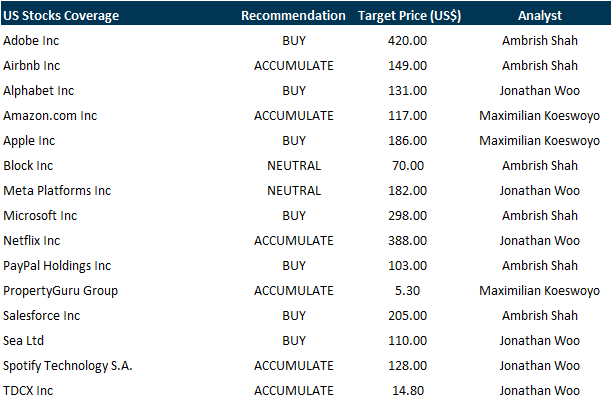

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Enviro-Hub Holdings Ltd [NEW]

Date: 14 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3KBprpA

Guest Presentation by Luminor Financial Holdings Ltd [NEW]

Date: 15 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3kj6LjP

Guest Presentation by Meta Health Limited [NEW]

Date: 16 March 2023

Time: 3pm – 4pm

Register: https://bit.ly/41oikGX

Guest Presentation by Keppel Pacific Oak US REIT (KORE) [NEW]

Date: 23 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3XY2n7v

Research Videos

Weekly Market Outlook: UOB, OCBC, CLI, SATS, ComfortDelGro, HRnetGroup, Venture Corp, Tech Analysis

Date: 27 February 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials